Delaware Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

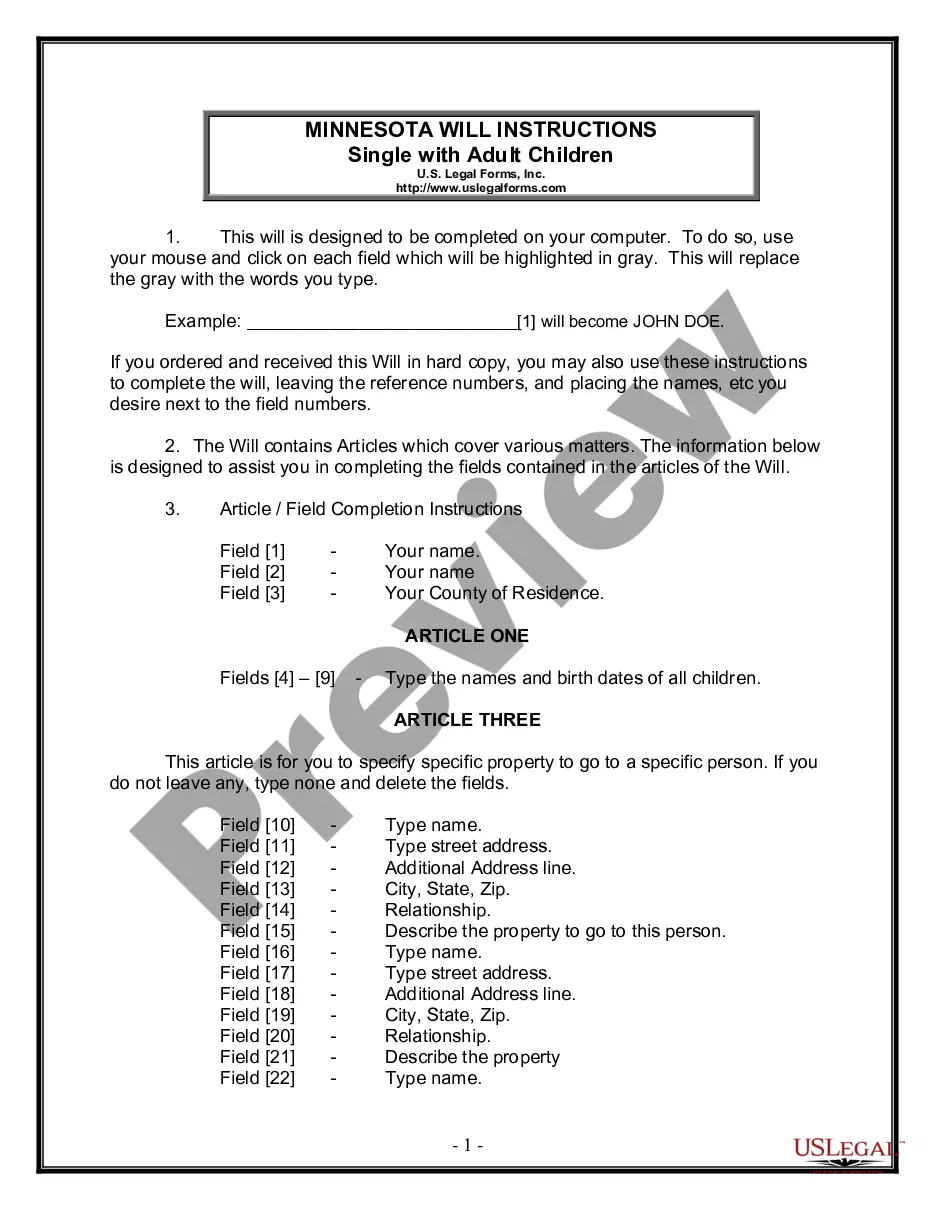

How to fill out Sample Identity Theft Policy For FCRA And FACTA Compliance?

It is possible to invest hours online looking for the authorized record web template that meets the federal and state demands you need. US Legal Forms provides a large number of authorized varieties that are evaluated by experts. You can easily download or produce the Delaware Sample Identity Theft Policy for FCRA and FACTA Compliance from the services.

If you currently have a US Legal Forms profile, you are able to log in and click on the Download switch. Next, you are able to full, modify, produce, or signal the Delaware Sample Identity Theft Policy for FCRA and FACTA Compliance. Each authorized record web template you acquire is your own for a long time. To obtain yet another copy of the bought form, check out the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms site the very first time, stick to the easy instructions listed below:

- Initial, make certain you have chosen the best record web template for the region/area of your liking. Read the form description to ensure you have picked out the proper form. If accessible, use the Review switch to check throughout the record web template at the same time.

- If you would like locate yet another edition of your form, use the Look for industry to get the web template that fits your needs and demands.

- After you have located the web template you desire, simply click Purchase now to proceed.

- Choose the pricing strategy you desire, type in your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You may use your charge card or PayPal profile to fund the authorized form.

- Choose the format of your record and download it to the device.

- Make changes to the record if possible. It is possible to full, modify and signal and produce Delaware Sample Identity Theft Policy for FCRA and FACTA Compliance.

Download and produce a large number of record web templates using the US Legal Forms Internet site, that provides the most important assortment of authorized varieties. Use specialist and state-specific web templates to tackle your company or individual requires.

Form popularity

FAQ

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft.

A copy of your FTC Identity Theft Report. A government-issued ID with a photo. Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc.

The Delaware Division of Revenue at 1-800-292-7826 or directly at 302-856-5358 to speak with a fraud auditor. Our business hours are Monday through Friday from am until pm. Contact and place a ?fraud alert? on your credit records with the three major credit bureaus: Equifax (800) 525-6285.

Types of Identity Theft The victim usually doesn't realize their identity is being used until they receive a court summons or employers uncover the infraction on their background check. Even once it's discovered, criminal identity theft is often hard and complicated to prove.

FACTA amends the Fair Credit Reporting Act (FCRA) to: help consumers combat identity theft; establish national standards for the regulation of consumer report information; assist consumers in controlling the type and amount of marketing solicitations they receive; and.

Your name, address and date of birth provide enough information to create another 'you'. An identity thief can use a number of methods to find out your personal information and will then use it to open bank accounts, take out credit cards and apply for state benefits in your name.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

If you're not sure of the victim's identity, the FCRA allows you to ask for proof of identity, such as a copy of a government-issued identification. You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report.