It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

Delaware Promissory Note - Forgivable Loan

Description

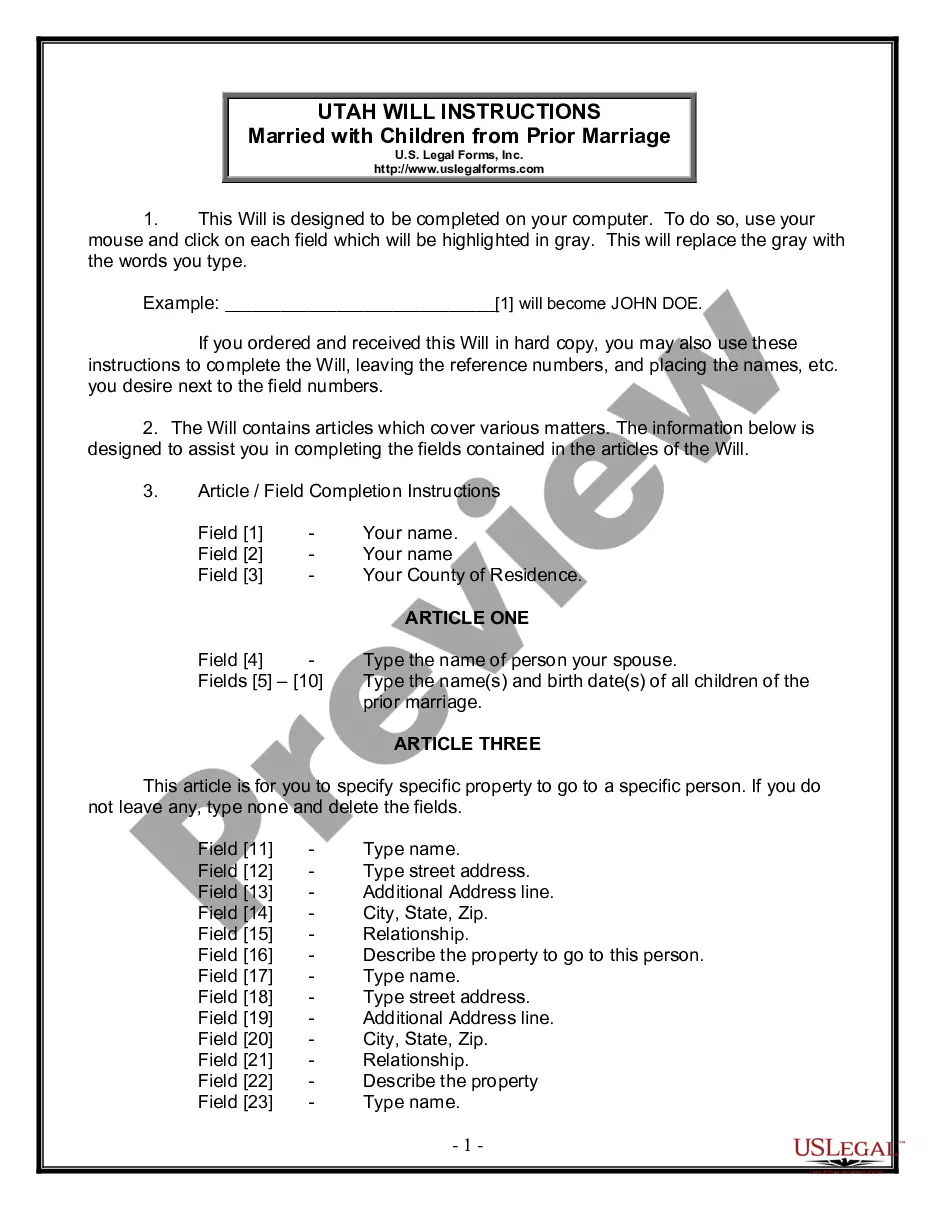

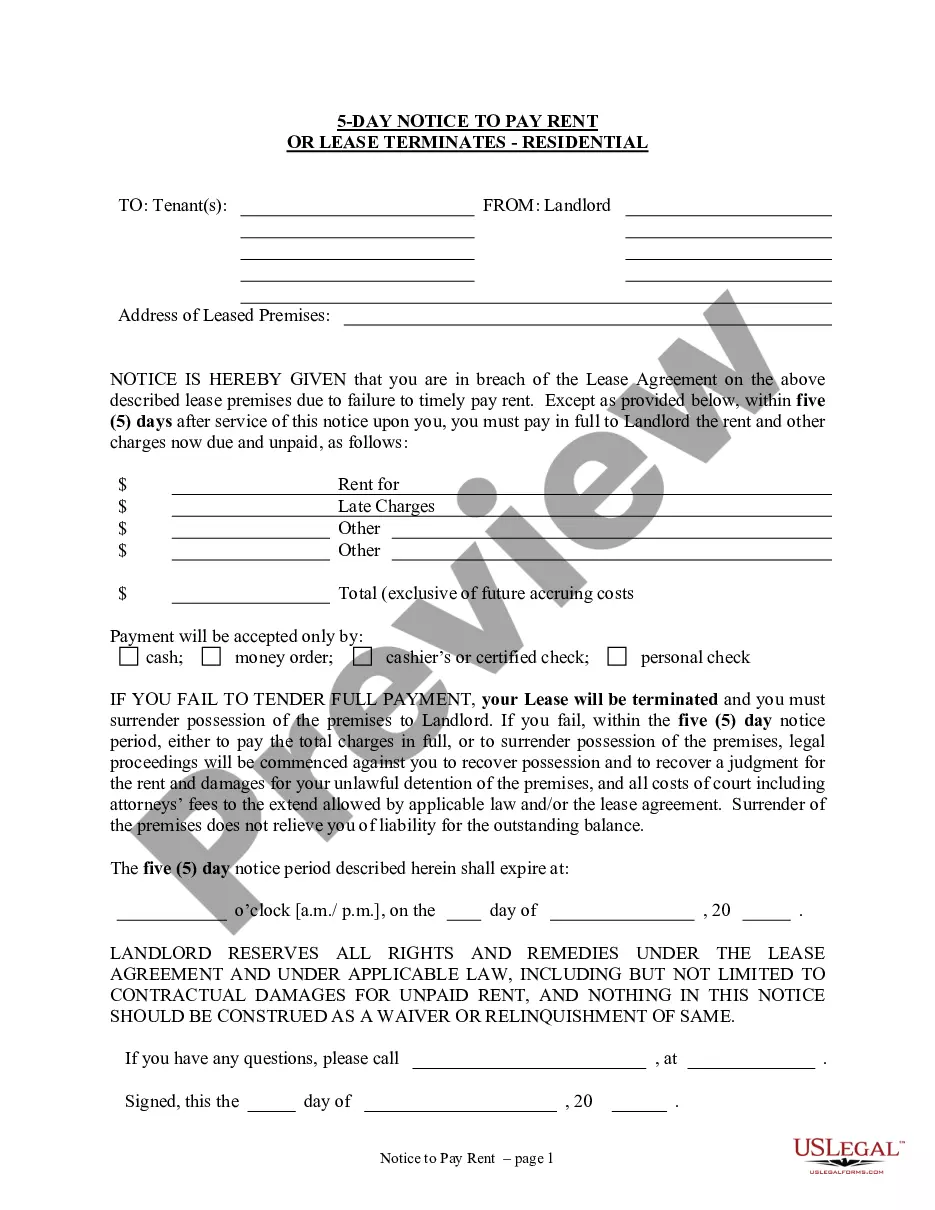

How to fill out Promissory Note - Forgivable Loan?

You have the capability to devote hours online trying to locate the authentic document format that satisfies the national and regional requirements you require.

US Legal Forms provides thousands of authentic forms that can be evaluated by specialists.

You can easily download or print the Delaware Promissory Note - Forgivable Loan from the service.

First, ensure that you have selected the correct document format for the area/city you choose. Review the form details to confirm that you have selected the proper form. If available, use the Review button to look at the document format as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Obtain button.

- After that, you can complete, modify, print, or sign the Delaware Promissory Note - Forgivable Loan.

- Each authentic document format you acquire is yours for many years.

- To retrieve another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Circumstances for Release of a Promissory Note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.

In the housing industry, a forgivable loan is a type of second mortgage. You don't have to pay this type of loan back unless you move before your loan term ends.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Promissory notes legally bind the borrower and lender in an agreement where the borrower is responsible for paying back a loan or debt. They lay out the conditions of the loan and detail the time frame for paying back the loan as well as any interest that might accrue over the life of the loan.

Paycheck Protection Program (PPP) borrowers may be eligible for loan forgiveness if the funds were used for eligible payroll costs, payments on business mortgage interest payments, rent, or utilities during either the 8- or 24-week period after disbursement.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

With Few Exceptions, You Need to Charge Interest Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.