Delaware Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

Finding the appropriate valid document template can be quite a challenge.

Certainly, there are numerous templates available online, but how do you obtain the official form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Delaware Storage Services Contract - Self-Employed, which can be utilized for both business and personal purposes. All of the documents are reviewed by experts and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate document. Once you are confident that the form is suitable, click the Get now button to obtain the form. Select the pricing plan you want and enter the necessary information. Create your account and pay for the order using your PayPal account or Visa or Mastercard. Choose the file format and download the valid document template to your device. Complete, modify, print, and sign the downloaded Delaware Storage Services Contract - Self-Employed. US Legal Forms is the largest repository of valid documents where you can find various paper templates. Utilize the service to download properly-crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and click on the Obtain button to retrieve the Delaware Storage Services Contract - Self-Employed.

- Use your account to view the valid forms you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines for you to follow.

- First, make sure you have selected the correct form for your city/county.

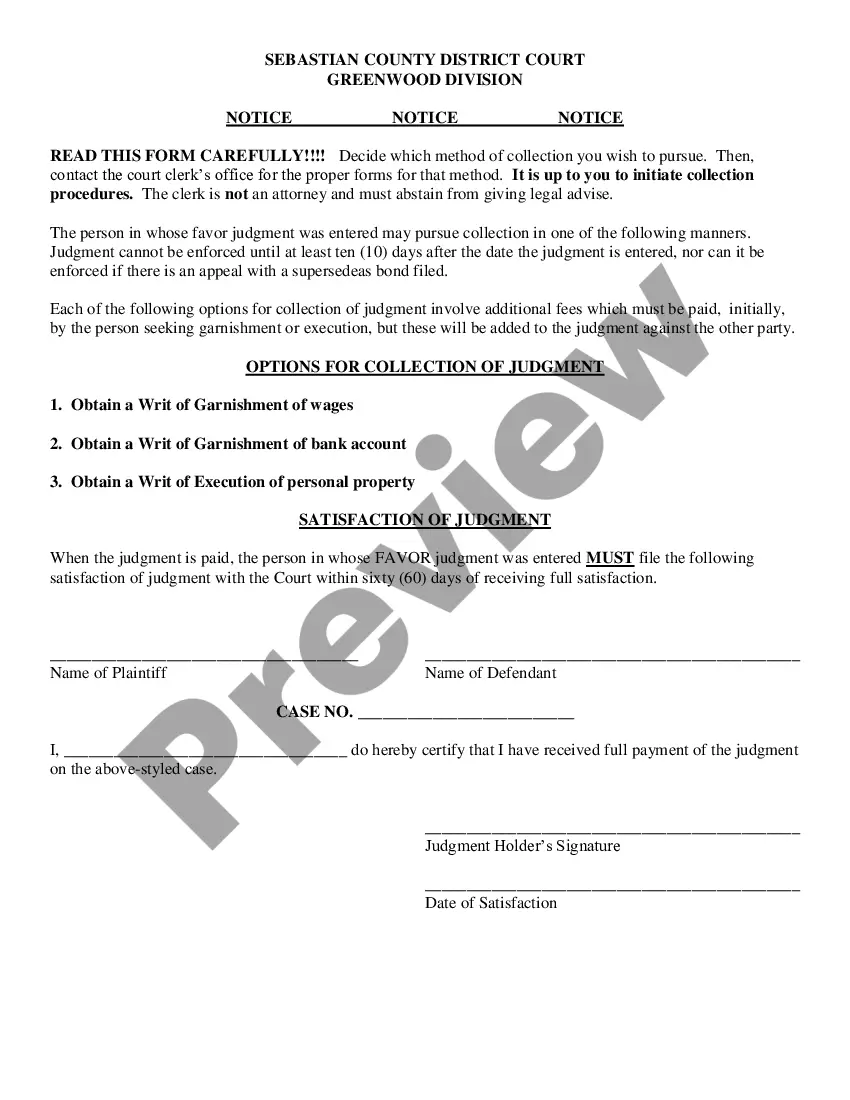

- You can browse the form using the Preview option and review the form description to confirm it is suitable for you.

Form popularity

FAQ

Yes, you can file a Delaware LLC online, making the process efficient and straightforward. The State of Delaware allows self-employed individuals to complete the necessary forms electronically, saving time and providing immediate confirmation. By filing online, you can swiftly obtain your Delaware Storage Services Contract - Self-Employed, ensuring that your business needs are fully supported while establishing your LLC easily.

tomonth lease in Delaware allows you to rent property for one month at a time, providing flexibility for both landlords and tenants. This type of lease rolls over automatically each month until either party gives proper notice to terminate. It is beneficial for those who may need temporary housing or wish to avoid longterm commitments. For selfemployed individuals, having a Delaware Storage Services Contract SelfEmployed can complement this arrangement by ensuring your storage needs are met without heavy obligations.

Yes, buying abandoned storage units is legal, but the process requires adherence to state laws and auction procedures. You must ensure that you understand the auction terms and the applicable Delaware Storage Services Contract - Self-Employed before participating. This can lead to unique finds but requires careful consideration and responsibility in handling the contents legally. Always stay informed of the legal implications before engaging in such transactions.

The income of storage unit owners can vary significantly based on location and management. On average, owners earn between $30,000 and $100,000 annually, depending on the scale of their operations. Understanding the financial aspects is crucial when entering into a Delaware Storage Services Contract - Self-Employed. Researching the market can provide insights into potential earnings and costs.

In Delaware, the cancellation timeframe depends on the specific terms of your contract. Generally, for self-employed individuals, you should check your Delaware Storage Services Contract - Self-Employed for any clauses regarding cancellation. Often, these agreements may not have a mandated cancellation period, so it is wise to act quickly if you wish to back out. Legal consultation is advisable to ensure compliance with the agreement.

A breach of contract in Delaware occurs when one party fails to perform their duties as defined in the contract. This may include not paying for the storage unit or not providing access as promised. Under a Delaware Storage Services Contract - Self-Employed, it’s crucial to know your rights in case of such a breach. Seeking legal advice can help clarify your options for addressing these issues.

Storage contracts typically outline the terms of renting a storage unit, including payment schedules, access rights, and responsibilities for both parties. Under a Delaware Storage Services Contract - Self-Employed, these details ensure transparency and protect each party’s interests. Understanding these elements helps you adhere to the agreement and avoid potential disputes. Always read and understand all terms before signing.

Generally, any person or entity conducting business activities in Delaware may need a business license. This includes sole proprietors, LLCs, and independent contractors. It's wise to confirm your requirements to ensure your Delaware Storage Services Contract - Self-Employed adheres to state regulations.

The Delaware business tax loophole refers to the state's favorable tax structure, which can benefit self-employed individuals. It allows businesses to reduce their overall tax burden through various incentives. This information can be strategic when considering how to structure your Delaware Storage Services Contract - Self-Employed.

Independent contractors may need a business license in Delaware, depending on the nature of their work. If your service requires specific licensing, you must obtain the appropriate business license. This ensures that your Delaware Storage Services Contract - Self-Employed is legally sound and recognized by the state.