Delaware Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement

Description

How to fill out Balloon Secured Note Addendum And Rider To Mortgage, Deed Of Trust Or Security Agreement?

Finding the appropriate legitimate document format can be a challenge. Of course, there are numerous templates available online, but how do you locate the correct type you require? Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Delaware Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement, that can be employed for both business and personal purposes. All of the forms are vetted by professionals and meet state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to find the Delaware Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement. Use your account to review the legal forms you have previously obtained. Go to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple steps you can follow: First, ensure you have chosen the correct form for your city/region. You may preview the document using the Preview option and review the document details to confirm it is indeed the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. When you are confident the form is correct, click on the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, edit, print, and sign the obtained Delaware Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement.

Make the most of the US Legal Forms service to ensure you have the right legal documents at your disposal.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to download professionally crafted documents that comply with state regulations.

- Navigate through a wide selection of legal forms tailored for different needs.

- Access your previous forms easily through the My documents section.

- Experience a user-friendly interface for managing your legal document requirements.

- Get assistance from experts to ensure your forms meet the necessary legal standards.

Form popularity

FAQ

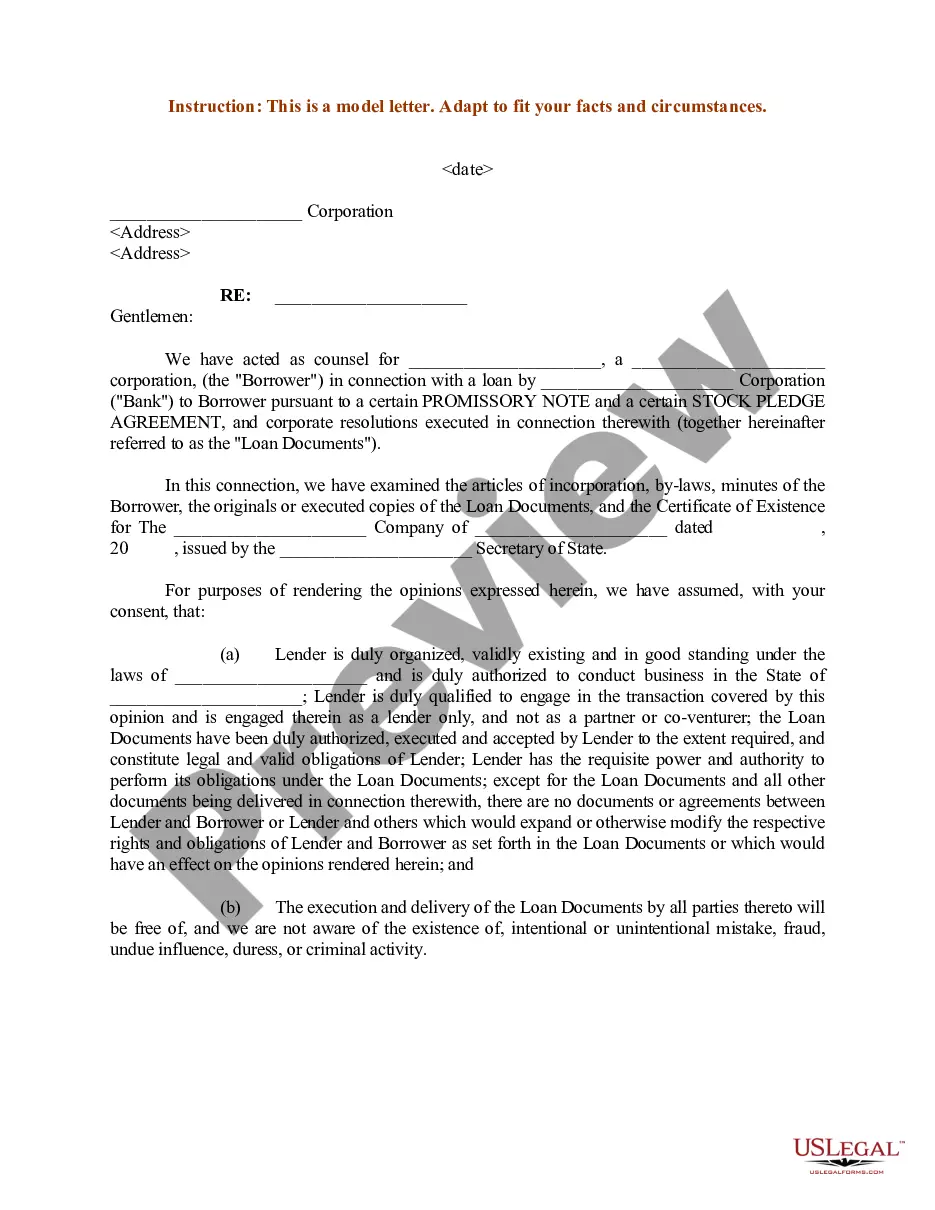

When a deed of trust is used as a security instrument, who holds the deed and the note? The trustee holds the deed, and the lender holds the note.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

The type of foreclosure: If you have a deed of trust, you will usually have a nonjudicial foreclosure. On the other hand, the courts will typically be involved if you have a mortgage. Foreclosure details: When your lender forecloses with a deed of trust, the process will usually take less time and money to complete.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.