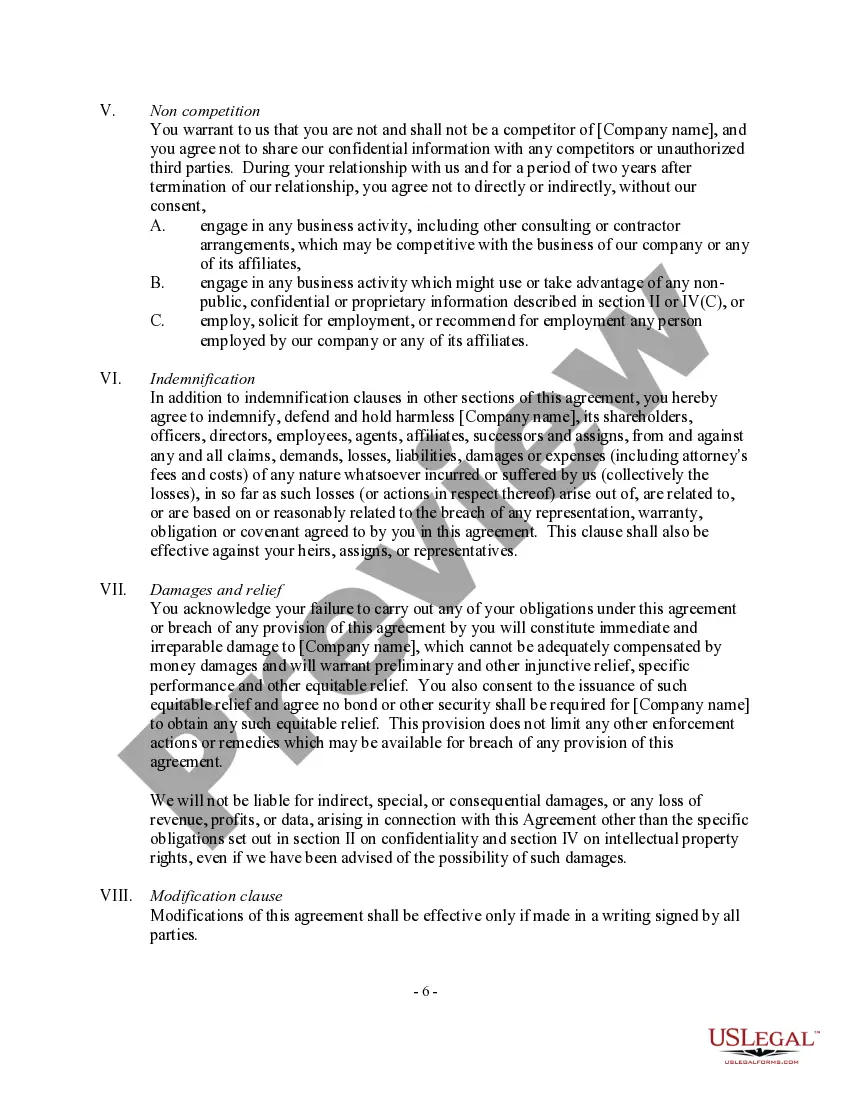

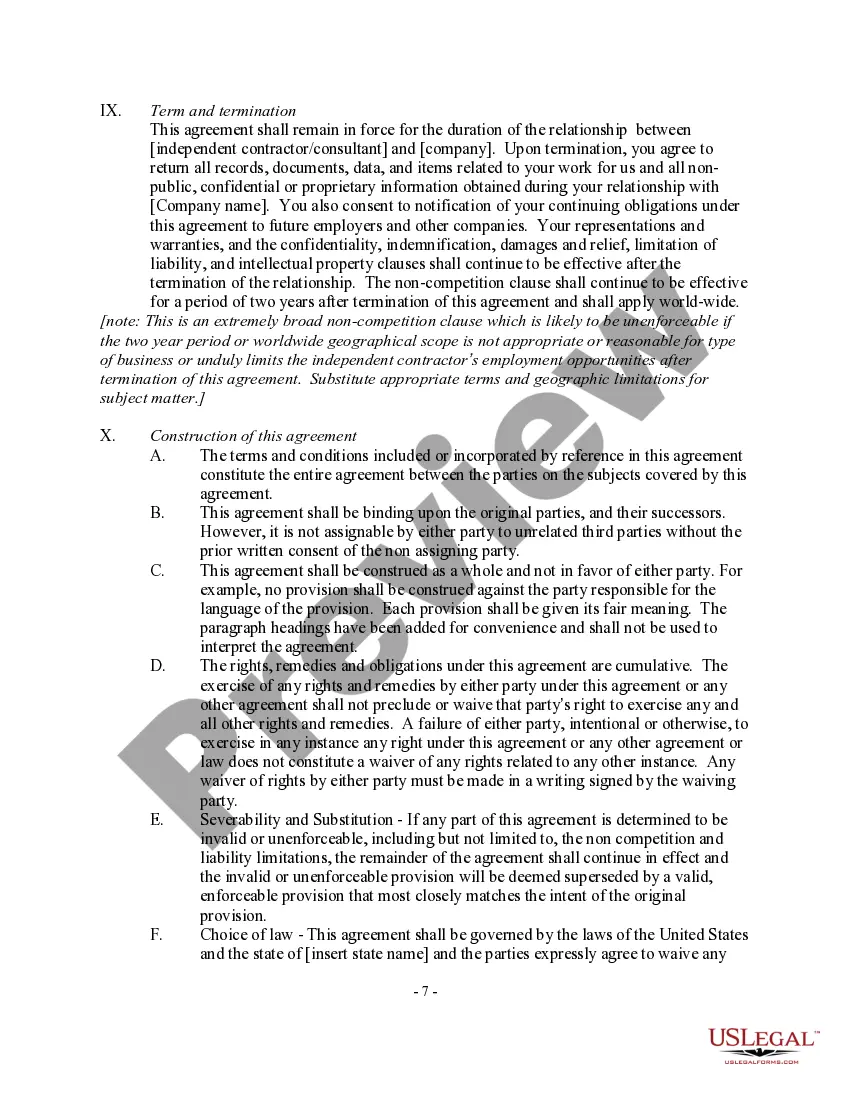

District of Columbia Non Employee Technology Transfer And Protection Agreement

Description

How to fill out Non Employee Technology Transfer And Protection Agreement?

If you wish to complete, obtain, or print authentic document templates, utilize US Legal Forms, the top choice of legal forms available online.

Employ the site’s simple and effective search to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the District of Columbia Non Employee Technology Transfer And Protection Agreement with just a few clicks.

Every legal document template you purchase is yours permanently. You can access all forms you downloaded in your account. Go to the My documents section and choose a form to print or download again.

Be proactive and download, and print the District of Columbia Non Employee Technology Transfer And Protection Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are currently a US Legal Forms member, Log In to your account and click the Download button to obtain the District of Columbia Non Employee Technology Transfer And Protection Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not happy with the form, use the Search box at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the District of Columbia Non Employee Technology Transfer And Protection Agreement.

Form popularity

FAQ

An employee intellectual property assignment agreement is a legal document that outlines the ownership of inventions, designs, and other intellectual property created by an employee during their employment. This agreement ensures that any intellectual property developed while working for a company belongs to that company, not the employee. In the context of the District of Columbia Non Employee Technology Transfer And Protection Agreement, it is essential to clearly define ownership and protect valuable ideas and innovations. By using a well-drafted agreement, businesses can safeguard their intellectual assets and foster a secure environment for creativity.

The four models of technology transfer include the push model, where innovations are developed and then pushed to the market; the pull model, which responds to market needs; the coupled model that integrates both push and pull strategies; and the network model, which relies on collaboration and partnerships. Each model offers a unique approach to sharing technology. The District of Columbia Non Employee Technology Transfer And Protection Agreement can be tailored to fit any of these models, ensuring protection and compliance.

Different types of technology transfer include formal agreements like licensing, collaborations, and partnerships, as well as informal sharing through discussions and presentations. Each type varies in terms of structure and legal implications. The District of Columbia Non Employee Technology Transfer And Protection Agreement is a formal approach that aims to safeguard technology across diverse contexts.

A technology transfer agreement is a legal document that outlines the terms under which technology is shared between parties. This agreement specifies how the technology can be used, shared, and commercialized, while also protecting the rights of the original developer. The District of Columbia Non Employee Technology Transfer And Protection Agreement is an essential tool for ensuring these terms are clear and enforceable.

Technology transfer agreements are contracts designed to manage the transfer of technology from one entity to another, be it an individual, organization, or government. They provide a framework for collaboration and innovation while ensuring that intellectual property is protected. The District of Columbia Non Employee Technology Transfer And Protection Agreement is a key example of such an agreement, focusing specifically on non-employee relations.

A TTA, or Technology Transfer Agreement, is a specific contract that facilitates the transfer of technology between parties, ensuring that both sides adhere to agreed-upon terms. It protects intellectual property rights and outlines how the technology can be used, shared, or commercialized. The District of Columbia Non Employee Technology Transfer And Protection Agreement exemplifies a TTA that focuses on non-employee transactions.

The five major types of technology transfer agreements include licensing agreements, research agreements, joint development agreements, material transfer agreements, and non-disclosure agreements. Each type serves a different purpose and addresses various aspects of technology sharing and protection. The District of Columbia Non Employee Technology Transfer And Protection Agreement falls under these categories, emphasizing the importance of protecting innovations.

Technology agreements are legally binding contracts that outline the rights and responsibilities of parties involved in the development, transfer, or use of technology. They ensure that intellectual property is protected and that all parties understand the terms of collaboration. The District of Columbia Non Employee Technology Transfer And Protection Agreement is a specific type that focuses on safeguarding technology and intellectual property rights.

The technology transfer process involves six essential steps that ensure effective management and protection of innovations. First, identify the technology and its potential applications. Next, evaluate the technology’s market viability and develop a strategy for its transfer. Third, draft the District of Columbia Non Employee Technology Transfer And Protection Agreement to formalize the terms. Following this, engage in negotiations with potential partners or licensees. Fifth, implement the agreement by transferring the technology and providing necessary support. Finally, monitor the agreement’s performance to ensure compliance and assess its impact.

The FR-500 in DC is a business registration form that facilitates the collection of various taxes from businesses operating in the District. Completing this form is essential for compliance with local tax regulations. If your organization is involved in the District of Columbia Non Employee Technology Transfer And Protection Agreement, understanding the FR-500 will help you maintain proper legal standing.