District of Columbia Pipe and Storage Yard Lease

Description

How to fill out Pipe And Storage Yard Lease?

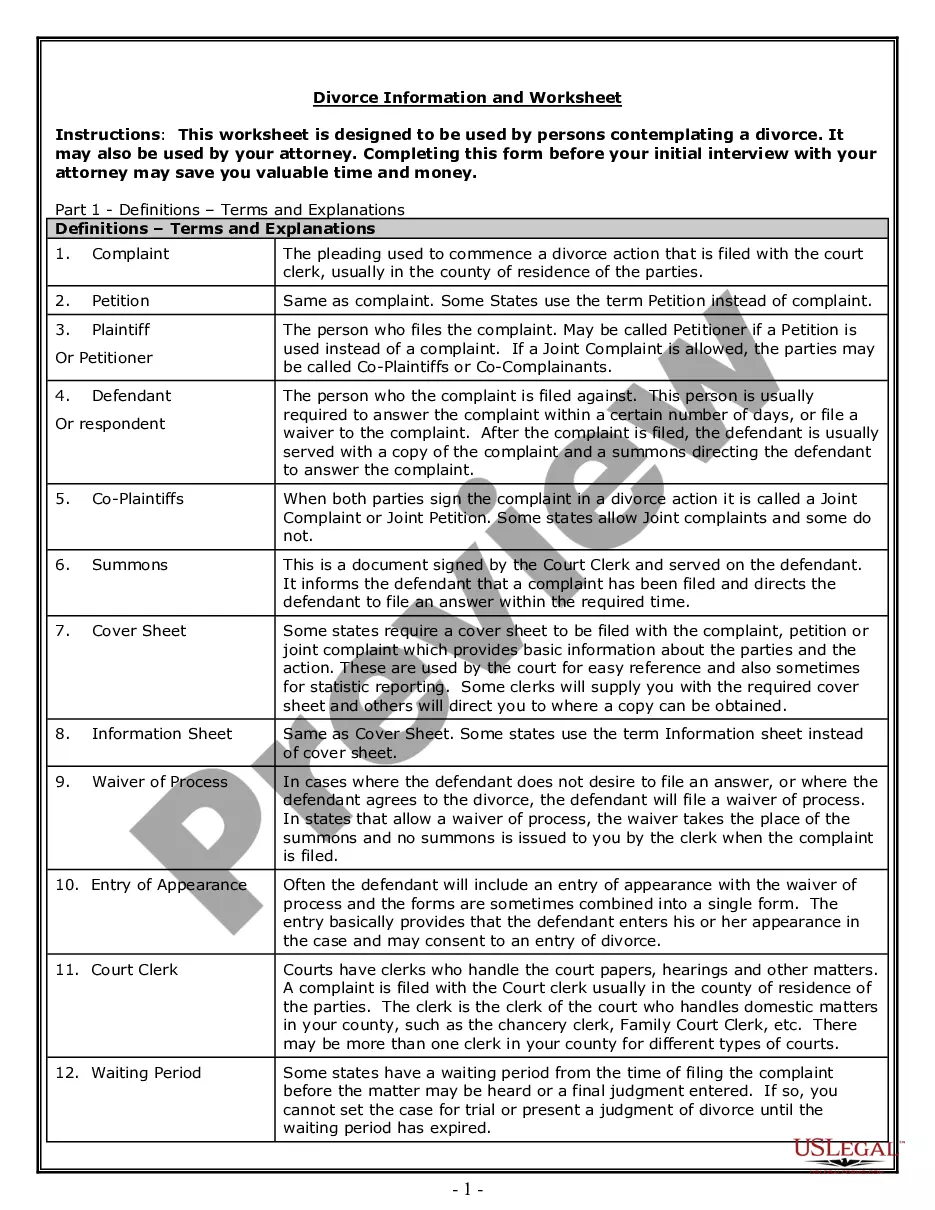

Discovering the right legal document template might be a battle. Naturally, there are tons of web templates accessible on the Internet, but how will you discover the legal develop you want? Take advantage of the US Legal Forms site. The assistance offers a huge number of web templates, for example the District of Columbia Pipe and Storage Yard Lease, that you can use for business and personal needs. All of the types are checked by pros and fulfill federal and state demands.

In case you are presently signed up, log in to the profile and click the Obtain switch to have the District of Columbia Pipe and Storage Yard Lease. Utilize your profile to appear throughout the legal types you possess purchased previously. Go to the My Forms tab of your profile and acquire one more version in the document you want.

In case you are a new user of US Legal Forms, allow me to share basic directions for you to follow:

- Initially, be sure you have chosen the right develop for your personal town/state. You are able to check out the form using the Preview switch and look at the form outline to ensure this is the best for you.

- In the event the develop fails to fulfill your needs, make use of the Seach industry to obtain the right develop.

- Once you are positive that the form is suitable, click the Acquire now switch to have the develop.

- Pick the rates plan you desire and enter in the needed information and facts. Design your profile and pay money for the order making use of your PayPal profile or bank card.

- Pick the file formatting and download the legal document template to the gadget.

- Full, revise and print and indication the received District of Columbia Pipe and Storage Yard Lease.

US Legal Forms may be the most significant catalogue of legal types in which you can discover various document web templates. Take advantage of the service to download skillfully-made papers that follow state demands.

Form popularity

FAQ

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

(a) Each year the district shall levy a tax against every person on the tangible personal property owned or held in trust in that person's trade or business in the District. The rate of tax shall be $3.40 for each $100 of value of the taxable personal property, in excess of $225,000 in value.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

(a) Each year the district shall levy a tax against every person on the tangible personal property owned or held in trust in that person's trade or business in the District. The rate of tax shall be $3.40 for each $100 of value of the taxable personal property, in excess of $225,000 in value.

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

The gross receipts tax is a tax imposed upon the gross revenue received by the following industries for services and/or deliveries to a District of Columbia address (commercial and non-commercial): Heating oil (and related services) Toll telecommunication service. Commercial mobile service.

How is the 183 days residency rule applied to tax returns? Every day that a taxpayer is in the District of Columbia and maintains a place of residency for an aggregate of 183 days or more, including days of temporary absence is counted towards the 183 days residency rule.

Services in Washington, D.C. are generally not taxable, with some exceptions. However if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Washington D.C. , with a few exceptions.