Delaware What To Do When Starting a New Business

Description

How to fill out What To Do When Starting A New Business?

US Legal Forms - one of the largest collections of legal forms in the United States - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Delaware What To Do When Starting a New Business in just seconds.

If you already have a subscription, Log In and download the Delaware What To Do When Starting a New Business from the US Legal Forms repository. The Download button will be visible on every form that you view.

Then, select your preferred pricing plan and enter your information to register for an account.

Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device.Edit. Complete, modify, print, and sign the downloaded Delaware What To Do When Starting a New Business.Each template you've added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.Obtain access to the Delaware What To Do When Starting a New Business with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are new to US Legal Forms, here are some simple steps to get you started.

- Ensure you have selected the correct form for your area/region.

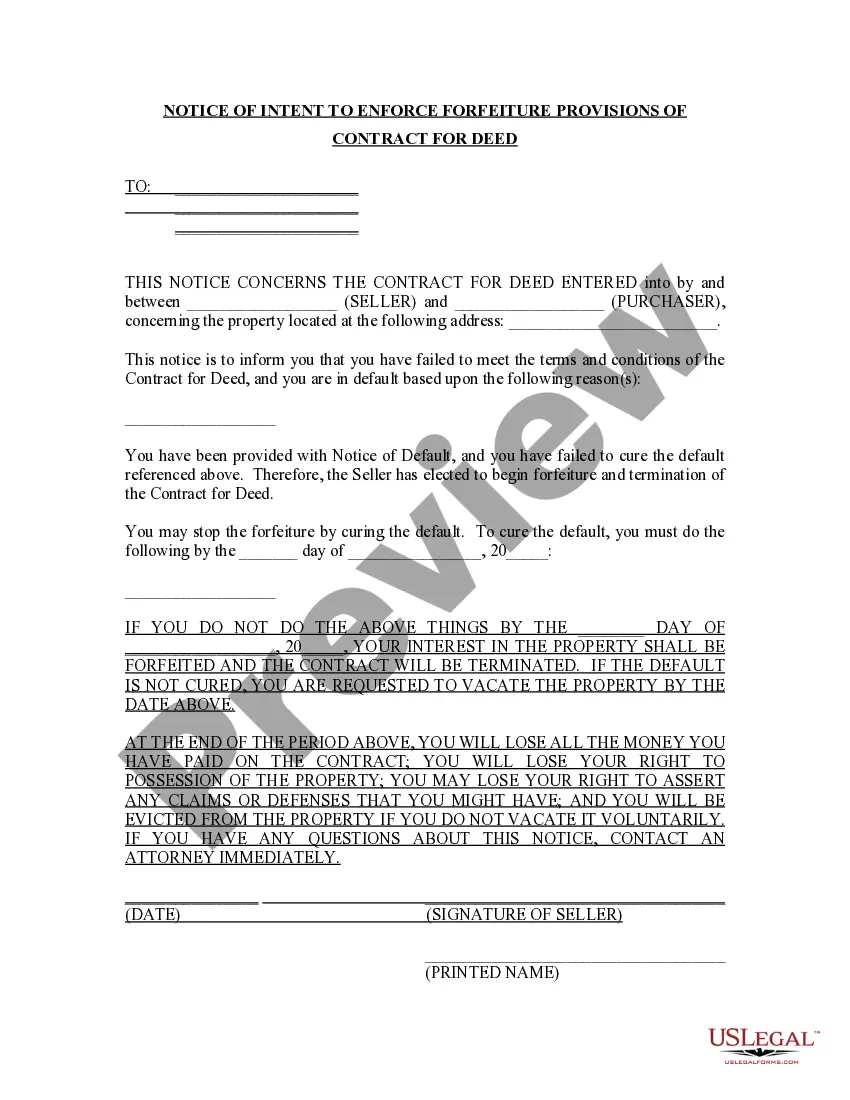

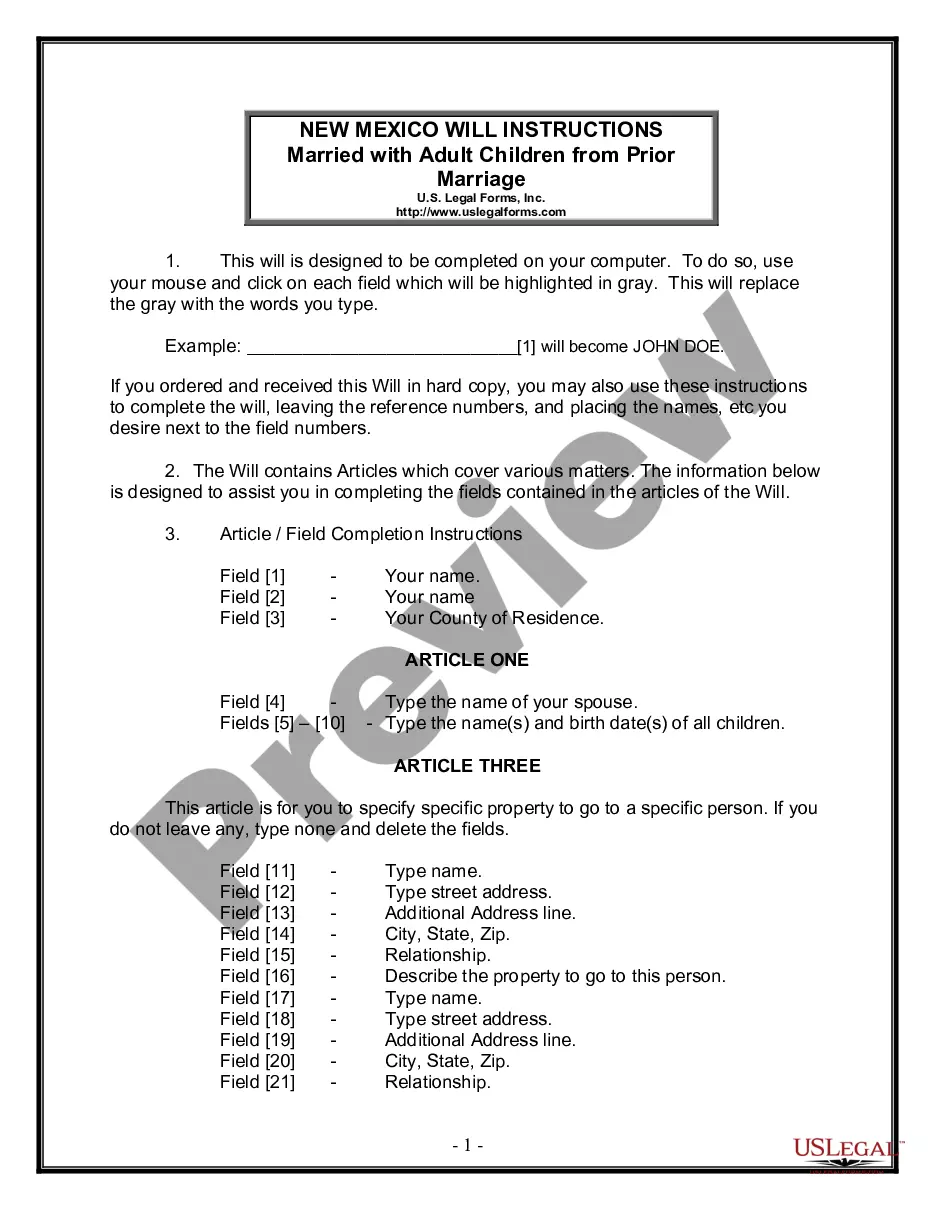

- Click the Preview button to review the form's content.

- Read the form description to verify that you've chosen the right form.

- If the form doesn't meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Get now button.

Form popularity

FAQ

Reasons Why Tech Startups Incorporate in Delaware: Establishing a US Presence. Some international ventures and non US residents prefer to incorporate in Delaware to establish a US presence and have access to US resources, including US venture capital.

How to Form a Corporation in DelawareChoose a Corporate Name.Prepare and File Certificate of Incorporation.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Directors and Hold Board Meeting.Issue Stock.File Annual Report and Pay Franchise Tax.Obtain an EIN.

If you're based in another country or state, you might be wondering if there's a reason to register your company as a Delaware corporation instead of just creating a simple LLC where you live. The short answer, especially if you're planning to grow your company and secure outside funding, is Yes.

Any person or entity conducting a trade or business in the State of Delaware, including corporations, must obtain a State of Delaware Business License from the Delaware Division of Revenue. To obtain a Delaware business license: Visit Delaware's One Stop Business Licensing and Renewal service; or.

All LLCs registered or doing business in Delaware are required to obtain a business license from the Delaware Division of Revenue. You are required to get your business license before you start transacting business in state.

Can I operate a business in my home? Generally, yes, provided that the business meets the New Castle County Unified Development Code (UDC) definition of a permitted home occupation and the conditions of Section 40.03.

Investors Prefer Delaware Corporations For many reasons, venture capital firms, angel investors, and startup accelerators prefer or even require that startups be incorporated in Delaware before they will make an investment.

Delaware Incorporation Fees The state fee to incorporate in Delaware is a minimum of $89. This includes your Division of Corporation fees ($50), filing fee tax ($15 minimum), and the county fee ($24).

To operate a sole proprietorship in Delaware, you do not have to register with the state. Also, you can conduct your business using your own name instead of an assumed or fictitious name, or a trade name. You must, however, formally register with the state if you use a name that is different from your own name.