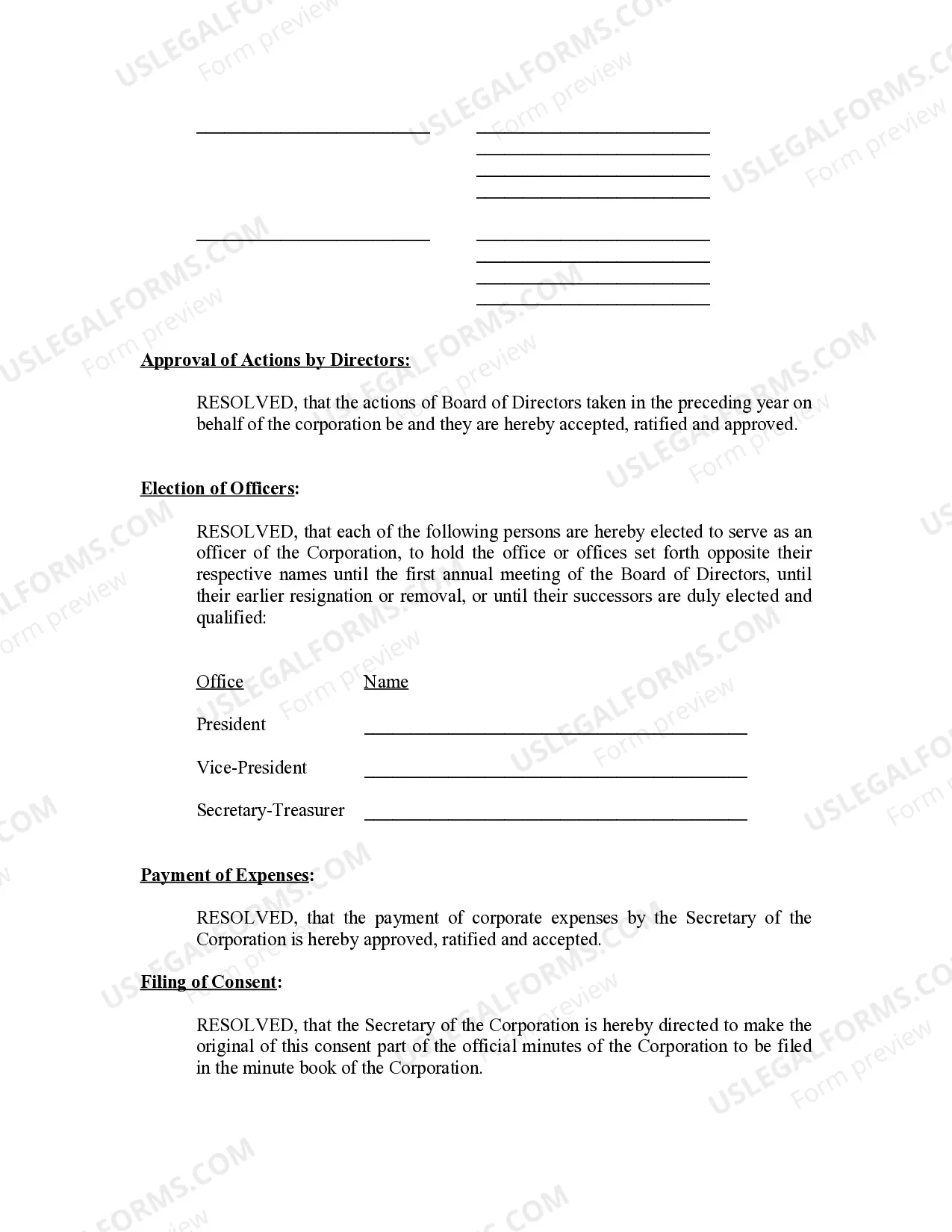

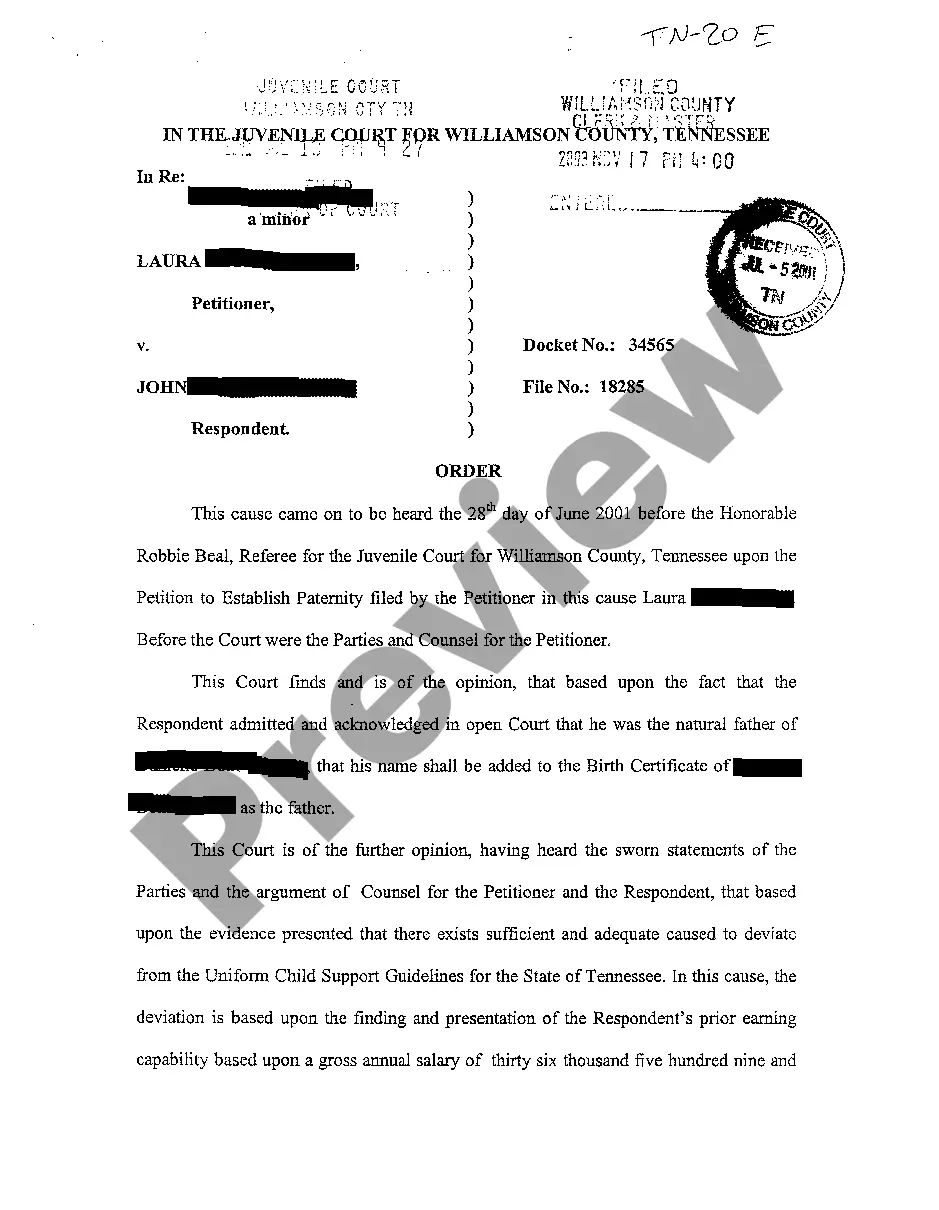

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Delaware Annual Minutes

Description

How to fill out Delaware Annual Minutes?

The larger quantity of documentation you must produce - the more anxious you feel.

You can find a vast array of Annual Minutes - Delaware templates online, but you may not be sure which ones to rely on.

Eliminate the frustration and simplify obtaining templates using US Legal Forms.

Enter the required information to set up your account and pay for the order using PayPal or a credit card. Choose a preferred file format and download your template. Access all files obtained in the My documents section. Simply navigate there to fill out a new version of the Annual Minutes - Delaware. Even with expertly created templates, it remains crucial to consider asking a local attorney to review the completed document to ensure your form is accurately filled out. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms account, Log In to your account, and you'll find the Download button on the Annual Minutes - Delaware’s page.

- If you haven’t used our site before, complete the registration process by following these guidelines.

- Ensure the Annual Minutes - Delaware is applicable in your state.

- Verify your selection by reviewing the details or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to begin the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

Yes, you can file your Delaware state taxes online through the Delaware Division of Revenue's website. This option streamlines the filing process, making it easy to comply with tax requirements. Filing your Delaware Annual Minutes online not only saves time but also simplifies your overall record-keeping.

Filing an annual report in Delaware involves completing the required documentation through the state's online portal. Make sure to provide accurate information about your business and submit any applicable fees. By prioritizing your Delaware Annual Minutes, you can keep your business in good standing and avoid penalties.

You can absolutely file your taxes electronically by yourself using user-friendly software and online services. Simply gather your financial documents, and follow the prompts to complete your tax return. This approach can save you time and help you manage your Delaware Annual Minutes efficiently.

Yes, you can file your Delaware state taxes electronically using various online platforms. Many businesses prefer this method for its convenience and speed. By filing electronically, you can ensure your Delaware Annual Minutes and tax returns are submitted quickly and accurately, making tax season less stressful.

You should send your Delaware state tax return to the Delaware Division of Revenue. Make sure to check the specific mailing address based on whether you are filing a paper return or electronically. Properly submitting your tax return ensures that your business stays compliant and minimizes potential issues with your Delaware Annual Minutes.

Failing to file your annual report in Delaware can lead to significant consequences for your business. Your company may face penalties, including fines, and can even risk being declared void by the state. To maintain compliance and protect your business status, it is essential to file your Delaware Annual Minutes on time.

If you don’t file your annual report in Delaware, your LLC may face significant consequences, including late fees and potential administrative dissolution. It is important to maintain accurate Delaware Annual Minutes, as they are often referenced during audits or in reviews. In addition, not meeting filing requirements can disrupt your business operations. To avoid these issues, US Legal Forms can assist in ensuring timely and compliant filings.

Yes, Delaware LLCs are required to submit annual reports. This includes providing the Delaware Annual Minutes, which serve as an important record of the company's activities. Failing to file these reports can lead to penalties or even dissolution of the LLC, so it’s crucial to stay compliant. For seamless handling of your annual reports, consider using US Legal Forms.

Delaware law does not require LLCs to hold annual meetings, but it is highly recommended for maintaining internal organization. Conducting these meetings and documenting them in your Delaware Annual Minutes can enhance transparency and facilitate better decision-making. Platforms like USLegalForms can assist you in preparing the necessary documentation.

Yes, a Delaware LLC must file an annual report to keep its status in good standing. This requirement includes submitting Delaware Annual Minutes, which detail the company's meetings and decisions. By adhering to these regulations, you can avoid penalties and maintain operational credibility within the state.