Delaware Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides a vast array of form templates, such as the Delaware Assignment of Security Agreement and Note with Recourse, which are designed to meet state and federal requirements.

Once you find the correct form, click on Purchase now.

Select the pricing plan you prefer, enter the required information to create your account, and process the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Delaware Assignment of Security Agreement and Note with Recourse template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct city/county.

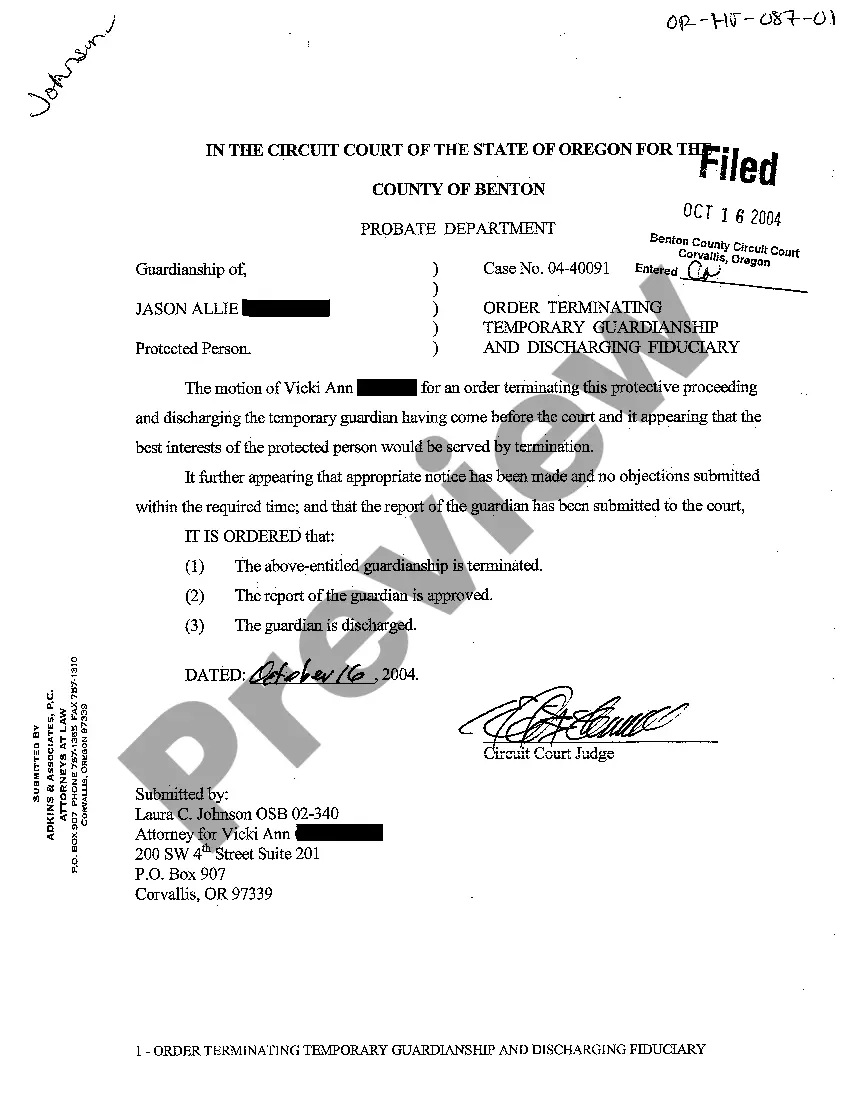

- Use the Review button to verify the form.

- Check the description to confirm you have selected the right form.

- If the form isn't what you're looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

Security Assignment Agreement means a Global Assignment Agreement on the Global Assignment of Accounts Receivable, substantially in the form of EXHIBIT Q, entered into by the Subsidiary Borrower and the Administrative Agent for the benefit of the Lenders.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

One form of transaction is "assignment without recourse," which means that once the loan is sold or transferred, neither the borrower nor the new loan holder can hold the original loan-maker liable for anything.

Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

In order to perfect, the secured creditor must have a valid security agreement and in most cases, file a valid financing statement. If the debtor becomes insolvent, there will be insufficient assets to pay all of the creditors. Other creditors will attack any security interest that has a weakness.

The assignment agreement is often seen in real estate but can occur in other contexts as well. An assignment is just the contractual transfer of benefits that will accrue or have accrued. Obligations don't transfer with the benefits of an assignment. The assignor will always keep the obligations.

Assignment by way of security is a concept that comes up on many construction projects; typically as a condition of providing finance a funder will require an assignment by way of security of key construction documents, including building contracts and appointments, with the intention that if the borrower defaults on

What Is a Secured Note? A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

The term 'assignment by way of charge only' is also often used. This just means that the security interest constitutes a charge, ie an encumbrance over the asset, rather than an assignment, ie a transfer of title to the chose in action (whether legal or beneficial) to the secured party.