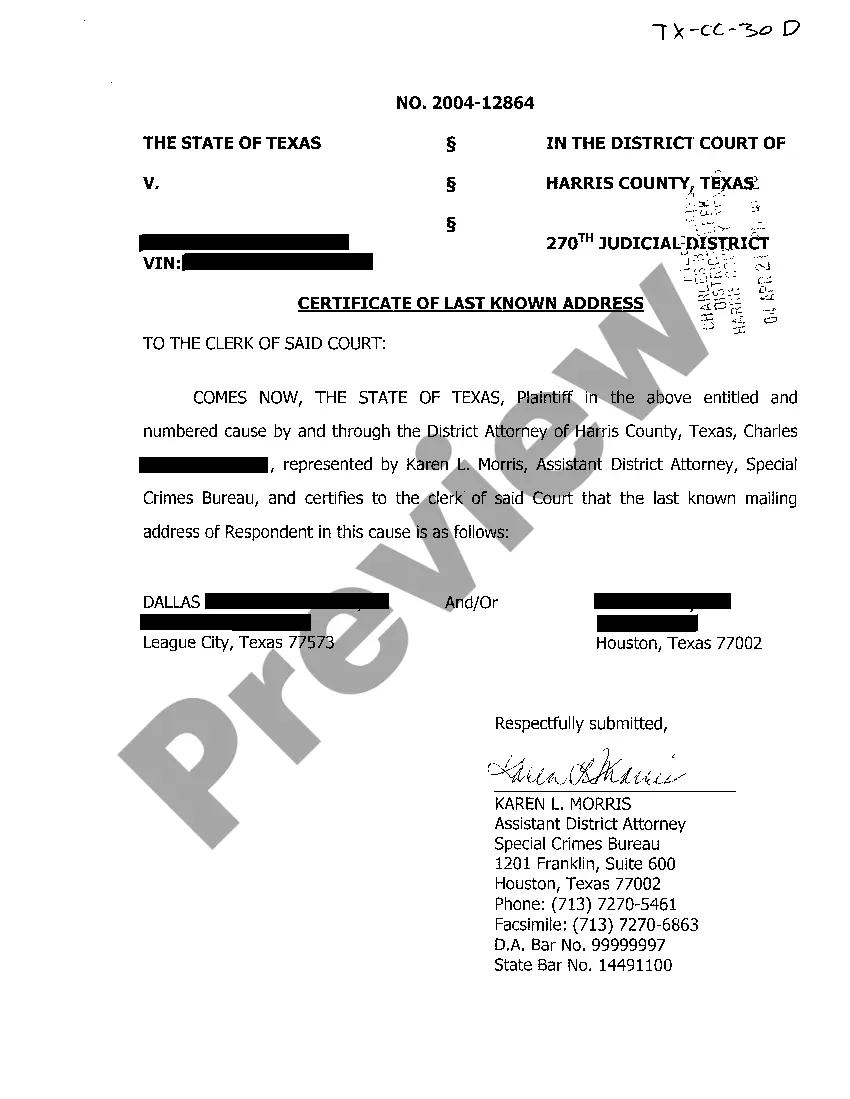

Delaware Sample Letter for Certificate of Title and Security Agreement

Description

How to fill out Sample Letter For Certificate Of Title And Security Agreement?

US Legal Forms - one of several greatest libraries of authorized forms in the United States - delivers a wide range of authorized papers layouts you may download or print. While using internet site, you will get thousands of forms for company and personal reasons, sorted by groups, says, or keywords.You will discover the newest versions of forms such as the Delaware Sample Letter for Certificate of Title and Security Agreement within minutes.

If you already have a registration, log in and download Delaware Sample Letter for Certificate of Title and Security Agreement through the US Legal Forms catalogue. The Acquire button will appear on each kind you look at. You have accessibility to all previously saved forms within the My Forms tab of your respective account.

In order to use US Legal Forms initially, allow me to share basic directions to get you started out:

- Ensure you have chosen the best kind for the area/area. Go through the Review button to analyze the form`s articles. Look at the kind information to actually have chosen the right kind.

- When the kind doesn`t fit your requirements, utilize the Look for area at the top of the display screen to get the one who does.

- Should you be satisfied with the shape, affirm your choice by simply clicking the Acquire now button. Then, choose the costs plan you like and supply your qualifications to sign up for an account.

- Method the transaction. Make use of your Visa or Mastercard or PayPal account to perform the transaction.

- Pick the file format and download the shape on your own system.

- Make modifications. Load, change and print and indicator the saved Delaware Sample Letter for Certificate of Title and Security Agreement.

Every format you put into your account lacks an expiry time and is also yours for a long time. So, if you want to download or print an additional duplicate, just check out the My Forms area and then click in the kind you need.

Get access to the Delaware Sample Letter for Certificate of Title and Security Agreement with US Legal Forms, probably the most comprehensive catalogue of authorized papers layouts. Use thousands of expert and express-specific layouts that satisfy your organization or personal demands and requirements.

Form popularity

FAQ

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.

A security interest on a loan is a legal claim on collateral that the borrower provides that allows the lender to repossess the collateral and sell it if the loan goes bad. A security interest lowers the risk for a lender, allowing it to charge lower interest on the loan.

If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.

A ?SECURITY AGREEMENT? is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation.

Generally, if a bank has a security interest in your company's assets, your company cannot sell or transfer its property. If the borrower defaults on the loan, the lender can ?enforce? against their security. This usually means they will sell the property and use the proceeds of the sale to pay themselves back.