This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

District of Columbia Royalty Payments

Description

How to fill out Royalty Payments?

Have you been in a placement the place you need papers for either organization or individual reasons almost every day? There are a lot of legal papers templates available online, but discovering kinds you can rely isn`t straightforward. US Legal Forms provides 1000s of develop templates, like the District of Columbia Royalty Payments, that happen to be published to fulfill federal and state needs.

When you are presently acquainted with US Legal Forms website and also have an account, merely log in. After that, you may download the District of Columbia Royalty Payments template.

If you do not offer an profile and want to start using US Legal Forms, abide by these steps:

- Find the develop you need and make sure it is to the proper town/county.

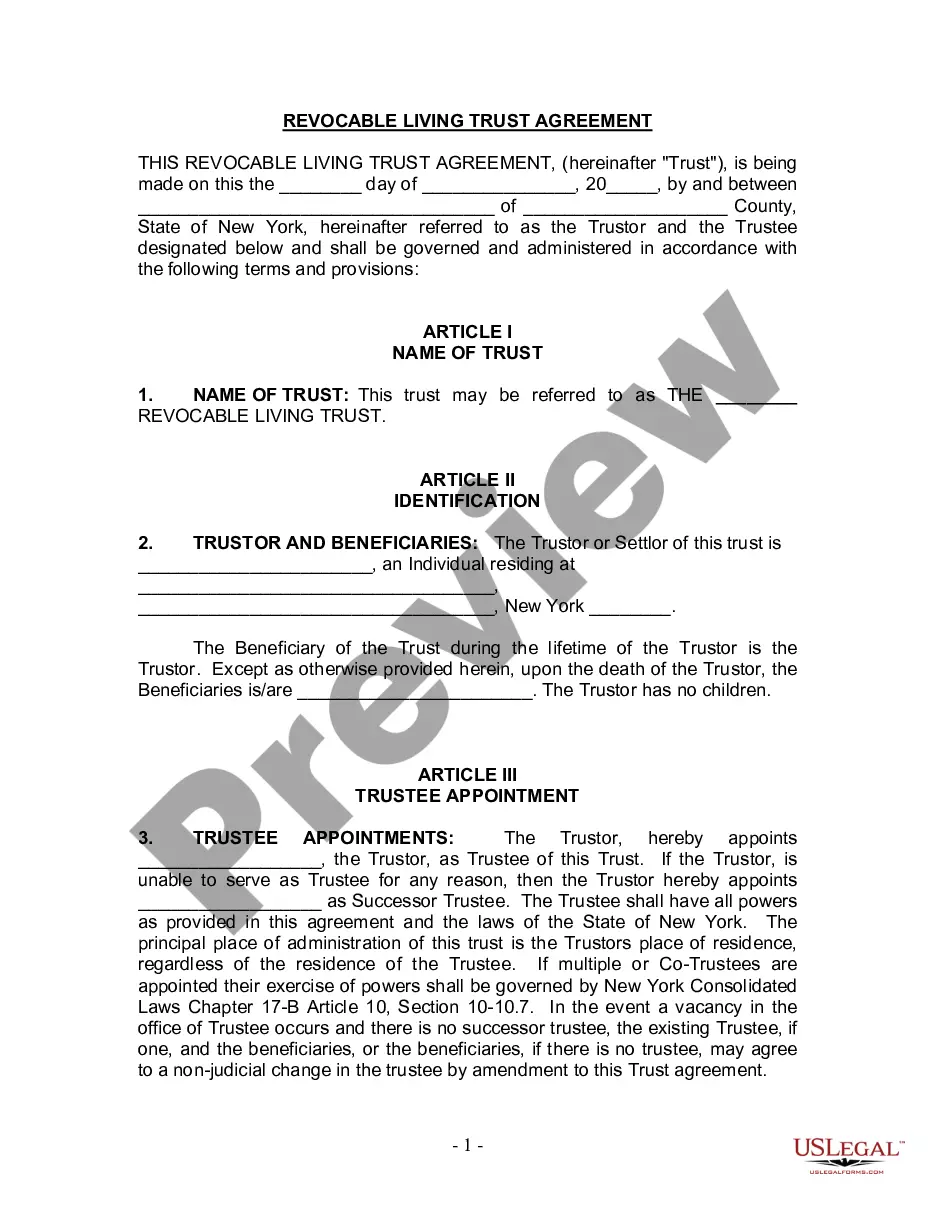

- Make use of the Preview switch to check the shape.

- Look at the description to ensure that you have selected the appropriate develop.

- When the develop isn`t what you are looking for, use the Lookup discipline to find the develop that suits you and needs.

- Once you obtain the proper develop, simply click Buy now.

- Select the prices plan you want, fill in the necessary details to make your account, and pay for an order making use of your PayPal or credit card.

- Pick a convenient file formatting and download your backup.

Locate each of the papers templates you have purchased in the My Forms menu. You can get a extra backup of District of Columbia Royalty Payments anytime, if necessary. Just go through the essential develop to download or print out the papers template.

Use US Legal Forms, by far the most comprehensive assortment of legal forms, to save lots of some time and prevent blunders. The assistance provides skillfully manufactured legal papers templates which you can use for an array of reasons. Make an account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

D.C. pays more in federal taxes than 23 states and more in overall federal taxes per capita than any state.

Nonresidents are not required to file a DC return. If you work in DC but are a resident of another state, you are not subject to DC income tax. Nonresidents may request a refund of erroneously withheld DC tax withheld or mistakenly made DC estimated payments by filing Form D-40B, Nonresident Request for Refund.

The rate structure for sales and use tax that is presently in effect: 6.0% - General rate for tangible personal property and selected services. 6.0% - Tickets to legitimate theaters and entertainment venues.

Instructions for Individuals You must pay estimated taxes if your residence is in the District, your gross income is not fully subject to withholding tax, and you have a remaining tax liability of more than $100 for the tax year.

How Your D.C. Paycheck Works. True to their unofficial motto of ?Taxation Without Representation,? Washington, D.C. residents have to pay federal income taxes. These, along with FICA taxes and district taxes, are taken out of each and every paycheck.

The Documentary Credit (DC) (Letter of Credit, LC), is commonly used for settling international trade. It offers a payment and financing method and is a practical tool for risk management that also can give your company a competitive edge. Avoid advance payment.

Positions that require District residency include all Agency heads, positions in the Excepted Service, Executive Service, Senior Executive Attorney Service, positions in the Legal Service of the Council for the District of Columbia, and new employees hired or new re-hires in the Career, Management Supervisory, or ...

The majority of Executive Service employees serve at the pleasure of the Mayor and are subject to residency requirements, unless otherwise provided by law or Council resolution. Executives are required to live in the District, and have 180 days from the date of appointment to establish residency.

You may pay your real property tax bill with a check or money order payable to the "DC Treasurer." Be sure to include your square, suffix and lot or parcel and lot numbers on your check or money order. Also include the top portion of your bill to help us process your payment on time.

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident.