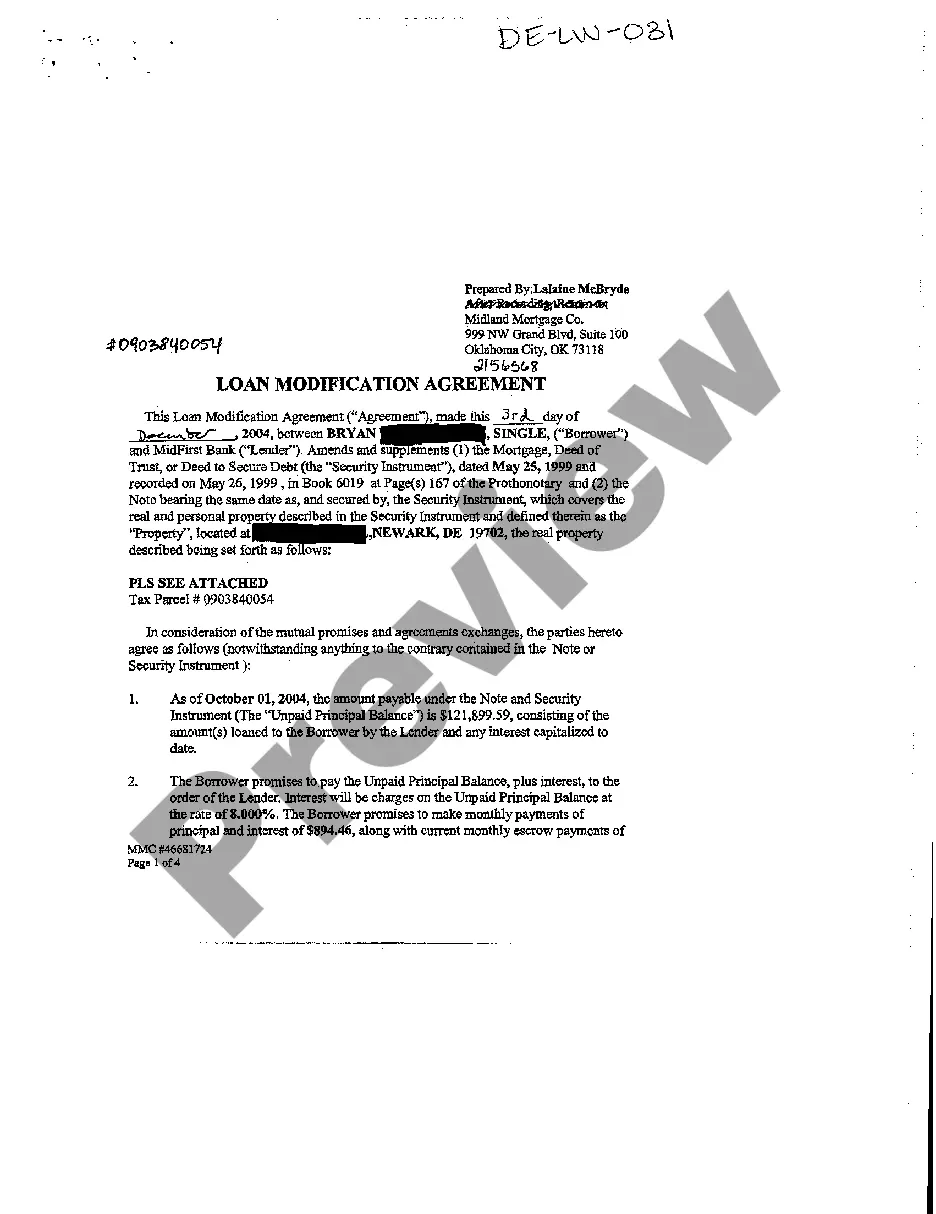

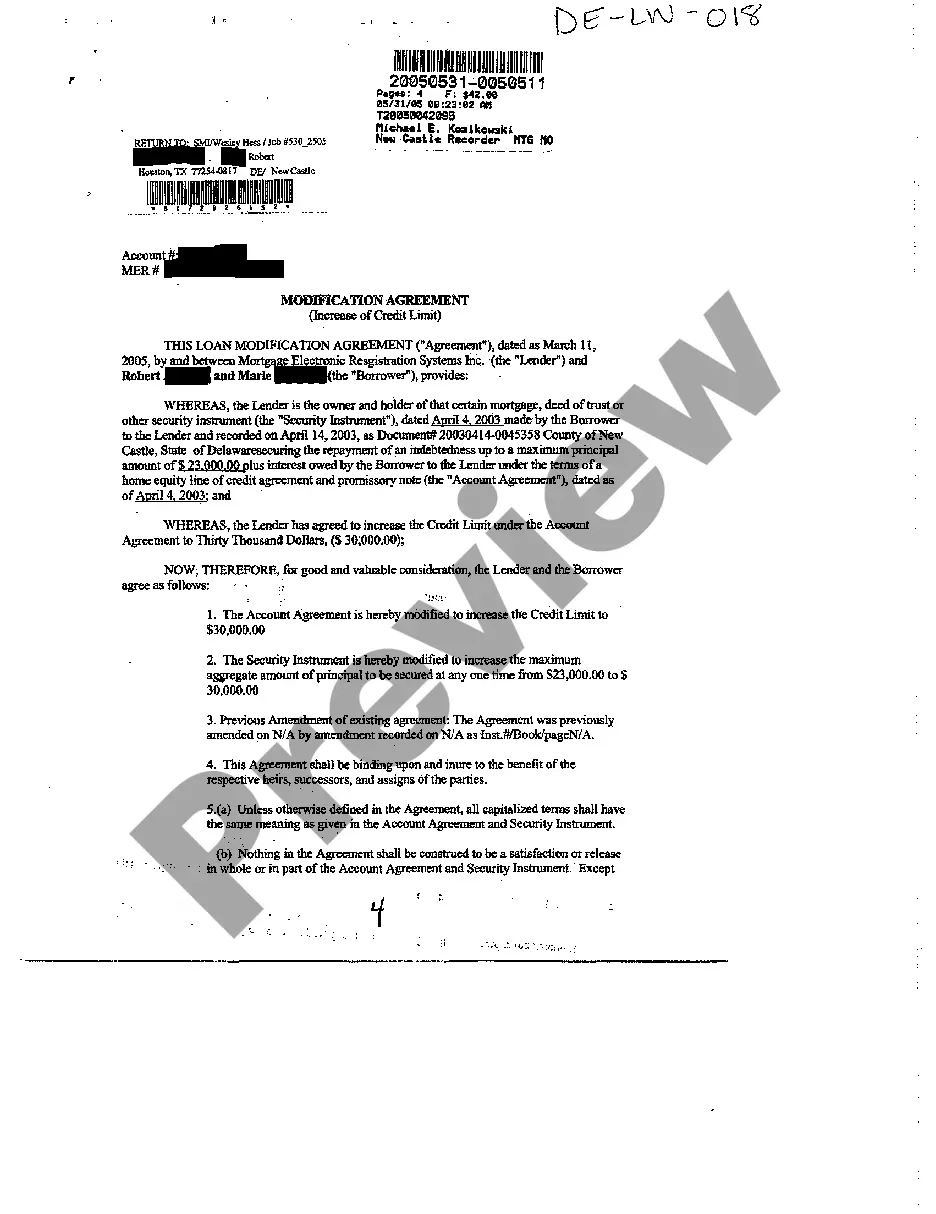

Delaware Loan Modification Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Loan Modification Agreement?

Among many complimentary and paid examples available online, you cannot be sure about their precision and dependability.

For instance, who designed them or whether they possess the expertise to fulfill your requirements.

Always stay calm and utilize US Legal Forms!

Ensure that the document you find is appropriate for your state. Review the document by utilizing the Preview function.

- Obtain Delaware Loan Modification Agreement templates created by expert attorneys.

- Avoid the expensive and lengthy process of searching for a lawyer.

- Do not pay them to draft a document you can conveniently locate yourself.

- If you already hold a subscription, Log In to your account and find the Download button next to the form you’re searching for.

- You'll also have access to previously downloaded files in the My documents section.

- If this is your first time using our platform, follow the steps below to obtain your Delaware Loan Modification Agreement quickly.

Form popularity

FAQ

A loan modification can result in an initial drop in your credit score, but at the same time, it's going to have a far less negative impact than a foreclosure, bankruptcy or a string of late payments.If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.

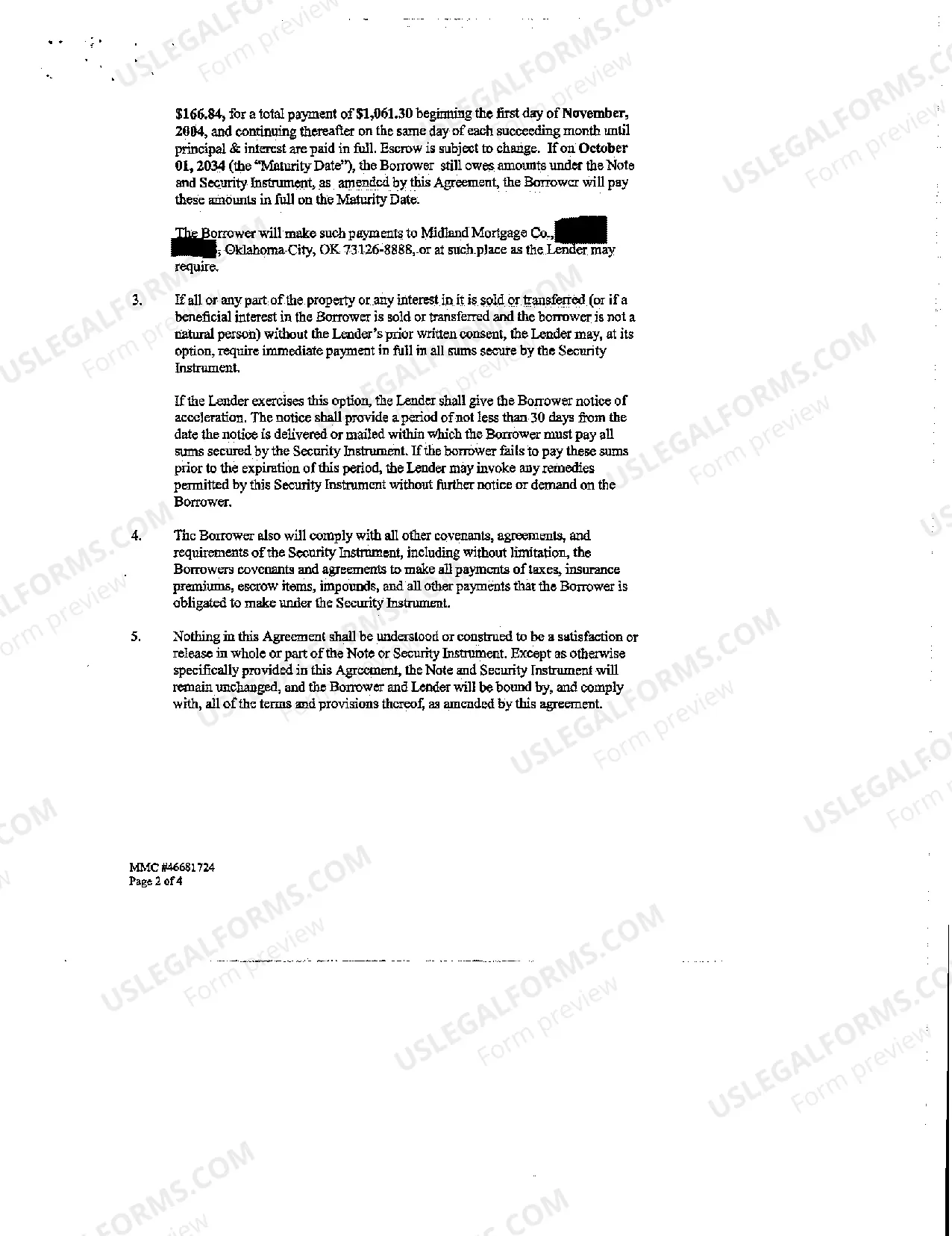

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one.Loan term changes: If you're having trouble making your monthly payments, your lender may modify your loan and extend your term.

Reason #1: Your Application is Incomplete The most common reason that loan modification requests are denied are incomplete applications. If you leave out a single signature or loan number, the lender will deem your entire application incomplete.

All modifications be in writing. All parties involved sign the modification. In appropriate cases, the modification should be recorded. The title company and attorneys be involved early in the process to properly structure the modification to protect the lender's interest at the lowest cost.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

Do Not Ignore Your Lender. When facing foreclosure, your lender will likely contact you regularly. Stay in the Home. Collect Evidence. Contact a Foreclosure Defense Attorney. Contact Your Lender. Be Patient. Let Our Florida Foreclosure Defense Lawyers Help With Your Loan Modification.

An income and expenses financial worksheet. tax returns (often, two years' worth) recent pay stubs or a profit and loss statement. proof of any other income (including alimony, child support, Social Security, disability, etc.) recent bank statements, and.

Now, under the new § 614.21, financial institutions can record the document without the borrower's signature.Best practice still is to obtain a signature from the borrower on the extension /modification of the underlying note. However, this can be obtained by electronic means and does not require notarization.