Delaware Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics

Description

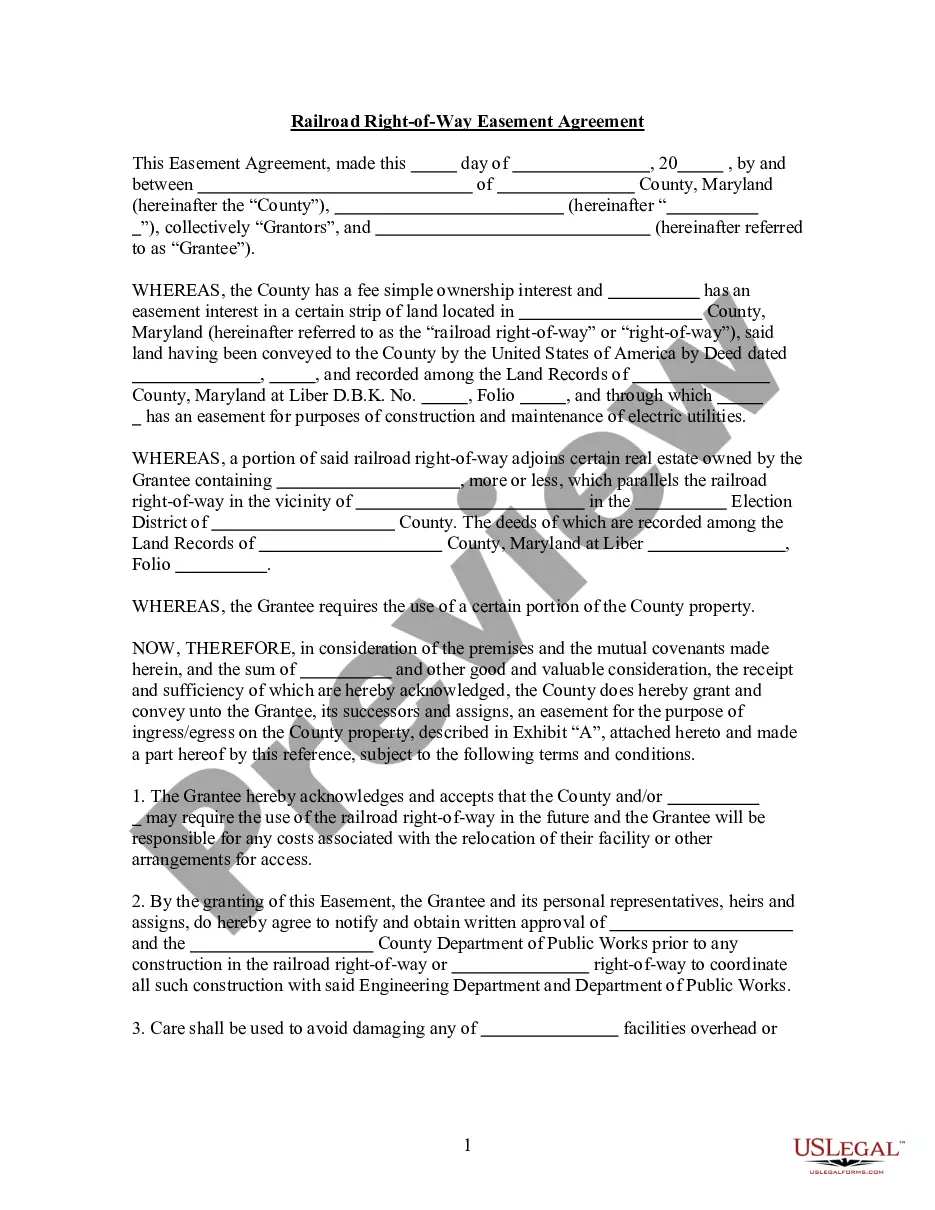

How to fill out Eligible Director Nonqualified Stock Option Agreement Of Wyle Electronics?

If you want to full, down load, or print lawful file themes, use US Legal Forms, the largest assortment of lawful types, that can be found on the web. Make use of the site`s basic and handy search to obtain the paperwork you require. Different themes for company and person functions are sorted by groups and states, or search phrases. Use US Legal Forms to obtain the Delaware Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics in a few mouse clicks.

In case you are currently a US Legal Forms client, log in to the profile and click the Download key to obtain the Delaware Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics. You can even entry types you previously downloaded from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for that right metropolis/nation.

- Step 2. Use the Review choice to examine the form`s articles. Don`t forget to read the information.

- Step 3. In case you are not happy with the kind, utilize the Research field near the top of the screen to locate other models in the lawful kind format.

- Step 4. Once you have located the shape you require, click the Buy now key. Select the rates plan you favor and add your qualifications to register on an profile.

- Step 5. Process the purchase. You can use your charge card or PayPal profile to complete the purchase.

- Step 6. Pick the formatting in the lawful kind and down load it in your product.

- Step 7. Complete, revise and print or signal the Delaware Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics.

Every single lawful file format you buy is your own forever. You possess acces to every single kind you downloaded inside your acccount. Select the My Forms segment and select a kind to print or down load once more.

Contend and down load, and print the Delaware Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics with US Legal Forms. There are thousands of skilled and state-certain types you may use to your company or person requirements.

Form popularity

FAQ

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

What are non-qualified stock options? Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

qualified stock option is an employee stock option wherein the employee pays ordinary income tax on the difference between the grant price and the fair market price at which he exercises the option. qualified stock option is one way to reward employees.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.