Delaware Subrogation Agreement between Insurer and Insured

Description

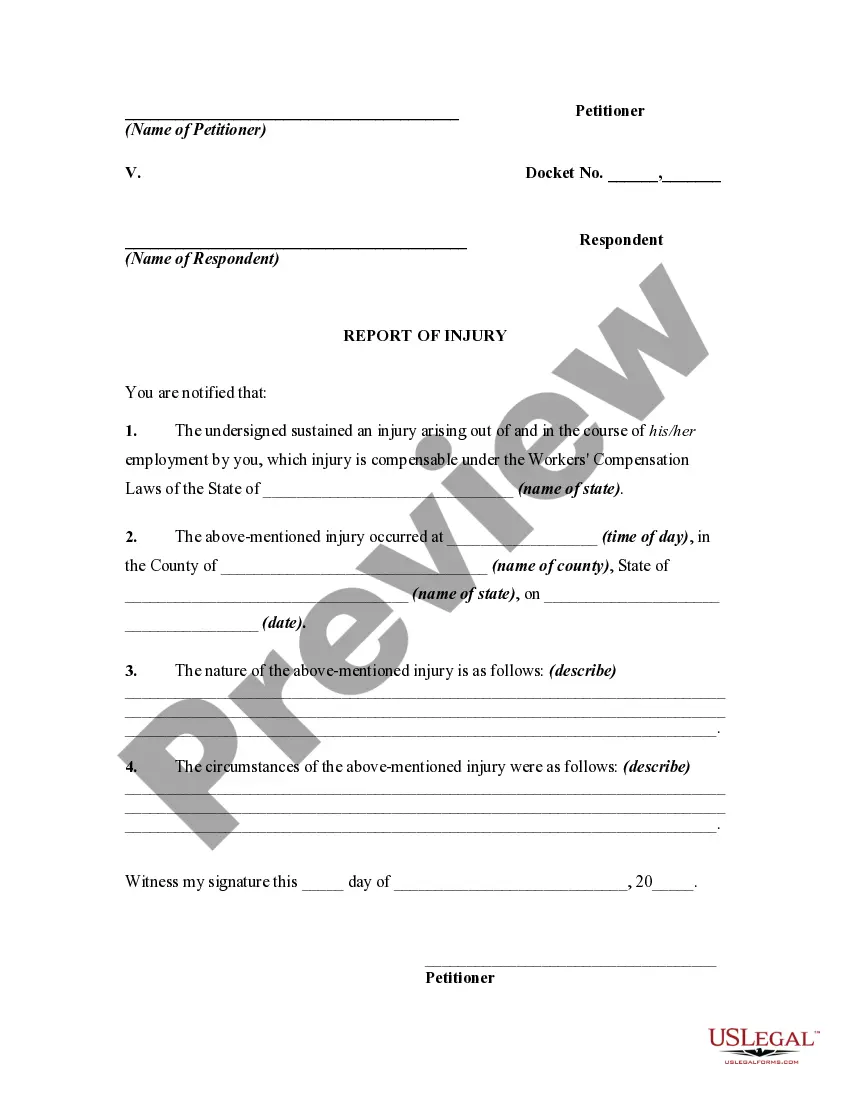

How to fill out Subrogation Agreement Between Insurer And Insured?

Have you been in the situation where you will need papers for possibly enterprise or personal uses just about every working day? There are plenty of authorized record layouts available online, but getting ones you can depend on is not simple. US Legal Forms provides 1000s of develop layouts, like the Delaware Subrogation Agreement between Insurer and Insured, that are created to fulfill state and federal needs.

Should you be already acquainted with US Legal Forms web site and possess an account, basically log in. Next, you may down load the Delaware Subrogation Agreement between Insurer and Insured design.

If you do not provide an bank account and wish to start using US Legal Forms, follow these steps:

- Obtain the develop you want and make sure it is to the proper metropolis/area.

- Utilize the Review switch to examine the form.

- Look at the outline to ensure that you have selected the proper develop.

- If the develop is not what you are trying to find, use the Search field to find the develop that fits your needs and needs.

- Once you find the proper develop, simply click Purchase now.

- Opt for the costs strategy you need, complete the desired information and facts to make your money, and pay money for the transaction utilizing your PayPal or charge card.

- Pick a handy paper formatting and down load your copy.

Locate each of the record layouts you possess purchased in the My Forms menus. You may get a additional copy of Delaware Subrogation Agreement between Insurer and Insured anytime, if possible. Just select the essential develop to down load or print out the record design.

Use US Legal Forms, by far the most considerable assortment of authorized types, to save lots of some time and avoid blunders. The services provides professionally produced authorized record layouts that you can use for a variety of uses. Make an account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

What is Subrogation? Subrogation in insurance is a legal right of the insurance company to legally pursue a third-party responsible for the damages/insurance loss caused to the insured. Subrogation is done to recover the claim amount insurance company pays to the insured for the damages.

Examples of subrogation clauses include: Example 1. Filing an auto insurance claim against a third party driver. Example 2. Trustee lenders subrogating trustee's indemnity rights. Example 3. Health insurance companies pursuing claims for third-party services.

Subrogation allows an insurer to step into the shoes of the policyholder and file a claim against a third party who caused the damage. The theory behind a subrogation clause is that the insurance company should not have to bear the loss when someone else was to blame for the damages.

Subrogation in insurance is a legal right of the insurance company to legally pursue a third-party responsible for the damages/insurance loss caused to the insured. Subrogation is done to recover the claim amount insurance company pays to the insured for the damages.

Delaware law provides that the PIP carrier is able to subrogate against a third party's liability insurance and is specifically granted the right to subrogate against and seek indemnity from a workers' compensation carrier.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

3 Benefits of Subrogation in Car Insurance Speeds up the claims process for policyholders. Refunds insurers for claims if their customer wasn't at-fault. Keeps premiums low for policyholders who aren't responsible for damage.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.