Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed

Description

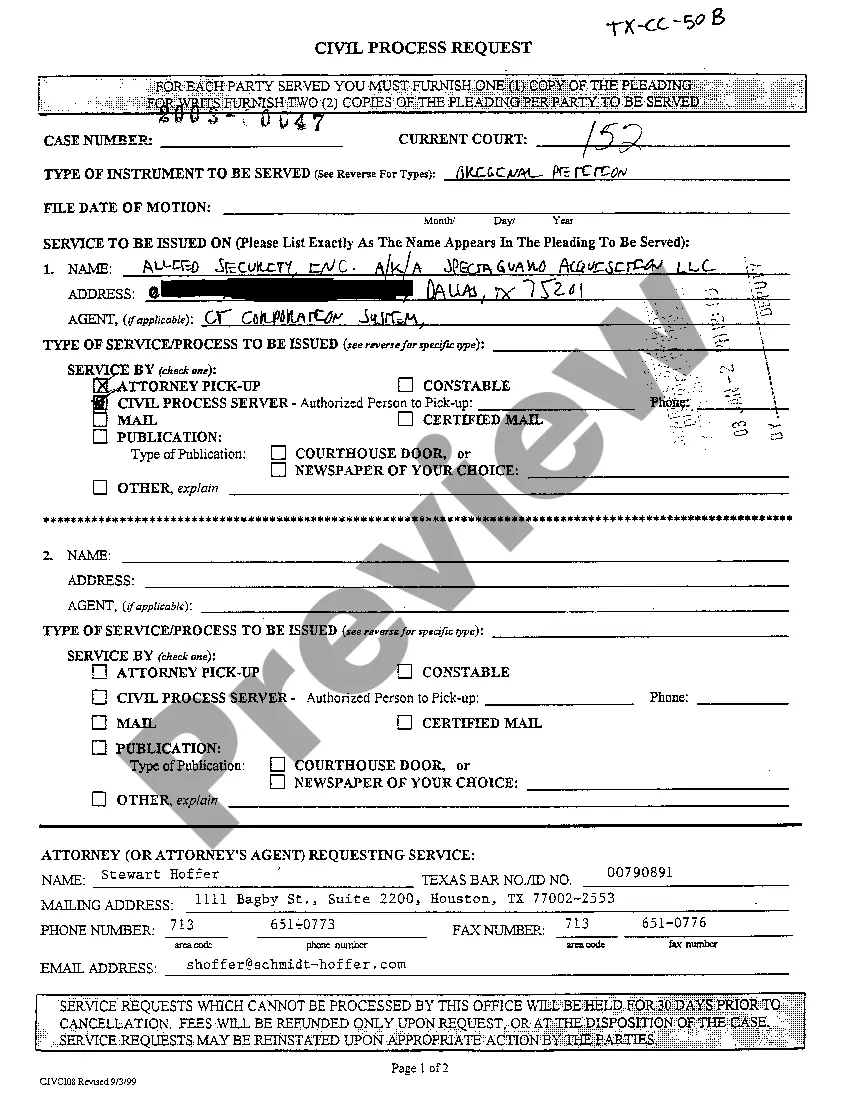

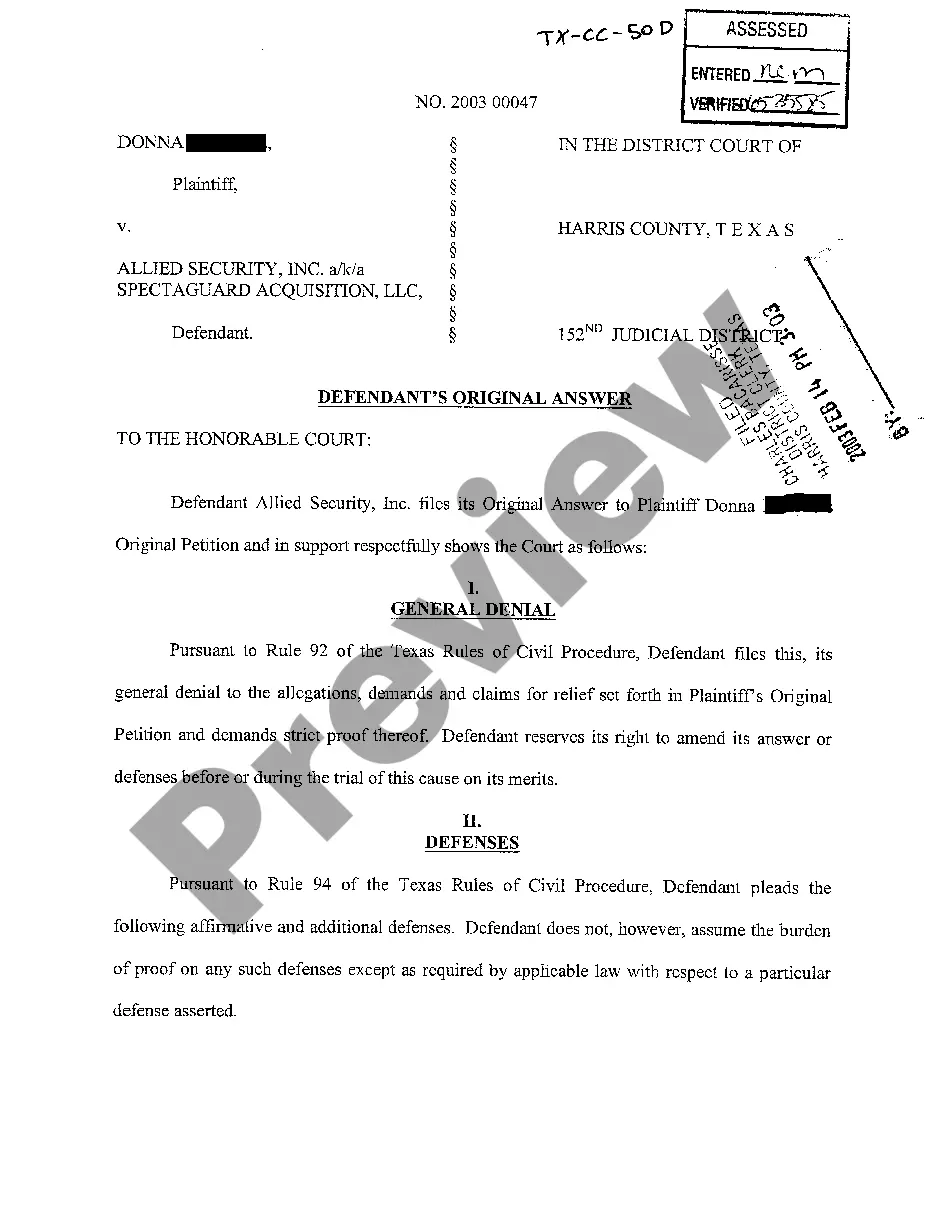

How to fill out Florida Seller's Disclosure Of Forfeiture Rights For Contract For Deed?

Utilize US Legal Forms to acquire a printable Florida Seller's Disclosure of Forfeiture Rights related to Contract for Deed. Our court-acceptable forms are created and frequently refreshed by experienced attorneys.

Ours is the most extensive Forms collection available online and offers reasonably priced and precise samples for clients, legal professionals, and small to medium-sized businesses.

The templates are organized into state-specific categories, and several can be viewed prior to downloading.

Create your account and make payment via PayPal or credit card. Download the form to your device and feel free to use it repeatedly. Use the search engine if you're looking for another document template. US Legal Forms provides a wide array of legal and tax templates and packages for business and personal purposes, including Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed. Over three million users have already successfully utilized our platform. Select your subscription plan and obtain high-quality forms in just a few clicks.

- To obtain templates, users must possess a subscription and Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For users without a subscription, follow the guide below to swiftly locate and download the Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed.

- Ensure you have the correct form pertaining to the state it’s needed.

- Examine the document by reviewing its description and utilizing the Preview function.

- Hit Buy Now if it’s the document you’re seeking.

Form popularity

FAQ

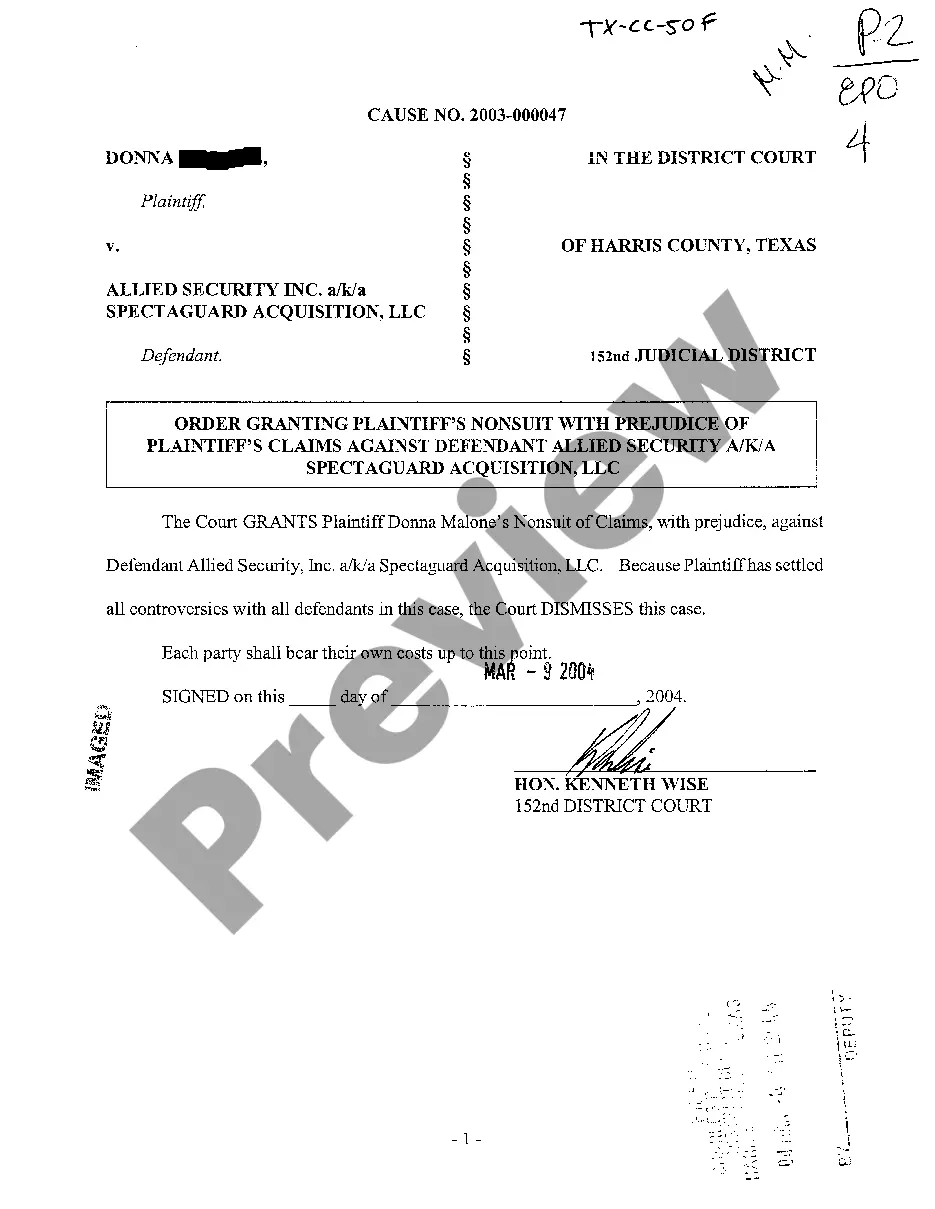

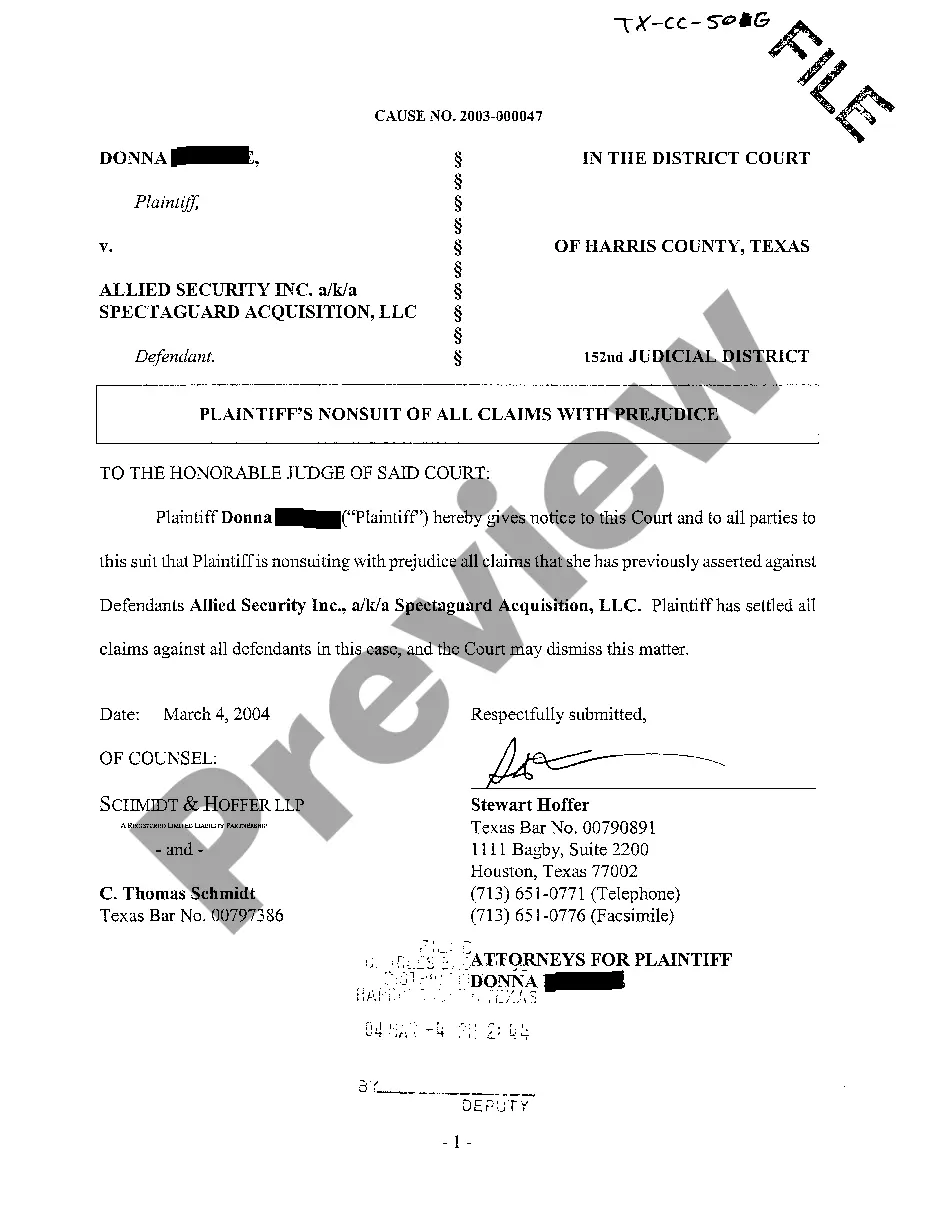

But unlike buyers, sellers can't back out and forfeit their earnest deposit money (usually 1-3 percent of the offer price). If you decide to cancel a deal when the home is already under contract, you can be either legally forced to close anyway or sued for financial damages.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

If a seller defaults, he must return all deposits, plus added reasonable expenses, to the buyer. The other party may also seek to compel the erring party to complete the deal under specific performance. From a buyer's point of view, it is advisable to get the sale agreement registered.

While a Seller's Property Disclosure Form is not required under Florida law, Florida law does require seller's and their realtors to disclose any significant property defects that may not be easily visible to the buyer. Buyers still have the responsibility to have the property inspected.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

Under Florida law (contract and case law), a buyer and/or seller is able, under certain circumstances, to terminate a residential real estate contract and walk away from the deal without penalty. One way a buyer can get out of a deal is by seeking rescission.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.