Delaware Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

Selecting the ideal legal document template can be challenging. Clearly, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers a vast collection of templates, including the Delaware Self-Employed Independent Contractor Consideration For Hire Form, which you can utilize for business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Delaware Self-Employed Independent Contractor Consideration For Hire Form. Use your account to browse the legal forms you have purchased previously. Visit the My documents tab of your account to get another copy of the documents you require.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have chosen the correct form for your city/county. You can review the form using the Preview button and examine the form outline to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are sure the form is suitable, click the Buy now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the transaction using your PayPal account or Visa or Mastercard. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Delaware Self-Employed Independent Contractor Consideration For Hire Form. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to download properly crafted documents that comply with state regulations.

US Legal Forms is definitely the largest local library of lawful forms in which you can discover a variety of papers web templates. Utilize the service to download appropriately-manufactured papers that stick to state demands.

- Choosing the best lawful papers template might be a struggle.

- Obviously, there are plenty of web templates available on the net.

- But how can you obtain the lawful develop you require.

- Utilize the US Legal Forms web site.

- The service provides a huge number of web templates.

- Each of the forms are examined by professionals.

Form popularity

FAQ

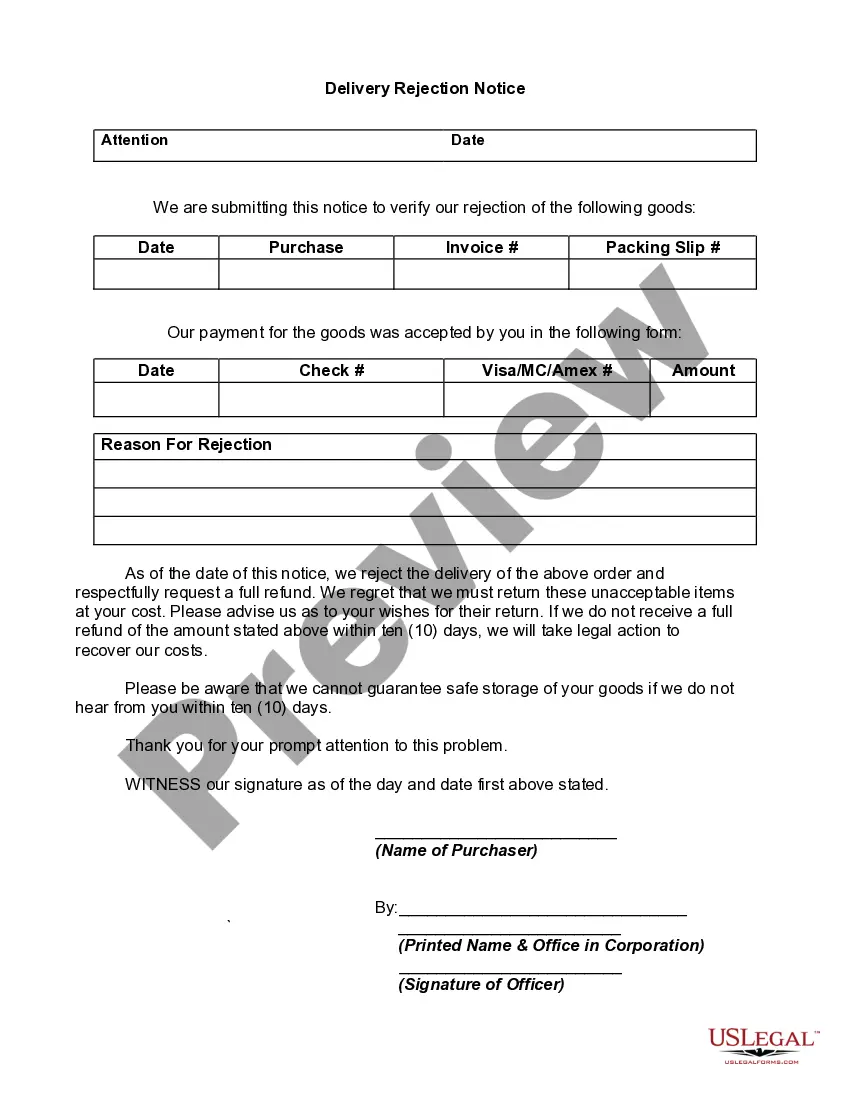

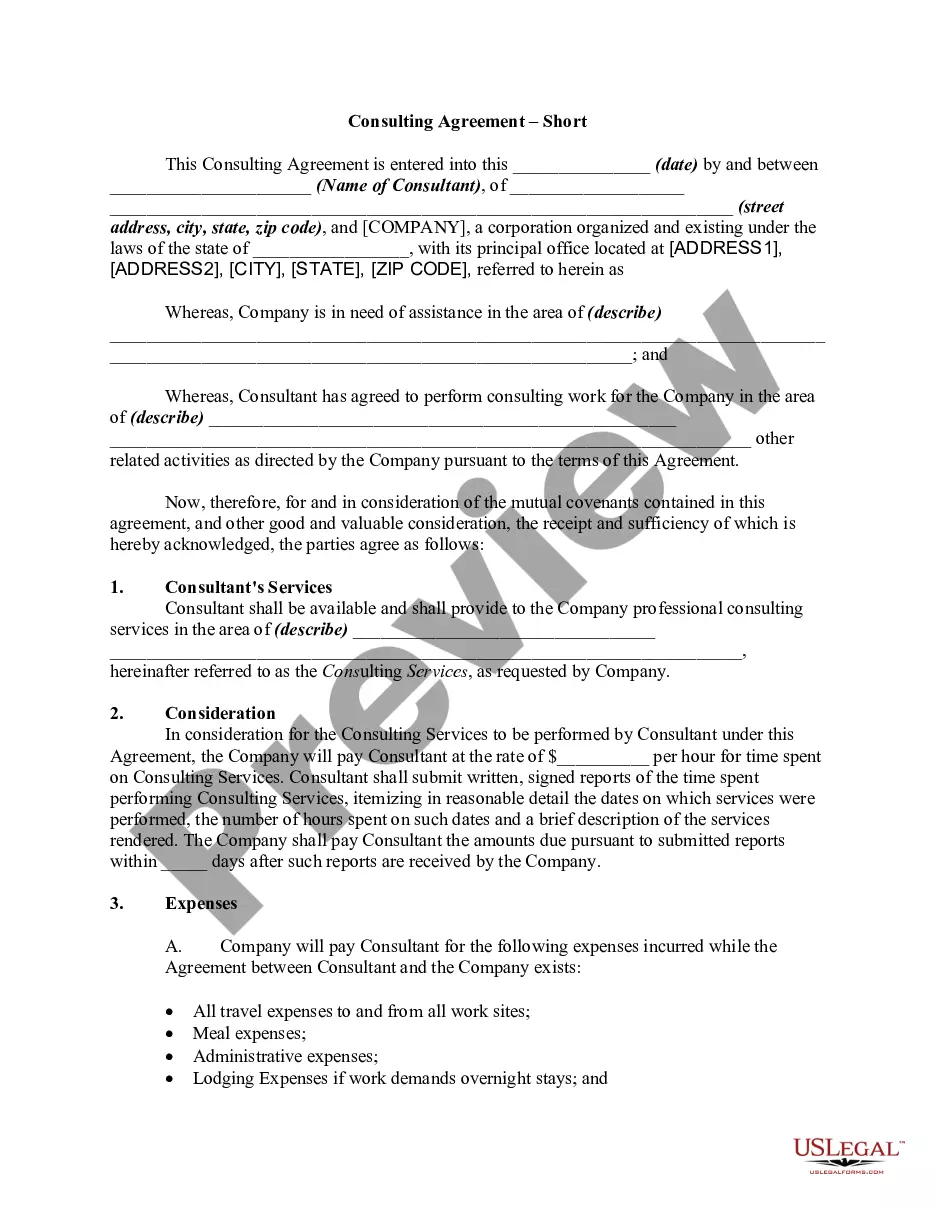

An independent contractor typically needs to complete a few essential documents, including a contract that outlines their services, payment terms, and deadlines. They should also fill out a W-9 form for tax purposes and a 1099 form once payment is processed. The Delaware Self-Employed Independent Contractor Consideration For Hire Form can streamline this process, ensuring that all requirements are met efficiently.

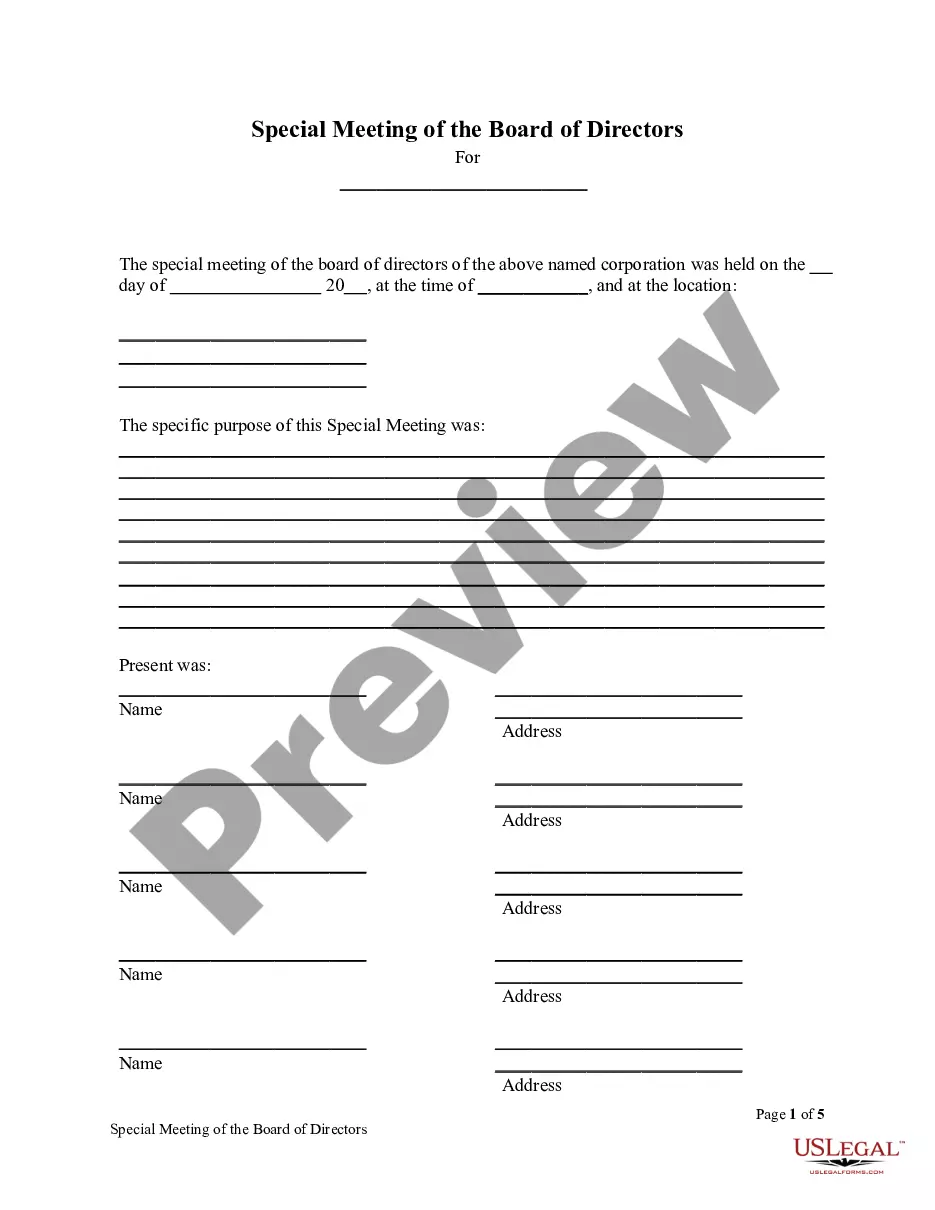

Filling out an independent contractor agreement begins with identifying the parties involved, including names and addresses. You should then describe the services to be performed, payment conditions, and project timelines. Utilizing the Delaware Self-Employed Independent Contractor Consideration For Hire Form ensures you include all necessary terms and protects both parties' interests in the contract.

To fill out an independent contractor form, start by inputting your name and contact information at the top. Next, specify the services you provide, along with the terms of payment and any deadlines involved. Finally, ensure all parties sign the Delaware Self-Employed Independent Contractor Consideration For Hire Form to validate the agreement. This process helps formalize your working relationship.

The primary consideration in determining if a hired person is an independent contractor involves the level of control and independence in their work. Typically, if you direct their work methods, hours, and schedule, they might be classified as an employee. However, if they operate independently and control how they complete their tasks, they are likely an independent contractor. Therefore, obtaining a Delaware Self-Employed Independent Contractor Consideration For Hire Form can clarify this distinction.

To set up as an independent contractor, start by defining your services and identifying your target market. Next, you may need to register your business and obtain any required licenses. Utilizing the Delaware Self-Employed Independent Contractor Consideration For Hire Form will help you establish clear terms with clients, providing a solid foundation for your contracting business. Finally, market your services effectively to attract potential clients.

Independent contractors often use the Delaware Self-Employed Independent Contractor Consideration For Hire Form to formalize their agreements with clients. This form outlines the terms of the engagement and clarifies your status as an independent contractor. It is essential for ensuring that both parties understand their rights and obligations. Using this form can make your contracting process smoother and more professional.

In Delaware, independent contractors generally do not need a specific business license to operate. However, depending on your business activities, you may need a general business license or permits related to your profession. It’s crucial to check local regulations for any specific requirements. Utilizing the Delaware Self-Employed Independent Contractor Consideration For Hire Form can help clarify your status and responsibilities.

The choice between a 1099 and a W-9 form depends on the context. A W-9 form is used to collect tax information from an independent contractor. On the other hand, a 1099 form reports payments made to independent contractors for tax purposes. Generally, you will need both forms in the hiring process to ensure compliance with tax regulations.

Independent contractors primarily need to fill out a Delaware Self-Employed Independent Contractor Consideration For Hire Form. This form clarifies the work arrangement. They also require a W-9 form for tax information. Ensuring that all necessary forms are filled out will streamline communication and compliance.

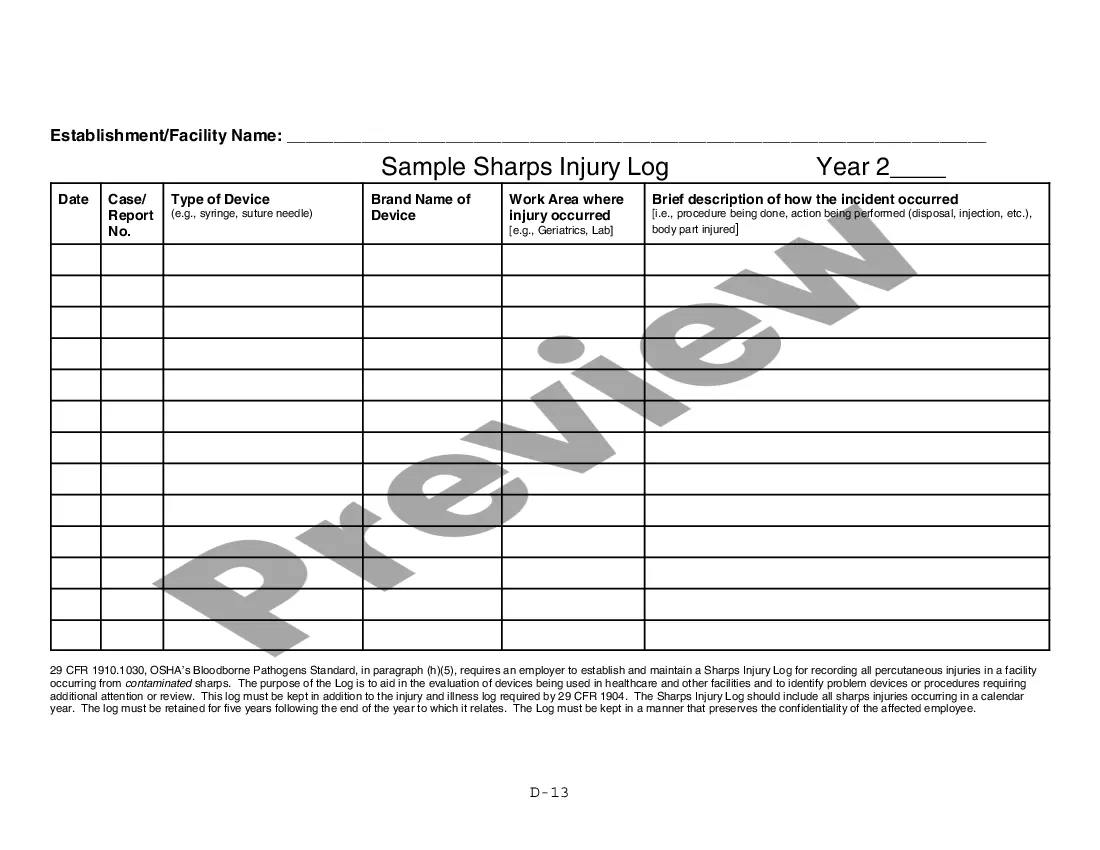

Independent contractors must meet several legal requirements, including proper documentation. The Delaware Self-Employed Independent Contractor Consideration For Hire Form is vital for establishing the relationship. Additionally, contractors should maintain their own tax obligations. Familiarizing yourself with these legal aspects is essential for both parties.