Delaware Checklist - Action to Improve Collection of Accounts

Description

How to fill out Checklist - Action To Improve Collection Of Accounts?

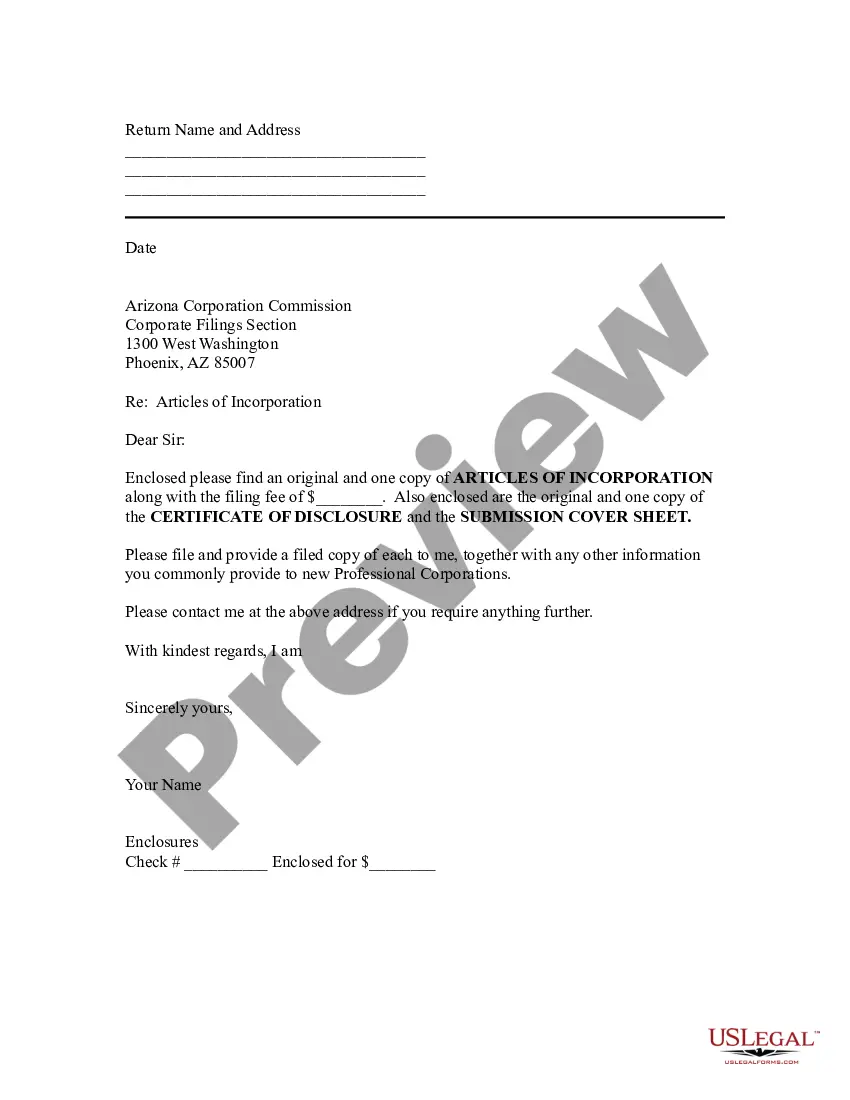

You might spend numerous hours online searching for the legal document template that complies with the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by professionals.

You can easily download or print the Delaware Checklist - Action to Enhance Collection of Accounts from your service.

If a different version of the document is needed, utilize the Search field to find the template that aligns with your needs and criteria.

- If you currently possess a US Legal Forms account, you can sign in and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Delaware Checklist - Action to Enhance Collection of Accounts.

- Every legal document template you obtain is yours permanently.

- To retrieve an additional copy of any purchased form, visit the My documents section and click the relevant option.

- If you are accessing the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- First, ensure that you have selected the correct document template for your region/town of choice.

- Review the form details to confirm you have chosen the appropriate document.

Form popularity

FAQ

The financial year closing checklist is a collection of critical tasks that accountants and finance teams must complete before the year ends. This checklist ensures that all financial transactions are recorded, reconciled, and reported properly. You can enhance your financial management by using tools like the Delaware Checklist - Action to Improve Collection of Accounts to ensure your accounts are clean and ready for the new financial year.

A checklist in accounting is a systematic list of tasks or items that accountants need to complete to ensure accuracy and compliance. It can range from monthly reconciliations to annual audits, providing a structured way to maintain financial integrity. By leveraging the Delaware Checklist - Action to Improve Collection of Accounts, businesses can streamline their accounting practices and boost collections.

To improve the collection of accounts receivable, businesses should regularly assess their billing processes and follow up diligently on overdue accounts. Implementing best practices, such as clear communication and flexible payment options, can significantly increase recovery rates. The Delaware Checklist - Action to Improve Collection of Accounts provides a framework for identifying gaps in your collection strategies and taking actionable steps toward improvement.

A checklist account is a financial tool used to monitor all actions taken to manage accounts effectively. This type of account allows businesses to follow a structured approach in tracking their collections. Utilizing the Delaware Checklist - Action to Improve Collection of Accounts ensures you stay organized while maximizing your revenue collection efforts.

A checklist is a practical tool that helps you keep track of tasks or items that need attention. It serves to ensure that nothing gets overlooked, making processes more efficient. For businesses focused on improving their finances, the Delaware Checklist - Action to Improve Collection of Accounts can guide you through essential steps to enhance your accounts receivable processes.

Individuals or entities who earn income in Delaware must file a tax return. This applies to residents and non-residents alike, depending on the income source. By using the Delaware Checklist - Action to Improve Collection of Accounts, you can ensure you meet all filing obligations.

Business entities that do not generate any income or do not meet the minimum thresholds set by the state of Delaware are typically not required to file a return. It's crucial to assess your business activities thoroughly. The Delaware Checklist - Action to Improve Collection of Accounts can clarify these requirements.

Delaware tax returns offer various filing statuses, including single, married filing jointly, married filing separately, and head of household. Selecting the correct status can significantly impact tax liability. Adhering to the Delaware Checklist - Action to Improve Collection of Accounts will help you choose the appropriate status.

The Delaware form pit-res is a specific form used to report Personal Income Tax Resale or Reporting. This form is essential for individuals and businesses to report certain types of income accurately. Completing the Delaware Checklist - Action to Improve Collection of Accounts ensures you address all necessary filings, including this form.

Yes, you can amend a Delaware annual report within a specific timeframe. If errors or omissions occur, it's important to correct them to avoid penalties. Consulting the Delaware Checklist - Action to Improve Collection of Accounts will guide you through the amendment process.