Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

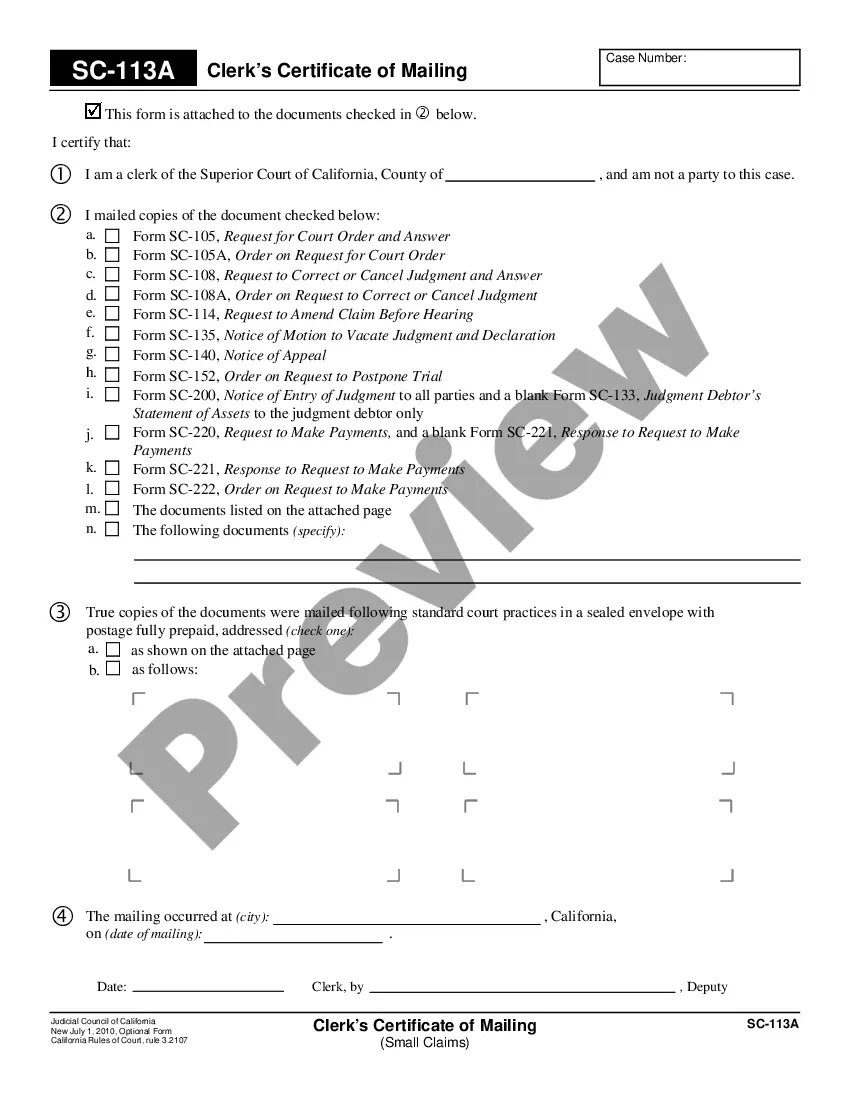

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you require to finalize, download, or print sanctioned document templates, utilize US Legal Forms, the largest array of sanctioned forms available online.

Employ the site’s straightforward and effortless search to locate the documents you need.

Numerous templates for corporate and personal purposes are organized by categories and regions, or keywords.

Step 4. When you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal document and download it onto your device. Step 7. Fill out, edit, and print or sign the Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Each legal document template you acquire belongs to you permanently. You will have access to every form you downloaded within your account. Go to the My documents section and choose a form to print or download again.

- Utilize US Legal Forms to obtain the Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to retrieve the Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the specifics.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative templates in the legal document category.

Form popularity

FAQ

Delaware's overall tax rate varies by category, but the state is known for lower tax rates compared to the national average. Entering into a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate can provide a tax-efficient way to run your business. It's advisable to stay informed about ongoing tax legislation that may affect your finances.

Delaware is often considered a tax haven because of its favorable laws and minimal taxation structure. Many businesses find it beneficial to incorporate or establish a retail presence in the state, especially through strategies like the Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. This makes it easier for companies to manage tax liabilities effectively.

Any individual or business earning income in Delaware must file a tax return, regardless of their residential status. This requirement includes those engaged in retail activities under a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Keeping a thorough record of your earnings and expenses will facilitate this process.

Delaware's state tax rate varies based on income level, with rates ranging from 2.2% to 6.6%. This framework can influence your decision when entering into a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. The overall tax structure is favorable for many business owners operating in the state.

In Delaware, certain businesses may qualify for exclusions under the gross receipts tax system, depending on their revenue and industry. This can significantly impact your bottom line when executing a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. It's beneficial to understand these exclusions as you plan your retail strategy.

Delaware does not impose a state-level rental tax, which can be advantageous for landlords and tenants alike. When you enter a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you can enjoy a tax-friendly environment that supports business growth. Always consult with a tax professional to ensure you comply with local regulations.

Delaware is known for its favorable tax environment, offering numerous exemptions on taxes like the gross receipts tax for certain types of businesses. If you are planning to lease a retail space, understanding these exemptions can help you optimize your financial planning. Using a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate may further enhance your benefits.

Delaware has a relatively low property tax rate compared to other states, averaging around 0.55%. This can positively impact your expenses if you are leasing a retail store under the Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Lower property taxes can lead to increased profitability for your business.

Delaware does not tax certain types of income, including Social Security benefits and some retirement income. This makes it an attractive option for retirees and others looking to minimize their tax liability. When considering a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this tax structure can contribute to your overall financial strategy.

Yes, shopping in Delaware can be cheaper due to the lack of a state sales tax. This means that when you enter into a Delaware Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you benefit from reduced operating costs. Additionally, the absence of sales tax attracts consumers, making it an appealing location for retail businesses.