Delaware Retail Internet Site Agreement

Description

How to fill out Retail Internet Site Agreement?

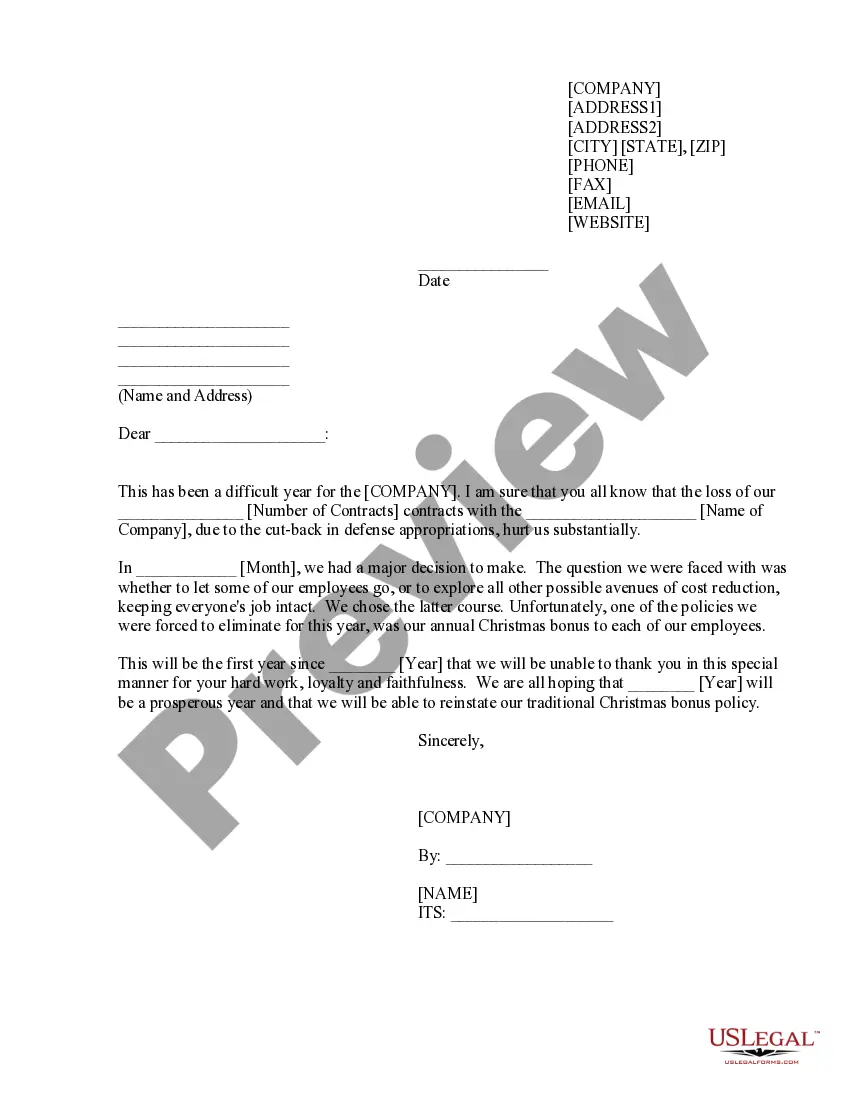

Choosing the best authorized record web template might be a struggle. Naturally, there are tons of web templates accessible on the Internet, but how will you obtain the authorized develop you require? Take advantage of the US Legal Forms website. The service offers thousands of web templates, like the Delaware Retail Internet Site Agreement, which can be used for business and personal requires. Each of the kinds are examined by professionals and fulfill federal and state demands.

If you are currently listed, log in for your accounts and then click the Obtain button to have the Delaware Retail Internet Site Agreement. Make use of your accounts to search with the authorized kinds you possess ordered in the past. Check out the My Forms tab of your respective accounts and acquire yet another version from the record you require.

If you are a whole new consumer of US Legal Forms, here are straightforward instructions that you should follow:

- Initially, ensure you have selected the right develop for the town/area. You can check out the form making use of the Review button and browse the form description to make sure this is basically the right one for you.

- In case the develop will not fulfill your expectations, utilize the Seach industry to get the right develop.

- Once you are certain that the form would work, click the Buy now button to have the develop.

- Select the costs strategy you need and enter in the necessary information. Build your accounts and pay money for your order making use of your PayPal accounts or Visa or Mastercard.

- Pick the submit format and download the authorized record web template for your gadget.

- Full, revise and print and signal the acquired Delaware Retail Internet Site Agreement.

US Legal Forms is definitely the greatest collection of authorized kinds that you can discover numerous record web templates. Take advantage of the company to download appropriately-manufactured paperwork that follow condition demands.

Form popularity

FAQ

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Delaware allows anonymous LLCs where the LLC's owners do not have to make their name and address a public record. The registered agent's address appears on the public record, keeping your address private. Maintain your LLC's good standing. Missing a tax deadline will jeopardize your LLC's status in Delaware.

Here is what Delaware LLC privacy offers: No information about the members or managers is required to be listed on the Certificate of Formation. The Delaware Division of Corporations does not request, obtain or store any information regarding the LLC's members and managers.

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Delaware is a tax-free state and doesn't have sales tax. Delaware law does not affect the amount of sales tax if sales tax was paid in another state.

Delaware is one of the few US states without a traditional sales tax. This means that sellers of SaaS and other digital products don't need to collect sales tax in the state.

A Delaware LLC Operating Agreement is a private company document. Delaware does not require LLCs to make their Operating Agreement publicly available.

One of the most popular aspects is that the state of Delaware does not require a Delaware LLC's Operating Agreement to be filed or made public, as some other states do; thus your Delaware LLC's Operating Agreement remains completely private among you and your fellow LLC members.