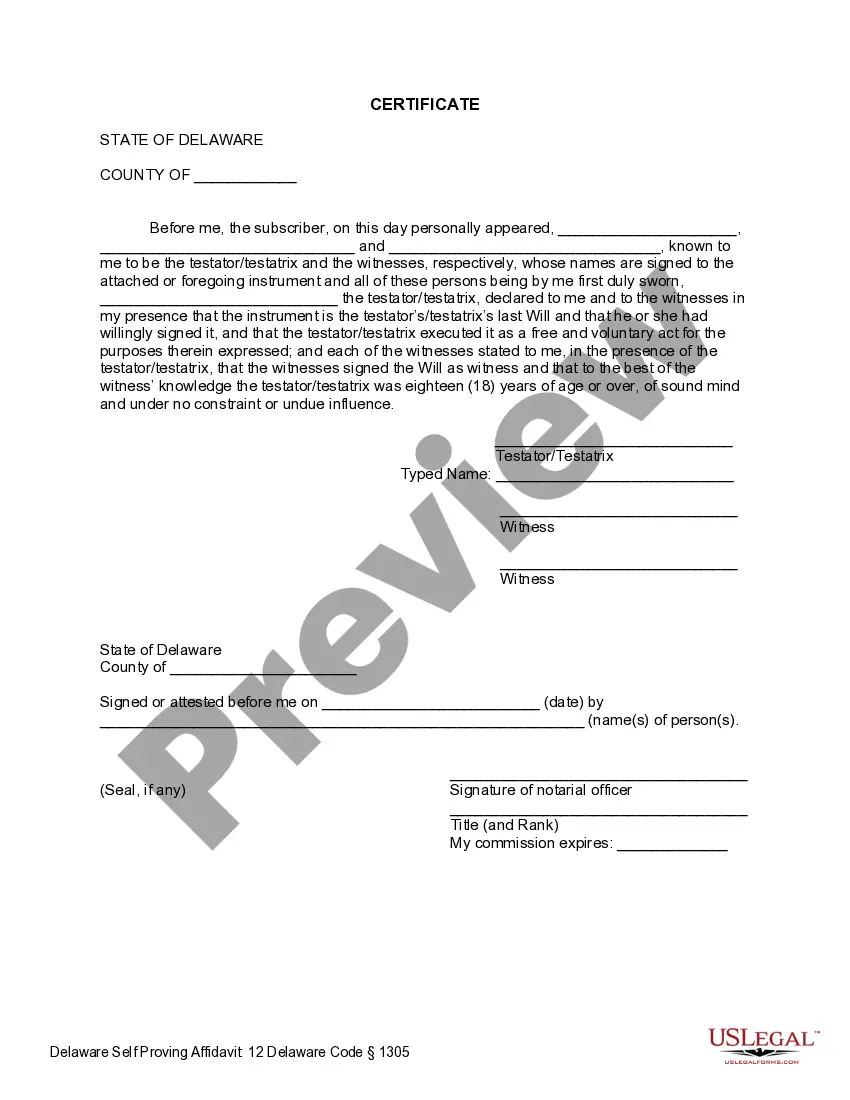

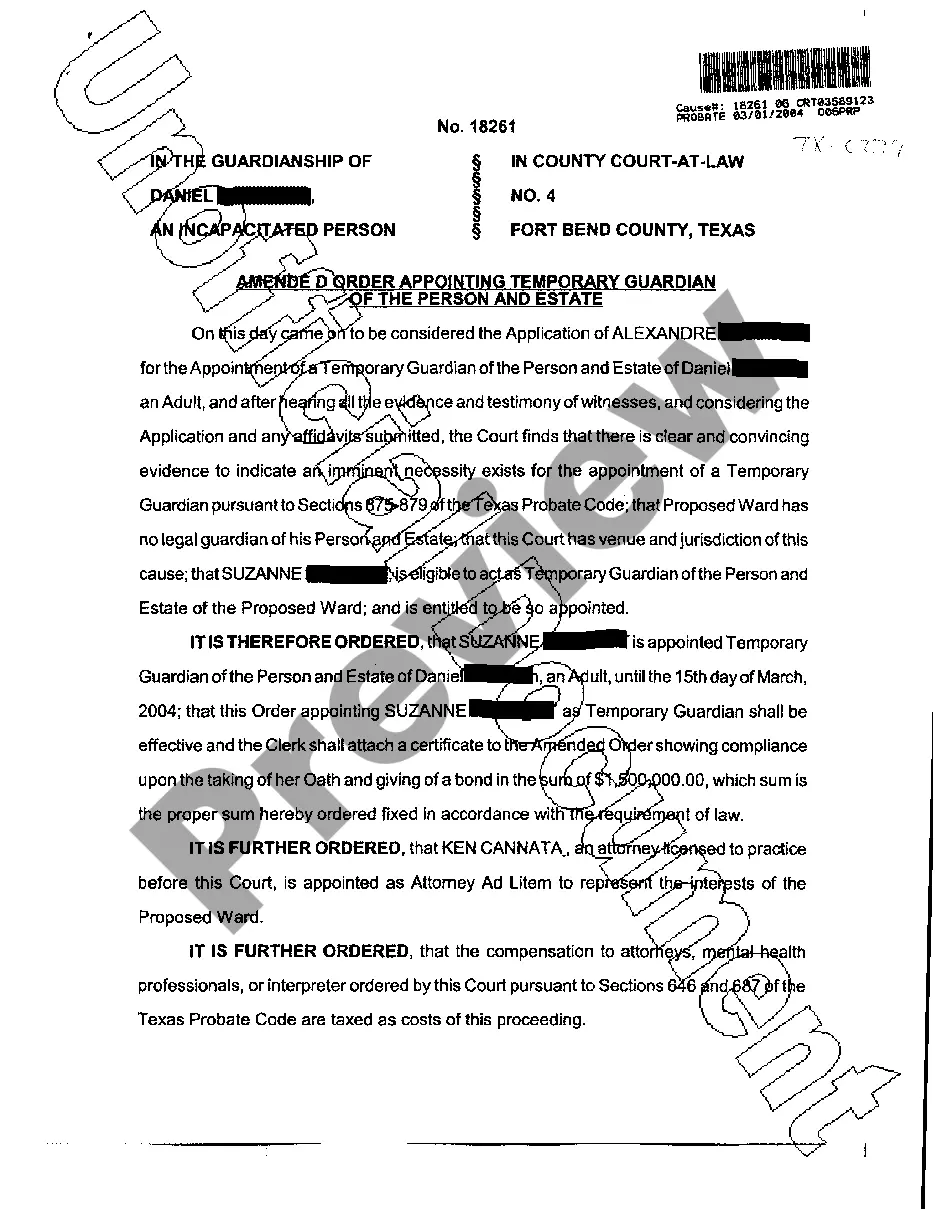

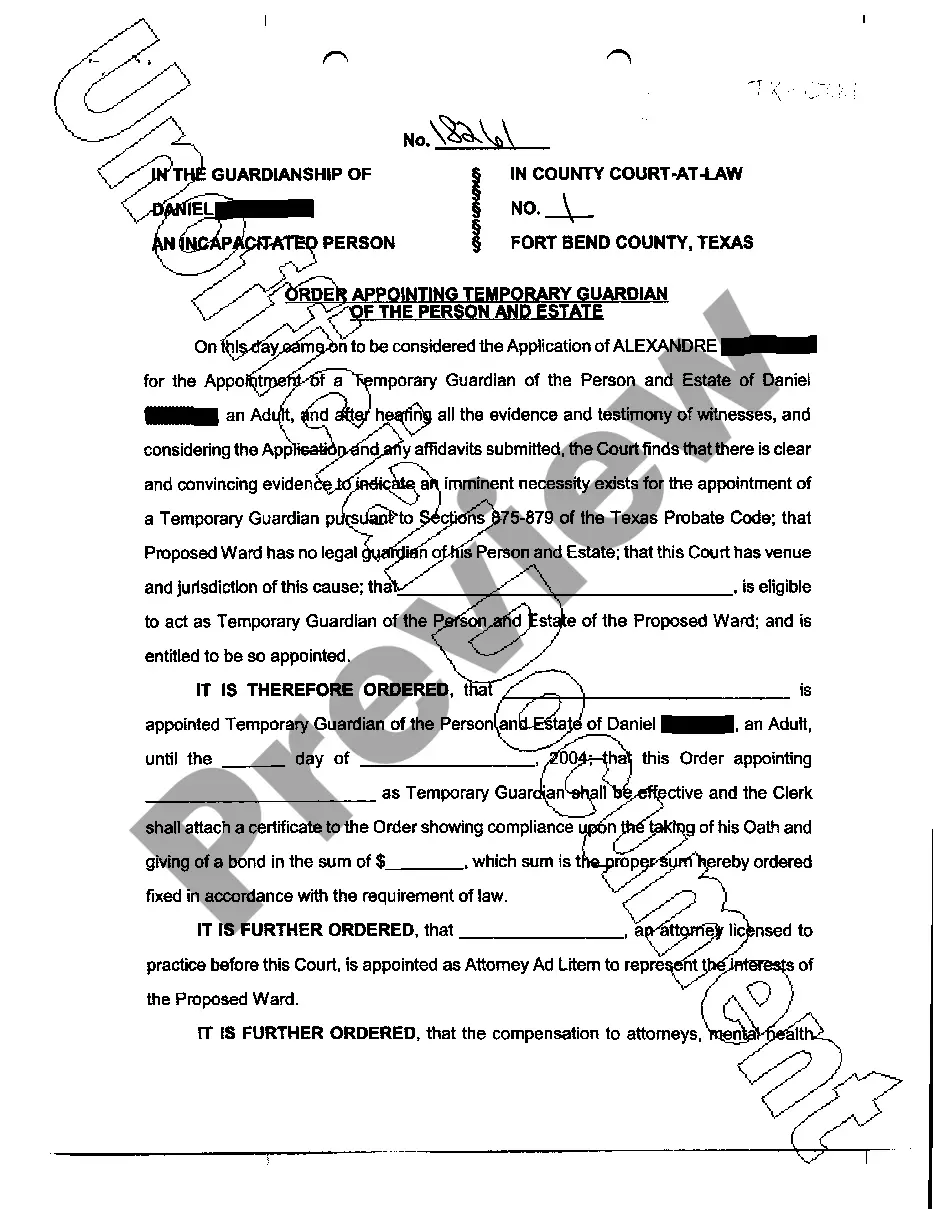

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Delaware Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Delaware Last Will And Testament With All Property To Trust Called A Pour Over Will?

The more documentation you need to organize - the more anxious you become.

You can locate countless Delaware Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will templates online, but you aren't sure which ones to rely on.

Eliminate the inconvenience to make acquiring samples simpler with US Legal Forms. Obtain precisely drafted documents that are designed to satisfy state requirements.

Input the required details to create your account and settle your order using PayPal or credit card. Choose a suitable file format and download your sample. Access each template you obtain in the My documents section. Go there to complete a new copy of the Delaware Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will. Even when utilizing expertly prepared forms, it is still important that you consider consulting your local legal advisor to verify that your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you currently possess a US Legal Forms subscription, Log In to your account, and you'll discover the Download key on the Delaware Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will’s page.

- If you’ve never used our service before, finish the registration process with the following steps.

- Ensure the Delaware Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will applies in your residing state.

- Double-check your selection by reviewing the description or by employing the Preview mode if it is available for the selected document.

- Simply click Buy Now to initiate the registration process and choose a pricing plan that fits your needs.

Form popularity

FAQ

Using a trust instead of a will can provide several advantages, including asset management flexibility and probate avoidance. A trust can control how assets are distributed over time, which is helpful for minor children or loved ones who need assistance. With a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you can leverage these benefits while still ensuring all your assets are directed to the trust upon your passing.

In general, a last will and testament does not override a trust, especially when the trust includes specific directives for asset distribution. If the assets are in the trust, they will be managed according to the trust’s guidelines rather than the provisions of the will. By understanding the dynamics of a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you can effectively ensure your estate plan works harmoniously.

Yes, a trust can override a last will and testament if the terms of the trust specify otherwise. For example, any assets placed in a trust during your lifetime will be distributed according to the trust and not according to your Delaware Last Will and Testament with All Property to Trust called a Pour Over Will. This emphasizes the importance of proper estate planning to ensure your wishes are clearly delineated.

over will functions by directing any assets not included in a trust at the time of your passing to be transferred into the trust. This ensures that everything you own can be managed under the same trust, which can make it easier to handle your estate. By utilizing a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you streamline your estate management and ensure your final wishes are honored.

over will is a specific type of last will and testament designed to transfer assets into a trust upon your death. In contrast, a traditional last will and testament only distributes assets directly to recipients. When you create a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, you ensure that any remaining assets not already in the trust will be moved there automatically, simplifying the estate process.

Beneficiaries do not take precedence over a trust; instead, they gain their rights through the terms of the trust. In the case of a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, the distribution of assets depends on what is outlined in the trust document. This means that the trust can dictate how and when beneficiaries receive their inheritances, which is not the case with a simple will.

A trust generally holds more power than a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will. This is because a trust can manage your assets while you are alive and after you pass away. Unlike a will, a trust allows for more control over how your assets are distributed, often avoiding probate. By using a trust, you can protect your loved ones from lengthy legal proceedings.

Distributing trust property to beneficiaries involves following the instructions laid out in the trust document. The trustee is responsible for managing assets and ensuring that distributions are made according to the terms of the trust. Utilizing a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will can simplify this process, as it helps to designate any remaining assets to flow directly into the trust for distribution.

Generally, a will does not override a trust, but it can influence how assets are distributed if there are conflicting directives. A Delaware Last Will and Testament with All Property to Trust called a Pour Over Will functions to align any leftover assets with your trust. If properly executed, this ensures your property will be managed according to your wishes established in the trust.

One disadvantage of a will is that it typically goes through probate, which can be a lengthy and public process. In contrast, a trust, particularly when combined with a Delaware Last Will and Testament with All Property to Trust called a Pour Over Will, can help your estate avoid the probate process. This benefit allows for quicker and more private distribution of assets to your beneficiaries.