Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT

Description

How to fill out Delaware CHART FOR DETERMINING AMOUNT Of WAGES SUBJECT TO 7% ATTACHMENT?

The larger quantity of documents you are required to produce - the more apprehensive you become.

You can acquire a vast amount of Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 7% templates online; however, you might not know which ones to trust.

Eliminate the inconvenience of searching for samples by utilizing US Legal Forms. Obtain professionally crafted forms that are designed to meet state standards.

Submit the requested information to create your profile and pay for your order using PayPal or a credit card. Select a convenient document format and obtain your sample. Access each document you download in the My documents section. Simply go there to create a new copy of the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 7%. Even with expertly crafted templates, it remains crucial to consult your local attorney to verify that your completed form is accurately filled out. Achieve more for less with US Legal Forms!

- If you currently have a subscription to US Legal Forms, Log In to your account, and you will see the Download button on the page of the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 7%.

- If you have yet to use our website, complete the registration process following these instructions.

- Ensure that the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 7% is applicable in your state.

- Verify your selection by reviewing the description or by using the Preview feature if available for the selected document.

- Simply click Buy Now to initiate the registration process and choose a payment plan that aligns with your needs.

Form popularity

FAQ

In 2025, the Delaware minimum wage is expected to increase to meet the state's economic needs. This adjustment directly impacts the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT. Understanding these changes is essential for employers and employees alike, as they ensure compliance with wage attachment laws. By utilizing the uslegalforms platform, you can easily access updated information and tools to navigate these regulations effectively.

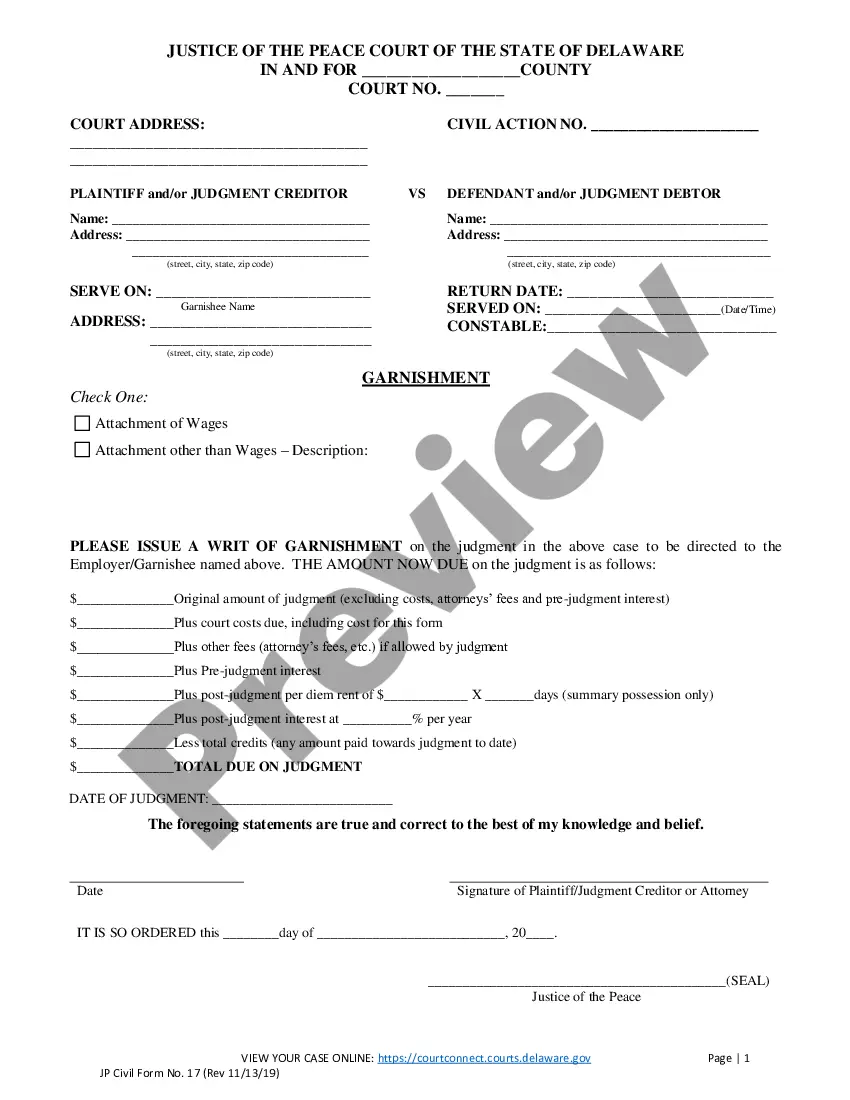

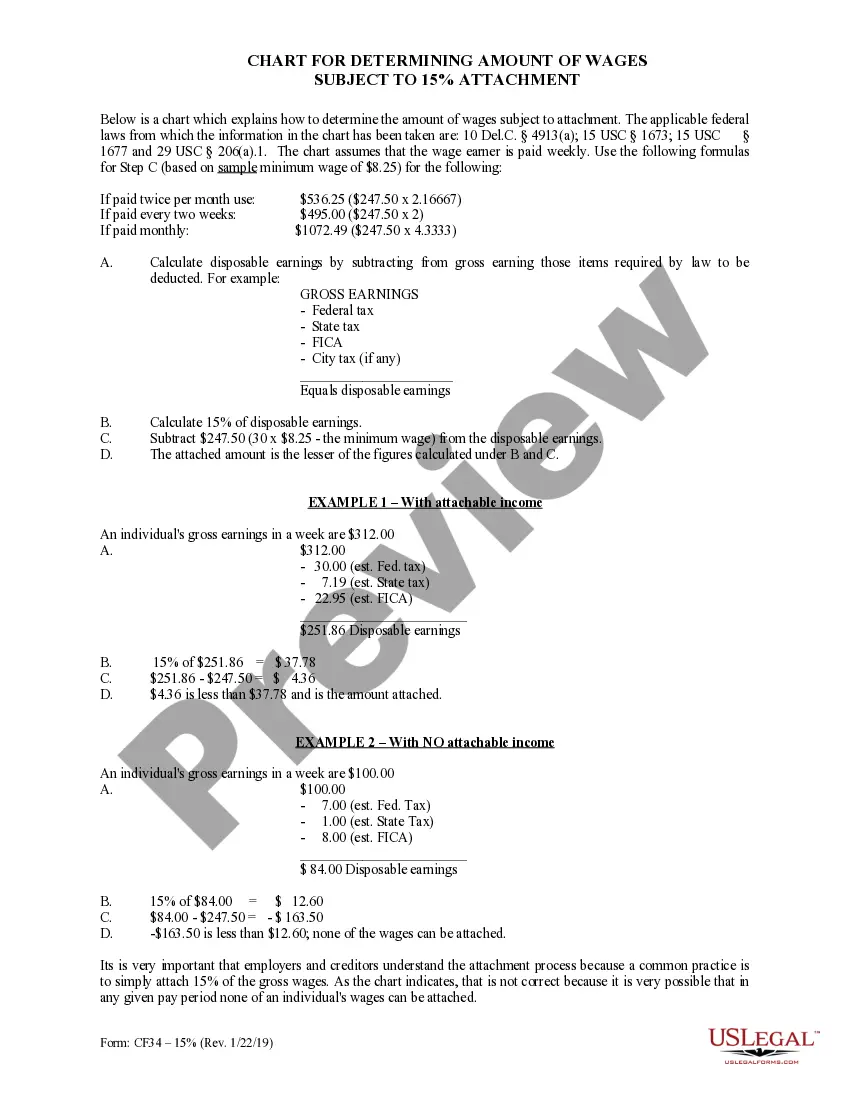

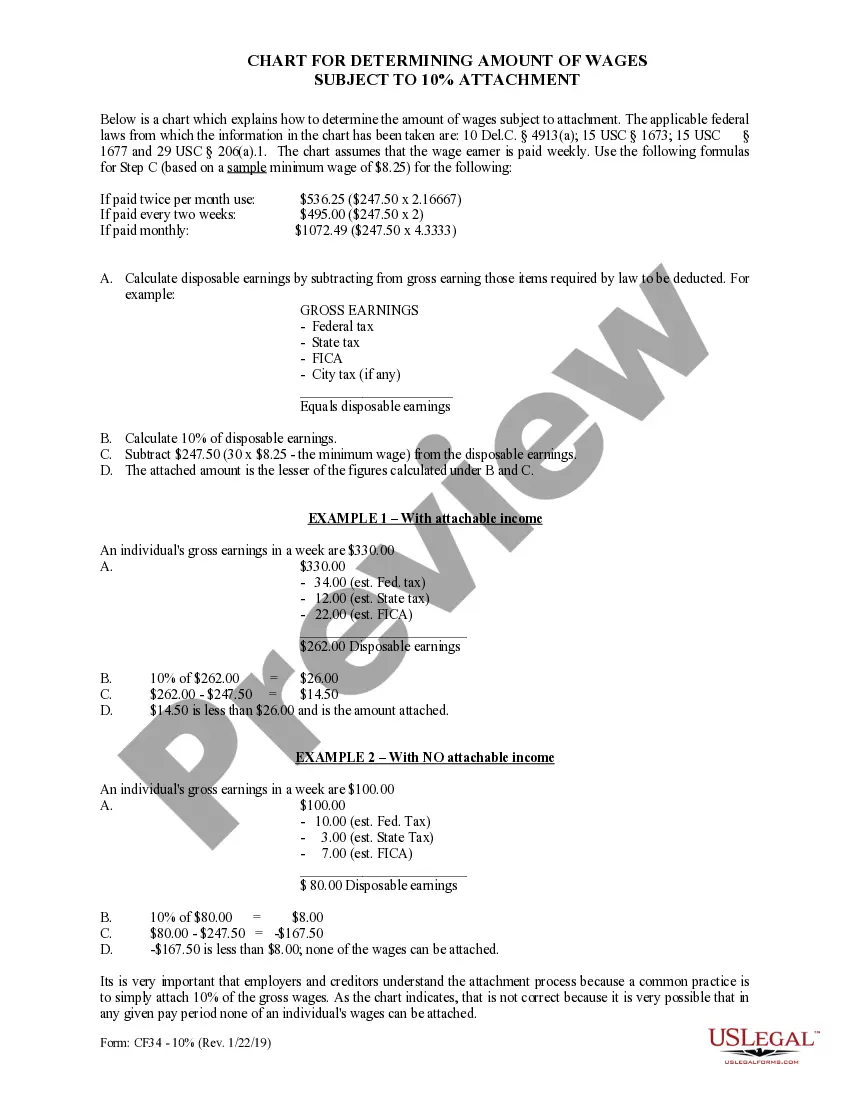

In Delaware, the law permits garnishment up to 7% of an employee's disposable earnings for certain debts. This means that if you are facing wage attachment, it is essential to understand how this might impact your financial situation. The Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT provides a straightforward way to assess your earnings after garnishment.

A livable wage in Delaware refers to the minimum income necessary to meet basic needs without government assistance. Typically, this amount varies based on family size and location within the state. Utilizing the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT can help individuals understand how wage attachments might affect their ability to live comfortably.

Under Delaware law, the maximum percentage allowed for garnishment is 7% of your disposable wages, as outlined in the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT. Employers must ensure compliance with these limits to protect your rights as an employee. Understanding this maximum can help you manage your income effectively.

Calculating subject wages involves referencing the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT to identify the portions of your income that can be garnished. Generally, the calculation considers your disposable earnings after mandatory deductions. Knowing how to perform this calculation can help you plan better financially.

Delaware law permits wage garnishment under specific conditions, following the guidelines in the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT. Employers may deduct a portion of your wages for debt repayment, provided they adhere to the state's regulations. Understanding these laws can help you anticipate how they impact your finances.

In general, employers must comply with wage garnishment orders, but they cannot refuse without valid reasons. If you believe your employer is not following the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 7% ATTACHMENT, you may need to seek legal advice. It's important to communicate with your employer and understand the garnishment process.