Delaware Security Agreement involving Sale of Collateral by Debtor

Description

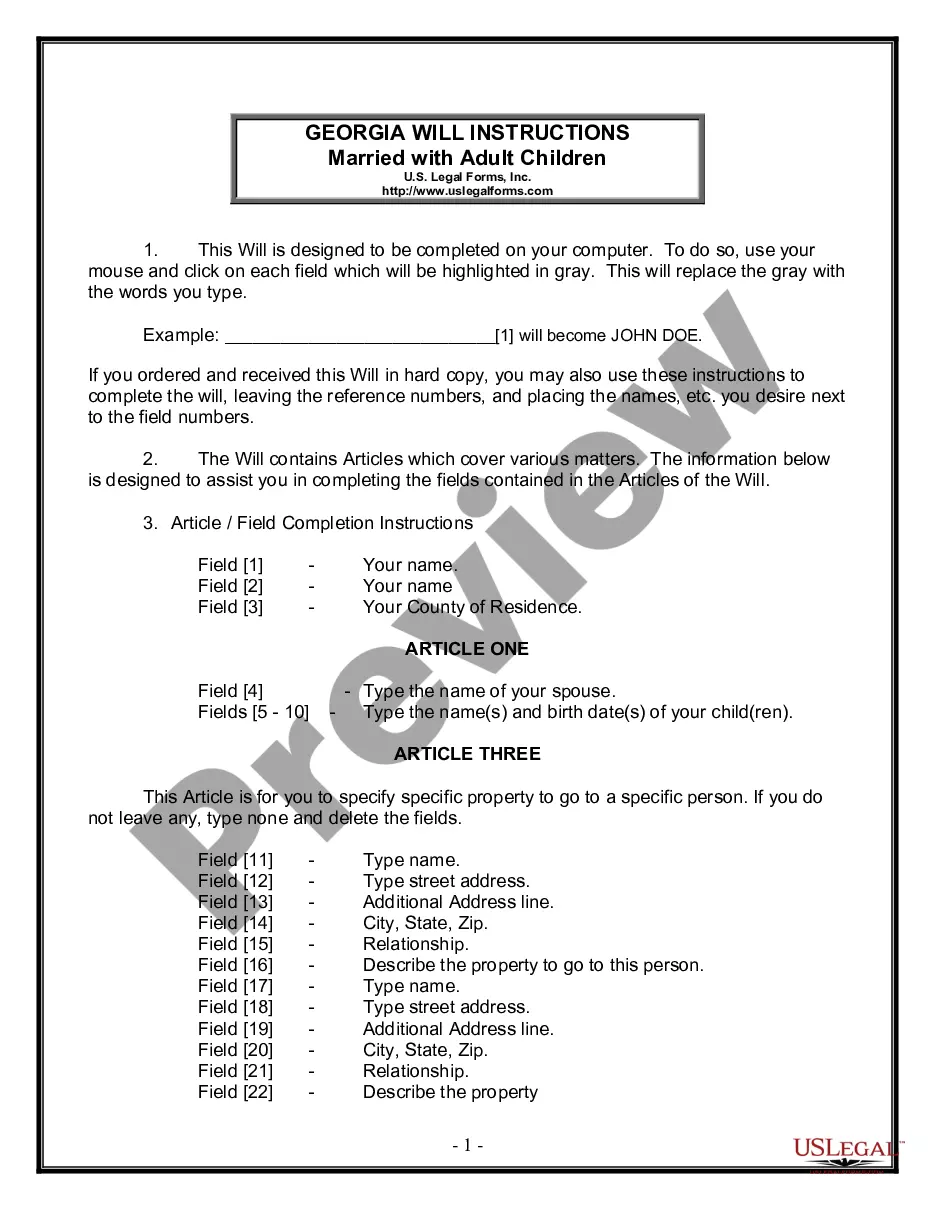

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

Are you currently in a situation where you require documents for either professional or personal purposes almost every business day.

There are numerous legal document templates available online, but finding versions you can rely on is not straightforward.

US Legal Forms provides thousands of form templates, including the Delaware Security Agreement regarding Sale of Collateral by Debtor, designed to comply with state and federal regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have a free account, simply Log In.

- Then, you can download the Delaware Security Agreement regarding Sale of Collateral by Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview option to view the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you're looking for, use the Search field to locate the one that fits your needs and requirements.

Form popularity

FAQ

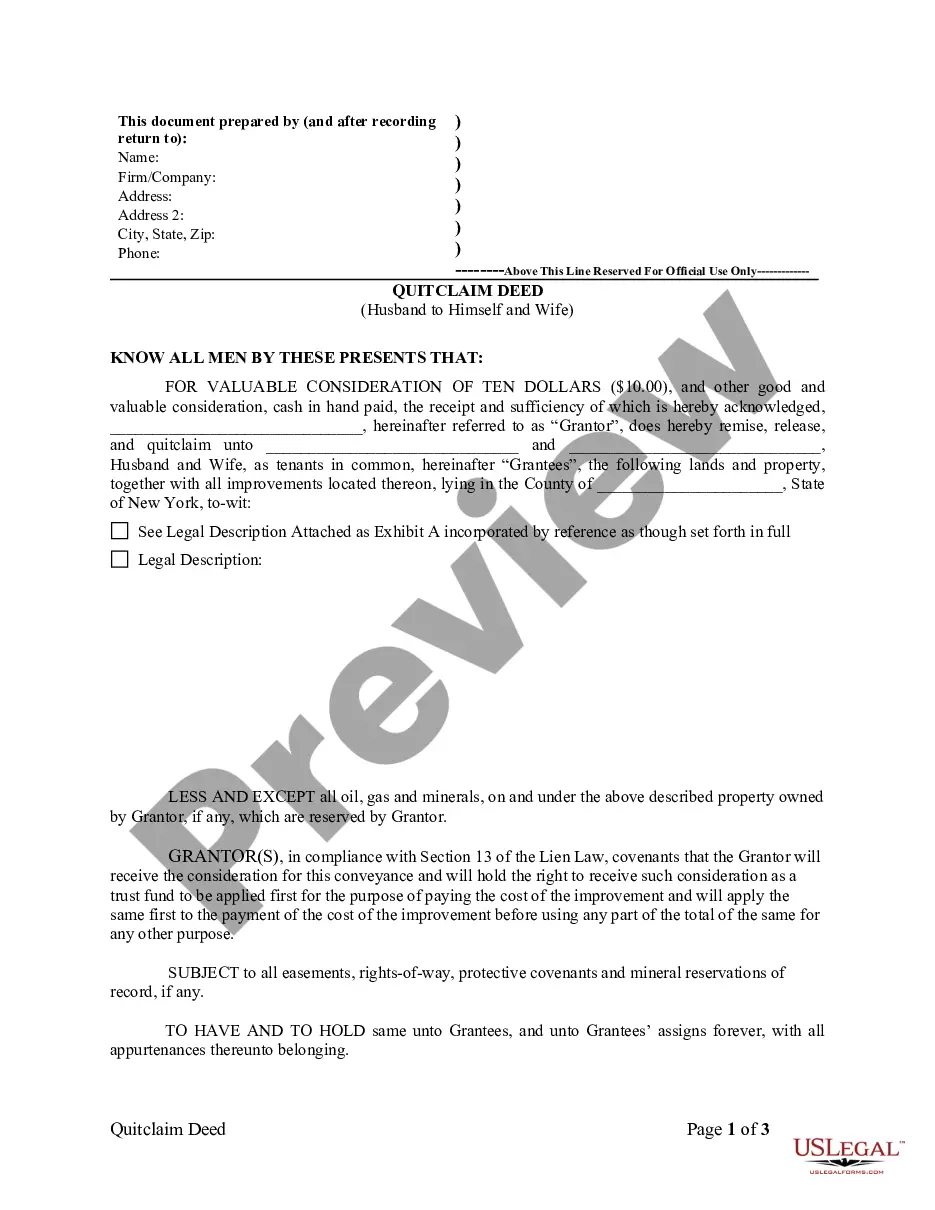

In secured transactions, the debtor is the party that borrows funds and pledges assets as collateral to the secured party. This relationship is formalized through agreements like the Delaware Security Agreement involving Sale of Collateral by Debtor. Recognizing the debtor's role is vital for understanding how these transactions function.

A security agreement typically involves two main parties: the debtor and the secured party. In the context of a Delaware Security Agreement involving Sale of Collateral by Debtor, these roles are crucial as they define the dynamics of the agreement. Knowing who the parties are establishes the rights and duties that each must fulfill under the terms set forth.

The description of collateral in a Delaware Security Agreement involving Sale of Collateral by Debtor must be specific and adequately identify the collateral. It should provide enough detail to distinguish the collateral from other assets. This clarity helps protect the interests of both the secured party and the debtor, ensuring transparent transactions.

Collateral enforceability refers to the legal protections and rights a secured creditor has over collateral identified in a Delaware Security Agreement involving Sale of Collateral by Debtor. For the collateral to be enforceable, it must be properly described in the security agreement and adequately perfected. This ensures that if the debtor defaults, the creditor has the right to seize and sell the collateral to satisfy outstanding obligations. Having the right legal documentation in place, such as those available from US Legal Forms, can solidify this enforceability.

Yes, when a debtor defaults on a Delaware Security Agreement involving Sale of Collateral by Debtor, a secured creditor can often take possession of the collateral without a court order, as long as it's done peacefully. This ability stems from the rights established in the security agreement and Article 9 of the UCC. It's important to understand the legal parameters surrounding this process to avoid disputes. Consulting a platform like US Legal Forms can provide clarity and assist in navigating these situations.

The Article 9 process relates to the Uniform Commercial Code (UCC) and governs security interests in personal property in the United States, including Delaware Security Agreements involving Sale of Collateral by Debtor. This process involves creating a security agreement, perfecting the interest through filing a financing statement, and enforcing the rights as a secured creditor upon default. Familiarizing yourself with Article 9 helps ensure compliance and effective protection of your security interests. Utilizing resources like US Legal Forms can guide you through these steps.

A security interest becomes enforceable when it meets certain requirements under the Delaware Security Agreement involving Sale of Collateral by Debtor. These requirements include a secured party's interest in the collateral, the debtor's consent, and the perfection of the security interest through filing or possession. This legal framework provides you with powerful protection in case the debtor defaults. Understanding these elements can significantly enhance your position as a secured creditor.

To file a Delaware Security Agreement involving Sale of Collateral by Debtor, you typically submit it with the Delaware Secretary of State. You can complete this process online or via mail, ensuring that the information is accurate and complete. Proper filing not only provides public notice of the security interest but also protects your rights as a secured creditor. Moreover, using a reliable platform like US Legal Forms simplifies this filing process.

A lease agreement is a contract that allows a party to use property owned by another party for a specified time in exchange for payment, without transferring ownership. In contrast, a finance agreement typically involves the borrowing of funds with the intent of purchasing an asset or property, where ownership is transferred to the borrower. Understanding the distinctions is crucial, especially when entering a Delaware Security Agreement involving Sale of Collateral by Debtor, ensuring that all parties are aware of their rights and responsibilities.

While a security agreement and a financing statement are related, they serve distinct purposes. The security agreement is the private contract that establishes the secured interest, detailing obligations and collateral, while the financing statement is a public document that offers notice of that interest to third parties. In a Delaware Security Agreement involving Sale of Collateral by Debtor, both documents play critical roles in ensuring legally enforceable security interests.