Delaware Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

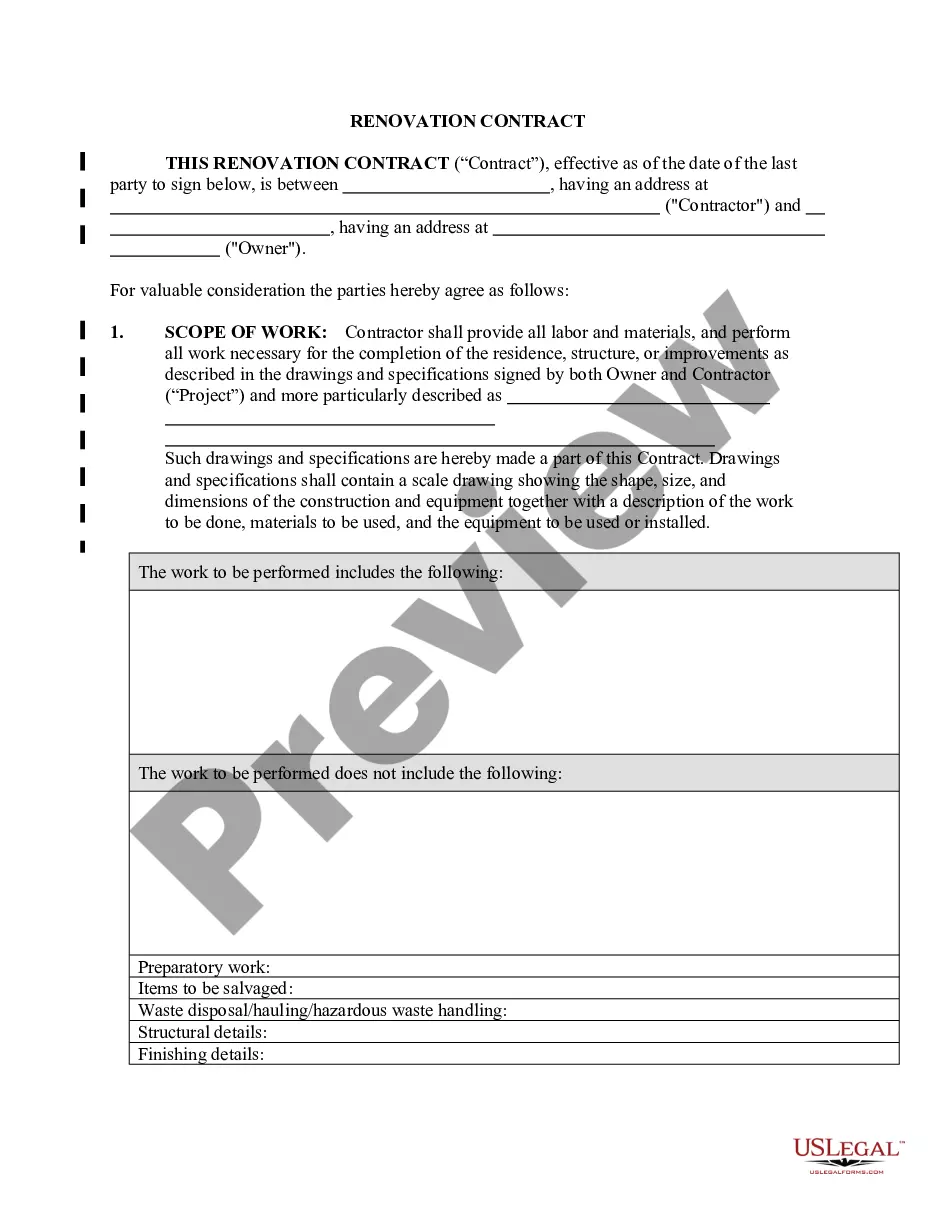

Description

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Discovering the right legitimate file design might be a have a problem. Needless to say, there are a lot of web templates available on the net, but how do you obtain the legitimate type you need? Use the US Legal Forms internet site. The assistance gives a huge number of web templates, like the Delaware Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, which you can use for enterprise and personal requires. All of the kinds are inspected by specialists and satisfy state and federal demands.

In case you are previously authorized, log in to your bank account and then click the Down load key to find the Delaware Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status. Make use of bank account to appear with the legitimate kinds you have acquired earlier. Go to the My Forms tab of the bank account and have an additional copy from the file you need.

In case you are a whole new user of US Legal Forms, here are easy guidelines for you to comply with:

- First, make sure you have selected the appropriate type for the town/area. You are able to check out the shape while using Preview key and study the shape information to ensure this is basically the right one for you.

- If the type is not going to satisfy your requirements, take advantage of the Seach area to discover the appropriate type.

- When you are certain the shape is acceptable, go through the Get now key to find the type.

- Select the pricing prepare you want and type in the needed details. Create your bank account and pay for the order making use of your PayPal bank account or Visa or Mastercard.

- Select the submit formatting and down load the legitimate file design to your product.

- Full, modify and produce and sign the received Delaware Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

US Legal Forms may be the most significant collection of legitimate kinds for which you will find numerous file web templates. Use the service to down load appropriately-created documents that comply with condition demands.

Form popularity

FAQ

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

Exempt Organization TypesCharitable Organizations.Churches and Religious Organizations.Private Foundations.Political Organizations.Other Nonprofits.

How to Start a Nonprofit in DelawareName Your Organization.Choose a Delaware nonprofit corporation structure.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.More items...

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

However, a charitable trust is not treated as a charitable organization for purposes of exemption from tax. Accordingly, the trust is subject to the excise tax on its investment income under the rules that apply to taxable foundations rather than those that apply to tax-exempt foundations.

Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code ("IRC") section 501(c)(3). Information, explanations, guides, forms, and publications available on irs.gov for tax-exempt social welfare organizations.

File Form 1023 with the IRS. Most nonprofit corporations apply for tax-exempt status under Sec. 501(c)(3).

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

For the purposes of PSLF, eligible not-for-profit organizations include a organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code (IRC), or other not-for-profit organizations that provide a qualifying service.