Delaware Separation Notice for Independent Contractor

Description

How to fill out Separation Notice For Independent Contractor?

Are you presently in a position where you require documentation for either professional or personal purposes nearly every day.

There are numerous legitimate form templates accessible online, but locating versions you can trust can be challenging.

US Legal Forms provides a wide array of form templates, such as the Delaware Separation Notice for Independent Contractor, designed to fulfill federal and state requirements.

Choose the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the form templates you have purchased in the My documents section. You can obtain an additional copy of the Delaware Separation Notice for Independent Contractor anytime if needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers well-crafted legal document templates suitable for various purposes. Create your account on US Legal Forms and start making your life simpler.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Delaware Separation Notice for Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and confirm it is for the correct city/state.

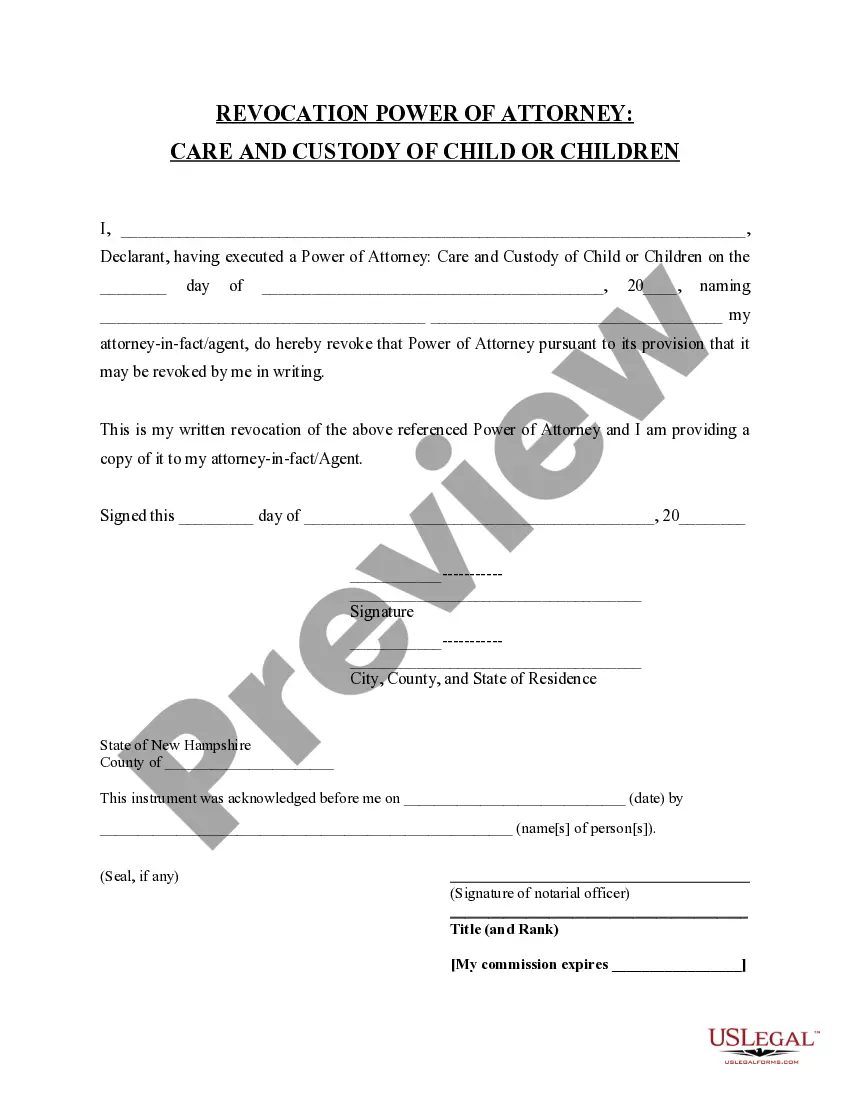

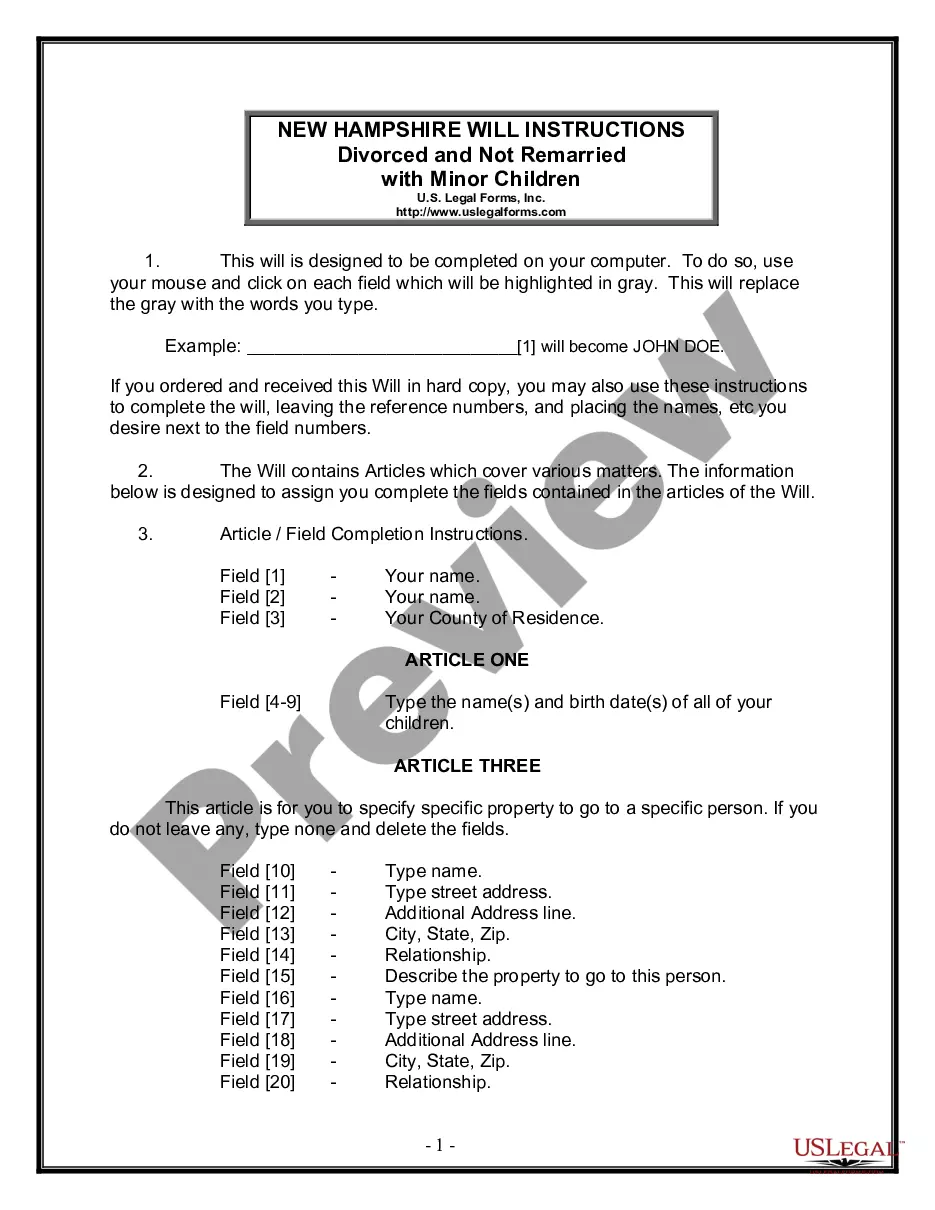

- Utilize the Review button to examine the form.

- Read the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Lookup area to find the form that suits your needs.

- Once you find the appropriate form, click Acquire now.

Form popularity

FAQ

PUA benefits ended September 4, 2021. The last day you could apply for a PUA claim was October 6, 2021, for weeks of unemployment before September 4. For more information about the ending of federal unemployment benefit programs, visit Federal Provisions for Unemployment.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

Do Negotiate. If your employer refuses your time off request, don't panic. Instead, begin negotiations to get the time off that you need. Propose different dates, offer to work ahead, or ask if it's possible to work greatly reduced hours during the time that you plan be away from work.

Reporting Requirements You must report independent contractor information to the EDD within 20 days of either making payments totaling $600 or more or entering into a contract for $600 or more or entering with an independent contractor in any calendar year, whichever is earlier.

The duration of these federal benefit programs was determined by Congress, and Delaware does not have the power to extend them. The final week that benefits were paid for these federal programs in Delaware was the week ending Saturday, September 4, 2021.

You may be eligible for PUA if you are self-employed, an independent contractor, do not have sufficient work history to qualify for regular UC, have exhausted your rights to regular UC benefits or extended benefits, work for certain faith based organizations, or otherwise are ineligible for traditional UI benefits.

Contractors aren't covered by most employment-related laws. This means they don't get things like annual leave or sick leave, they can't bring personal grievances, they have to pay their own tax, and general civil law determines most of their rights and responsibilities.

Put your resignation in writing so there is no confusion about the status of your work. Add a date for when you will stop working. Unless your contract requires you to give a certain amount of notice when you quit, you may stop the work immediately -- and say so in the letter.

You must have earned at least a minimum amount in wages before you were unemployed. You must be unemployed through no fault of your own, as defined by Delaware law. You must be able and available to work, and you must be actively seeking employment.

The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.