Delaware Release of Security Interest - Termination Statement

Description

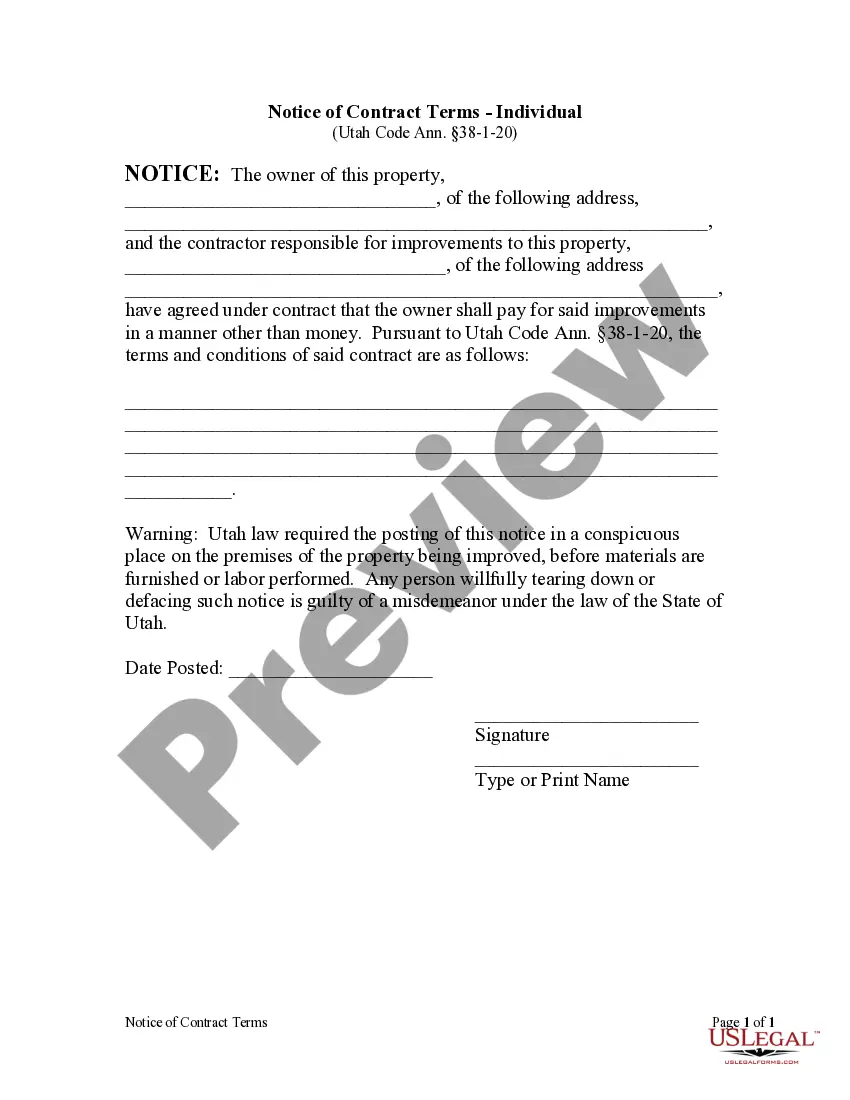

How to fill out Release Of Security Interest - Termination Statement?

Choosing the right legal record web template could be a struggle. Of course, there are a lot of web templates available on the Internet, but how would you get the legal form you need? Use the US Legal Forms web site. The service delivers a large number of web templates, like the Delaware Release of Security Interest - Termination Statement, that can be used for company and private demands. Every one of the kinds are examined by experts and meet up with federal and state specifications.

When you are presently registered, log in to the profile and click on the Download button to get the Delaware Release of Security Interest - Termination Statement. Make use of your profile to look with the legal kinds you may have bought formerly. Proceed to the My Forms tab of your own profile and get an additional backup in the record you need.

When you are a new user of US Legal Forms, listed here are straightforward guidelines that you should stick to:

- Very first, make sure you have chosen the correct form to your town/region. It is possible to examine the form making use of the Review button and look at the form description to ensure it is the right one for you.

- In case the form does not meet up with your needs, make use of the Seach area to obtain the correct form.

- Once you are certain the form is suitable, select the Get now button to get the form.

- Select the prices program you desire and type in the required info. Create your profile and buy an order utilizing your PayPal profile or bank card.

- Choose the file formatting and down load the legal record web template to the device.

- Complete, change and print out and indication the received Delaware Release of Security Interest - Termination Statement.

US Legal Forms may be the most significant library of legal kinds for which you can see various record web templates. Use the service to down load expertly-made files that stick to status specifications.

Form popularity

FAQ

3 is used as a way to amend that original lien filing and do things like terminate the UCC, edit any of the details of the lien, or assign your interests to another secured party for the lien.

What authorization is required to file a financing statement? A secured party must be authorized to file a financing statement against the assets of the debtor. If the debtor is bound by a security agreement, authorization to file a financing statement is implied.

However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 ? Continuation ? A UCC1 filing is good for five years.

3 termination statement (a ?Termination?) is a required filing that terminates a security interest that has been perfected by a UCC1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC3 with the Secretary of State's office in the appropriate state.

When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

For unsecured loans, such as credit cards or personal lines of credit, termination statements are not required. Once a termination statement has been signed by the lender, that lender will no longer have any legal recourse to the assets that were previously held as collateral.

UCC Financing Statement Amendment (Form UCC3) Uniform Commercial Code Financing Statement Amendment is for used for the termination, continuation, and/or transfer changes to Financing Statement.