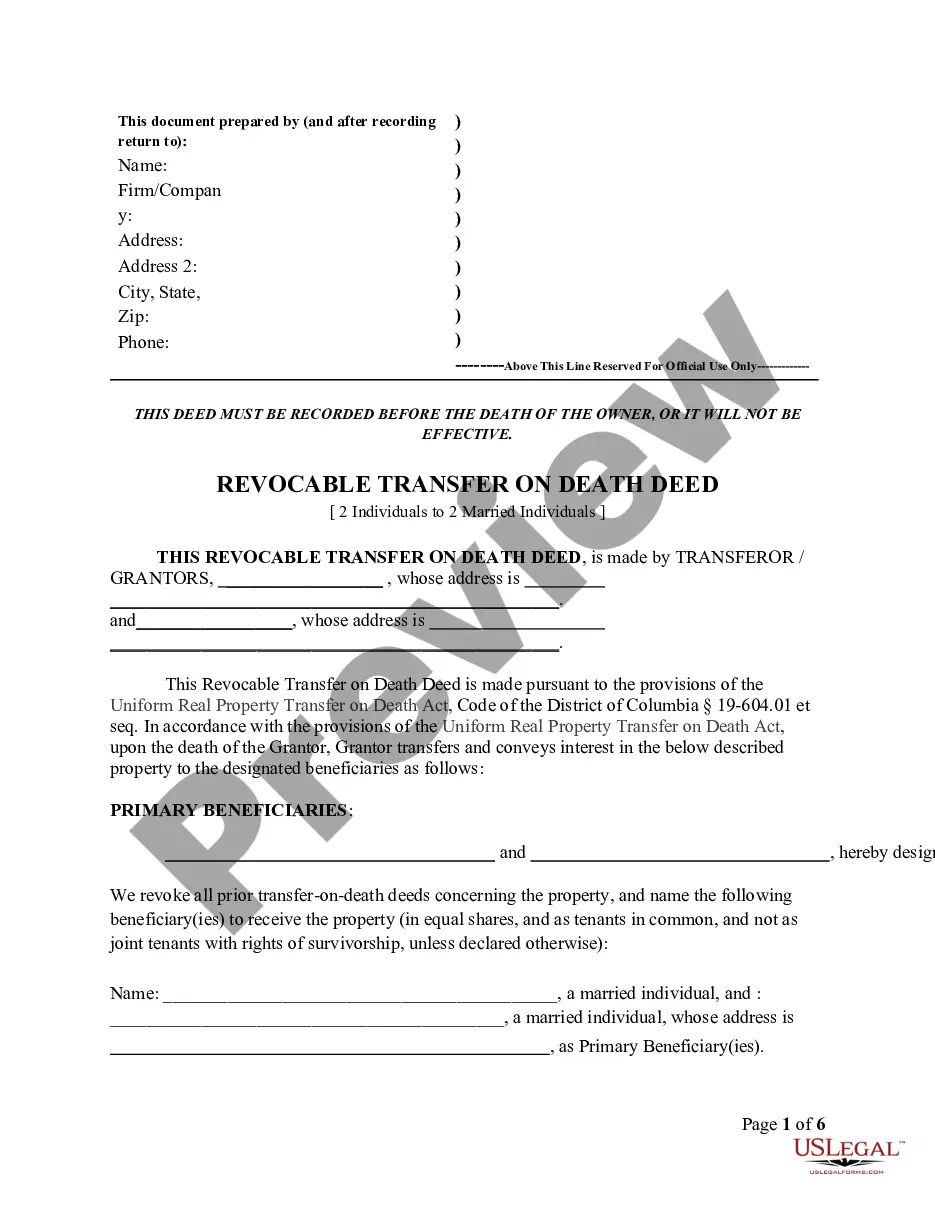

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Husband And Wife Beneficiaries?

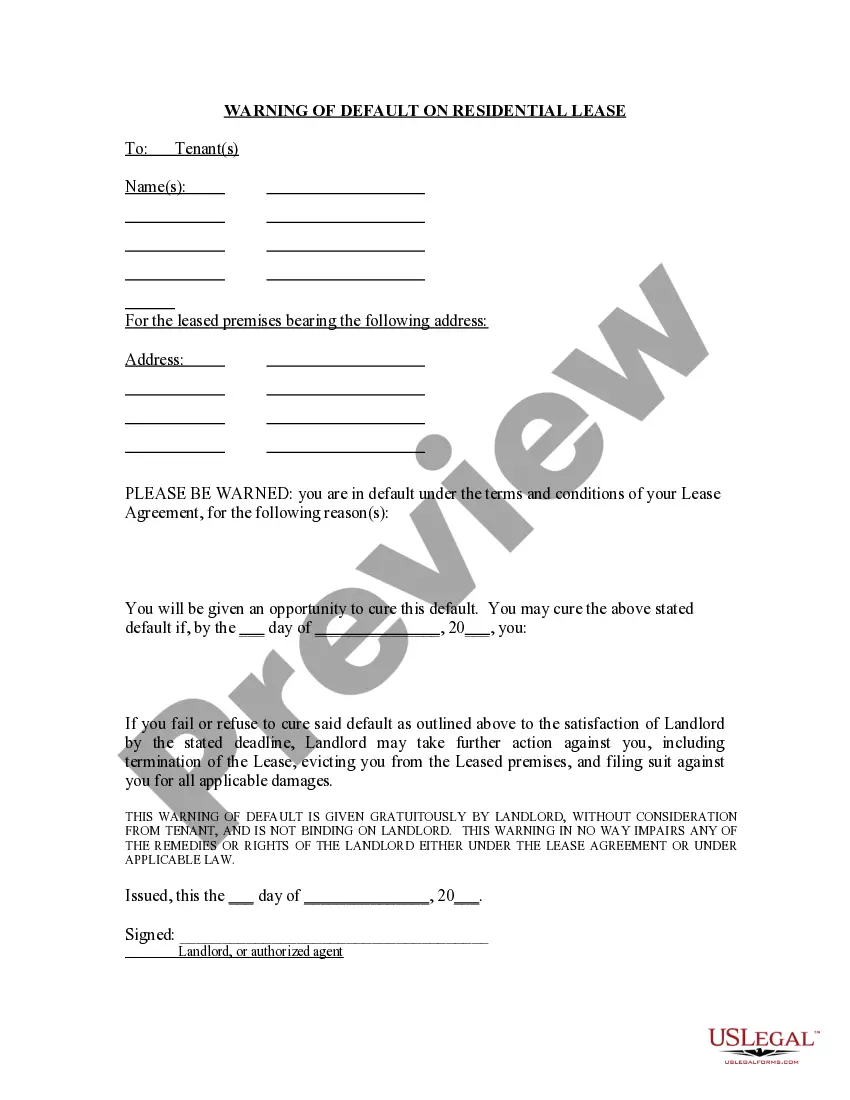

Utilize US Legal Forms to acquire a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed designated for Two Individuals as Beneficiaries, specifically a Husband and Wife.

Our court-approved forms are crafted and consistently refreshed by experienced attorneys. We offer the most comprehensive Forms collection available online, providing reasonably priced and precise samples for clients, legal professionals, and small to medium-sized businesses.

The documents are classified into state-specific categories and a selection of them may be previewed prior to downloading.

US Legal Forms provides an extensive array of legal and tax templates and packages catering to business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries. More than three million users have successfully engaged with our platform. Choose your subscription plan and acquire high-quality documents with just a few clicks.

- Ensure you select the correct form pertaining to the state it is required in.

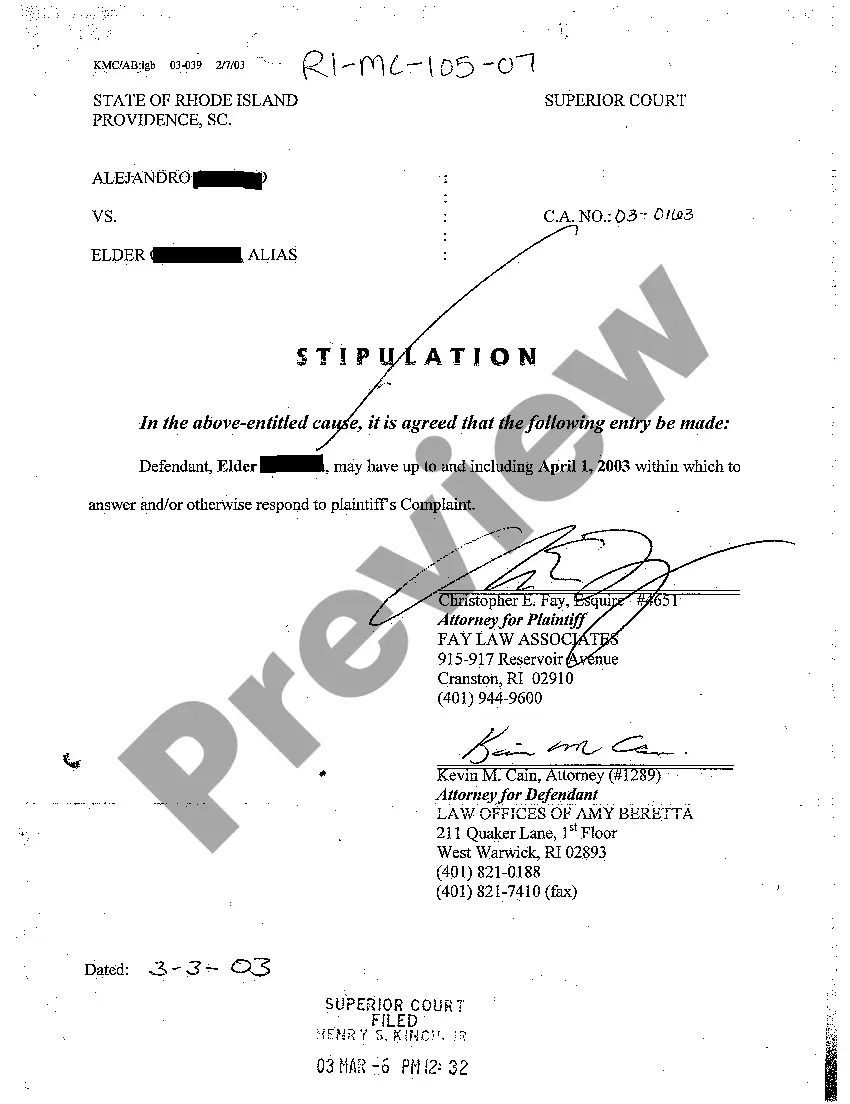

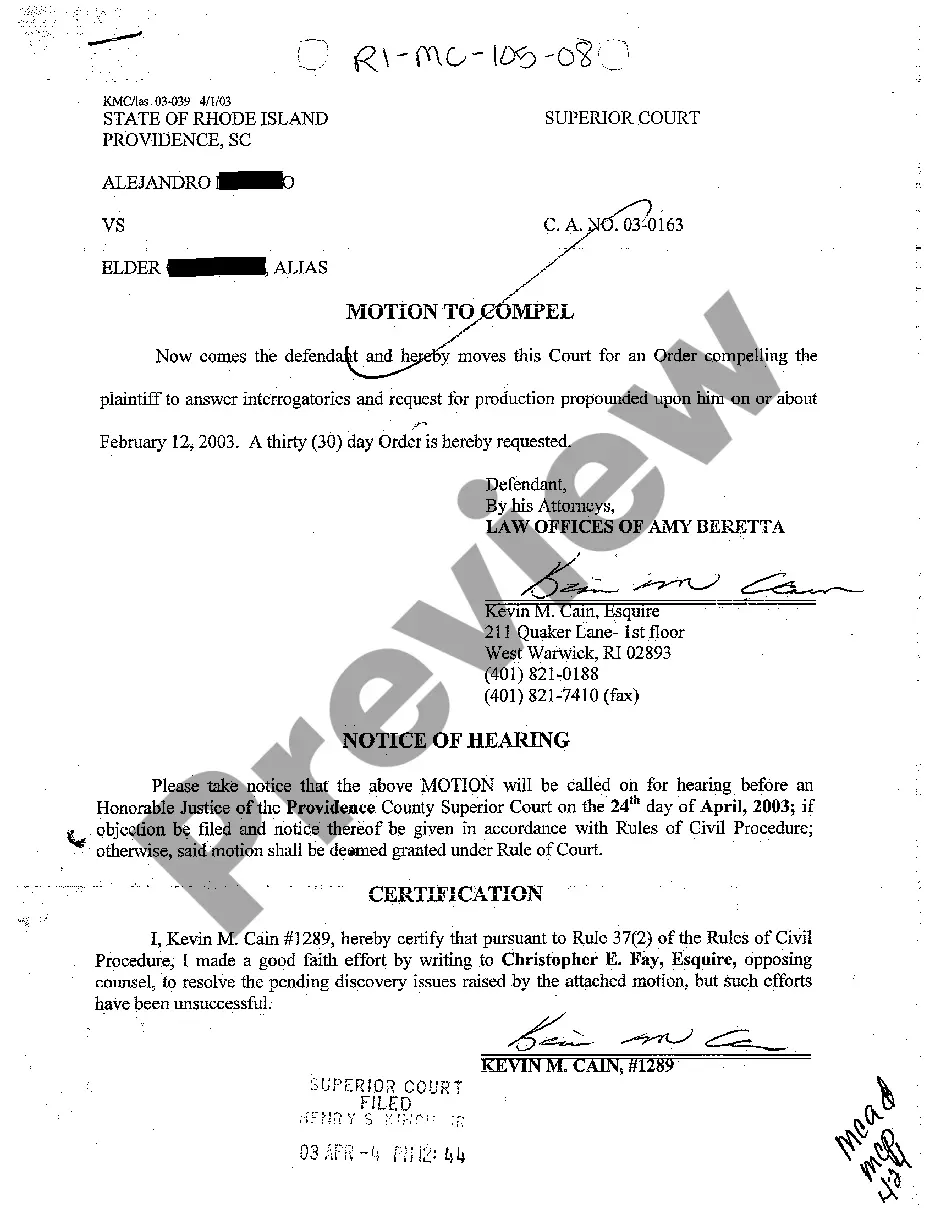

- Examine the document by reviewing the description and utilizing the Preview function.

- Click Buy Now if it aligns with your needs.

- Establish your account and complete the payment via PayPal or credit card.

- Download the form to your device and feel free to reuse it anytime.

- Employ the Search feature if you need to locate another document template.

Form popularity

FAQ

Yes, a TOD account can have multiple beneficiaries. In a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries, you can list more than one beneficiary, allowing for shared ownership after your death. It's essential to specify each beneficiary's share clearly to avoid confusion or conflict later. Using a platform like uslegalforms can simplify the process and provide clarity in legal documentation.

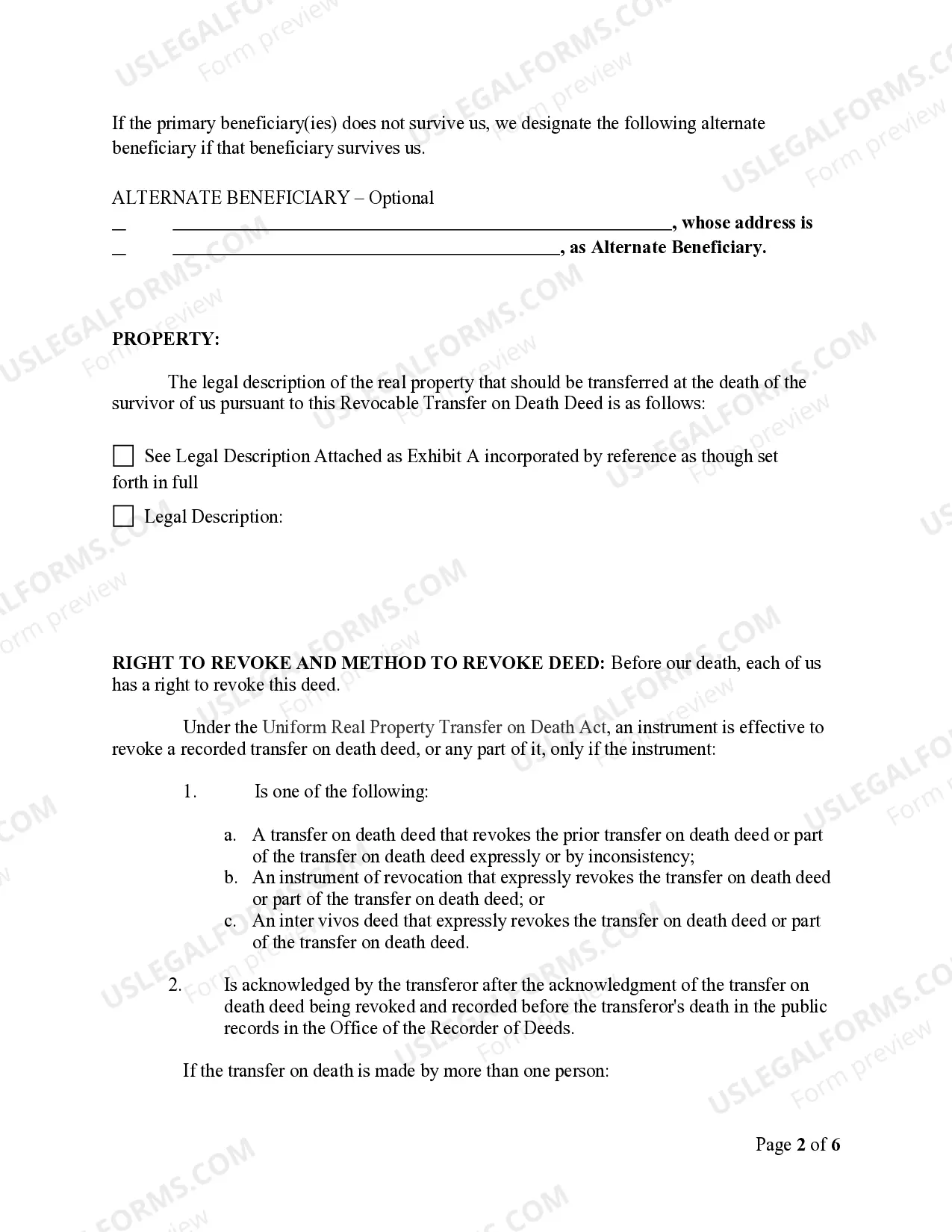

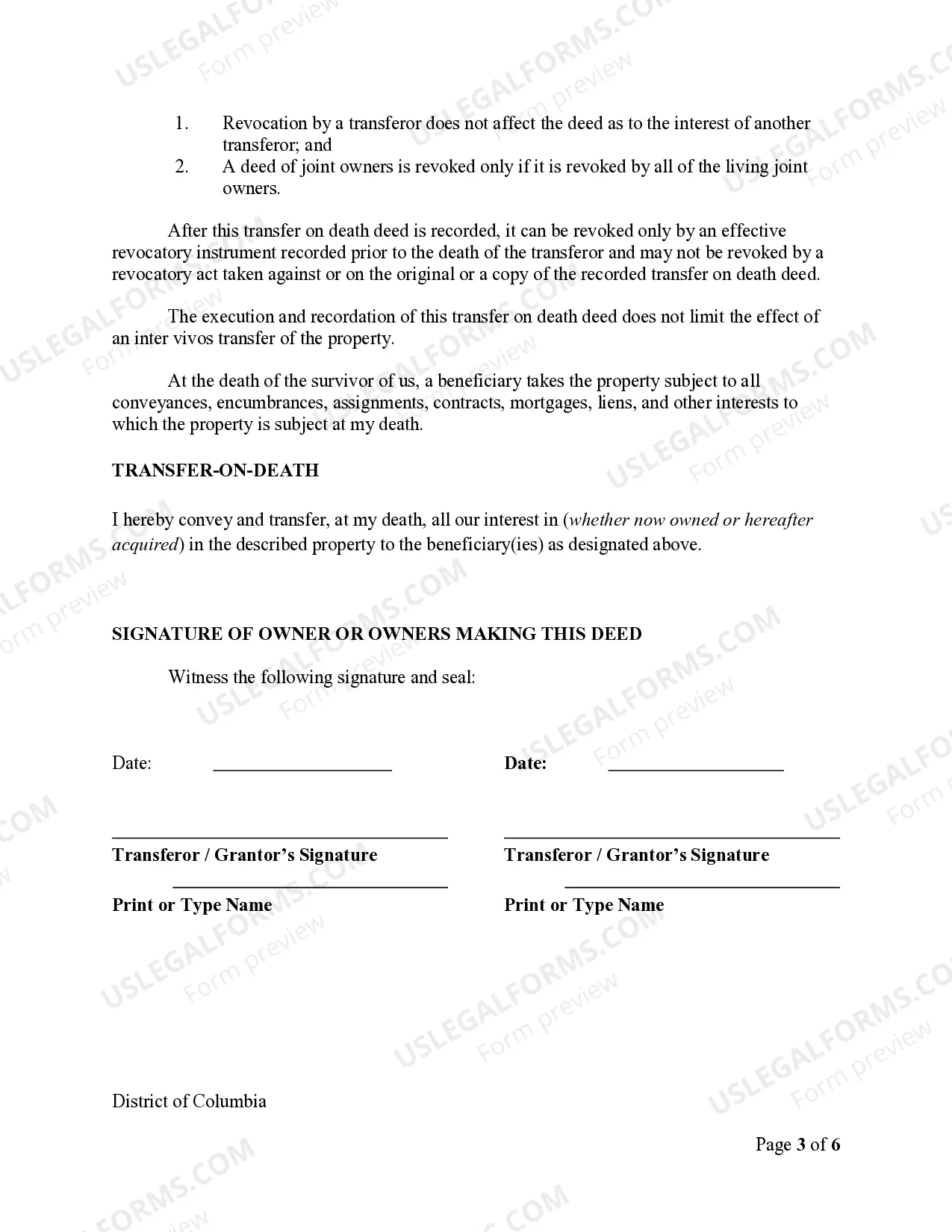

There are several drawbacks to using a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries. For example, it does not allow for any management of the property during your lifetime, as it only transfers ownership upon death. Additionally, creditors may still claim the property before transferring it to beneficiaries, which could reduce their inheritance. Consider discussing these concerns with a legal professional to make an informed decision.

To transfer on death deed to two beneficiaries, specifically in a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries, you must clearly name both beneficiaries on the deed. You should include their full names and identify their relationship to you. After completing the deed, you must file it with the appropriate district office to ensure it takes effect upon your passing.

While you can complete a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries without an attorney, it's advisable to consult one. The process may involve complex legal language and requirements, and an attorney can help ensure that your deed complies with local regulations. Additionally, professional guidance can prevent potential disputes among beneficiaries in the future.

While it is not strictly necessary to hire a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries, doing so can be beneficial. A legal professional can help ensure that all documents are correctly prepared and executed according to DC laws. Additionally, they can provide guidance tailored to your specific situation and needs, enhancing overall confidence in the estate planning process.

Generally, a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries does not directly avoid capital gains tax. When the property is transferred, the beneficiaries inherit it at its current market value, which may set the stage for future capital gains if they decide to sell. It’s crucial to consider the potential tax implications and consult a financial advisor for tailored advice.

Yes, accounts that utilize a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries typically avoid probate. This means that the designated beneficiaries can directly receive assets without the delays and costs associated with court proceedings. This advantage can significantly ease the transition for your loved ones during an already difficult time.

A District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries has some potential disadvantages. One notable concern is that the property transferred may not be distributed according to the owner’s wishes if the beneficiaries predecease them or if their needs change. Additionally, property owners retain no control over how the beneficiaries manage the property after the transfer, which might lead to conflicts.

While a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries offers many benefits, it does come with some drawbacks. The deed must be correctly executed and recorded; otherwise, it may be deemed invalid. Additionally, if the property owner incurs significant debts, creditors may still have claims against the property, which could affect the beneficiaries’ inheritance.

A District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Husband and Wife Beneficiaries can be a wise estate planning tool. It allows you to transfer property directly to your chosen beneficiaries upon your passing, avoiding the long and costly probate process. This option provides both efficiency and simplicity, making it a favorable choice for many couples. However, it’s essential to evaluate your specific circumstances and consult a professional if needed.