Delaware Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

How to fill out Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

US Legal Forms - one of the most significant libraries of legal kinds in the USA - delivers a wide range of legal file themes you may acquire or print out. Using the website, you will get a large number of kinds for company and specific functions, categorized by groups, claims, or key phrases.You will find the latest versions of kinds such as the Delaware Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc in seconds.

If you already have a monthly subscription, log in and acquire Delaware Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc through the US Legal Forms local library. The Acquire key will appear on every single develop you view. You gain access to all formerly downloaded kinds inside the My Forms tab of your bank account.

If you want to use US Legal Forms the first time, listed below are straightforward recommendations to help you began:

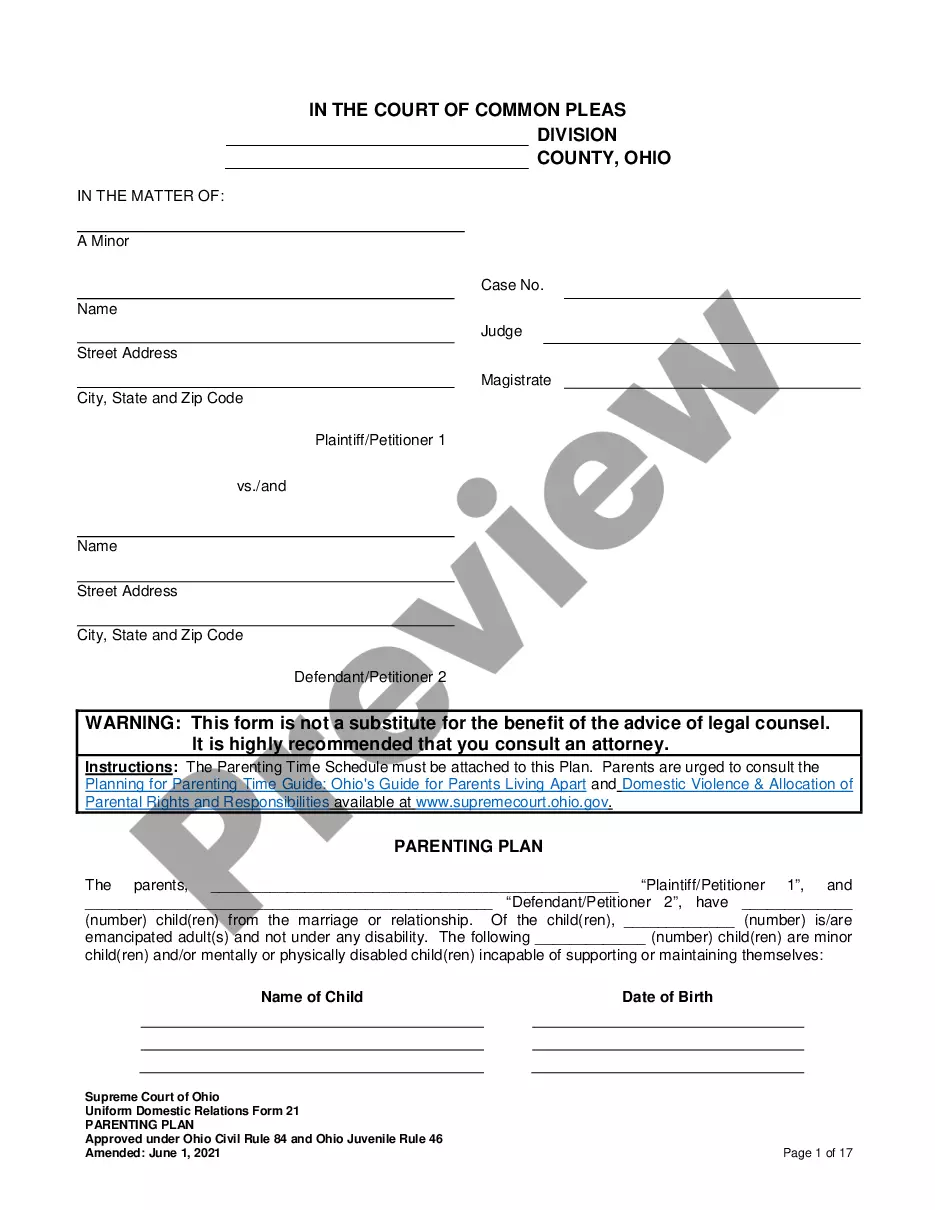

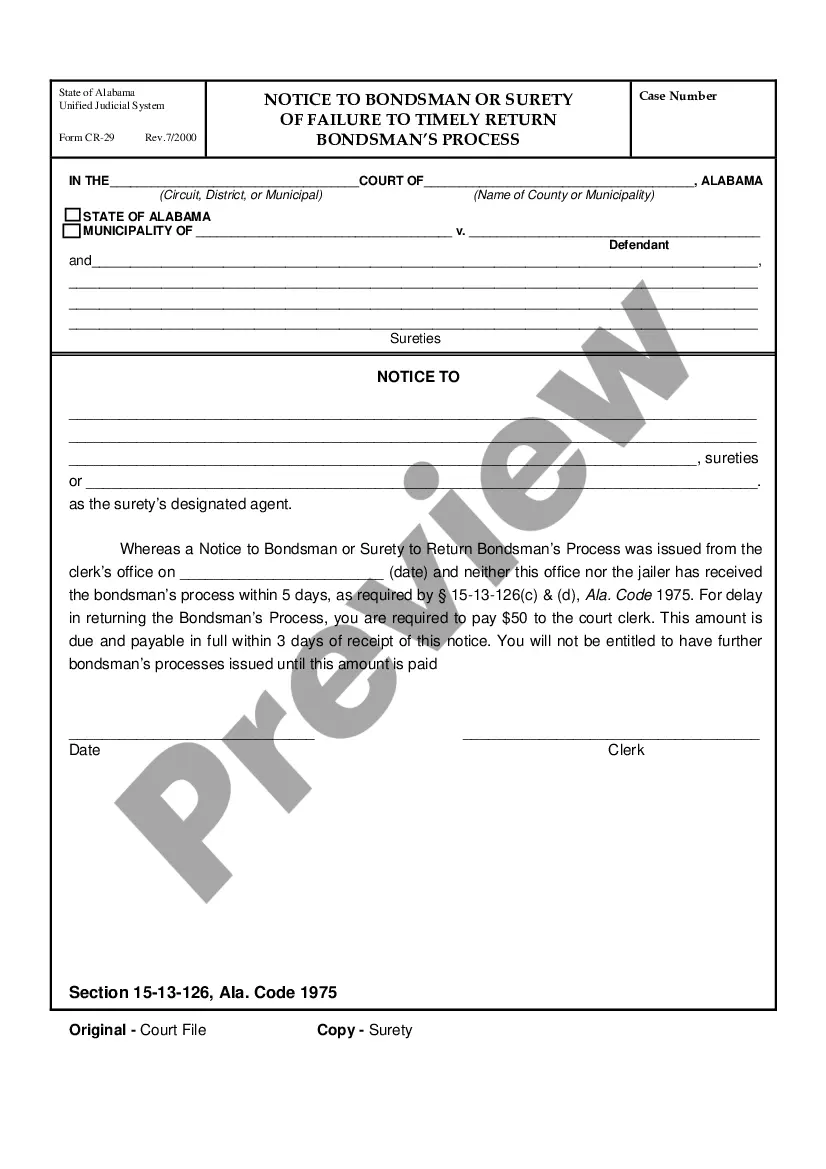

- Be sure to have selected the proper develop to your metropolis/state. Select the Preview key to check the form`s content. Browse the develop information to ensure that you have selected the right develop.

- If the develop does not fit your needs, utilize the Lookup area towards the top of the screen to obtain the one who does.

- When you are content with the form, affirm your option by clicking on the Buy now key. Then, opt for the costs plan you favor and offer your references to sign up for an bank account.

- Approach the purchase. Make use of credit card or PayPal bank account to finish the purchase.

- Pick the structure and acquire the form on your own system.

- Make alterations. Fill out, modify and print out and indicator the downloaded Delaware Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc.

Each and every format you added to your account does not have an expiry day which is your own forever. So, if you want to acquire or print out one more duplicate, just visit the My Forms portion and click in the develop you require.

Get access to the Delaware Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc with US Legal Forms, probably the most substantial local library of legal file themes. Use a large number of expert and condition-particular themes that meet up with your business or specific demands and needs.

Form popularity

FAQ

Hear this out loud PauseVertical merger This type of merger is ideal for streamlining operations, boosting efficiencies, and cutting costs across the supply chain, but it can also reduce flexibility and result in new complexities for the business to manage. A well-known example of a vertical merger is the deal between eBay and PayPal.

Hear this out loud PauseThere are five commonly-referred to types of business combinations known as mergers: conglomerate merger, horizontal merger, market extension merger, vertical merger and product extension merger.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

There are four types of mergers that you are likely to encounter: general mergers, parent-subsidiary mergers, triangular mergers and multi-entity mergers.

Types of Mergers Horizontal ? a merger between companies with similiar products. Vertical ? a merger that consolidates the supply line of a product. Concentric ? a merger between companies who have similar audiences with different products. Conglomerate ? a merger between companies who offer diverse products/services.

Hear this out loud PauseA triangular merger involves three business entities: a parent (the acquirer), its subsidiary, and the entity to be acquired (the target). This merger type involves the creation of a wholly-owned subsidiary of the acquiring company in order to facilitate a share exchange between the buyer and the seller.

Also known as a parent-subsidiary merger, a short-form merger is a merger between a parent company and its substantially (but not necessarily wholly) owned subsidiary, with either the parent company or the subsidiary surviving the merger.