Delaware Triple Net Lease

Description

How to fill out Triple Net Lease?

It is feasible to spend time online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a plethora of legal forms that are reviewed by experts.

It is easy to download or print the Delaware Triple Net Lease from my service.

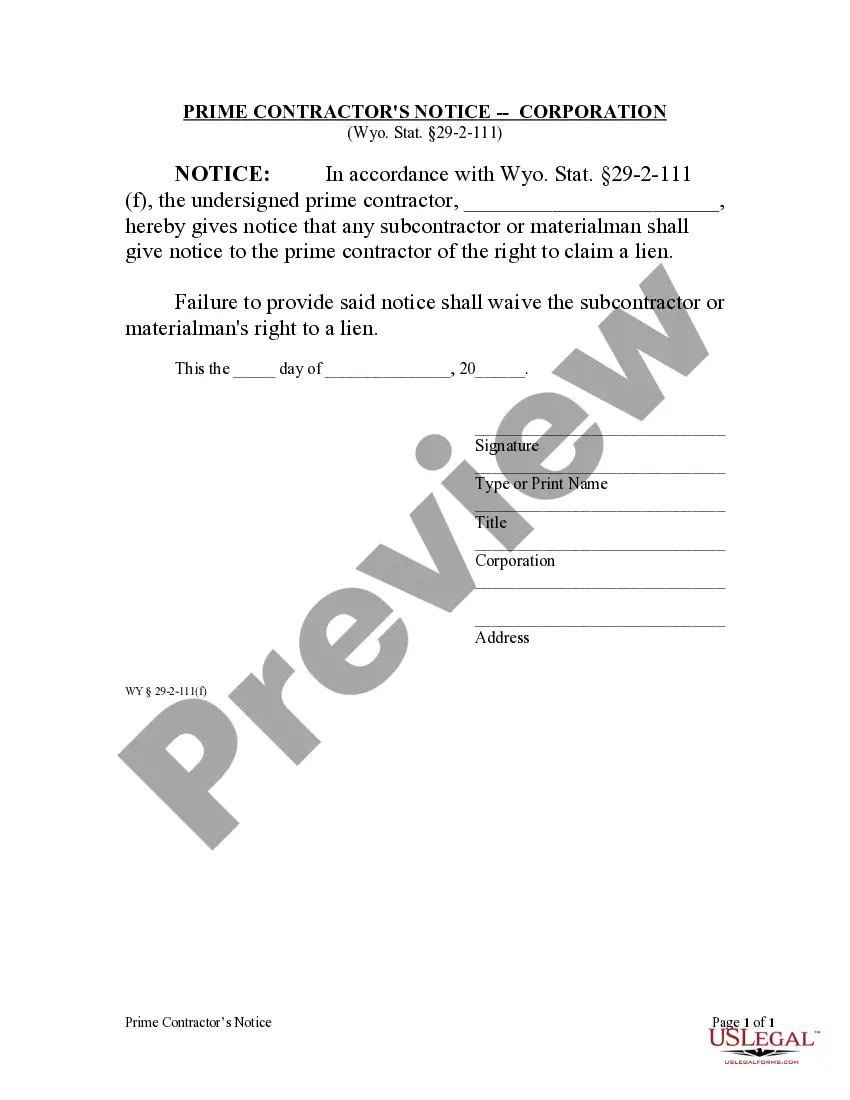

If available, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, modify, print, or sign the Delaware Triple Net Lease.

- Each legal document template you obtain is your own forever.

- To get another copy of the obtained form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the right document template for the area/city of your choosing.

- Review the document description to confirm you have selected the correct form.

Form popularity

FAQ

The best Delaware Triple Net Lease tenants typically include large, established corporations with strong financial backing, such as major retail chains and healthcare providers. These tenants often have a proven track record of reliability and are capable of fulfilling their lease obligations while covering all additional expenses. Landlords benefit greatly from partnering with such tenants due to their stability and ability to maintain properties effectively.

Accounting for a Delaware Triple Net Lease requires recognizing the rental income as it is earned while also tracking expenses related to property maintenance, taxes, and insurance. Under this lease structure, the landlord typically receives net income after the tenant covers the property costs. It's important to accurately record these transactions in financial statements to maintain clarity on profits and expenses related to the lease.

Structuring a triple net lease involves establishing clear terms regarding the rental amount, lease duration, and responsibility for property expenses. Typically, the tenant is responsible for utilities, insurance, and property taxes. Both parties must negotiate terms that ensure a fair agreement. Utilizing resources available at US Legal Forms can simplify the creation of a Delaware Triple Net Lease tailored to your needs.

The opposite of a triple net lease is often considered a gross lease. In a gross lease, the landlord assumes all responsibility for property expenses, including maintenance and taxes. This model provides less variability in income for landlords but transfers more risk to them. Exploring situations of Delaware Triple Net Lease versus gross lease scenarios can highlight the benefits and trade-offs of each.

One potential disadvantage of a triple net lease is the financial responsibility placed on the tenant. If the tenant fails to meet their obligations, the landlord faces financial risk. Additionally, properties with NNN leases can be less liquid, making it harder to sell them quickly. A thorough understanding of Delaware Triple Net Lease terms can help mitigate these risks.

The best triple net lease varies depending on your investment strategy. Generally, leases with strong, creditworthy tenants and long remaining terms are sought after. High-demand locations and properties that have a history of tenant stability also contribute to a high-quality lease. For those interested, the Delaware Triple Net Lease market offers attractive options worth considering.

The largest triple net lease REIT is often considered to be Realty Income Corporation. This firm focuses on acquiring and managing commercial properties with long-term, net lease agreements. Investors often turn to Realty Income for its reliability and consistent dividend payouts. Understanding the dynamics of a Delaware Triple Net Lease can help in exploring such investment opportunities.

Some of the best states for triple net leases include Delaware, Texas, and Florida due to their favorable business environments and tax structures. These states often attract established businesses that prefer the predictability of a Delaware Triple Net Lease. To explore possibilities and streamline your investment process, consider utilizing services from uslegalforms, which can provide essential legal documents and resources tailored to your needs.

Determining the best triple net REIT can depend on your investment goals, but many investors consider those focused on properties in prime locations with long-term tenants as top choices. A Delaware Triple Net Lease can provide a unique avenue for investors looking to capitalize on this real estate investment trust structure. Platforms like uslegalforms can help you navigate information about various REITs to find the best fit for your strategy.

An absolute nnn lease, often referred to as an absolute triple net lease, places all responsibilities on the tenant. This means the tenant pays property taxes, insurance, and maintenance costs, ensuring the landlord has minimal involvement in property management. Consequently, this arrangement can offer investors a stable income stream from properties like those found in a Delaware Triple Net Lease. For those new to such leases, uslegalforms provides comprehensive resources to guide you.