Statutory Guidelines [Appendix A(5) Tres. Regs 1.46B and 1.46B-1 to B-5] regarding designated settlement funds and qualified settlement funds.

Delaware Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5

Description

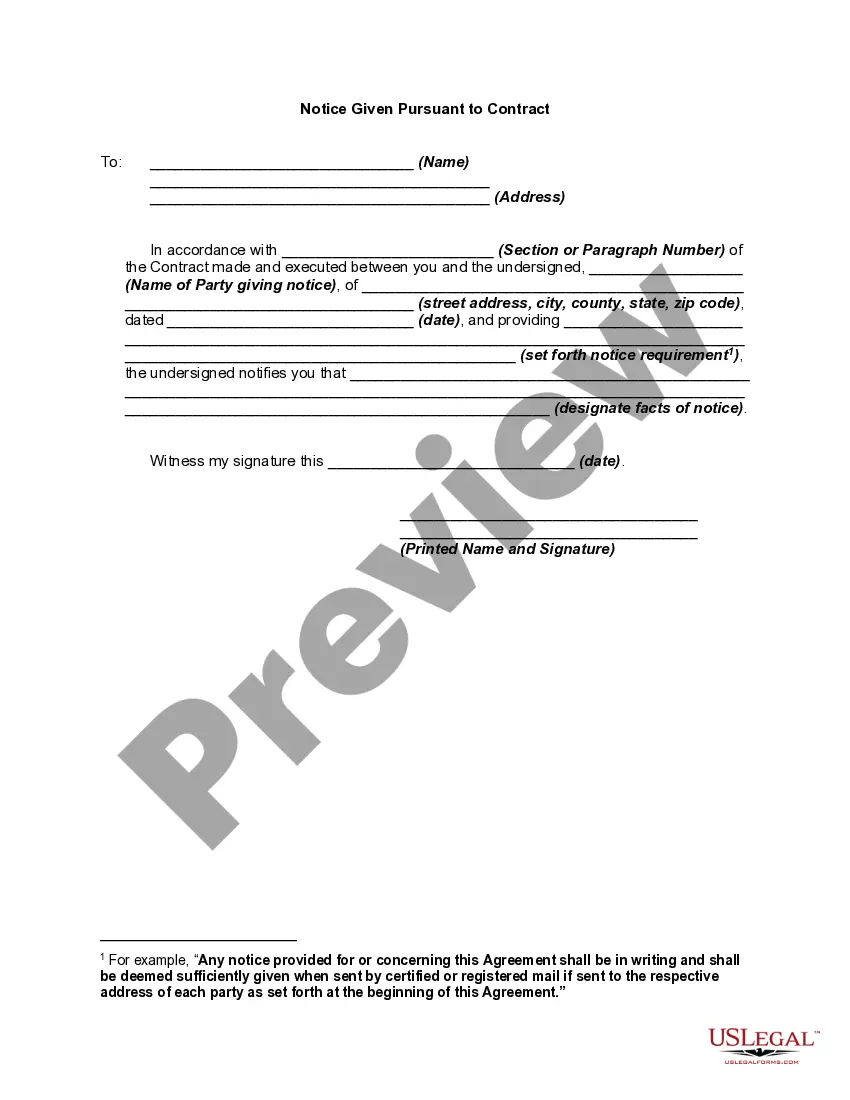

How to fill out Designated Settlement Funds Treasury Regulations 1.468 And 1.468B.1 Through 1.468B.5?

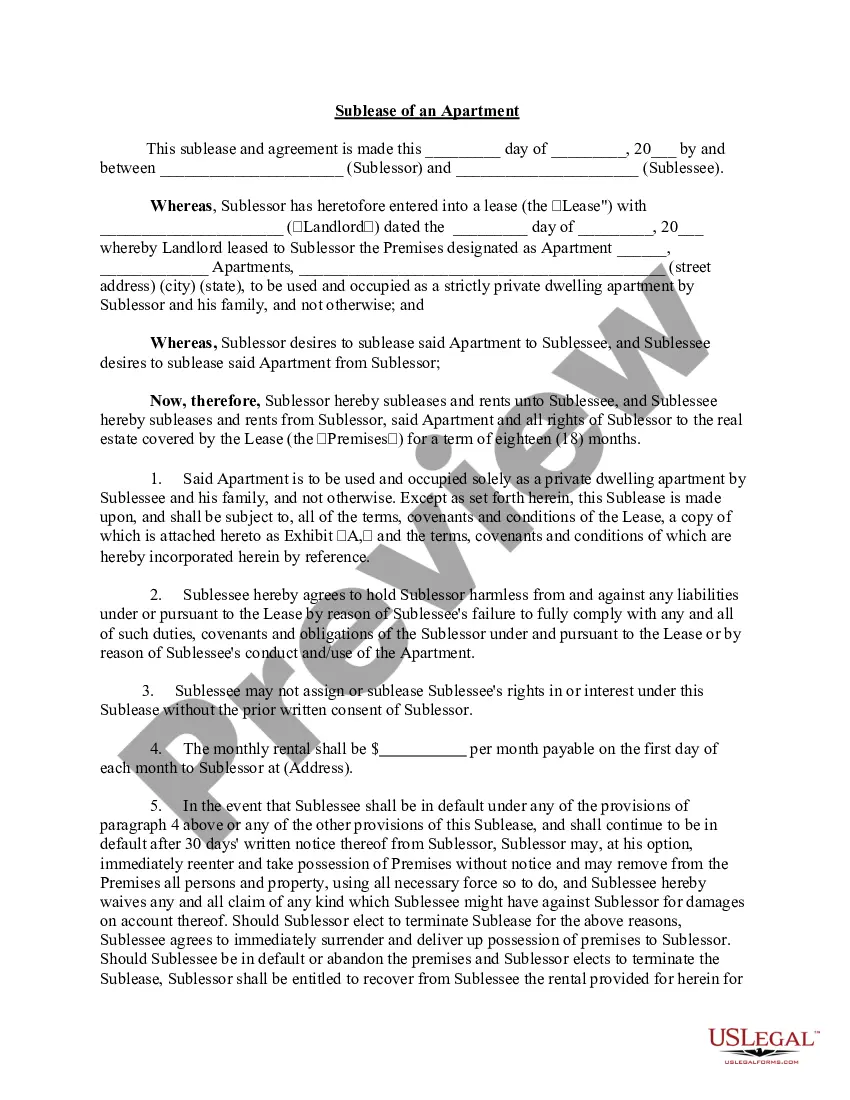

Choosing the right legal file web template can be a struggle. Of course, there are a lot of templates available online, but how do you get the legal kind you need? Make use of the US Legal Forms internet site. The support gives a huge number of templates, for example the Delaware Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5, which you can use for business and personal requirements. All of the varieties are checked by specialists and meet up with federal and state needs.

If you are already listed, log in for your profile and click the Down load option to have the Delaware Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5. Make use of your profile to check through the legal varieties you might have purchased formerly. Proceed to the My Forms tab of the profile and have an additional duplicate from the file you need.

If you are a new consumer of US Legal Forms, here are straightforward instructions so that you can follow:

- Initially, be sure you have selected the correct kind for your personal area/area. It is possible to check out the form using the Preview option and browse the form information to make certain it is the right one for you.

- In case the kind fails to meet up with your requirements, use the Seach field to get the appropriate kind.

- When you are certain that the form is acceptable, go through the Acquire now option to have the kind.

- Select the pricing program you want and enter the required details. Make your profile and purchase the transaction making use of your PayPal profile or Visa or Mastercard.

- Pick the submit file format and down load the legal file web template for your system.

- Total, revise and print and indicator the received Delaware Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5.

US Legal Forms will be the largest library of legal varieties in which you can discover a variety of file templates. Make use of the service to down load skillfully-manufactured files that follow condition needs.

Form popularity

FAQ

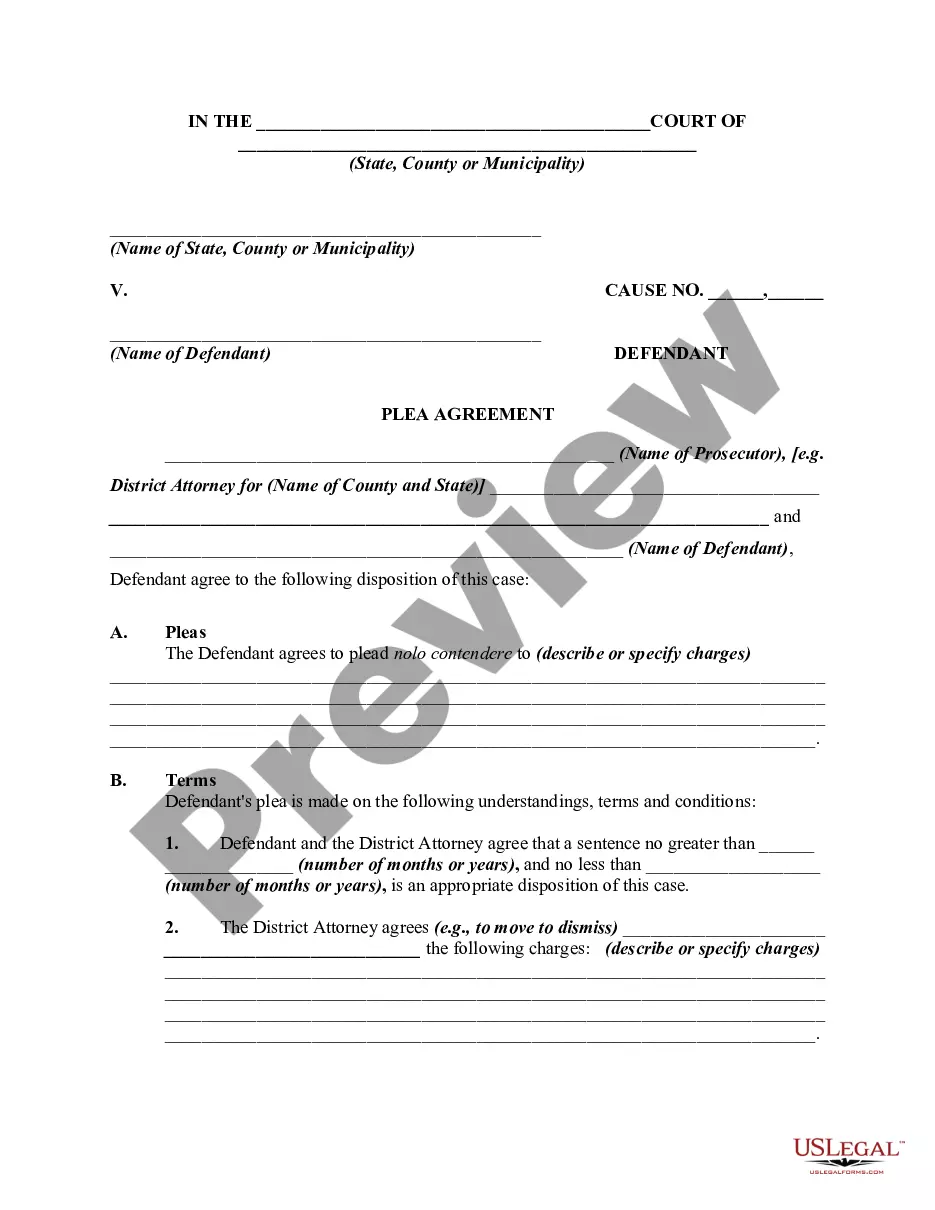

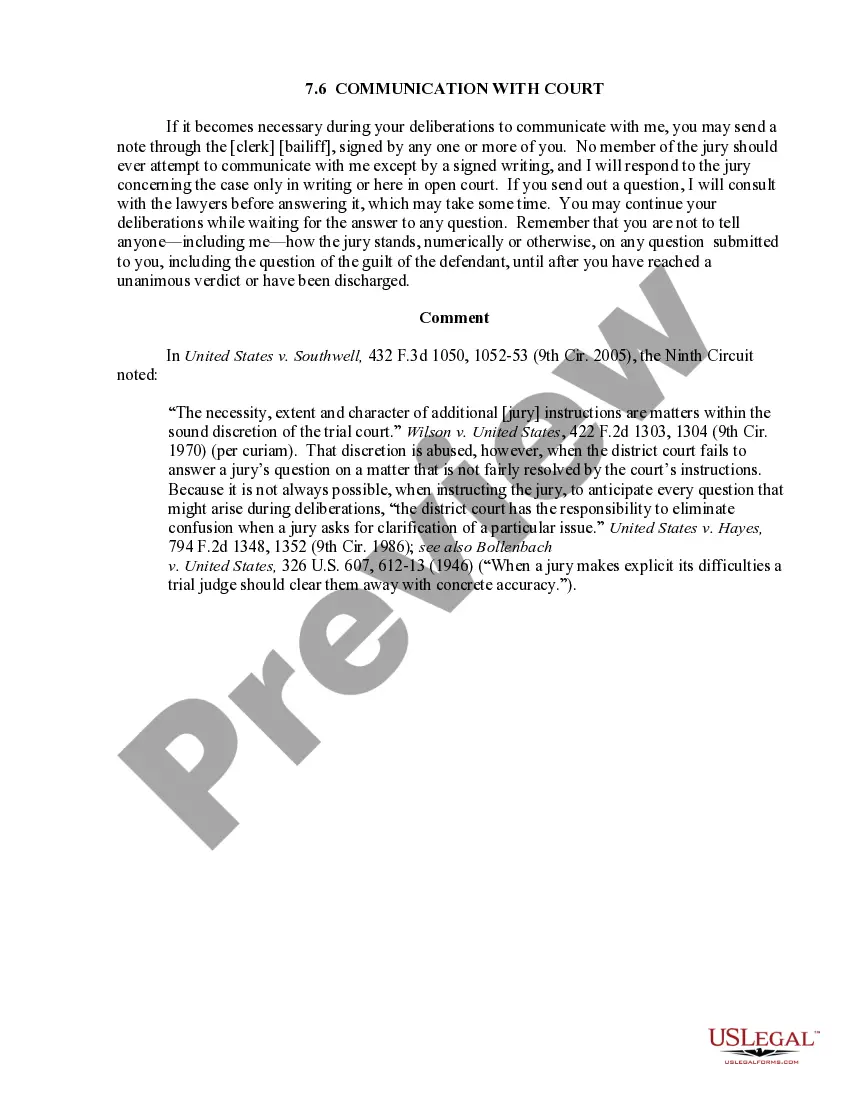

§ 1.468B?1 Qualified settlement funds. If a fund, account, or trust that is a qualified settlement fund could be classified as a trust within the meaning of §301.7701?4 of this chapter, it is classified as a qualified settlement fund for all purposes of the Internal Revenue Code (Code).

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

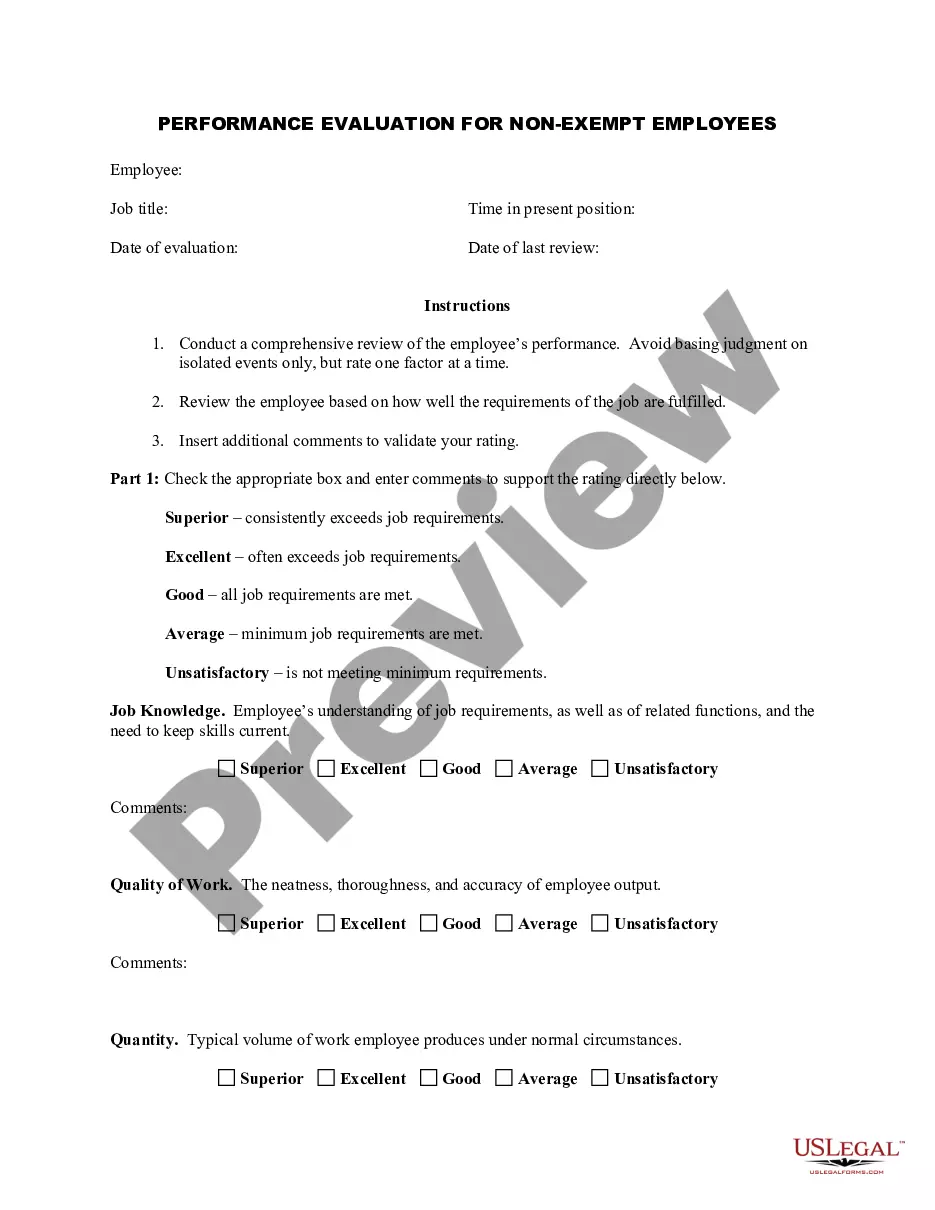

Qualified Settlement Fund Services Generating client closing statements and providing accounting for the fund. Disbursement of all claimant payments, including directing funding of Special Needs Trusts and/or structured settlements.

Settlement funding is the act of receiving cash in advance of a lawsuit settlement. The funder charges an interest rate usually between 30% and 60% per year and is paid back only at the end of the case if it's successful.

A qualified settlement fund (QSF), commonly referred to as a 468B Trust, is a legal mechanism used in mass tort lawsuits to expedite the administration and distribution of settlement payments. A QSF is essentially a temporary ?holding tank? for the proceeds of a settlement.

The benefits of a QSF for an attorney include: More time to plan for contingency fees using attorney fee deferral. Affording clients extra time to implement settlement planning strategies and comply with government benefits income thresholds.

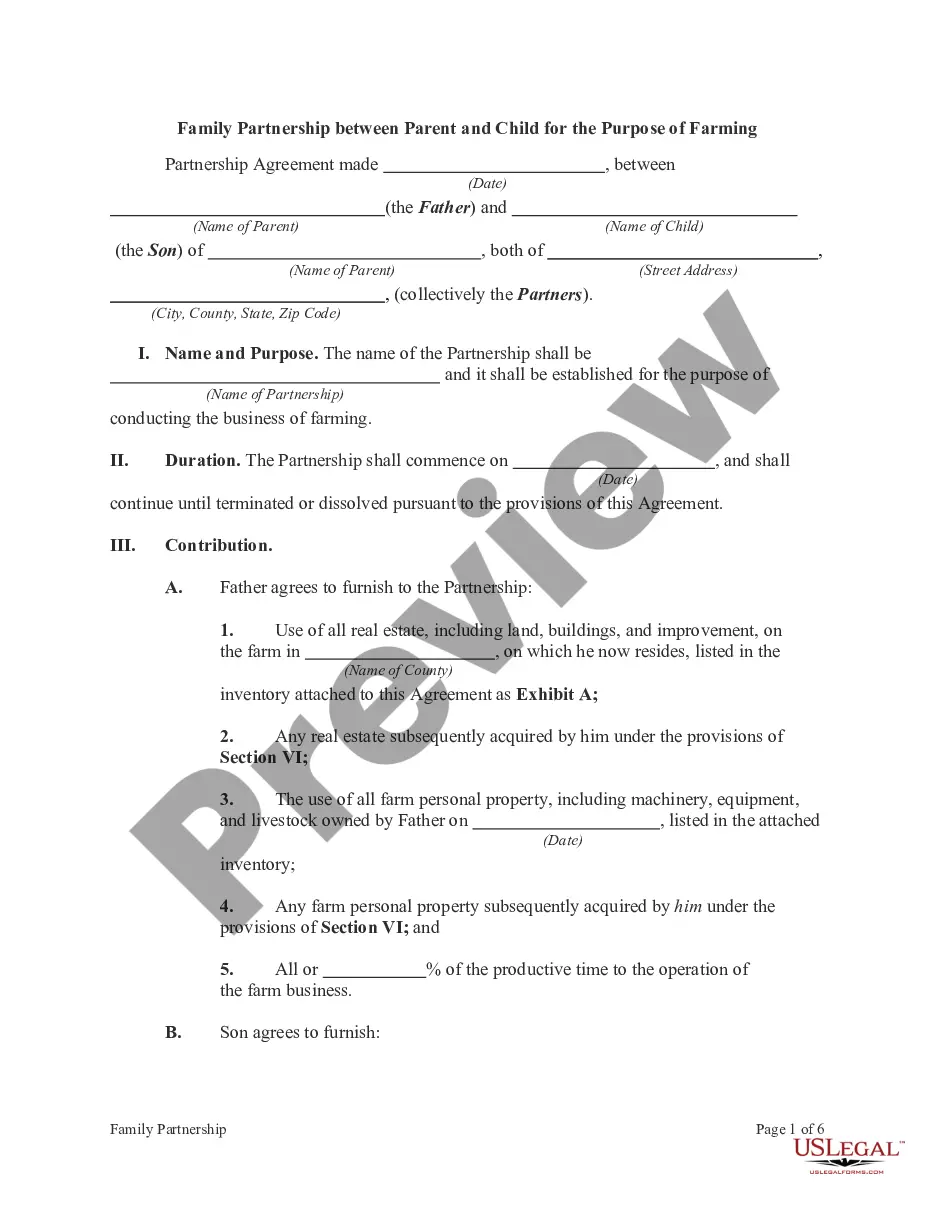

The designated settlement fund concept was created in 1986 under Section 468B of the IRC to enable defendants to deduct amounts paid to settle multi-plaintiff lawsuits before it was agreed how these amounts would be allocated.

The tax treatment of QSFs is uncomplicated. A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.