Delaware Business Trust

Description

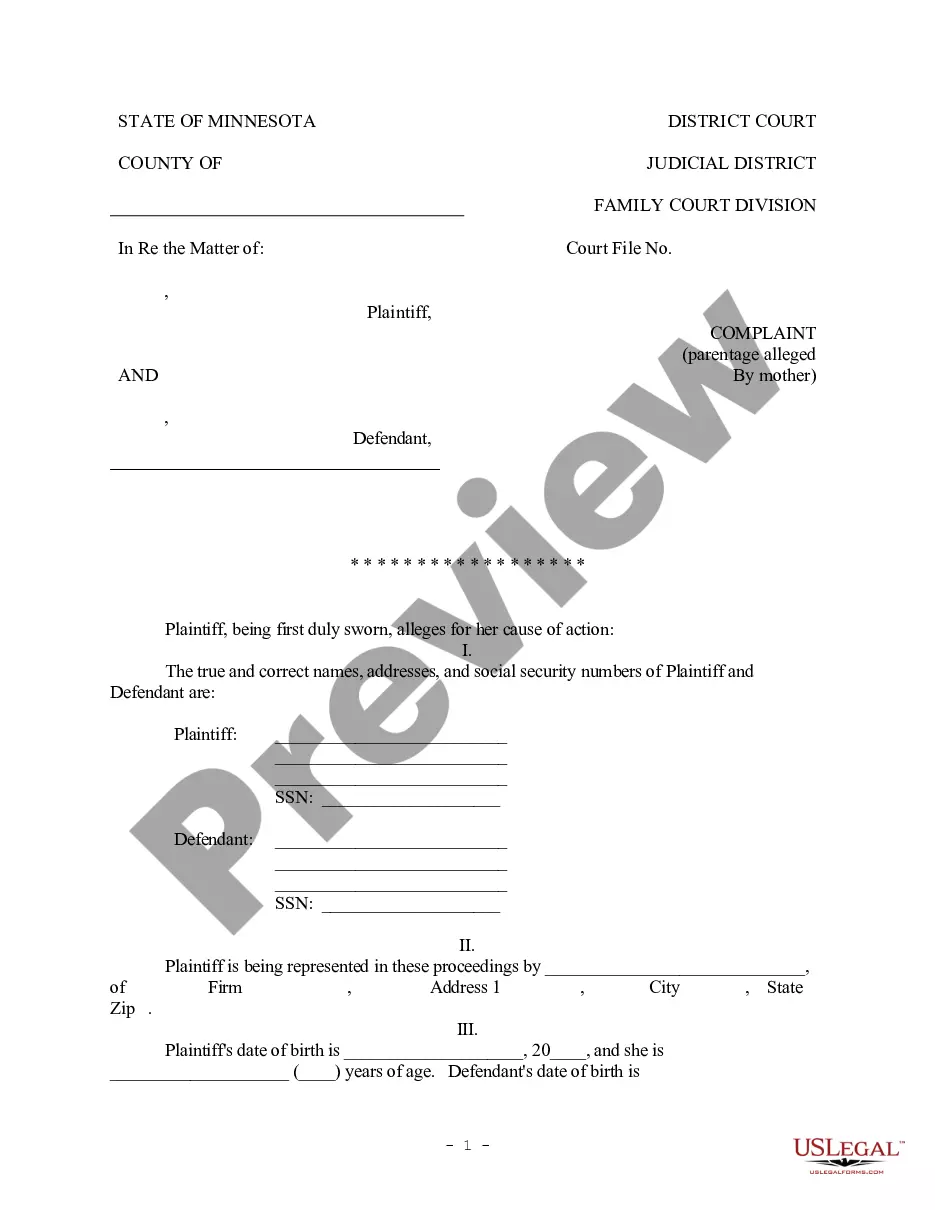

How to fill out Business Trust?

Finding the appropriate authorized document template can be quite challenging.

Certainly, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Delaware Business Trust, that can be applied for both business and personal needs.

You may browse the form using the Review button and read the form description to confirm it is suitable for you.

- All of the forms are reviewed by professionals and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Delaware Business Trust.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Statutory trusts are regulated by the Uniform Statutory Trust Entity Act. They are based on the law of the state in which they are set up, so these trusts vary by state. This type of trust can enhance privacy when conducting business. This is because the beneficiary of the trust is kept private.

A Delaware Statutory Trust is a real estate ownership structure where multiple investors each hold an undivided fractional interest in the holdings of the trust. The trust is established by a professional real estate company, referred to as DST sponsor, who first identifies and acquires the real estate assets.

Cons of Delaware Statutory Trust 1031 ExchangesInability to raise new capital/refinance. Once the DST offering closes, there cannot be future contributions by current or new investors.Lack of personal control. DST's are passive investments.Illiquidity.

The statutory trust is often regarded as a type of business organization. Statutory trusts must follow these regulations: Listed rules are binding and cannot be overruled in the business documents. A statutory trust cannot have a donative purpose.

A Delaware statutory trust (DST) is a legally recognized trust that is set up for the purpose of business, but not necessarily in the U.S. state of Delaware. It may also be referred to as an Unincorporated Business Trust or UBO.

Used correctly, DSTs can indeed be an effective tool for building and preserving wealth as they help investors defer their capital gains tax from the sale of a real estate investment property.

The Delaware Statutory Trust (DST), however, is a statutory entity, created by filing a Certificate of Trust with the Delaware Division of Corporations, and governed by Chapter 38, Part V, Title 12 of the annotated Delaware Code (See 12 ? 3801 through 3862).

DSTs offer several advantages over a common law trust in structured finance transactions. One advantage is a comprehensive statutory framework, the DST Act, which authorizes the creation of DSTs and provides express rules governing their internal affairs.

A business trust is defined as a trust where the trustee uses the trust assets to do business for profit in order to benefit the trust beneficiary or to further the aims of the trust.