Delaware Accounts Receivable Monthly Customer Statement

Description

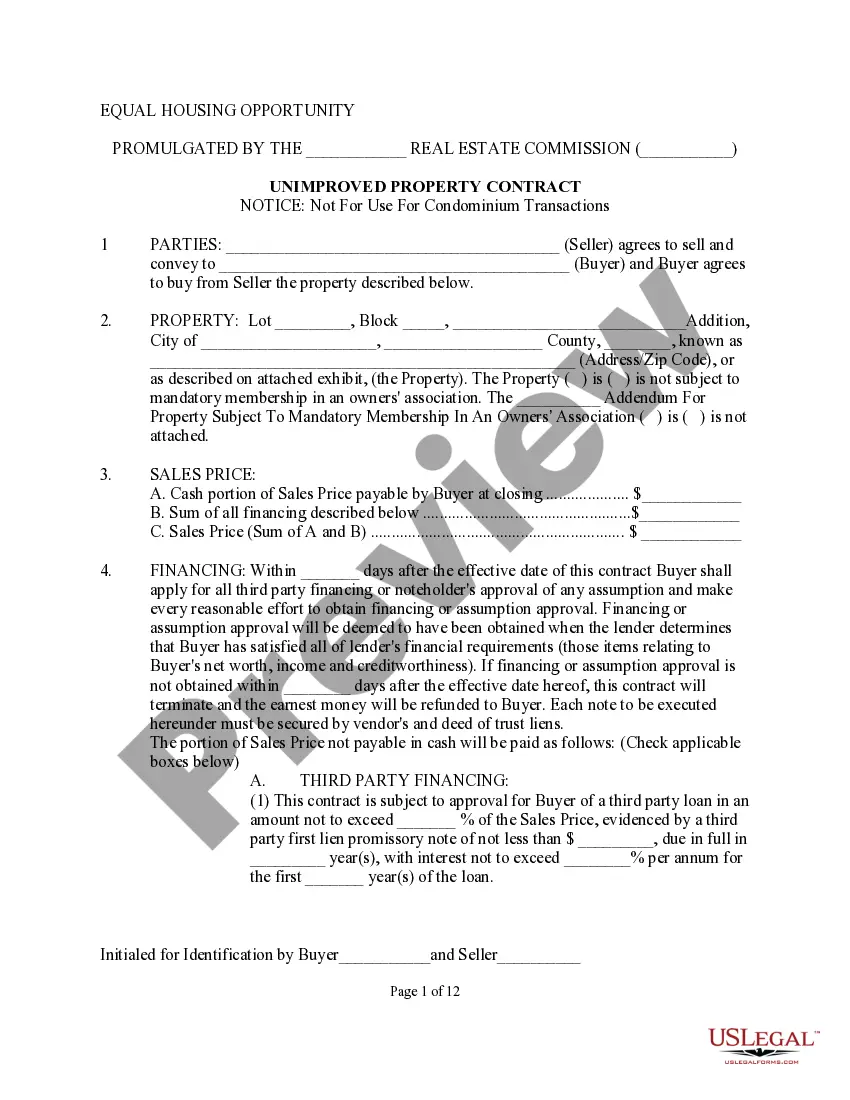

How to fill out Accounts Receivable Monthly Customer Statement?

If you wish to obtain, download, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to find the Delaware Accounts Receivable Monthly Customer Statement in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you acquired in your account. Visit the My documents section and choose a form to print or download again.

Be proactive and download, and print the Delaware Accounts Receivable Monthly Customer Statement with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Delaware Accounts Receivable Monthly Customer Statement.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Delaware Accounts Receivable Monthly Customer Statement.

Form popularity

FAQ

Yes, Delaware requires a statement of information for certain business entities, including corporations. This statement provides essential details about your company’s structure and operations. Keeping your accounts receivable monthly customer statement updated is crucial for maintaining transparency. US Legal Forms can assist you in preparing this statement efficiently.

To file a Delaware annual report, you need to access the Delaware Division of Corporations website. There, you can complete the necessary forms online or download them for submission. Make sure to include details about your business, including your Delaware accounts receivable monthly customer statement, to ensure accuracy. US Legal Forms offers an easy-to-follow guide to help you navigate this process.

Yes, Delaware LLCs must file annual reports to maintain good standing. These reports help keep the state informed about your business activities. When you manage your accounts receivable, including your monthly customer statement, it’s essential to stay compliant with state requirements. Using platforms like US Legal Forms can streamline this process for you.

To find your Delaware withholding account number, you can check your state tax documents or visit the Delaware Division of Revenue website. This number is essential for reporting employee withholdings accurately. If you are unsure about the process, consider using the US Legal Forms platform to simplify your tax reporting and ensure that you have all necessary information at hand.

The Delaware supplier ID number is a unique identifier assigned to businesses that provide goods or services in the state. This number is crucial for tax purposes and vendor registration. If you need assistance obtaining this number, the US Legal Forms platform can guide you through the necessary steps, ensuring compliance with state regulations.

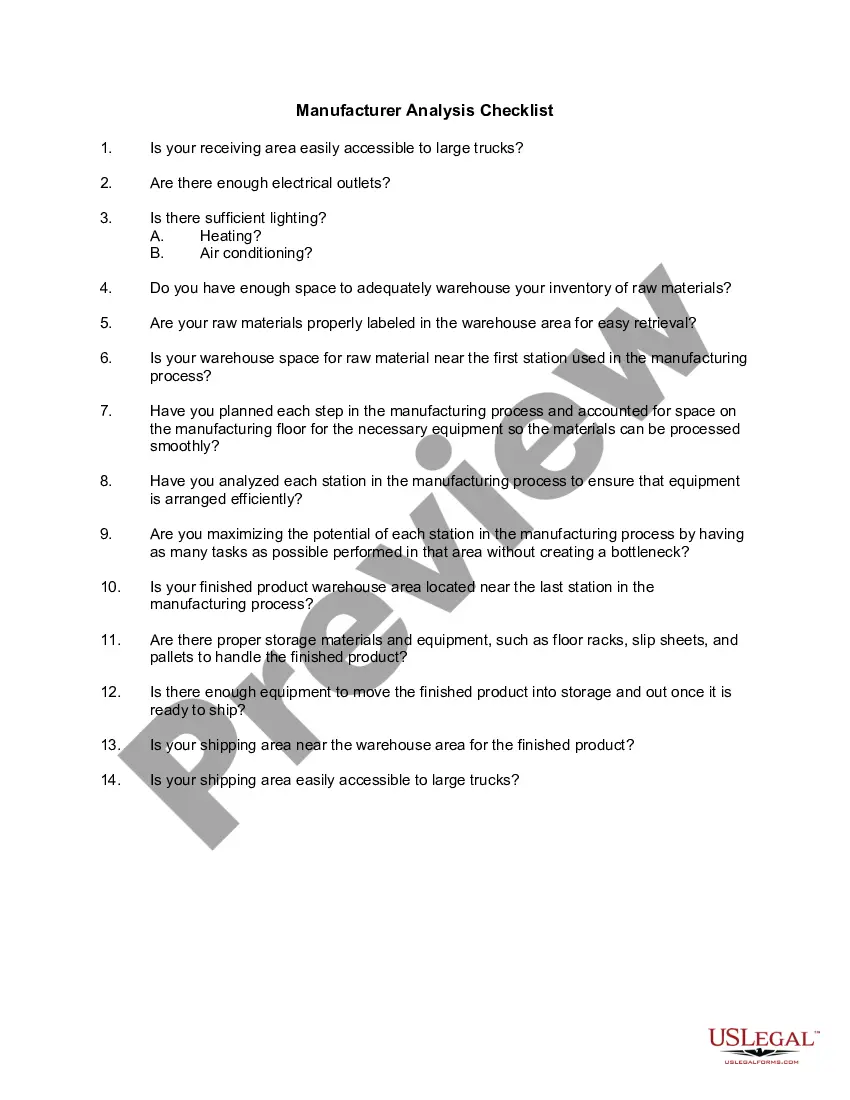

A customer's statement must include essential elements such as the customer's name, contact information, and a summary of transactions. It should clearly outline each invoice issued, payments made, and the total amount due. To ensure accuracy and transparency, a solid Delaware Accounts Receivable Monthly Customer Statement should also indicate the statement date and any payment terms, helping maintain a positive relationship with your customers.

Creating a statement for a customer involves compiling all relevant transactions into a clear format. Begin with customer details, then list each transaction chronologically, including dates, invoice numbers, and amounts. A well-prepared Delaware Accounts Receivable Monthly Customer Statement not only helps your customer understand their balance but also reinforces your professionalism and attention to detail.

To fill out a statement of account, start by listing the customer's name and contact information at the top. Next, include transaction dates, invoice numbers, and descriptions of services or products provided. Finally, detail the amounts owed and any payments received, ensuring you create a comprehensive Delaware Accounts Receivable Monthly Customer Statement that can serve as a helpful reference for both the business and the customer.