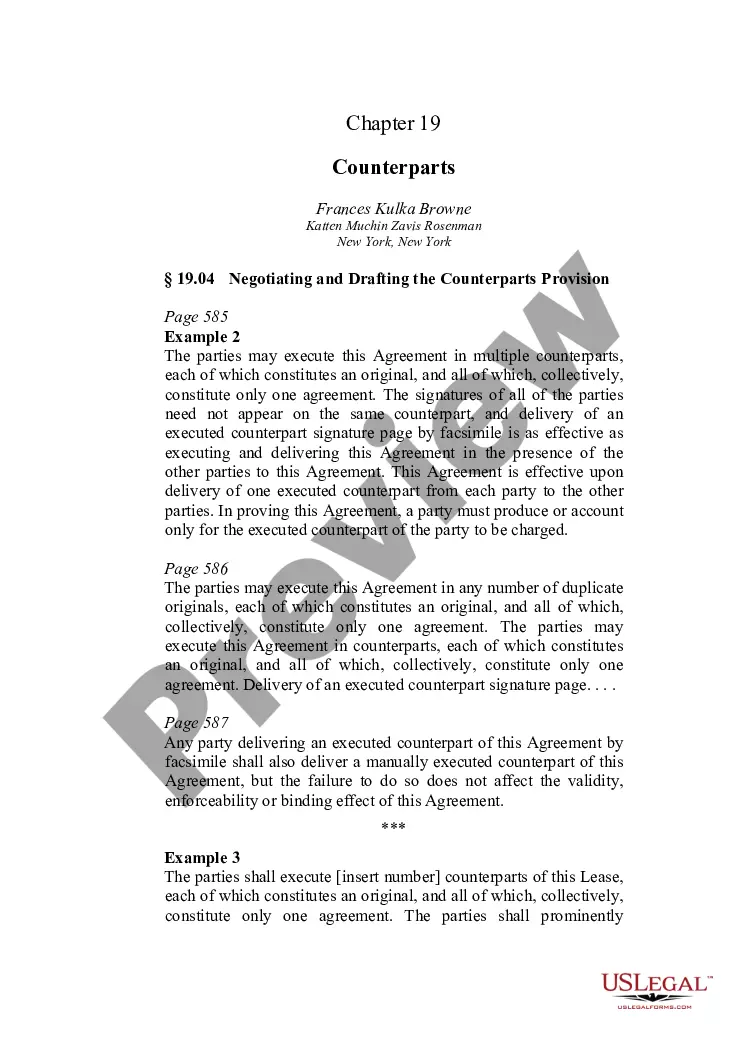

This form provides boilerplate contract clauses that merge prior and contemporary negotiations and agreements into the current contract agreement. Several different language options are included to suit individual needs and circumstances.

Delaware Negotiating and Drafting the Merger Provision

Description

How to fill out Negotiating And Drafting The Merger Provision?

You may devote several hours on-line attempting to find the legal file format that suits the federal and state requirements you want. US Legal Forms supplies a huge number of legal types that happen to be examined by professionals. You can easily obtain or printing the Delaware Negotiating and Drafting the Merger Provision from the assistance.

If you already possess a US Legal Forms account, you may log in and then click the Obtain switch. After that, you may total, change, printing, or signal the Delaware Negotiating and Drafting the Merger Provision. Every legal file format you acquire is yours forever. To acquire one more backup of any bought kind, check out the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms website initially, follow the basic guidelines listed below:

- First, be sure that you have chosen the correct file format for the region/area of your choice. See the kind information to make sure you have selected the proper kind. If readily available, use the Review switch to appear with the file format as well.

- If you want to find one more variation in the kind, use the Search field to find the format that meets your requirements and requirements.

- After you have located the format you need, just click Purchase now to continue.

- Select the pricing program you need, key in your references, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal account to fund the legal kind.

- Select the format in the file and obtain it to your system.

- Make alterations to your file if needed. You may total, change and signal and printing Delaware Negotiating and Drafting the Merger Provision.

Obtain and printing a huge number of file templates utilizing the US Legal Forms web site, that provides the most important assortment of legal types. Use expert and status-particular templates to deal with your organization or personal needs.

Form popularity

FAQ

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

If you're eyeing up a company to acquire and are eager to make the first move, here's some key things to remember. Assess whether your mission and visions align. ... Prepare in advance. ... Give an idea of how much you'd pay. ... Get only the essential info from the seller. ... Establish important terms. ... Negotiate buyer protections.

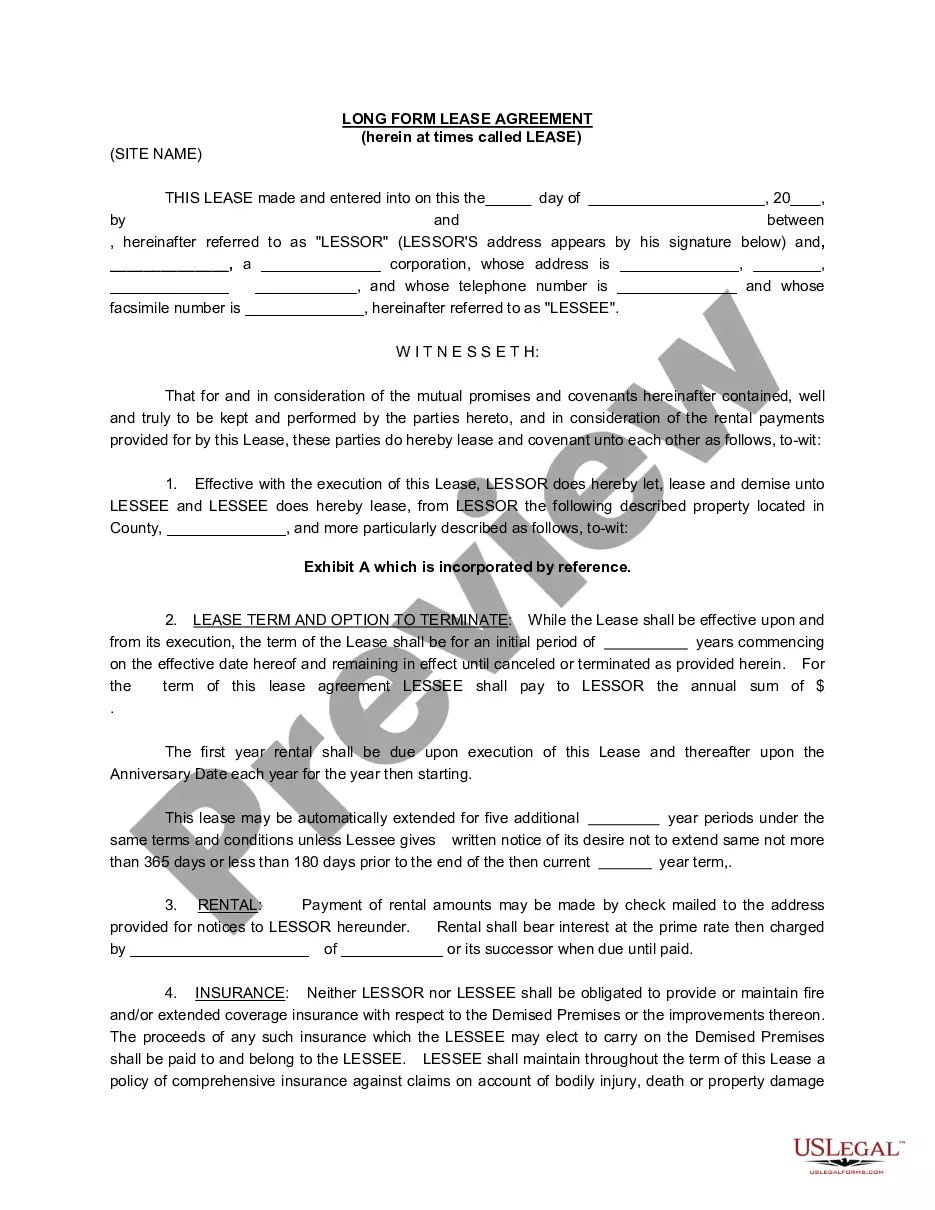

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

(a) Any 2 or more corporations of this State may merge into a single surviving corporation, which may be any 1 of the constituent corporations or may consolidate into a new resulting corporation formed by the consolidation, pursuant to an agreement of merger or consolidation, as the case may be, complying and approved ...

In a merger, the acquirer and the target?s board of directors agree on a price, and the target?s shareholders then vote whether or not to approve the proposal. In a tender offer, the acquirer proposes a per-share price to the target?s shareholders, who then have the choice of whether or not to sell at the offer price.

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).