Delaware Assignment of Profits of Business

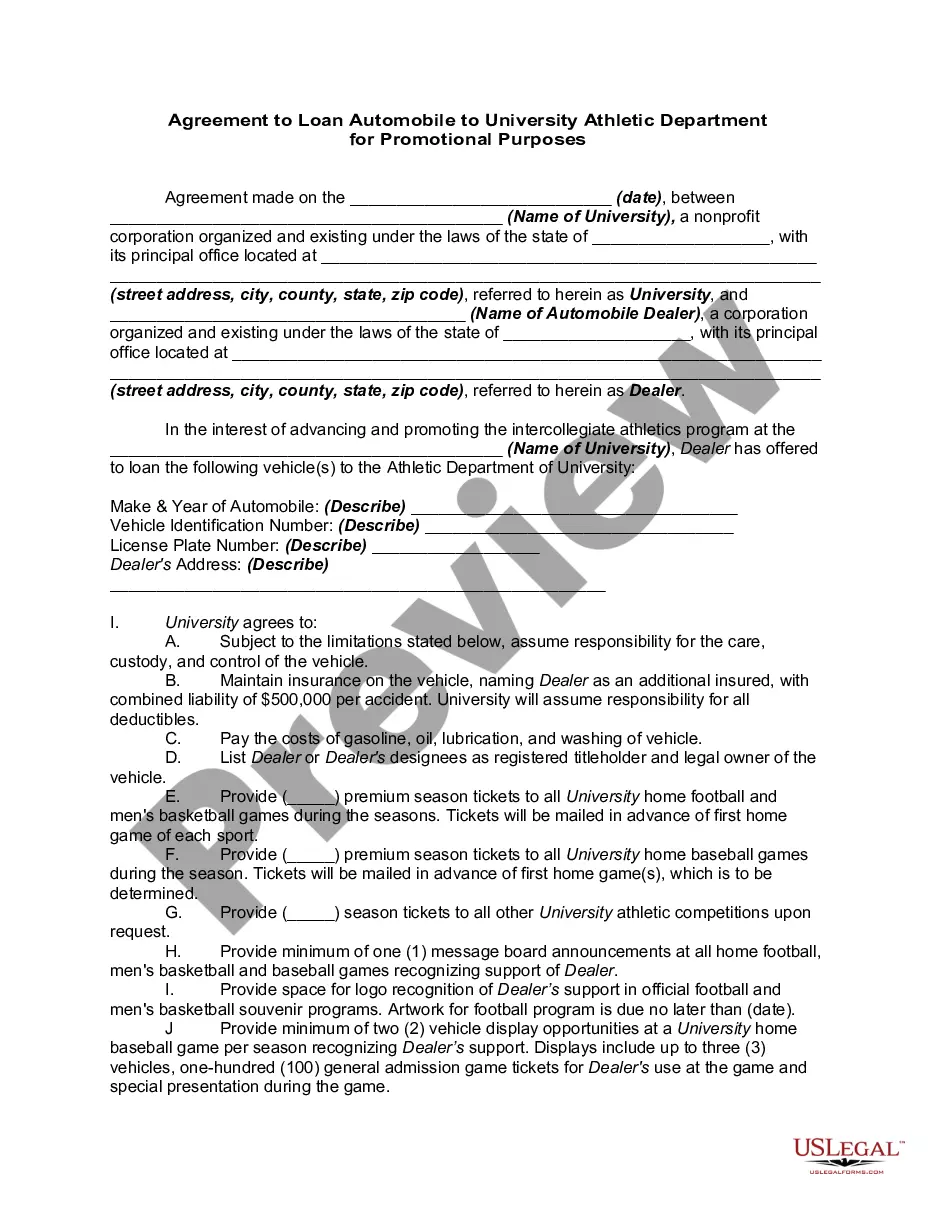

Description

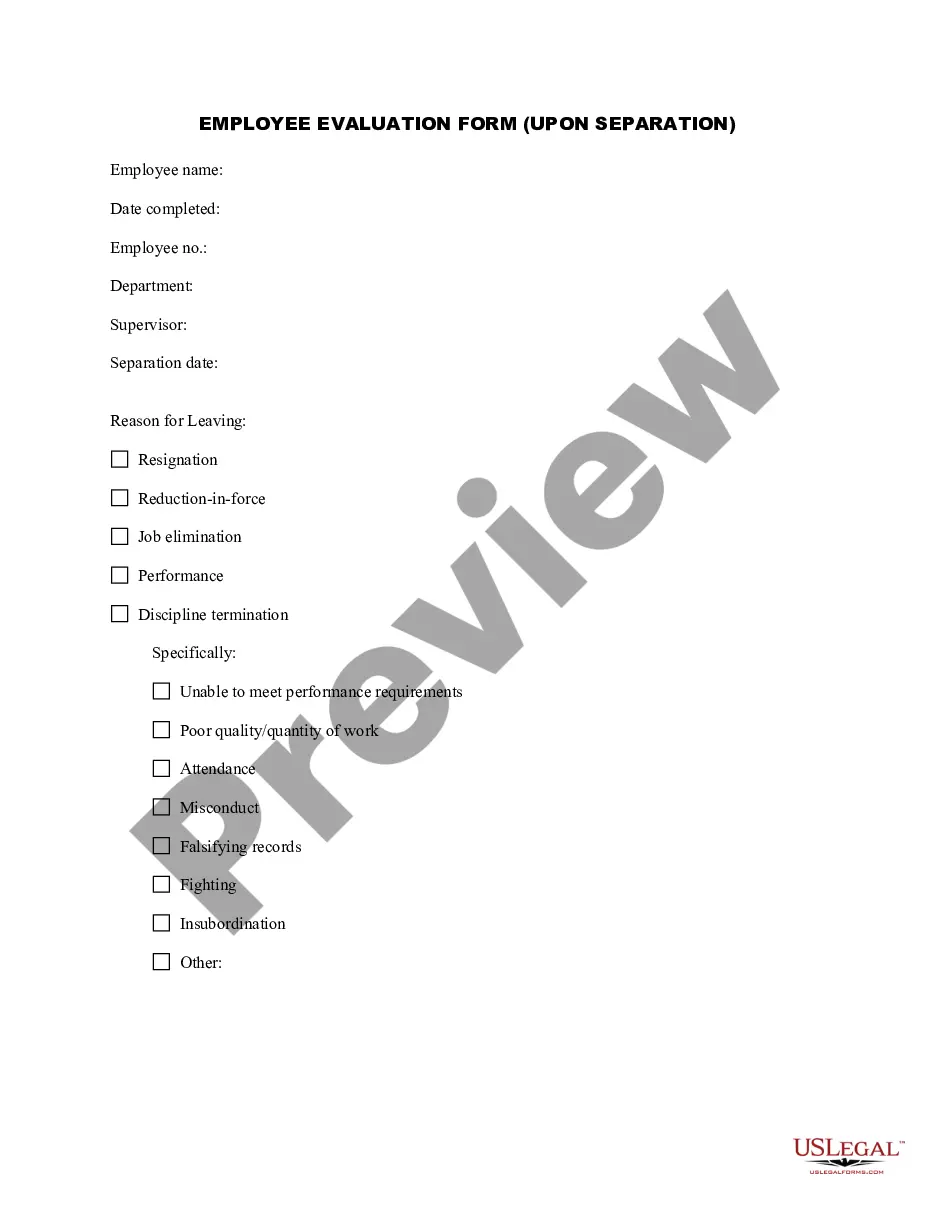

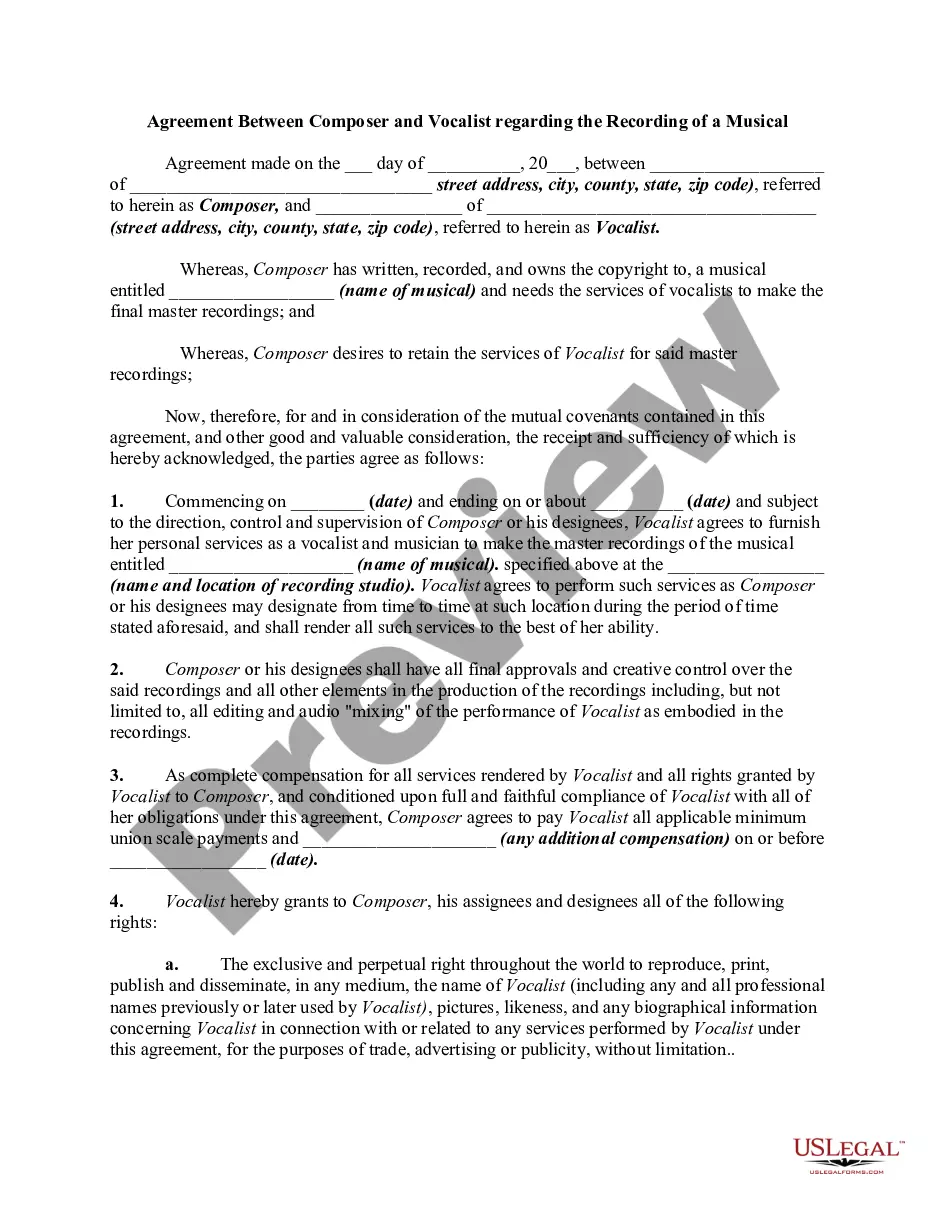

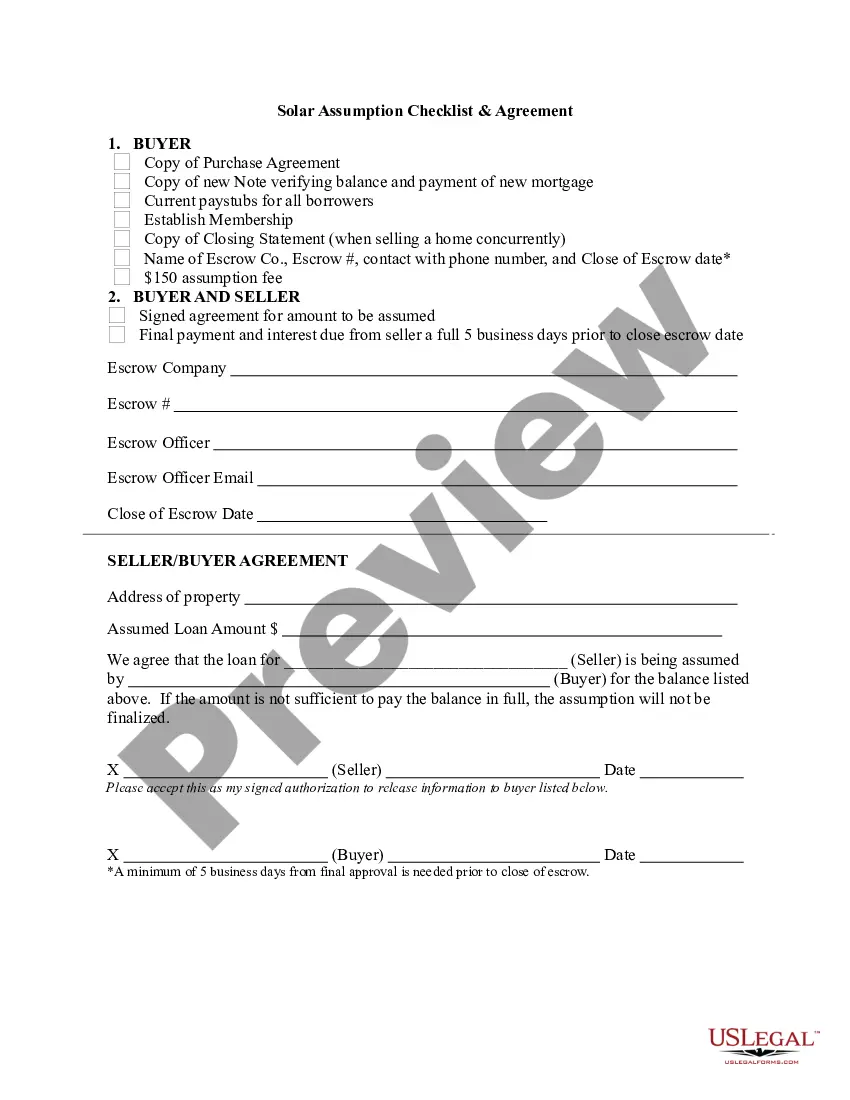

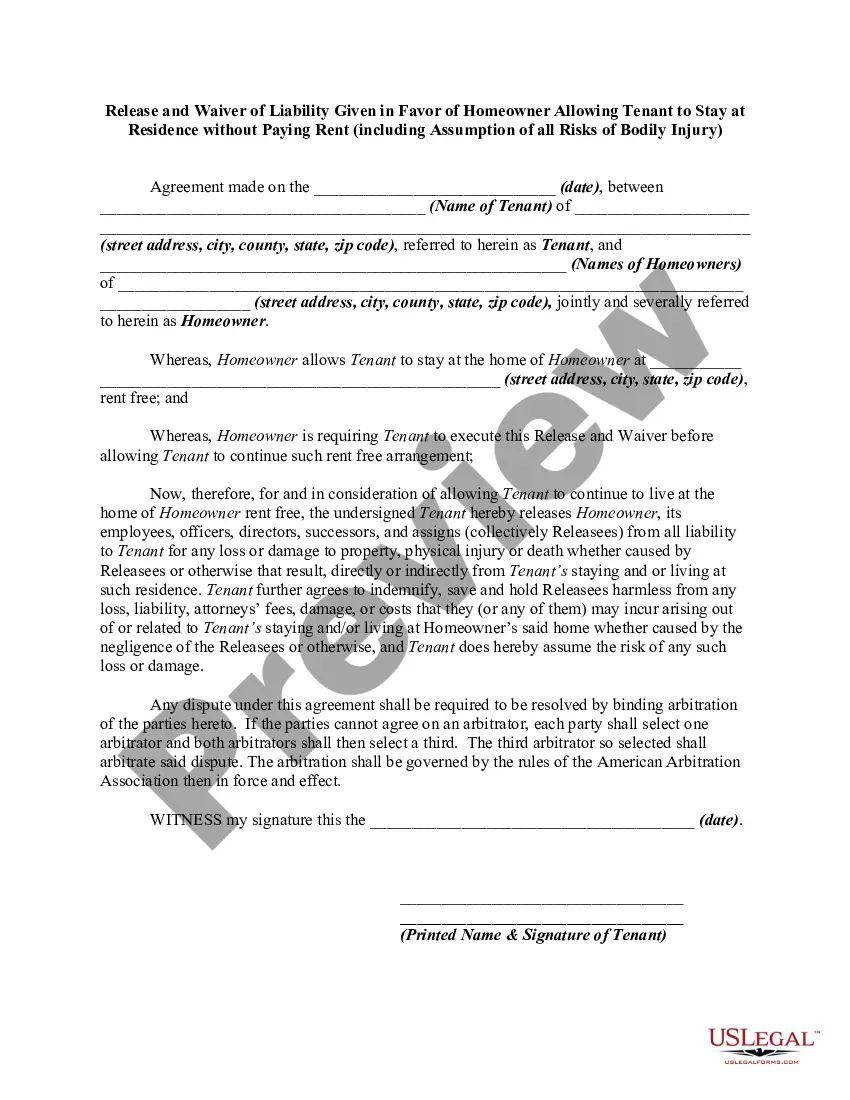

How to fill out Assignment Of Profits Of Business?

You might dedicate multiple hours online trying to locate the legal document template that aligns with the state and federal requirements you seek.

US Legal Forms offers an extensive range of legal documents that are evaluated by experts.

It's easy to download or print the Delaware Assignment of Profits of Business from our services.

If available, utilize the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then select the Download option.

- After that, you can complete, modify, print, or sign the Delaware Assignment of Profits of Business.

- Every legal document template you obtain is yours to keep permanently.

- To get another copy of any obtained form, go to the My documents section and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow these simple steps.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Review the form details to confirm you have chosen the appropriate type.

Form popularity

FAQ

6.60%Multiply the number of employee's personal exemption by $110.Subtract the total amount of the employee's personal exemption credit (Step 5) from the computed tax (Step 4).Divide the resulting amount by the appropriate number of payroll period to determine the amount of tax to be withheld each pay period.

Federal income tax withholding was calculated by:Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).More items...

If you form a corporation in Delaware, you must file Corporate Income Tax with the Delaware Division of Revenue at a rate of 8.7% of federal taxable income allocated and apportioned to Delaware, based on an equally weighted three-factor method of apportionment.

Delaware treats a single-member disregarded entity as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

According to Delaware Instructions for Form 200-01, If you are a Full-Year Resident of Delaware, you must file a tax return for 2020 if, based on your Age/Status, and if your individual adjusted Delaware gross income (AGI) exceeds the limit.

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) and pay a tax of 8.7% on its federal taxable income allocated and apportioned to Delaware.

Delaware corporation income tax is assessed at a flat 8.7% of taxable income derived from Delaware. (By comparison, the state's personal income tax rate varies from zero for nominal personal income to the highest rate of 6.6%.)

Business Tax Forms 2021-2022 Delaware Corporations: Who do NOT Conduct Business in Delaware are not required to file a Delaware Corporate Income Tax Return, regardless if incorporated under the laws of Delaware.

A. Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) regardless of the amount, if any, of its gross income or its taxable income.

6.60%Multiply the number of employee's personal exemption by $110.Subtract the total amount of the employee's personal exemption credit (Step 5) from the computed tax (Step 4).Divide the resulting amount by the appropriate number of payroll period to determine the amount of tax to be withheld each pay period.