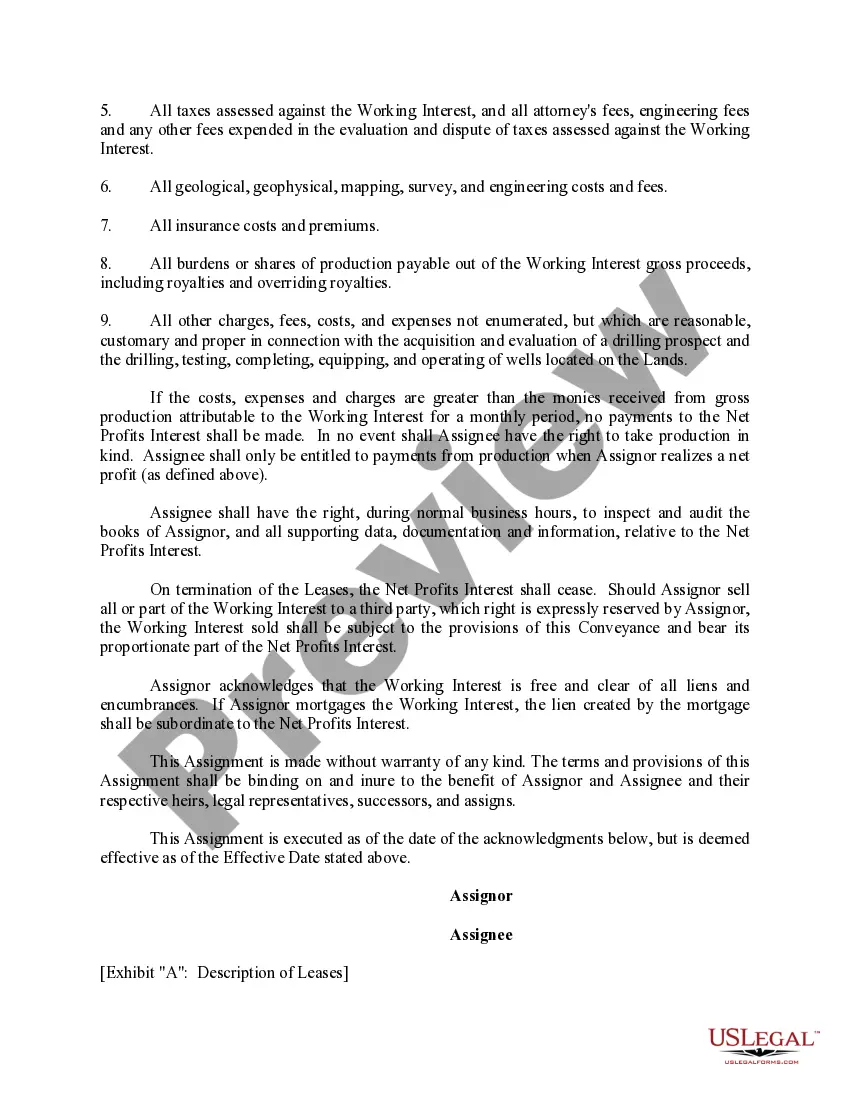

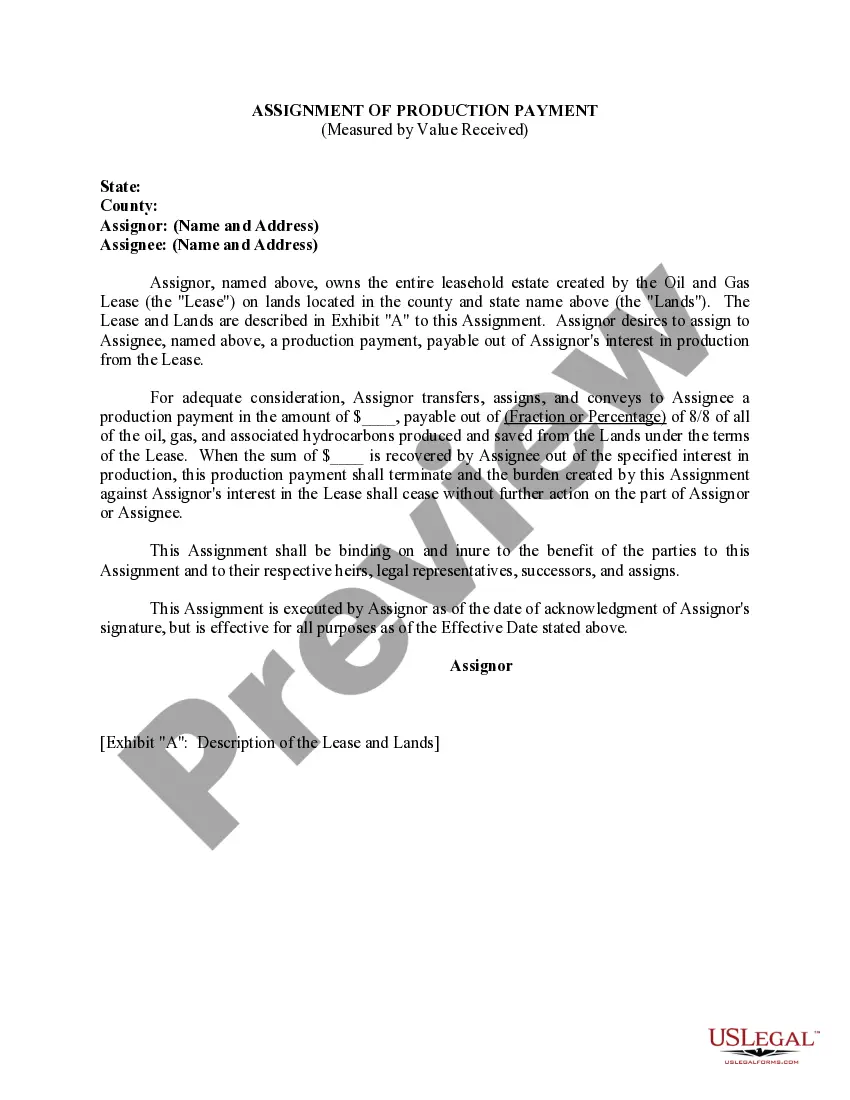

This form is used when Assignor grants, assigns, and conveys to Assignee a percentage of the net profit interest in the Working Interest. The Net Profits Interest is the stated percentage interest in the share of monies payable for gross production attributable to the Working Interest less the costs and expenses attributable to the Working Interest.

District of Columbia Assignment of Net Profits Interest

Description

How to fill out Assignment Of Net Profits Interest?

Choosing the right legitimate document format can be quite a struggle. Needless to say, there are tons of web templates available online, but how will you obtain the legitimate develop you need? Take advantage of the US Legal Forms web site. The support delivers a large number of web templates, for example the District of Columbia Assignment of Net Profits Interest, which you can use for business and private requires. All the varieties are inspected by professionals and meet up with federal and state requirements.

In case you are currently authorized, log in to your profile and click the Obtain option to find the District of Columbia Assignment of Net Profits Interest. Use your profile to appear throughout the legitimate varieties you may have purchased earlier. Proceed to the My Forms tab of the profile and obtain yet another backup from the document you need.

In case you are a brand new end user of US Legal Forms, allow me to share easy recommendations for you to stick to:

- Very first, ensure you have selected the correct develop to your metropolis/region. You may check out the form utilizing the Preview option and look at the form description to make certain this is basically the best for you.

- If the develop fails to meet up with your expectations, use the Seach discipline to discover the right develop.

- Once you are certain the form is suitable, go through the Buy now option to find the develop.

- Select the prices plan you desire and enter the necessary information and facts. Design your profile and buy the transaction using your PayPal profile or bank card.

- Pick the data file formatting and acquire the legitimate document format to your gadget.

- Full, revise and print out and sign the received District of Columbia Assignment of Net Profits Interest.

US Legal Forms is definitely the most significant catalogue of legitimate varieties in which you can see various document web templates. Take advantage of the company to acquire skillfully-produced files that stick to condition requirements.

Form popularity

FAQ

In addition, if an individual is domiciled in another jurisdiction, they must file a DC individual income tax return if that individual maintained a place of abode for a total of 183 days or more during the year at issue. Non-Filer FAQs | otr - Office of Tax and Revenue - DC.gov dc.gov ? page ? non-filer-faqs dc.gov ? page ? non-filer-faqs

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return.

How is the 183 days residency rule applied to tax returns? Every day that a taxpayer is in the District of Columbia and maintains a place of residency for an aggregate of 183 days or more, including days of temporary absence is counted towards the 183 days residency rule.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources. 2022 D 30 - Office of Tax and Revenue - DC.gov dc.gov ? otr ? publication ? attachments dc.gov ? otr ? publication ? attachments

The D-30 form will print when gross income is more then $12,000. The D-65 will print when gross income is less than $12,000. There are print options for these forms located on D.C. interview form DC1. How is it determined how the D.C. D-30 and D-65 forms print for a 1065 cch.com ? solution cch.com ? solution

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

Except for partnerships required to file an unincorporated business fran- chise tax return, DC Form D-30, or corporation franchise tax return, DC Form D-20, or an LLC, or publicly traded partnership that filed a federal corporation return, all partnerships engaged in any trade or business in DC or which received income ... 2022 D-65 - Office of Tax and Revenue Office of Tax and Revenue (.gov) ? publication ? attachments Office of Tax and Revenue (.gov) ? publication ? attachments PDF

Who Must File. You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year.