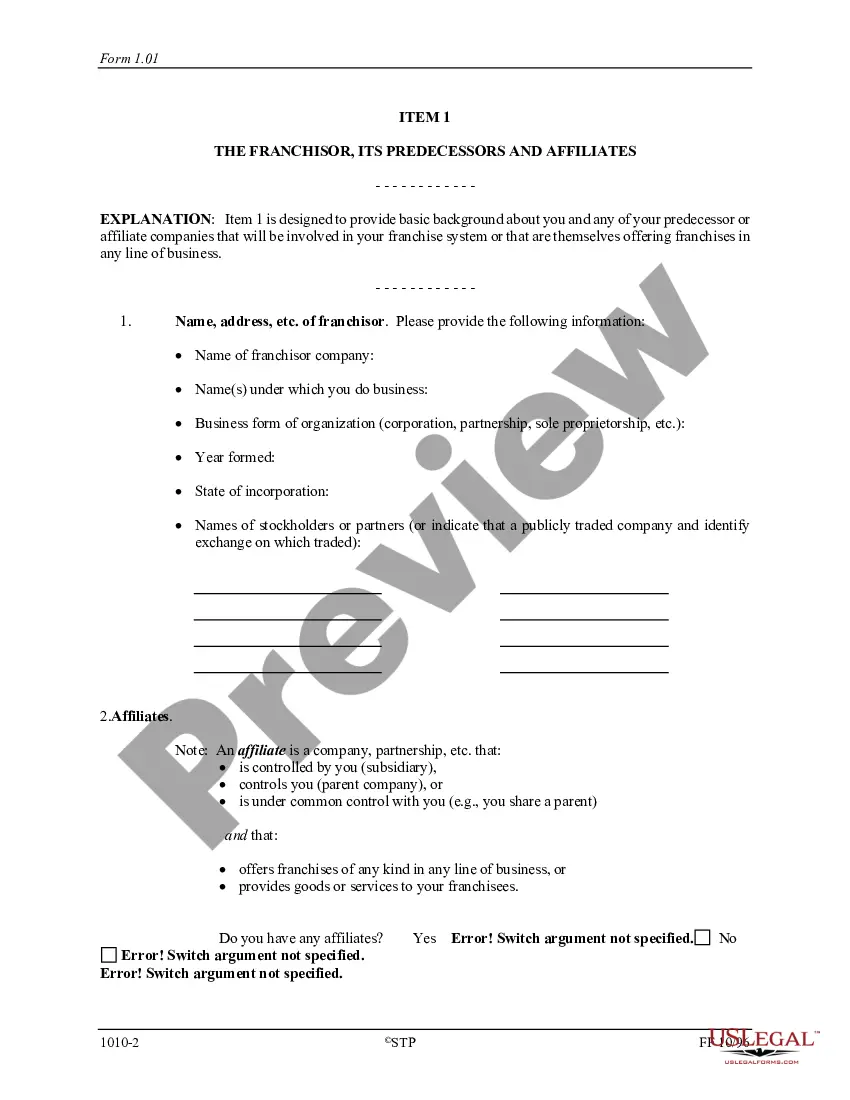

Delaware Franchise Registration Questionnaire

Description

How to fill out Franchise Registration Questionnaire?

Have you been within a position in which you require documents for both company or specific reasons almost every day time? There are tons of lawful document themes available online, but finding versions you can rely on isn`t straightforward. US Legal Forms offers a large number of kind themes, such as the Delaware Franchise Registration Questionnaire, which are composed to meet state and federal requirements.

Should you be already knowledgeable about US Legal Forms internet site and also have a merchant account, just log in. Afterward, you may download the Delaware Franchise Registration Questionnaire design.

If you do not come with an account and wish to begin to use US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is to the correct area/state.

- Make use of the Preview key to examine the shape.

- Look at the description to ensure that you have selected the appropriate kind.

- If the kind isn`t what you are searching for, make use of the Look for discipline to get the kind that meets your requirements and requirements.

- Once you find the correct kind, simply click Buy now.

- Pick the rates prepare you would like, complete the required information and facts to make your money, and pay for the transaction with your PayPal or credit card.

- Choose a handy data file formatting and download your copy.

Locate all the document themes you have purchased in the My Forms menus. You can get a additional copy of Delaware Franchise Registration Questionnaire anytime, if necessary. Just click the needed kind to download or produce the document design.

Use US Legal Forms, one of the most substantial variety of lawful forms, to save lots of efforts and steer clear of mistakes. The assistance offers expertly manufactured lawful document themes which can be used for a range of reasons. Generate a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

Owners of a newly-incorporated business often wonder if they need a Delaware business address. No, you do not need to have a business address or office in Delaware. All businesses incorporated in Delaware require a Registered Agent with a physical street address in Delaware, such as Agents and Corporations (IncNow®).

I'm not a Delaware resident and don't have a physical address in Delaware. Can I still form an LLC in Delaware? Yes, a non-resident with no physical address in Delaware can form a Delaware LLC. The State of Delaware only requires the company to have a Registered Agent in Delaware.

The answer is, yes, anyone in the world can form a Delaware LLC! The state of Delaware does not restrict non-U.S. residents from owning or managing Delaware LLCs, nor do they require any physical presence in the state of Delaware, or even within the U.S., for that matter.

Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual Franchise Tax Report and pay Franchise Tax for the privilege of incorporating in Delaware.

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation.

You don't need to reside in the state for the process of Delaware company registration for non-residents. Though, to receive IRS correspondence or official state mail you need to register a proper physical address in the US.

Absolutely, as a non-resident you can still start a Delaware LLC. The state only requires that you maintain a registered agent with a physical office within the state.

There is no documentation required to form an LLC in Delaware. The only information required, whether you are a United States citizen or not, is: Name of the company (check a company name for free) Communications Contact (must be an individual)