Delaware Complex Will - Credit Shelter Marital Trust for Spouse

Description

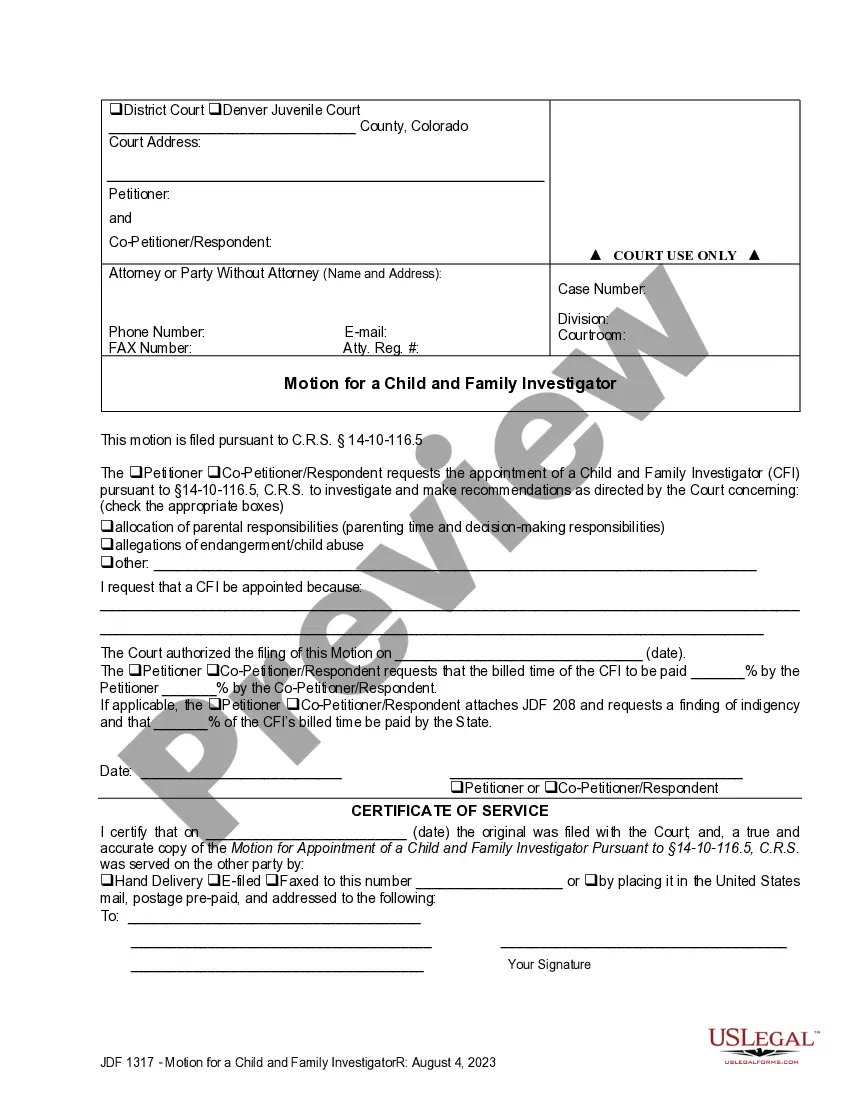

How to fill out Complex Will - Credit Shelter Marital Trust For Spouse?

US Legal Forms - one of many largest libraries of legitimate varieties in the USA - offers an array of legitimate papers themes you are able to obtain or produce. Using the website, you can get 1000s of varieties for company and person purposes, sorted by classes, suggests, or key phrases.You will discover the most up-to-date models of varieties just like the Delaware Complex Will - Credit Shelter Marital Trust for Spouse in seconds.

If you currently have a membership, log in and obtain Delaware Complex Will - Credit Shelter Marital Trust for Spouse from the US Legal Forms library. The Download option can look on each form you see. You have access to all earlier acquired varieties from the My Forms tab of the account.

If you would like use US Legal Forms initially, here are easy directions to get you started off:

- Make sure you have picked the proper form to your area/state. Click the Preview option to examine the form`s articles. Read the form description to actually have selected the correct form.

- If the form does not match your specifications, utilize the Look for industry at the top of the display to find the one which does.

- If you are satisfied with the shape, confirm your option by simply clicking the Buy now option. Then, opt for the prices plan you like and offer your qualifications to sign up to have an account.

- Procedure the purchase. Make use of credit card or PayPal account to perform the purchase.

- Choose the format and obtain the shape on the system.

- Make modifications. Fill out, change and produce and indication the acquired Delaware Complex Will - Credit Shelter Marital Trust for Spouse.

Each and every web template you added to your money lacks an expiry date and is also your own for a long time. So, if you wish to obtain or produce an additional copy, just visit the My Forms area and click on around the form you will need.

Obtain access to the Delaware Complex Will - Credit Shelter Marital Trust for Spouse with US Legal Forms, one of the most comprehensive library of legitimate papers themes. Use 1000s of specialist and condition-specific themes that meet your small business or person requirements and specifications.

Form popularity

FAQ

Delaware's directed trust law provides: Freedom to engage in estate planning or asset protection planning using illiquid assets, such as stock in the family business, real estate, or hedge fund/private equity investments, when a trustee may otherwise be reluctant to hold these types of assets.

Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.

An A/B/C Trust (sometimes referred to as a "Q-TIP" or "Qualified Terminable Interest Property" Trust) is similar to an A and B Trust in purpose and function. However, an A/B/C Trust is for married couples with estates that are clearly above the estate tax exemption amount.

One of the more attractive options that many married couples incorporate into their estate plans is the use of a QTIP trust. It may sound like piece of cotton, but its true name is much more daunting? the Qualified Terminable Interest Property trust.

An irrevocable trust offers your assets the most protection from creditors and lawsuits. Assets in an irrevocable trust aren't considered personal property. This means they're not included when the IRS values your estate to determine if taxes are owed.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

Unlike a QTIP trust, the assets of the credit shelter trust are not included in the beneficiary's gross estate and, as a result, are not subject to estate tax at the beneficiary's death (in other words, the assets bypass the beneficiary's estate).

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.