Delaware Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

Finding the appropriate legitimate document format can be challenging.

Certainly, there are numerous templates accessible online, but how can you obtain the legitimate template you require.

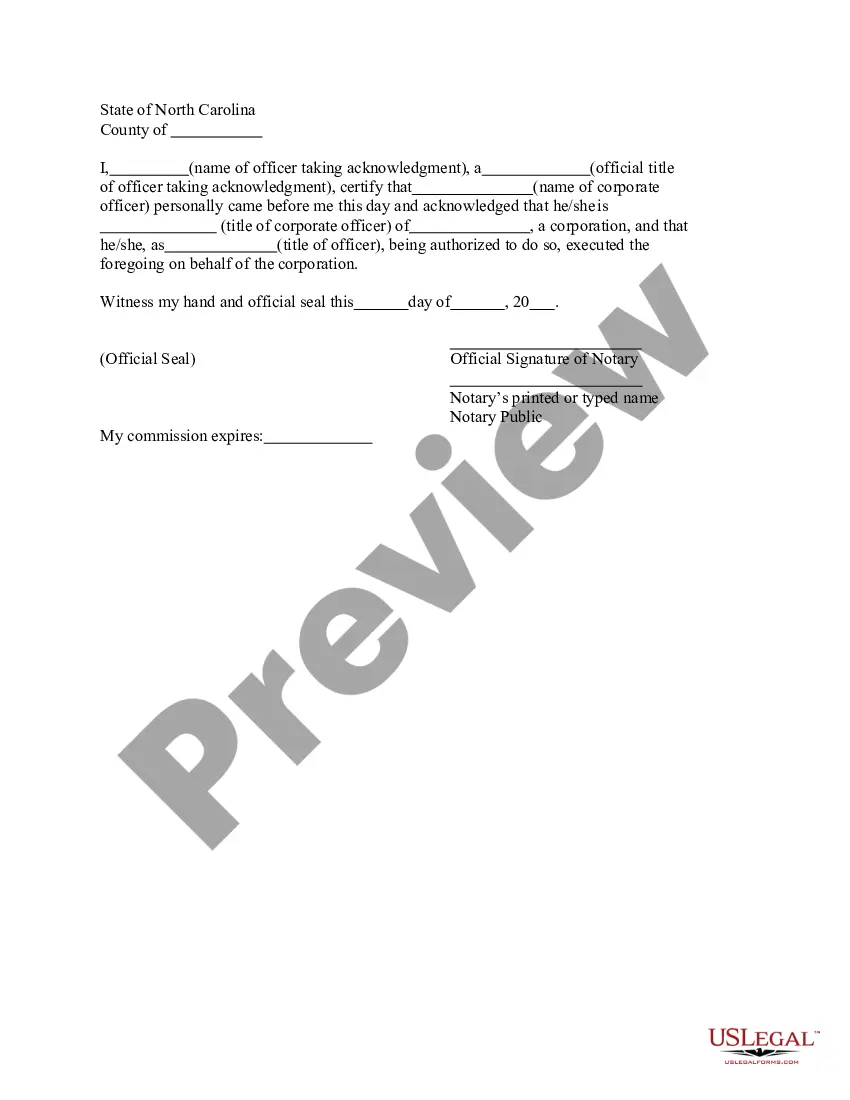

Utilize the US Legal Forms site.

If you are a new user of US Legal Forms, here are some simple steps to follow: First, ensure you have selected the correct form for your area/county. You can preview the form using the Preview option and read the form details to verify it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain the form works for you, click the Buy now button to obtain the form. Select the pricing plan you want and enter the necessary information. Create your account and pay for the transaction using your PayPal account or Visa or MasterCard. Finally, choose the file format and download the legitimate document format to your device. Fill out, edit, print, and sign the obtained Delaware Revocable Trust for Lottery Winnings. US Legal Forms is the largest repository of legitimate documents where you will find various document formats. Use the service to acquire professionally crafted documents that adhere to state requirements.

- The service provides a vast array of templates, including the Delaware Revocable Trust for Lottery Winnings, suitable for both business and personal use.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Delaware Revocable Trust for Lottery Winnings.

- Use your account to search for the legitimate documents you have purchased in the past.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

Yes, you can win the lottery in one state while residing in another. However, state laws regarding winnings and taxes may vary, impacting your overall payout. By using a Delaware Revocable Trust for Lottery Winnings, you can potentially navigate these complexities more smoothly. This trust structure offers additional advantages that can make managing your lottery win easier, no matter where you live.

Several states have specific regulations that require lottery winners to disclose their identity. States like Florida and New York allow public disclosure of winners, which can feel intrusive. If anonymity is important to you, consider a Delaware Revocable Trust for Lottery Winnings as an effective solution. This approach can help you manage your anonymity, regardless of the state's disclosure rules.

When a trust wins the lottery, it signifies that a legal entity, rather than an individual, is the official ticket holder. In this context, a Delaware Revocable Trust for Lottery Winnings allows for a smooth transfer of assets while providing certain protections. This method can help beneficiaries avoid probate and manage the funds more efficiently. Additionally, the original ticket holder can retain control over the trust until they choose to pass it on.

In Delaware, you can indeed use strategies to maintain a level of anonymity when claiming lottery winnings. Utilizing a Delaware Revocable Trust for Lottery Winnings lets you collect your prize without revealing your identity to the public. This is a powerful way to safeguard your personal life while still enjoying your winnings. Make sure to consult a legal expert for the best approach.

While many people wish to keep their lottery wins private, claiming winnings anonymously can be challenging. In several states, including Delaware, you can use a Delaware Revocable Trust for Lottery Winnings to shield your identity. This option allows you to maintain privacy and protect your financial future. Thus, it can be a smart tactic to consider.

Investing your lottery winnings wisely is crucial, and a Delaware Revocable Trust for Lottery Winnings can facilitate that process. Once your funds are placed in the trust, you can work with financial advisors to explore diverse investment opportunities. Common options include real estate, stocks, or starting a business, all of which can provide potential growth. By utilizing a trust, you can create a robust strategy that aligns with your financial goals and secures your future.

A Delaware Revocable Trust for Lottery Winnings can be an excellent choice for individuals who hit the jackpot. This type of trust allows you to maintain control over your assets while providing a level of privacy and protection. By placing your lottery winnings in a Delaware Revocable Trust, you can avoid probate and manage distributions according to your wishes. Moreover, using a revocable trust can simplify the process of transferring your wealth to heirs.

To claim lottery winnings with a trust, you should first establish a Delaware Revocable Trust for Lottery Winnings before claiming your prize. After creation, you can redeem your winning ticket in the name of the trust to maintain privacy and security. It’s essential to follow the lottery's specific claiming procedures and provide necessary documentation. Using the US Legal Forms platform can streamline this process, helping you create the required legal documents.

If you win the lottery, the first step is to secure your ticket and ensure it is stored safely. Next, consider setting up a Delaware Revocable Trust for Lottery Winnings. This trust can help protect your prize and provide a clear plan for managing your funds. Consulting with a financial advisor or legal expert is wise to guide you through the winning process effectively.

Avoiding gift tax on lottery winnings involves thoughtful planning. One effective strategy is to use a Delaware Revocable Trust for Lottery Winnings, which can help in structuring how you distribute your wealth to others. Consulting with a tax advisor can provide additional strategies to minimize your tax liability while following the law.