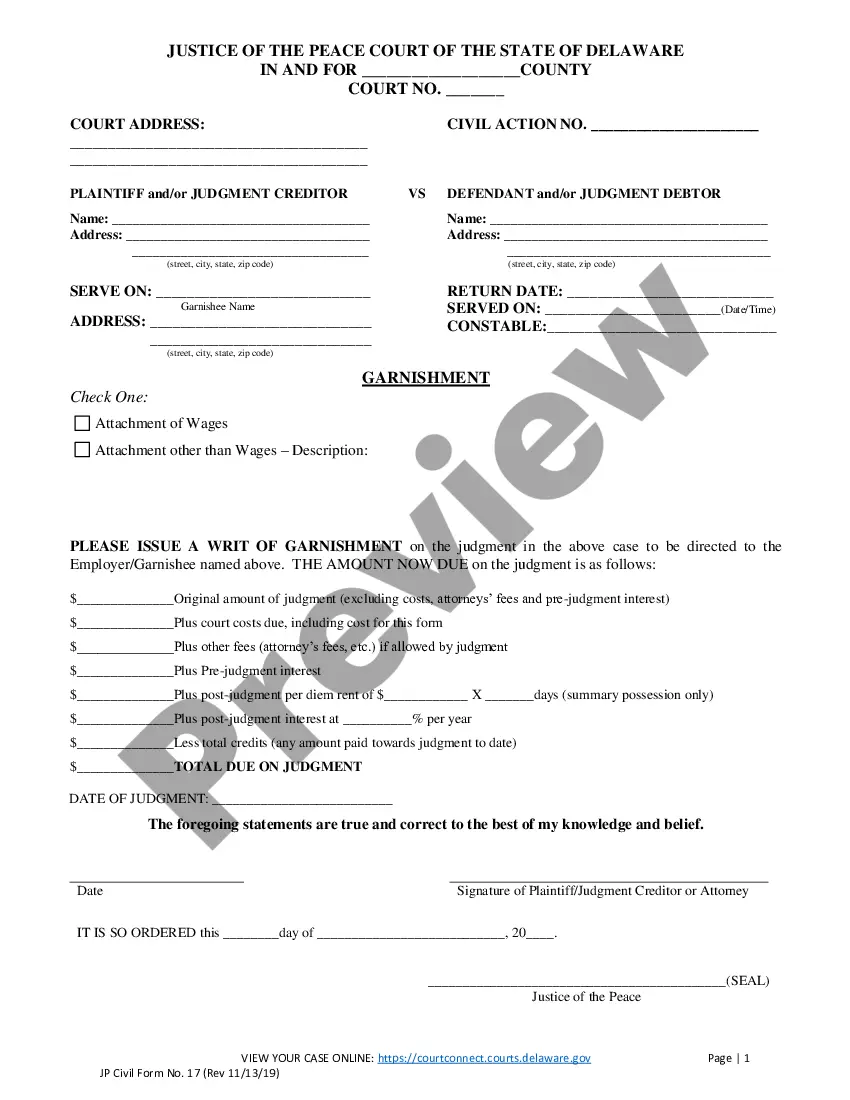

Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN)

Description

How to fill out Delaware GARNISHMENT Of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN)?

Managing formal paperwork demands focus, precision, and utilizing well-constructed templates. US Legal Forms has been assisting individuals nationwide accomplish this for 25 years, so when you select your Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) template from our platform, you can be confident it adheres to federal and state regulations.

Utilizing our service is simple and quick. To acquire the necessary document, all you need is an account with an active subscription. Here’s a concise guide for you to obtain your Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) in just a few minutes.

All documents are crafted for versatile use, like the Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) you see here. If you need them again, you can complete them without any additional payment - just navigate to the My documents tab in your profile and finalize your document whenever you require it. Experience US Legal Forms and prepare your business and personal documents swiftly and in full legal compliance!

- Ensure to carefully review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative formal template if the previously accessed one does not fit your needs or state laws (you can find the tab for that in the upper corner of the page).

- Log in to your account and store the Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) in your preferred format. If this is your first experience with our service, click Buy now to continue.

- Create an account, choose your subscription plan, and complete the payment using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the blank form or upload it to a professional PDF editor to submit it electronically.

Form popularity

FAQ

To stop wage garnishment in Delaware, one effective method is to challenge the garnishment in court. You can present reasons why the garnishment should be halted, such as proving that it causes undue financial hardship. You may also negotiate with your creditor for a payment plan to avoid further garnishments. Using U.S. Legal Forms can assist you in preparing all necessary documents to present your case.

Several states have laws that restrict or prohibit bank account garnishments. Each state has different rules regarding the enforcement of debts, and some states protect a greater portion of a debtor's assets than others. Understanding these variations is crucial if you find yourself in a situation involving Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN). Always check specific state laws or consult a legal resource for guidance.

Delaware's garnishment laws allow creditors to collect debts by garnishing wages or bank accounts after obtaining a judgment. Under Delaware law, certain exemptions protect a portion of income and specific assets from garnishment. It is important to be familiar with these laws to understand your rights and obligations. U.S. Legal Forms can assist you in navigating these laws easily.

To collect a judgment in Delaware, you can initiate Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) against the debtor's wages or bank accounts. This process begins by filing the necessary legal documents with the court. It's essential to follow the proper procedures outlined by Delaware law to ensure a successful collection. Using a platform like U.S. Legal Forms can help streamline the documentation process.

Yes, Delaware does allow bank account garnishment. If a creditor obtains a judgment against you, they can use Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) to empty funds from your bank account. However, there are specific rules and exemptions that may apply, so it’s advisable to understand your legal rights. Consulting with a legal professional can provide clarity.

To fill out a wage garnishment exemption, begin by identifying your eligible income and property that fit within the exemption criteria. Clearly and accurately fill in the required information, including citing any specific laws that support your claim. Completing this correctly is crucial to protect your assets during Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN). Uslegalforms offers templates to help streamline this process for you.

To garnish wages in Delaware, you must first obtain a court judgment against the debtor. After that, you can file the necessary paperwork to initiate the garnishment process. Ensure you comply with all legal requirements to properly execute the Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN). Using elaborative resources like uslegalforms can simplify this process for you.

Federal exemptions from garnishment include protections for certain income sources like social security, veterans' benefits, and certain retirement benefits. Generally, a portion of your wages is also protected based on your income level and family size. These exemptions are essential to know when dealing with Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN). To explore your specific situation, consider using resources from uslegalforms.

To write a letter to stop wage garnishment, start by addressing it to the appropriate party, such as your employer or the creditor. Clearly state your intentions and provide reasons along with relevant documentation, like proof of hardship. Be polite yet assertive as you explain your situation regarding Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN). Using uslegalforms can provide you with templates that make this process easier.

The right to claim exemptions allows individuals to protect a portion of their income or property from garnishment. Exemptions may include necessities such as wages, social security benefits, and certain types of property. Understanding your rights is crucial when dealing with Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN). Always consult legal resources or platforms like uslegalforms for guidance on this matter.