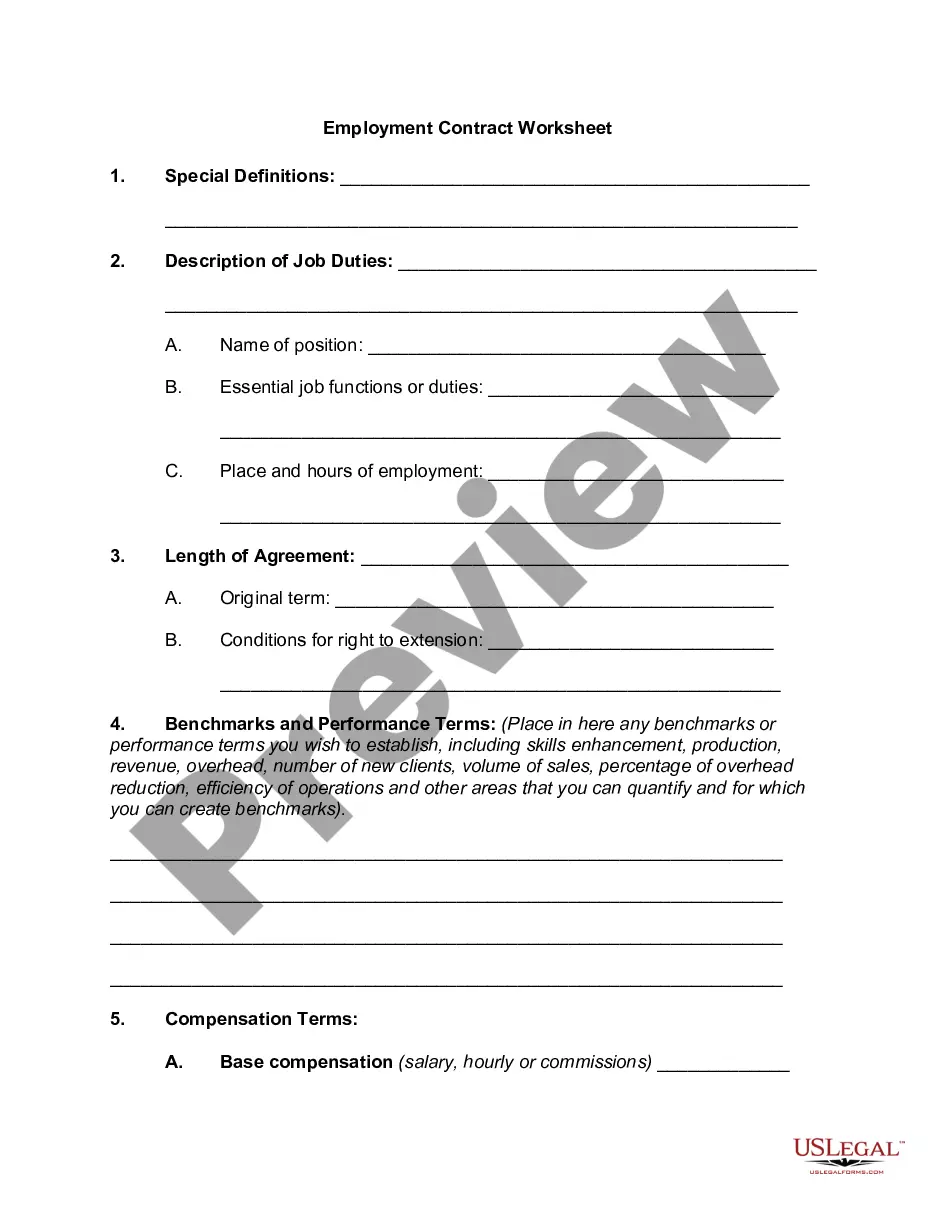

Delaware Worksheet for Job Requirements

Description

How to fill out Worksheet For Job Requirements?

If you wish to total, obtain, or create legal document templates, utilize US Legal Forms, the premier selection of legal forms, which are accessible online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require.

A selection of templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded in your account. Browse the My documents section and select a form to print or download again.

Be proactive and download, then print the Delaware Worksheet for Job Requirements with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal requirements.

- Utilize US Legal Forms to locate the Delaware Worksheet for Job Requirements in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to download the Delaware Worksheet for Job Requirements.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and input your information to register for an account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Delaware Worksheet for Job Requirements.

Form popularity

FAQ

Non-residents who earn Delaware income must file a tax return if their income exceeds the state's filing threshold, which is generally set at $2,000. Remember, this applies only to income sourced from Delaware. The Delaware Worksheet for Job Requirements can guide you in determining your filing responsibilities.

Delaware requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxes. Find Delaware's tax rates here. Employers use the federal W-4 form, completed by employees, when calculating employee wage withholdings for Delaware.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

Federal income tax withholding was calculated by:Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).More items...

Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee's paycheck. In practice, employees in the United States use Internal Revenue Service (IRS) Form W-4, Employee's Withholding Certificate to calculate and claim their withholding allowance.

Everyone should check withholdingFor those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

6.60%Multiply the number of employee's personal exemption by $110.Subtract the total amount of the employee's personal exemption credit (Step 5) from the computed tax (Step 4).Divide the resulting amount by the appropriate number of payroll period to determine the amount of tax to be withheld each pay period.

How To Fill Out The Most Complicated Tax Form You'll See At A New...Determine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.