Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

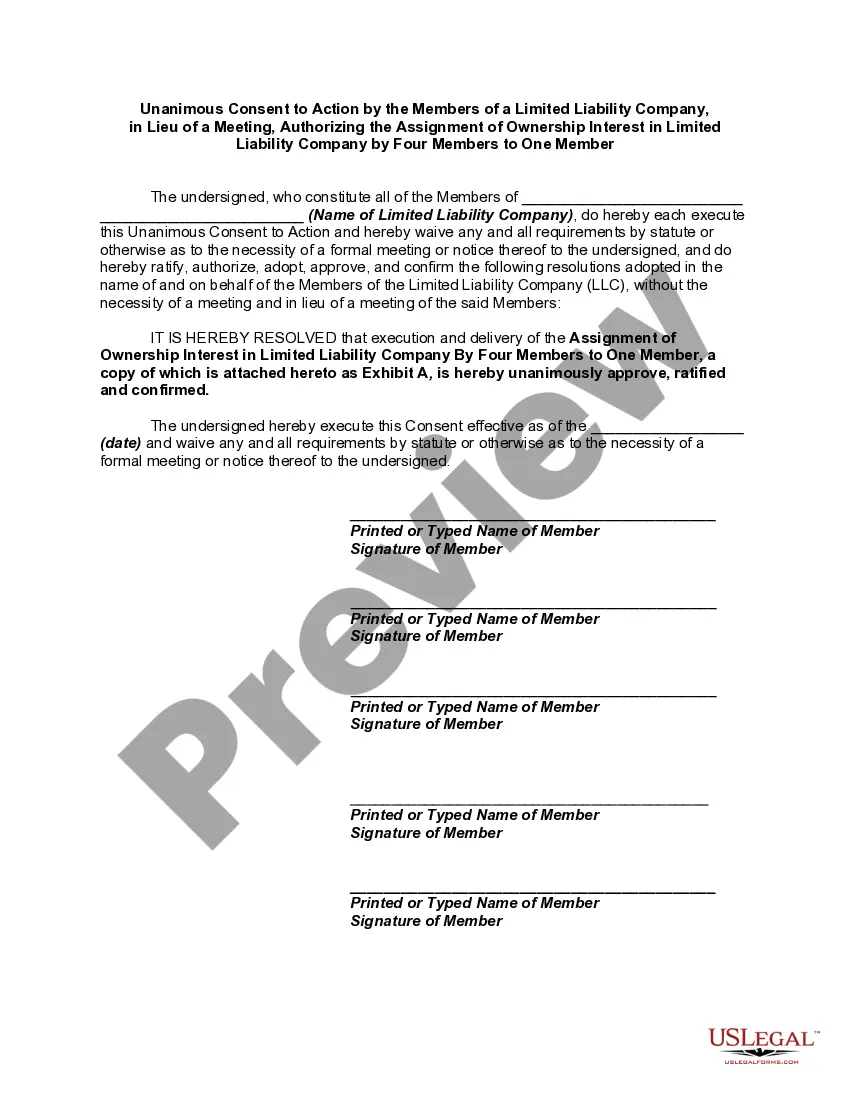

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a broad array of legal document formats that you can obtain or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest editions of forms such as the Delaware Reimbursement for Expenses - Resolution Form - Corporate Resolutions within minutes.

Review the form’s content by clicking on the Review button.

Check the form summary to make sure you have chosen the right one.

- If you have a monthly membership, Log In and obtain the Delaware Reimbursement for Expenses - Resolution Form - Corporate Resolutions from the US Legal Forms library.

- The Download button will be present on every template you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have selected the correct form for your locale.

Form popularity

FAQ

You can get a certificate of good standing in Delaware by visiting the Delaware Division of Corporations website. There, you can request the certificate online, which usually takes a short amount of time. Ensuring you have a valid certificate is crucial when dealing with corporate resolutions like the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, providing necessary proof of compliance.

To obtain a letter of good standing from Delaware, you can request it online from the Delaware Division of Corporations. This letter verifies that your company is authorized to do business and is compliant with state law. If you plan to submit the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, ensure you have your good standing letter ready for a smooth submission process.

In Delaware, your company must have a registered office, but it does not need to maintain a physical office in the state. This registered office serves as the official address for legal correspondence. If you are preparing corporate resolutions, such as the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, ensuring you have the proper registered office is essential for receiving important documents.

To change the address of your Delaware LLC, you must file a Certificate of Amendment with the Delaware Division of Corporations. This process enables you to update your registered office address officially. If your changes pertain to corporate resolutions about reimbursements, such as the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, seeking assistance from uSlegalforms can simplify the process.

Delaware does not have a specific requirement for a treasurer for all corporations. However, corporations often appoint a treasurer as part of their internal governance structure. If you are seeking guidance on how to handle corporate resolutions, such as the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, uSlegalforms can assist you in structuring your corporate documents effectively.

A Delaware certificate of good standing is typically valid for one year from the date of issuance. This document confirms that your company is compliant with Delaware laws and has fulfilled its necessary requirements. If you require a Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, ensure your documents are up to date to avoid issues during renewals.

Section 153 of the DGCL outlines the requirements for a corporation's capital stock structure. It specifies information such as the number of authorized shares and classes of stock. Incorporating the guidelines of Section 153 when creating the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions ensures that your corporation adheres to Delaware laws concerning share structure and authorization.

Section 223 of the DGCL pertains to the power of stockholders to fill vacancies on the board of directors. This section provides a framework for how these vacancies are addressed, ensuring continuity in governance. When drafting the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, being aware of Section 223 can help your corporation manage potential board changes effectively.

Yes, Delaware does accept federal extensions for corporations, which allows them to extend their time for filing tax returns. This extension grants additional time to assess financials and prepare required documentation. Utilizing the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions during the preparation process can help ensure your documents are organized and compliant, thus easing any potential tax filing burdens.

Section 145 of the DGCL provides provisions for indemnification of officers and directors. It establishes the conditions under which a corporation can protect its leaders from personal liability in legal matters. Knowing this section’s implications aids in making informed decisions regarding indemnity clauses within the Delaware Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, thus ensuring proper legal coverage for corporate executives.