This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Petition to Determine Distribution Rights of the Assets of a Decedent

Description

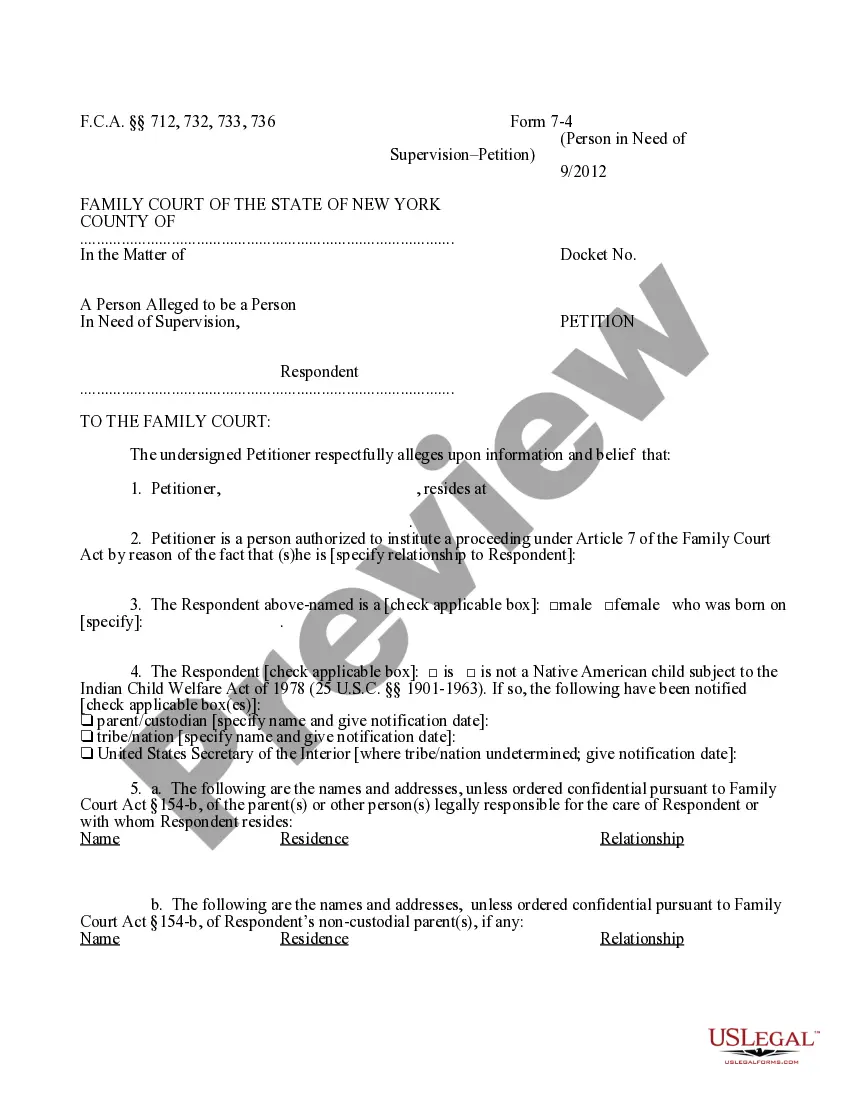

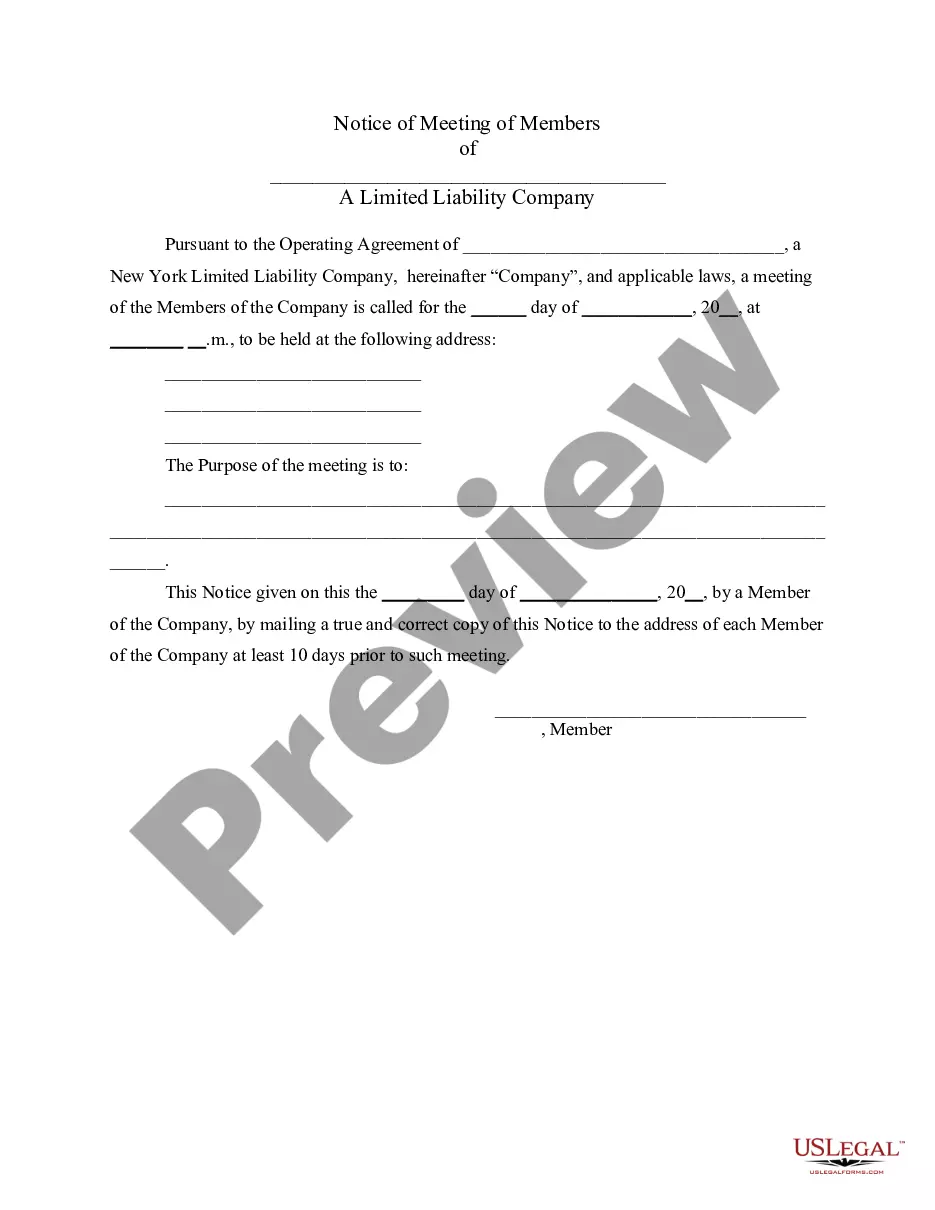

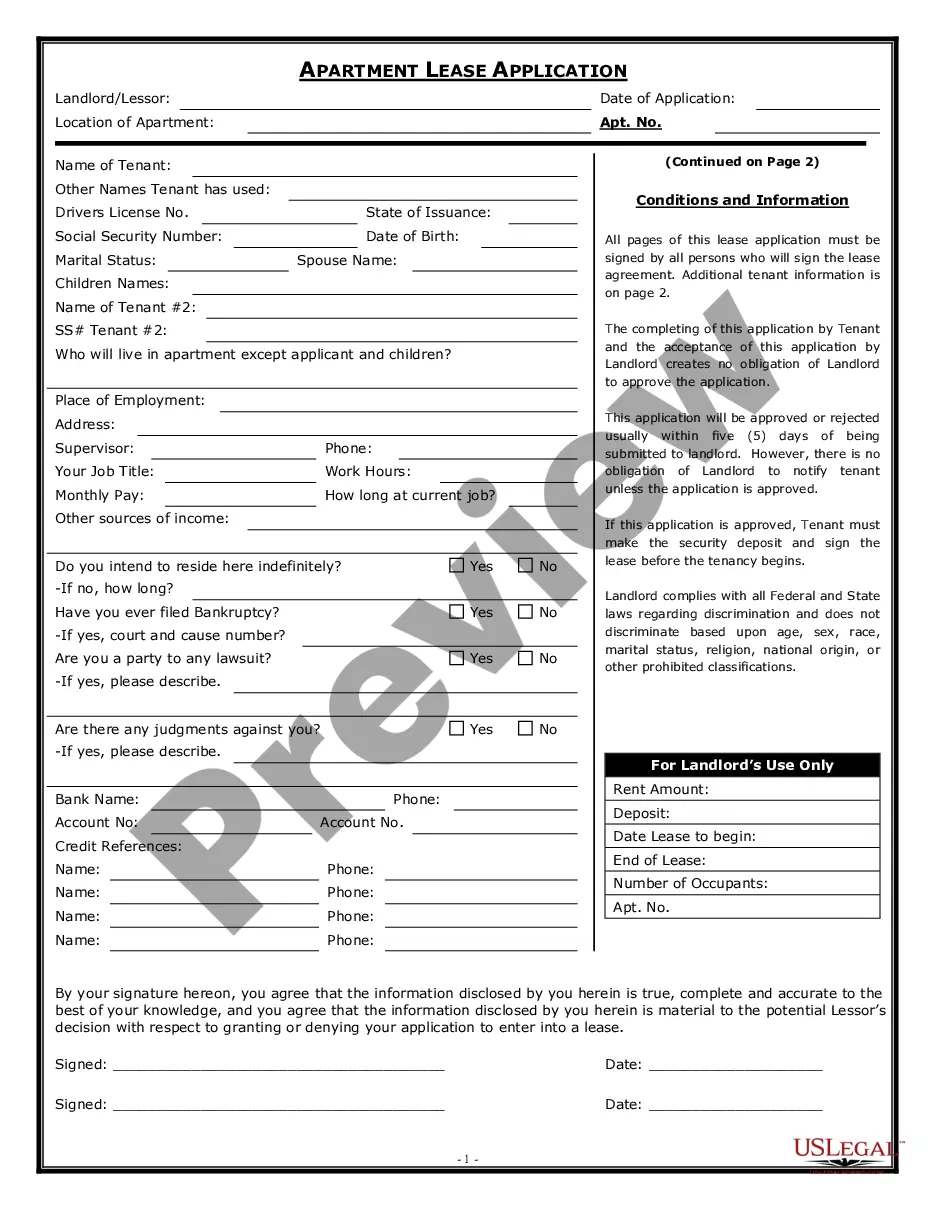

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

Choosing the right legitimate document format can be a battle. Obviously, there are a variety of themes available online, but how will you obtain the legitimate form you want? Take advantage of the US Legal Forms internet site. The service delivers a large number of themes, including the Delaware Petition to Determine Distribution Rights of the Assets of a Decedent , which can be used for company and personal requirements. Every one of the kinds are checked by pros and meet up with state and federal specifications.

Should you be already signed up, log in to the profile and then click the Acquire key to find the Delaware Petition to Determine Distribution Rights of the Assets of a Decedent . Make use of your profile to search through the legitimate kinds you might have ordered in the past. Go to the My Forms tab of your respective profile and acquire another backup from the document you want.

Should you be a fresh consumer of US Legal Forms, listed here are simple directions so that you can adhere to:

- First, make sure you have selected the right form to your city/state. You may check out the form using the Preview key and browse the form explanation to make certain this is the right one for you.

- In the event the form fails to meet up with your expectations, use the Seach area to obtain the correct form.

- When you are positive that the form would work, click the Buy now key to find the form.

- Select the pricing strategy you need and enter the essential info. Make your profile and pay money for the order utilizing your PayPal profile or Visa or Mastercard.

- Pick the document format and obtain the legitimate document format to the product.

- Comprehensive, edit and produce and sign the obtained Delaware Petition to Determine Distribution Rights of the Assets of a Decedent .

US Legal Forms is the most significant library of legitimate kinds for which you can find numerous document themes. Take advantage of the company to obtain skillfully-created files that adhere to condition specifications.

Form popularity

FAQ

§ 2306. Distribution of decedent's property without grant of letters where estate assets do not exceed $30,000.

Who Gets What in Delaware? If you die with:here's what happens:parents but no spouse or descendantsparents inherit everythingsiblings but no spouse, descendants, or parentssiblings inherit everything5 more rows

Delaware Usury Laws In Delaware, the maximum amount of interest a borrower can charge is 5% over the Federal Reserve discount rate. The Delaware legislature has an exception to interest rate limits: there is no limit where loan exceeds $100,000 and is not secured by a mortgage on the borrower's personal residence.

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...

(5) "Total return unitrust'' means an income trust that has been converted under this section or the laws of any other jurisdiction that permits an income trust to be converted to a trust in which a unitrust amount is treated as the net income of the trust.

The surviving spouse is entitled to receive up to the amount of $7,500 out of the estate of the decedent. The allowance to the surviving spouse of a decedent shall be made within the shorter of 9 months from the date of death or 6 months from the date of the granting of letters, testamentary or of administration.

If you die with a surviving spouse and with children with someone other than that spouse, the spouse gets ½ of your intestate assets, plus the right to use any intestate real estate for life. Your children get everything else. If you die with children but no surviving spouse, your children inherit everything.

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...