District of Columbia Clauses Relating to Capital Withdrawals, Interest on Capital

Description

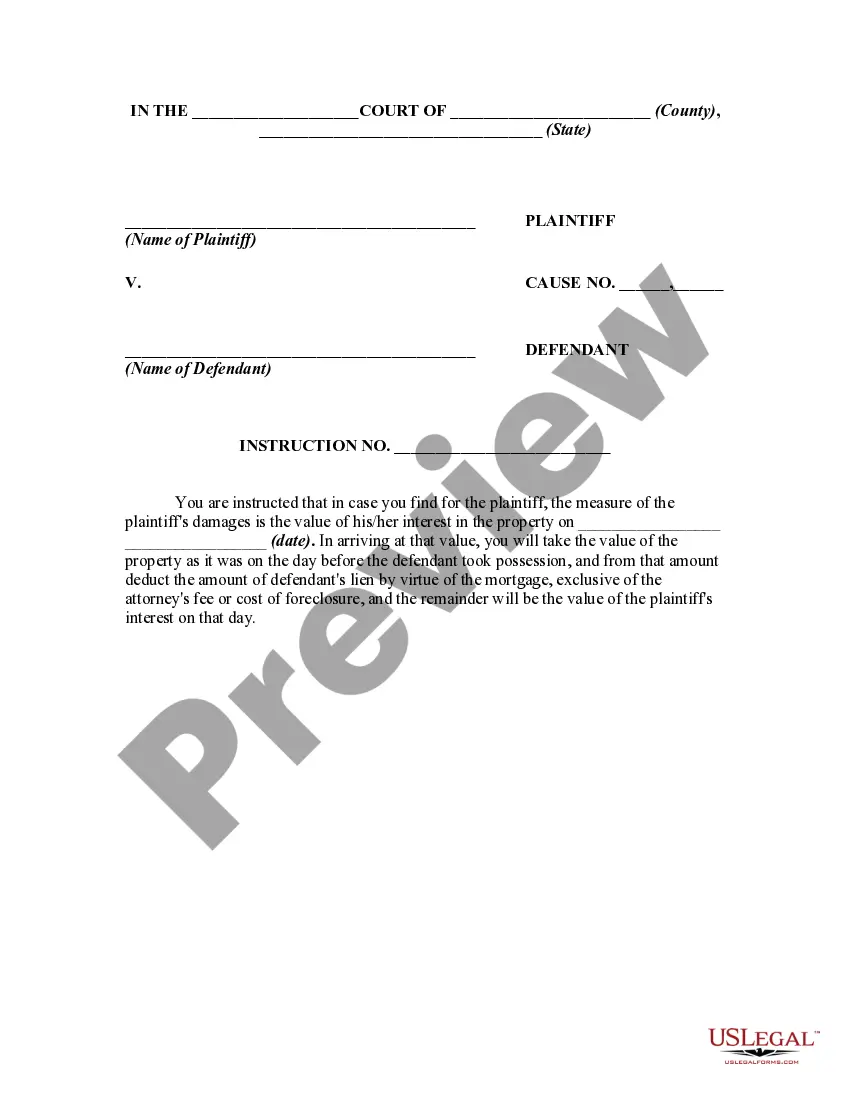

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

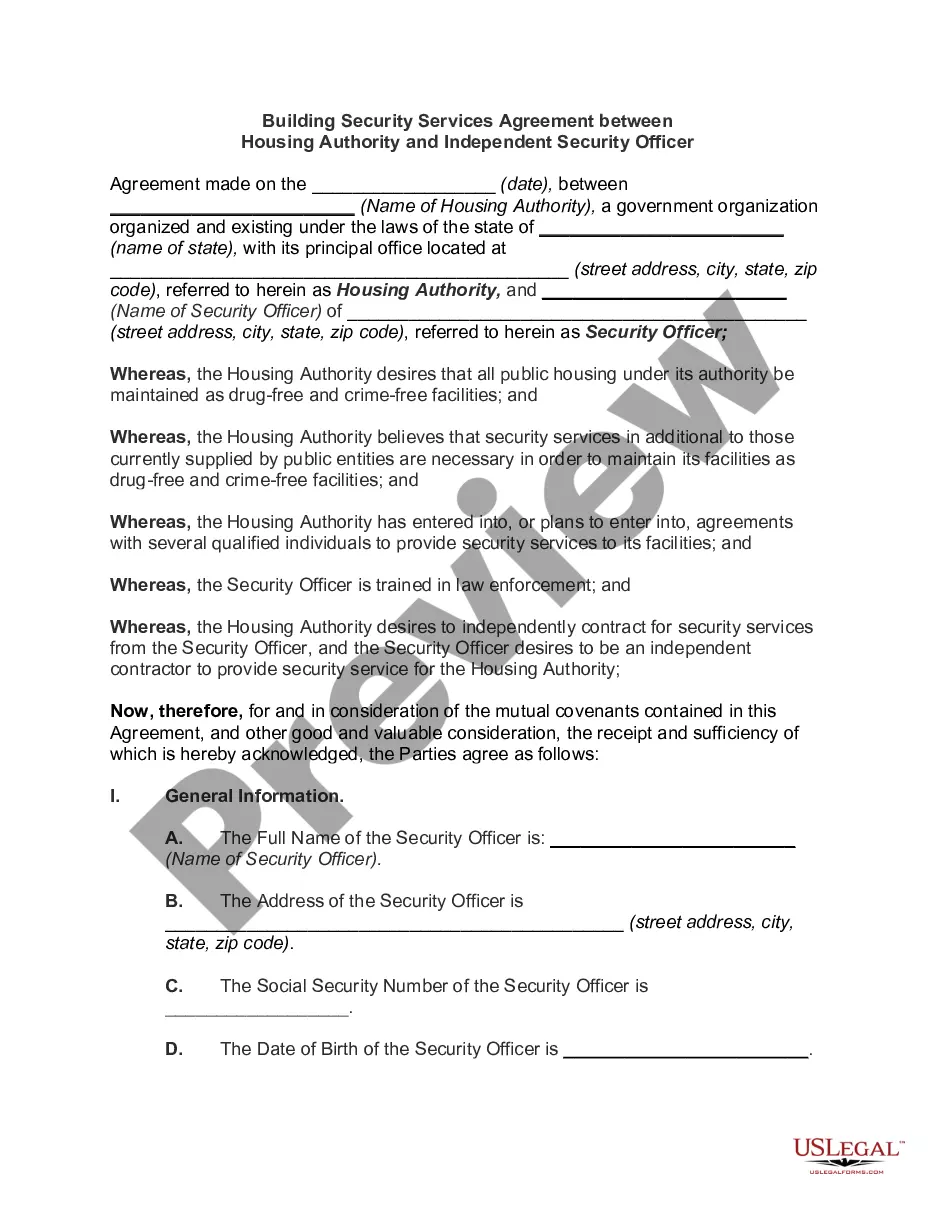

You can devote several hours online attempting to find the lawful papers template which fits the state and federal demands you want. US Legal Forms offers a huge number of lawful varieties which can be analyzed by professionals. You can actually obtain or print the District of Columbia Clauses Relating to Capital Withdrawals, Interest on Capital from our services.

If you have a US Legal Forms account, you may log in and click the Download button. Afterward, you may total, change, print, or sign the District of Columbia Clauses Relating to Capital Withdrawals, Interest on Capital. Each and every lawful papers template you get is your own eternally. To acquire one more copy associated with a acquired kind, proceed to the My Forms tab and click the related button.

Should you use the US Legal Forms site initially, keep to the basic instructions listed below:

- First, ensure that you have selected the best papers template to the county/area of your choice. Look at the kind outline to ensure you have selected the right kind. If accessible, use the Review button to search from the papers template too.

- If you wish to find one more edition from the kind, use the Look for area to obtain the template that suits you and demands.

- When you have located the template you would like, simply click Buy now to move forward.

- Pick the rates prepare you would like, type your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your bank card or PayPal account to purchase the lawful kind.

- Pick the formatting from the papers and obtain it in your device.

- Make modifications in your papers if needed. You can total, change and sign and print District of Columbia Clauses Relating to Capital Withdrawals, Interest on Capital.

Download and print a huge number of papers templates using the US Legal Forms website, that provides the most important collection of lawful varieties. Use expert and condition-specific templates to handle your small business or individual needs.

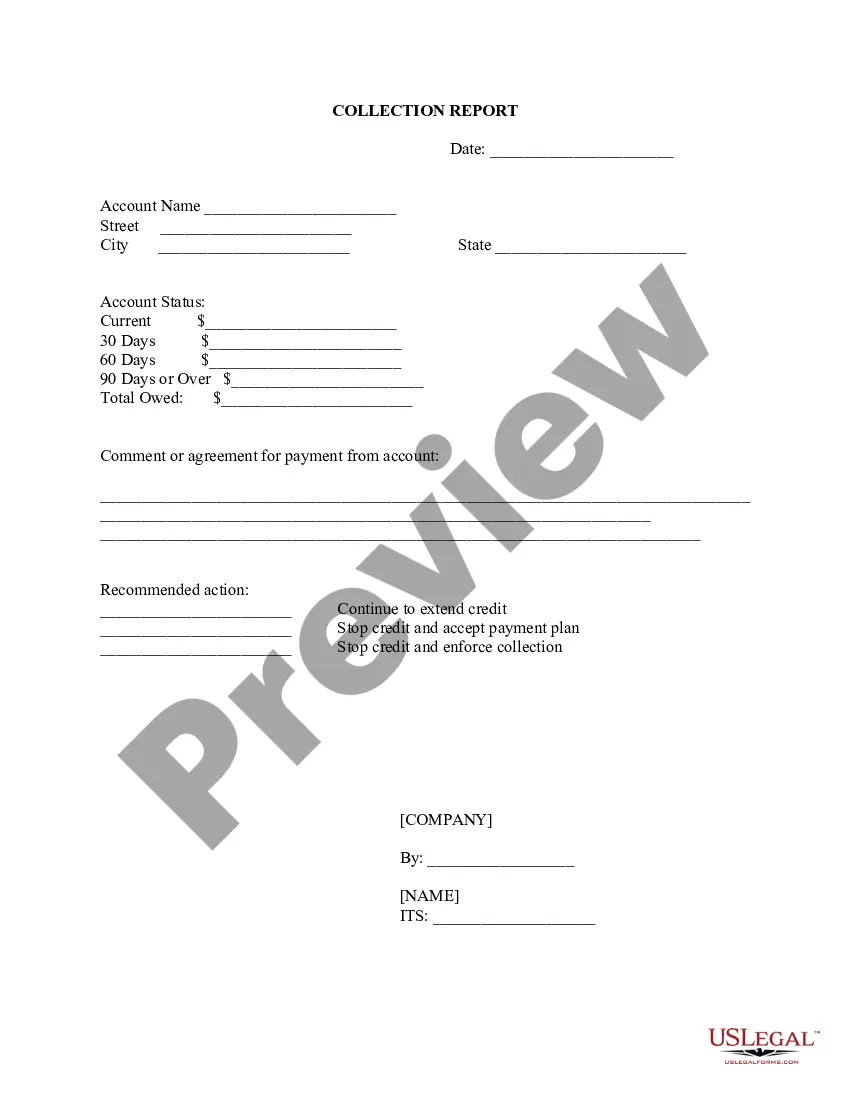

Form popularity

FAQ

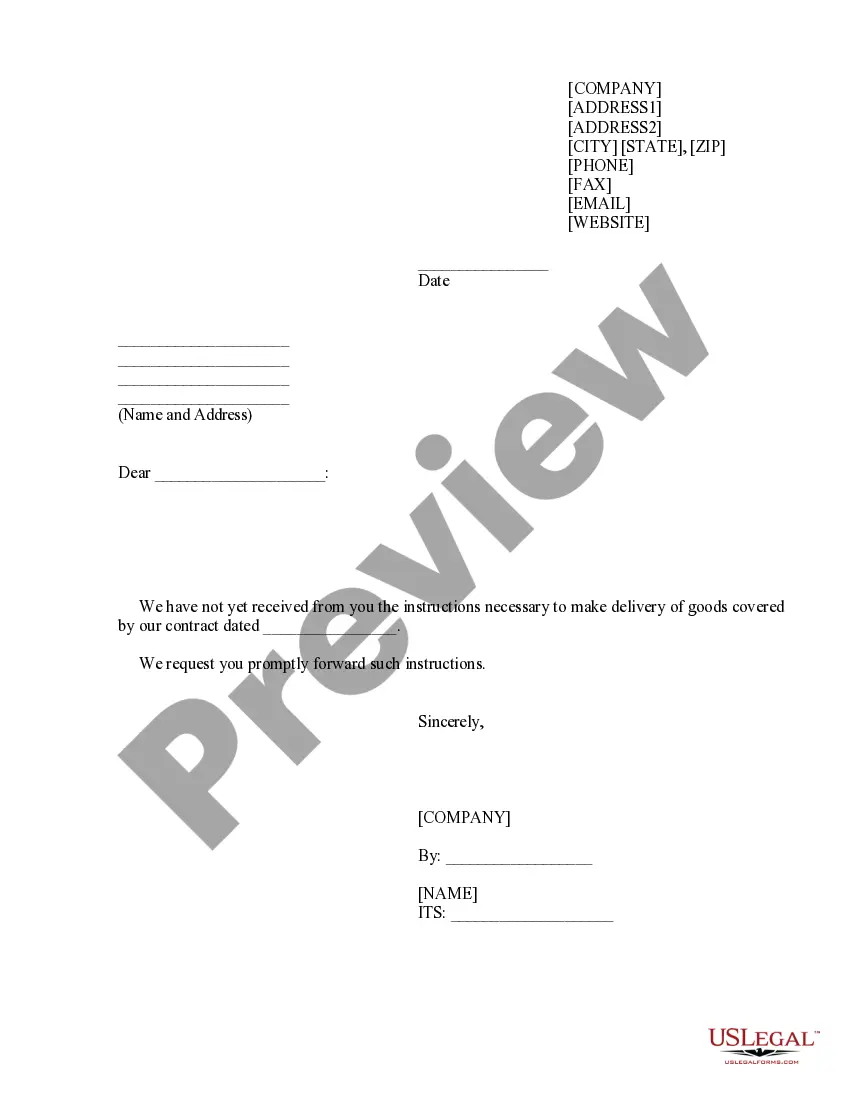

Married filing separately is a tax status used by married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. Some couples might benefit from filing separately, especially when one spouse has significant medical expenses or miscellaneous itemized deductions.

The DC franchise tax, also known as the DC unincorporated business franchise tax, is a tax imposed on some businesses operating in the District of Columbia that have gross receipts of $12,000 or more.

Generally, you will use the same filing status on your DC return as that used on your federal return. However, if you used married filing jointly on your federal return, it may be better for you to file your DC return using either married filing separately or filing separately on the same return.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Section 47-1801.04(17) of the DC Official Code describes a statutory resident as any individual who maintains a place of abode within the District for an aggregate of 183 days or more during the taxable year, whether or not such individual is domiciled in the District.

It means that you and your spouse each report income, deductions, credits and exemptions on separate tax returns instead of on one return jointly.

Share: Yes, even if you've filed jointly for years, you can change your filing status to married filing separately on a new return whenever you wish.

DC participates in the Modernized e-File program for Corporation (D-20 family), Unincorporated Business Franchise (D-30 family with an EIN only) tax returns and Partnership Return of Income (D-65).