Delaware Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

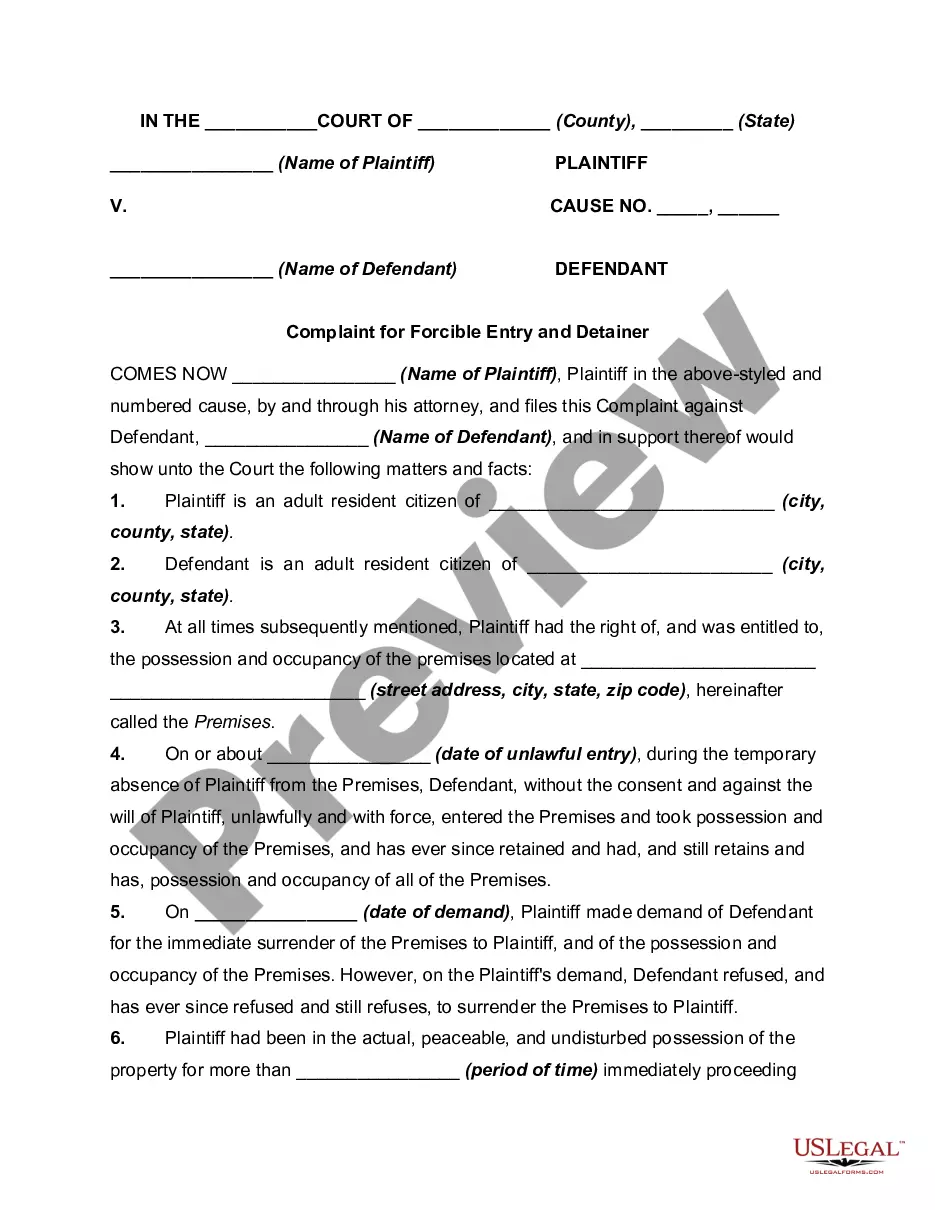

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

Finding the appropriate valid document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how can you locate the valid form you require.

Utilize the US Legal Forms site. The service offers an extensive selection of templates, such as the Delaware Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase, suitable for both business and personal purposes.

You can preview the form using the Review button and read the form details to confirm that this is the correct one for you.

- All the documents are reviewed by professionals and comply with federal and state regulations.

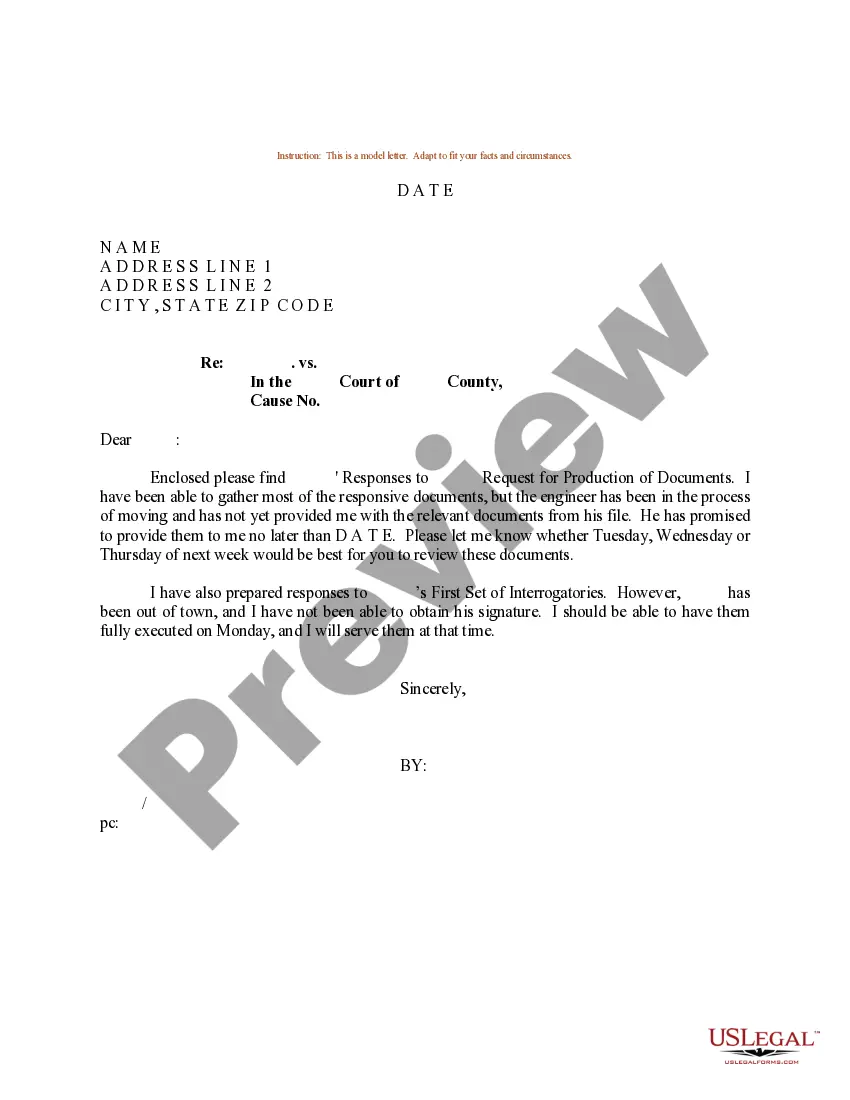

- If you are already registered, Log In to your account and click the Download button to obtain the Delaware Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

- You can use your account to browse through the legal documents you have purchased previously.

- Visit the My documents tab in your account and receive another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward instructions you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

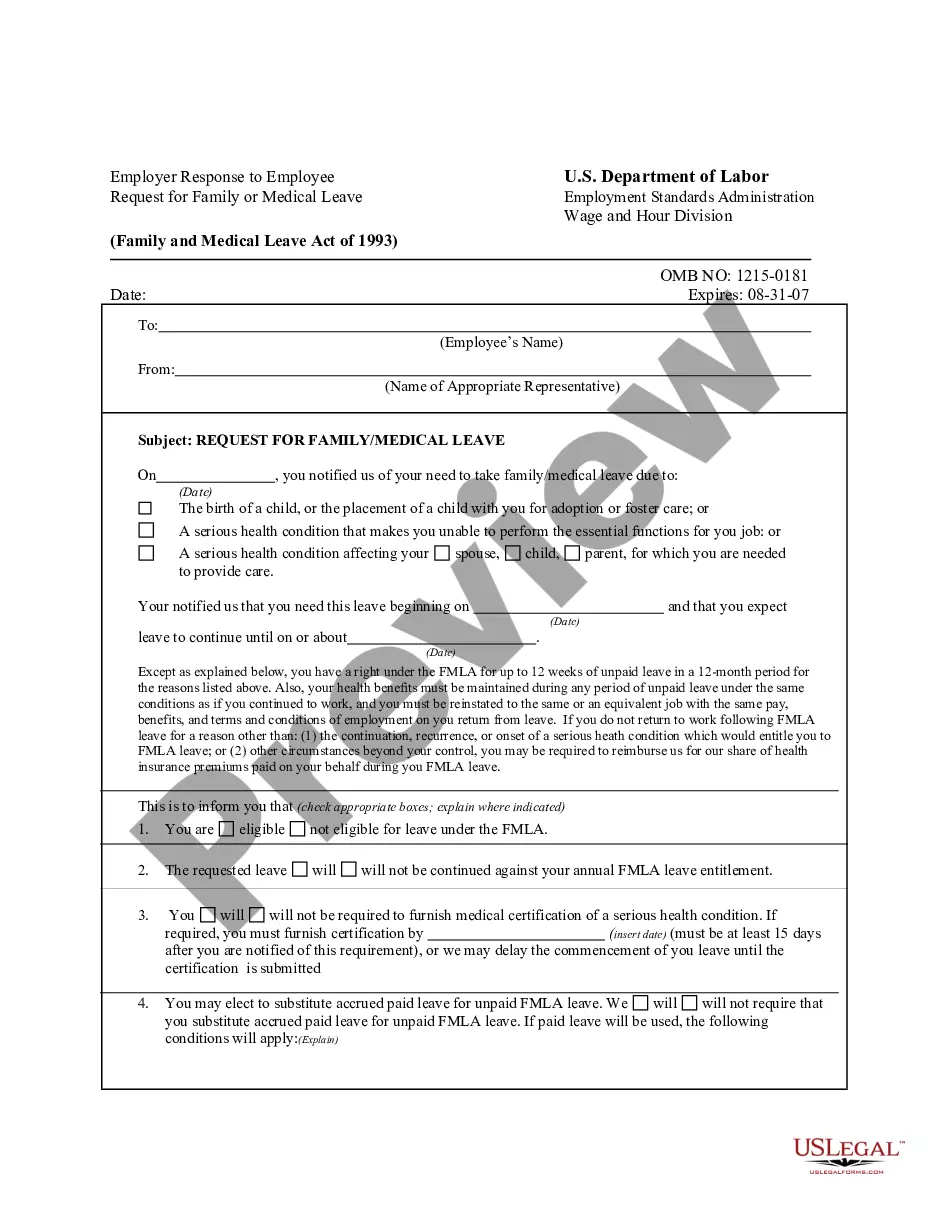

Typically, the parties to a sales contract in Delaware regarding a Delaware Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase include the lessor and the lessee. The lessor is the owner of the equipment, while the lessee is the party renting it under the lease agreement. Understanding the roles and responsibilities of each party is key to a successful transaction. For expert assistance in drafting or reviewing contracts, consider using USLegalForms as a trusted resource.

Delaware imposes a lease tax rate on a Delaware Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. The rate typically depends on the type of lease and the nature of the equipment involved. Businesses should be aware of these rates when structuring leases to ensure compliance. For comprehensive guidance on lease tax rates and related forms, USLegalForms offers essential resources.

In Delaware, the rental tax for a Delaware Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase varies based on the type of equipment and its usage. Generally, the rental tax applies to tangible personal property, including equipment. It is crucial for businesses engaging in such leases to understand their tax obligations to avoid penalties. For detailed information and resources, you can check platforms like USLegalForms, which can guide you through the specifics.

To exit an equipment lease, begin by checking your lease agreement for termination options. You might be able to return the equipment early or negotiate a settlement with the lessor. Alternatively, consider arranging for a third party to take over the lease, but ensure this complies with the contractual obligations. Using platforms like USLegalForms can provide you with templates to manage this transition smoothly.

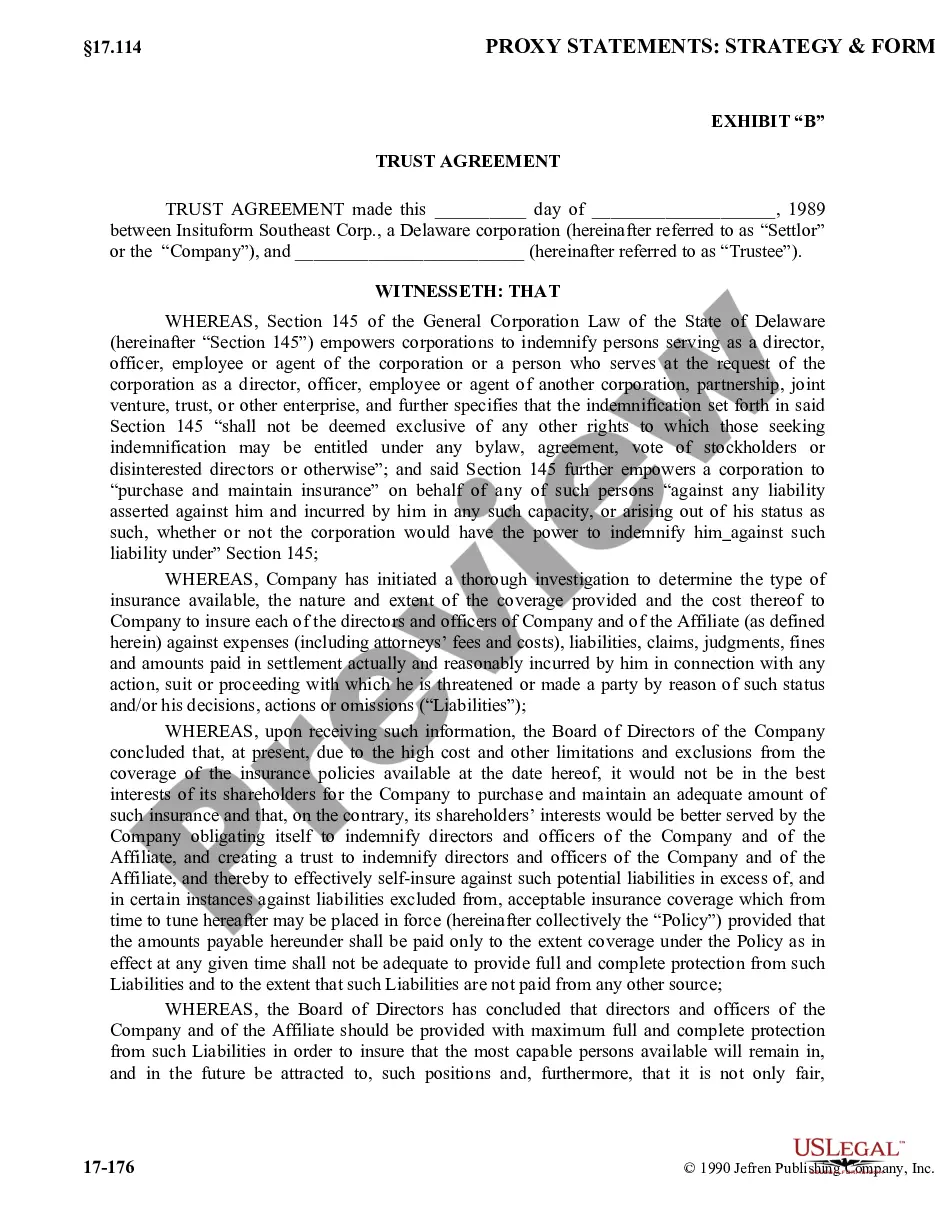

There are different types of leases, but the most common types are absolute net lease, triple net lease, modified gross lease, and full-service lease.

Most financial leases are "net" leases, meaning that the lessee is responsible for maintaining and insuring the asset and paying all property taxes, if applicable. Financial leases are often used by businesses for expensive capital equipment.

The term "net lease" is distinguished from the term "gross lease". In a net lease, the property owner receives the rent "net" after the expenses that are to be passed through to tenants are paid.

Net leases generally include property taxes, property insurance premiums, or maintenance costs, and are often used in commercial real estate. In addition to triple net leases, the other types of net leases are single net leases and double net leases.

There are three main types of net leases: single net leases, double net leases, and triple net leases. When a tenant signs a single net lease, they pay one of the three expense categories: taxes, maintenance, and insurance fees.

A $1 Buyout Lease, also called a capital lease, is similar to purchasing equipment with a loan. With this type of lease, there is a higher monthly payment compared with an FMV lease, but at the end of the lease term, the lessee purchases the equipment for $1.