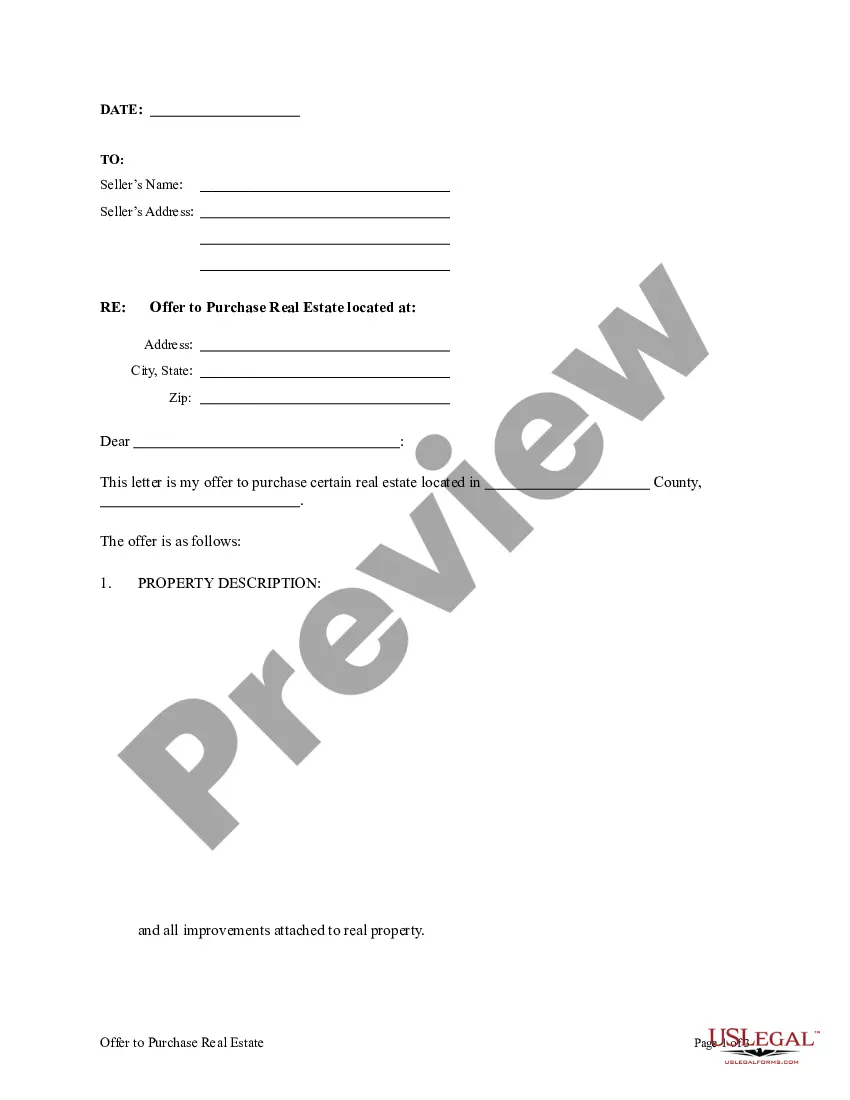

District of Columbia Offer to Purchase Real Estate

Description

How to fill out Offer To Purchase Real Estate?

US Legal Forms - one of many most significant libraries of authorized types in the USA - delivers an array of authorized file layouts you may obtain or print out. While using internet site, you may get 1000s of types for organization and specific reasons, sorted by classes, says, or keywords.You can find the newest models of types much like the District of Columbia Offer to Purchase Real Estate in seconds.

If you have a membership, log in and obtain District of Columbia Offer to Purchase Real Estate through the US Legal Forms library. The Obtain key will appear on every kind you perspective. You get access to all formerly saved types inside the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, listed below are straightforward recommendations to help you started off:

- Ensure you have picked the correct kind to your town/area. Go through the Preview key to review the form`s content material. See the kind explanation to actually have selected the correct kind.

- If the kind doesn`t fit your needs, use the Look for field near the top of the display to obtain the the one that does.

- In case you are pleased with the form, verify your decision by clicking on the Buy now key. Then, select the rates program you like and provide your accreditations to sign up on an accounts.

- Process the financial transaction. Use your Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Select the structure and obtain the form on the product.

- Make alterations. Fill up, change and print out and sign the saved District of Columbia Offer to Purchase Real Estate.

Every single format you added to your money lacks an expiration particular date and is also your own permanently. So, if you want to obtain or print out an additional backup, just check out the My Forms portion and click on in the kind you need.

Gain access to the District of Columbia Offer to Purchase Real Estate with US Legal Forms, probably the most considerable library of authorized file layouts. Use 1000s of professional and state-distinct layouts that fulfill your company or specific requirements and needs.

Form popularity

FAQ

Schedule the DC real estate licensing examination by visiting .psiexams.com or call PSI at (800) 733-9267. Be sure to request either Broker or Salesperson state exam only.

Washington, D.C. has proven to be a reliable and upward-moving market, with homes continually selling at or above the listed price. ing to WTOPnews, sellers receive, on average, 99.7% of the asking price, making it one of the best seller's markets on the East Coast.

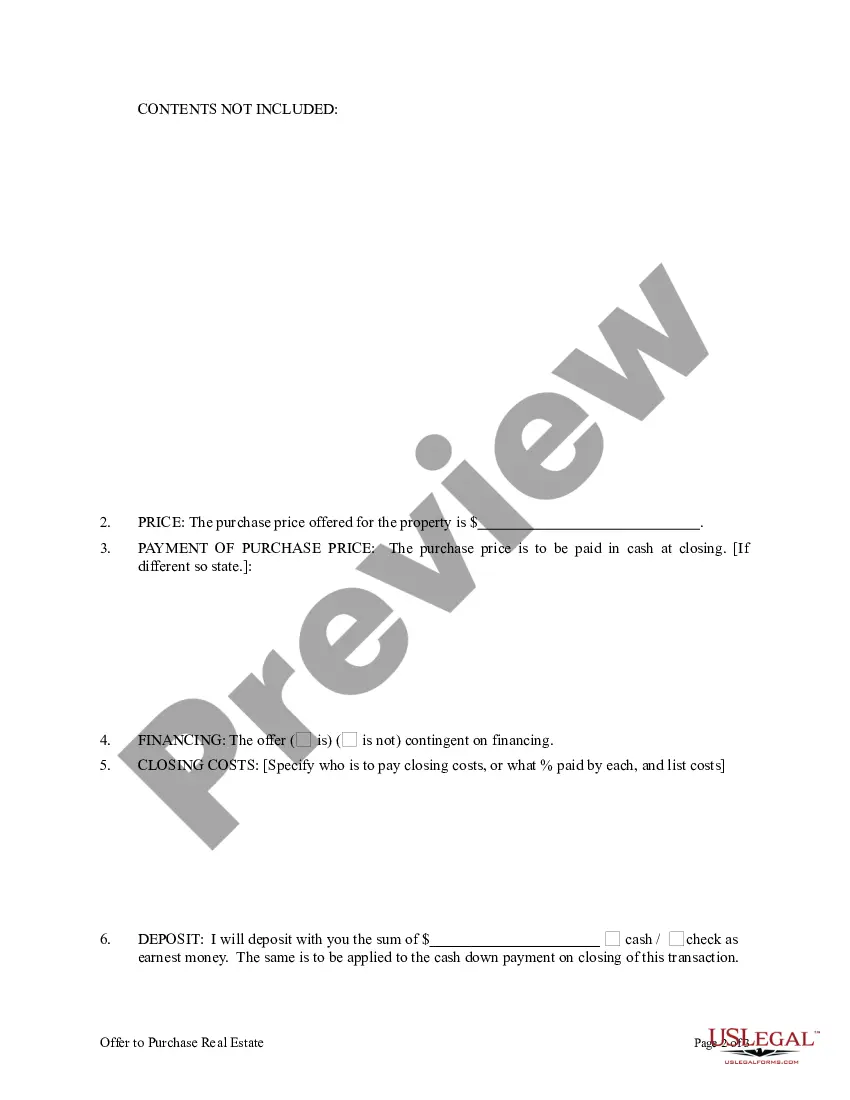

Down Payment amounts vary. In the DC Metro area, down payments range from as low as 0% down for qualifying VA borrowers, to 3.5% for FHA loans, 3% to 5% for specialized mortgage loan programs, 10% to 20% for co-ops and conventional loan programs from 5% to 20% or higher.

Ing to the study, which used home-price data from the fourth quarter of 2018, the annual salary needed to buy a home in the Washington, D.C., metro is $94,408 a year with 20 percent down. If homebuyers in the D.C. region put 10 percent down, the required salary increases to $109,000.

The minimum credit score to buy a house in District of Columbia is 580. Borrowers will a lower credit score of 500 to 579 may also be eligible for select mortgage lenders.

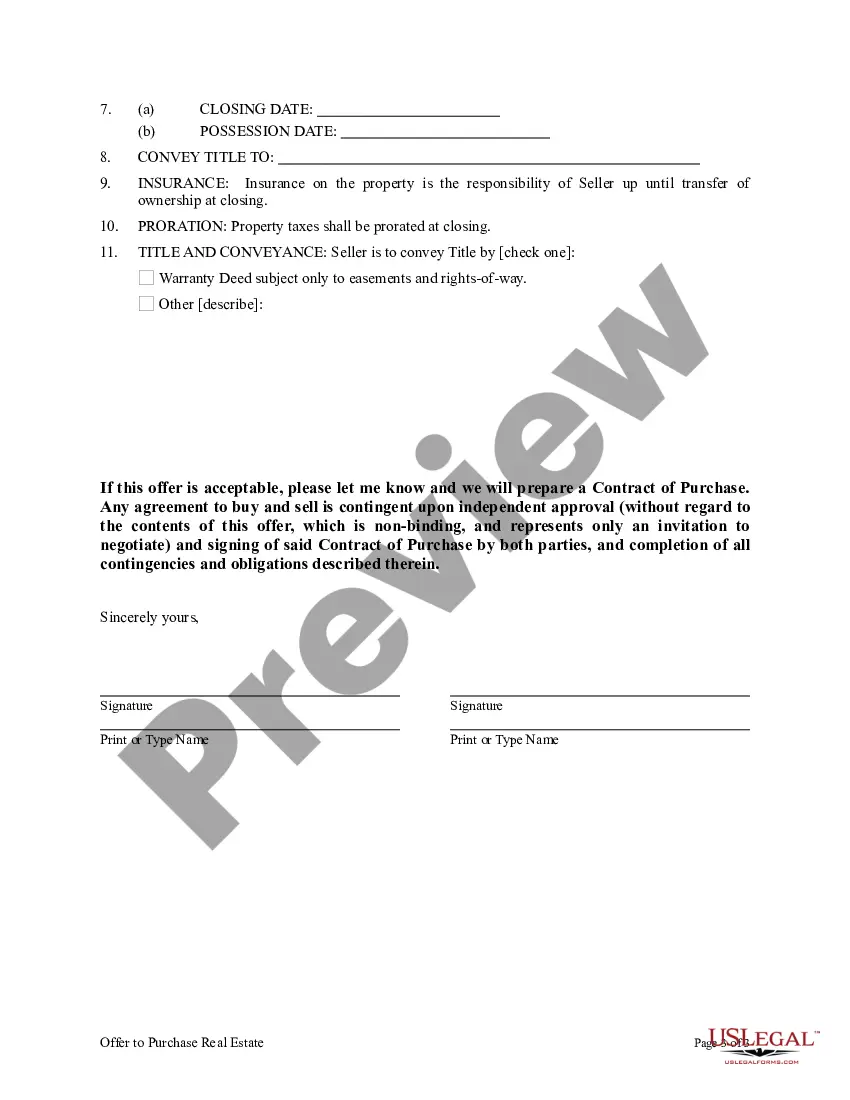

The BC contract of purchase and sale is an official document that contains the main aspects of the agreement between seller and buyer during the real estate purchase. This form is crucial in British Columbia. It contains information on the price of the purchase, details on the deposit, and deadlines.

7 Steps to Buying a House in Washington DC Step 1: Check Your Financial Health. ... Step 2: Plan Your Down Payment and Closing Costs. ... Step 3: Get the Preapproval Letter For Your Mortgage. ... Step 4: Start Your Home Search. ... Step 5: Make an Offer. ... Step 6: Schedule a Home Inspection & Appraisal. ... Step 7: Close the Sale.

The important difference is that an offer hasn't been agreed upon yet. A signed purchase agreement also usually contains the terms of the sale, spelling out what is required for the sale to be completed and that both parties have agreed to.