Delaware Subrogation Agreement in Favor of Medical Provider

Description

How to fill out Subrogation Agreement In Favor Of Medical Provider?

Discovering the right legal record format might be a battle. Obviously, there are tons of themes available on the net, but how will you find the legal kind you require? Take advantage of the US Legal Forms site. The support provides a large number of themes, such as the Delaware Subrogation Agreement in Favor of Medical Provider, which can be used for organization and personal demands. All of the types are checked out by specialists and fulfill state and federal demands.

If you are previously authorized, log in in your accounts and click on the Down load option to find the Delaware Subrogation Agreement in Favor of Medical Provider. Use your accounts to check with the legal types you may have purchased in the past. Go to the My Forms tab of your respective accounts and have one more copy of the record you require.

If you are a fresh consumer of US Legal Forms, allow me to share simple recommendations for you to stick to:

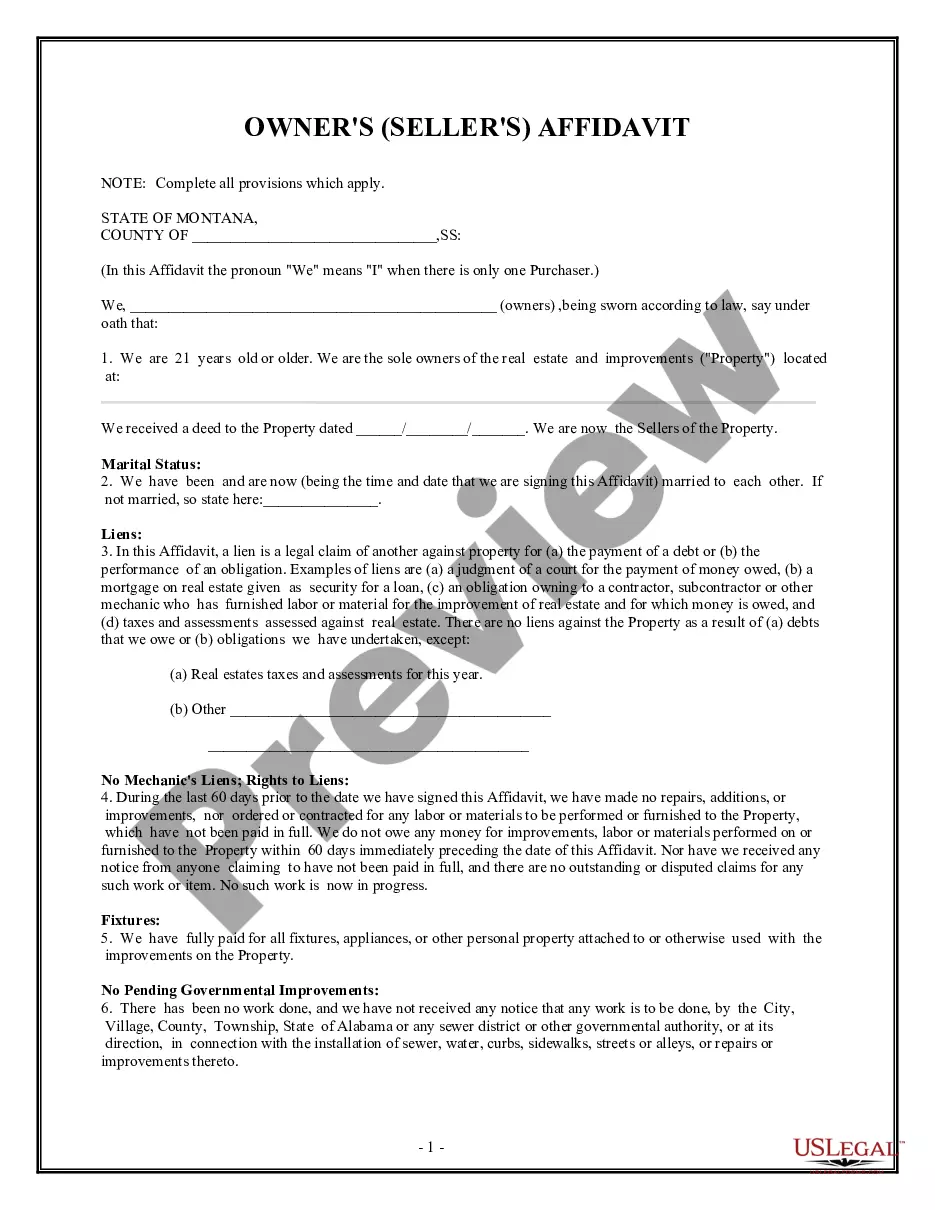

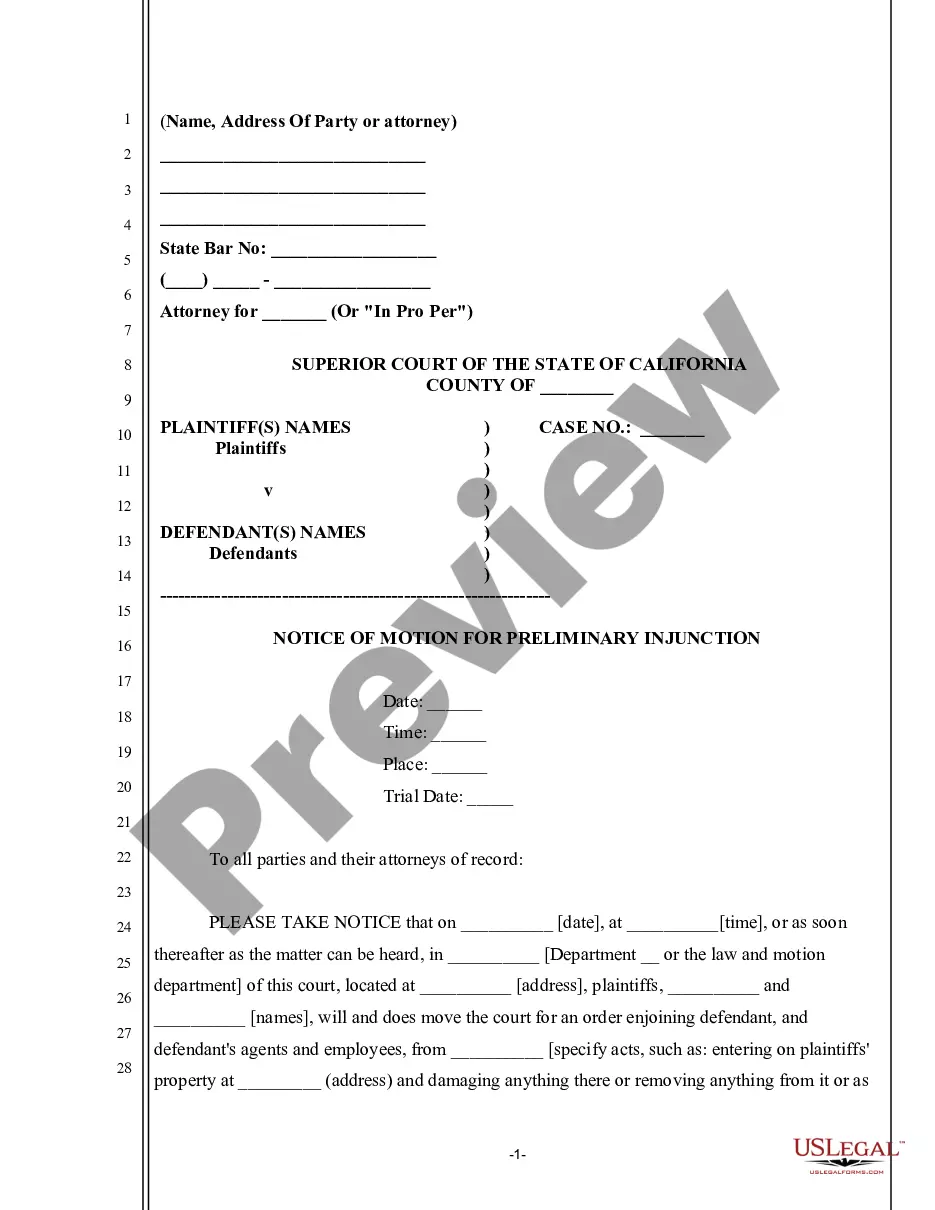

- Initially, ensure you have selected the proper kind to your city/region. You can check out the form utilizing the Review option and look at the form description to make certain it will be the best for you.

- In case the kind does not fulfill your preferences, use the Seach industry to find the correct kind.

- Once you are sure that the form would work, go through the Purchase now option to find the kind.

- Pick the pricing strategy you need and type in the necessary details. Design your accounts and pay for your order with your PayPal accounts or bank card.

- Select the file format and download the legal record format in your device.

- Complete, edit and produce and indication the attained Delaware Subrogation Agreement in Favor of Medical Provider.

US Legal Forms may be the largest catalogue of legal types for which you can see various record themes. Take advantage of the company to download appropriately-produced files that stick to express demands.

Form popularity

FAQ

Subrogation in auto insurance For example, suppose you have suffered injuries due to an accident caused by a third party. In that case, subrogation gives your insurance company the legal right to step into your shoes and seek compensation for the damages caused to your car.

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

There is no requirement to respond, but it can be in your best interests to reply. The subrogation claim will likely be sent to a collection agency, and that collection agency may be willing to accept less than the total amount owed in order to settle the debt.

As another example, a guarantor guarantees a borrower's loan to a bank. If the bank demands payment from the guarantor and the guarantor repays the loan, the guarantor is subrogated to the bank's claim against the borrower and takes on all the rights that the bank had against the borrower for reimbursement.

When factoring comparative negligence and improper referrals, the recovery rate should be somewhere in the range of 85-90%. This requires adjusters properly identifying subrogation, assessing comparative negligence and pursuing only what they are entitled to.

Through subrogation, the Ministry of Health and Long-Term Care can recover expenses or treatment paid to an injured party through the Ontario Health Insurance Plan. The Ministry's subrogation right is outlined in Ontario's Health Insurance Act, RSO 1990, c H. 6.

The principle of subrogation in insurance enables the insurer to take over the policyholder's legal right to recover damages. In other words, the insurance company has the right to pursue any third-party liable for the damages that it has paid out to the policyholder.

In health insurance, subrogation refers to the legal right of an insurance company ? after payment of a loss ? to recover monies from the responsible party's insurance carrier. For Health Advantage, it refers to those times when another insurance carrier may be responsible for payment of medical care.