Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust without the necessity of court supervision in the event of the trustor's incapacity or death. Other provisions of the trust document include: trust assets, disposition of income and principal, and administration of the trust assets after the death of the trustor.

Delaware Living Trust - Revocable

Description

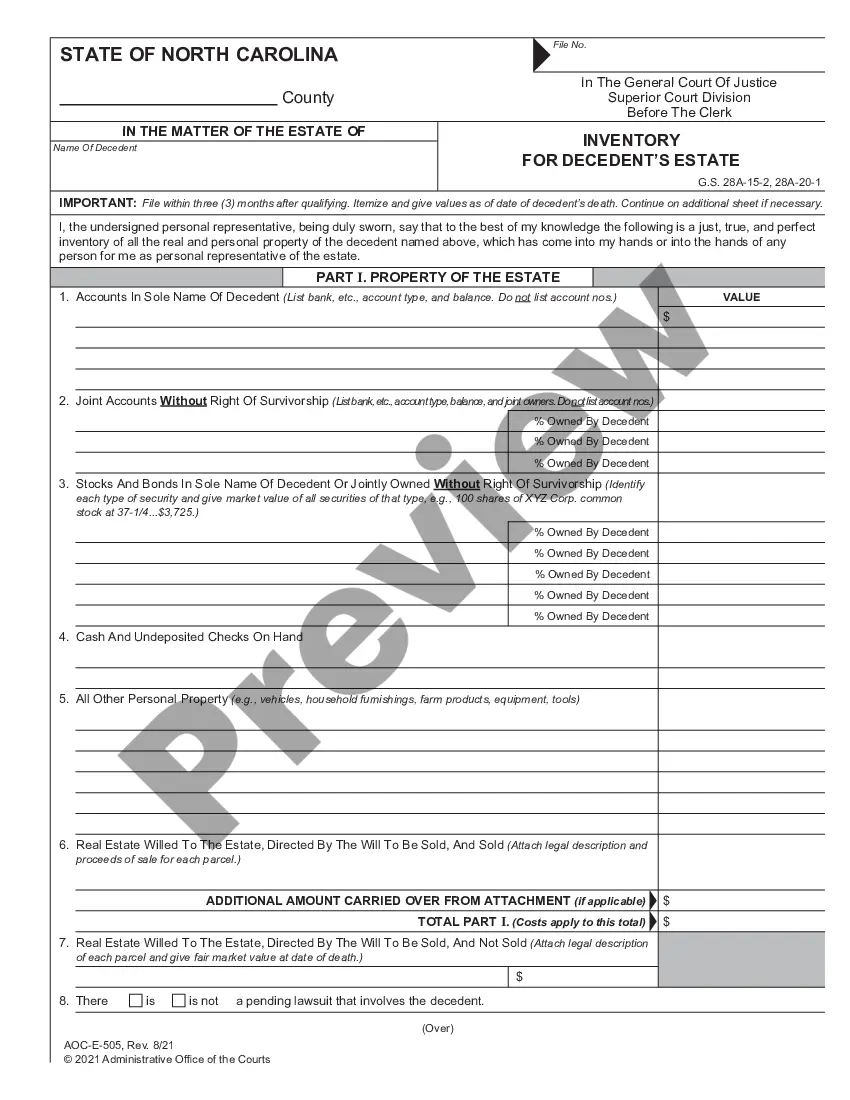

How to fill out Living Trust - Revocable?

You can dedicate hours on the Internet searching for the legal document template that meets the federal and state regulations you require.

US Legal Forms provides thousands of legal forms that are evaluated by experts.

You can easily obtain or print the Delaware Living Trust - Revocable from your service.

If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- If you have a US Legal Forms account, you can.

- Log In.

- and then click the Download button.

- After that, you can fill out, edit, print, or sign the Delaware Living Trust - Revocable.

- Every legal document template you acquire is yours indefinitely.

- To receive an additional copy of a purchased form, navigate to the My documents tab and click the appropriate button.

Form popularity

FAQ

Suze Orman emphasizes the importance of a revocable trust in her financial planning advice. She points out that a Delaware Living Trust - Revocable allows individuals to manage their assets during their lifetime while specifying distribution after their passing. This type of trust can help minimize estate taxes and protect family wealth. Orman encourages everyone to consider this option to ensure their wishes are clearly documented and to simplify the inheritance process.

One major advantage of a Delaware Living Trust - Revocable is the flexibility it offers. With this type of trust, you maintain control over your assets, allowing you to change or dissolve it at any time. Additionally, it provides privacy and can help avoid the lengthy probate process. Choosing a Delaware trust also benefits from the state’s favorable laws, making it an attractive option for asset protection.

Titling a revocable living trust is a critical step in establishing it. You must ensure that assets are placed in the name of the trust, often using the format 'Your Name, Trustee of the Your Trust Name, dated date'. When you properly title your property this way, it avoids probate and simplifies the transfer of assets to your beneficiaries. Using resources from uslegalforms can help you navigate this process easily.

A Delaware statutory trust is generally not revocable. Unlike a Delaware Living Trust - Revocable, which you can modify or revoke during your lifetime, a statutory trust is typically designed to remain in place. It's important to understand these distinctions when planning your estate, and Uslegalforms can provide valuable resources to help clarify your options.

Again, Delaware is often highlighted as the best state for setting up a revocable trust. Its robust legal framework protects your assets while providing flexibility in management. A Delaware Living Trust - Revocable not only allows for easy modifications but also ensures your estate plan is executed smoothly and efficiently.

Several states do not impose taxes on trusts, making them attractive for estate planning. States like Delaware, Nevada, and South Dakota offer tax advantages for trusts, including no income tax for the trust. This makes a Delaware Living Trust - Revocable particularly appealing as it allows you to preserve more wealth for your beneficiaries without the burden of state income tax.

Delaware is often seen as one of the best states for a revocable living trust due to its favorable trust laws and strong legal protections. The state allows for more flexibility and privacy regarding trust assets compared to many others. Establishing your Delaware Living Trust - Revocable here can provide you with distinct advantages in estate planning.

When considering a Delaware Living Trust - Revocable, the best place to open a trust account is typically at a reputable bank or financial institution that understands trust management. Look for institutions with expertise in estate planning and strong customer service. Uslegalforms can help you find suitable institutions and offer guidance on establishing your trust account efficiently.

The primary downside to a Delaware Living Trust - Revocable is that you maintain control over the assets, which means you cannot completely shield them from creditors. Additionally, revocable trusts do not provide tax benefits during your lifetime, as you are still responsible for taxes on income generated by the trust’s assets. Furthermore, unless properly funded, a revocable trust may not effectively avoid probate.

Filling out a Delaware Living Trust - Revocable requires careful attention to detail. Start by gathering information on your assets and beneficiaries. Then, use a template or tool, like those offered by USLegalForms, to complete the trust document accurately. Be sure to review your choices with a legal professional to confirm compliance with Delaware laws.