District of Columbia Production Assistant Contract - Self-Employed Independent Contractor

Description

How to fill out Production Assistant Contract - Self-Employed Independent Contractor?

US Legal Forms - among the largest collections of legal documents in the USA - offers a variety of legal template documents that you can download or print.

By using the site, you can access thousands of forms for business and personal use, categorized by type, state, or keywords. You can find the most recent versions of forms such as the District of Columbia Production Assistant Contract - Self-Employed Independent Contractor in just seconds.

If you already have a monthly subscription, Log In to download the District of Columbia Production Assistant Contract - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Make adjustments. Complete, modify, print, and sign the saved District of Columbia Production Assistant Contract - Self-Employed Independent Contractor. Each template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the District of Columbia Production Assistant Contract - Self-Employed Independent Contractor with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to examine the contents of the form.

- Read the form description to ensure you have chosen the appropriate document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you wish and provide your details to register for an account.

Form popularity

FAQ

Yes, a personal assistant can be a contractor, particularly in arrangements under a District of Columbia Production Assistant Contract - Self-Employed Independent Contractor. This setup allows personal assistants to have flexibility in their work hours and terms. It also means they will handle their own taxes and should be aware of the responsibilities that come with self-employment.

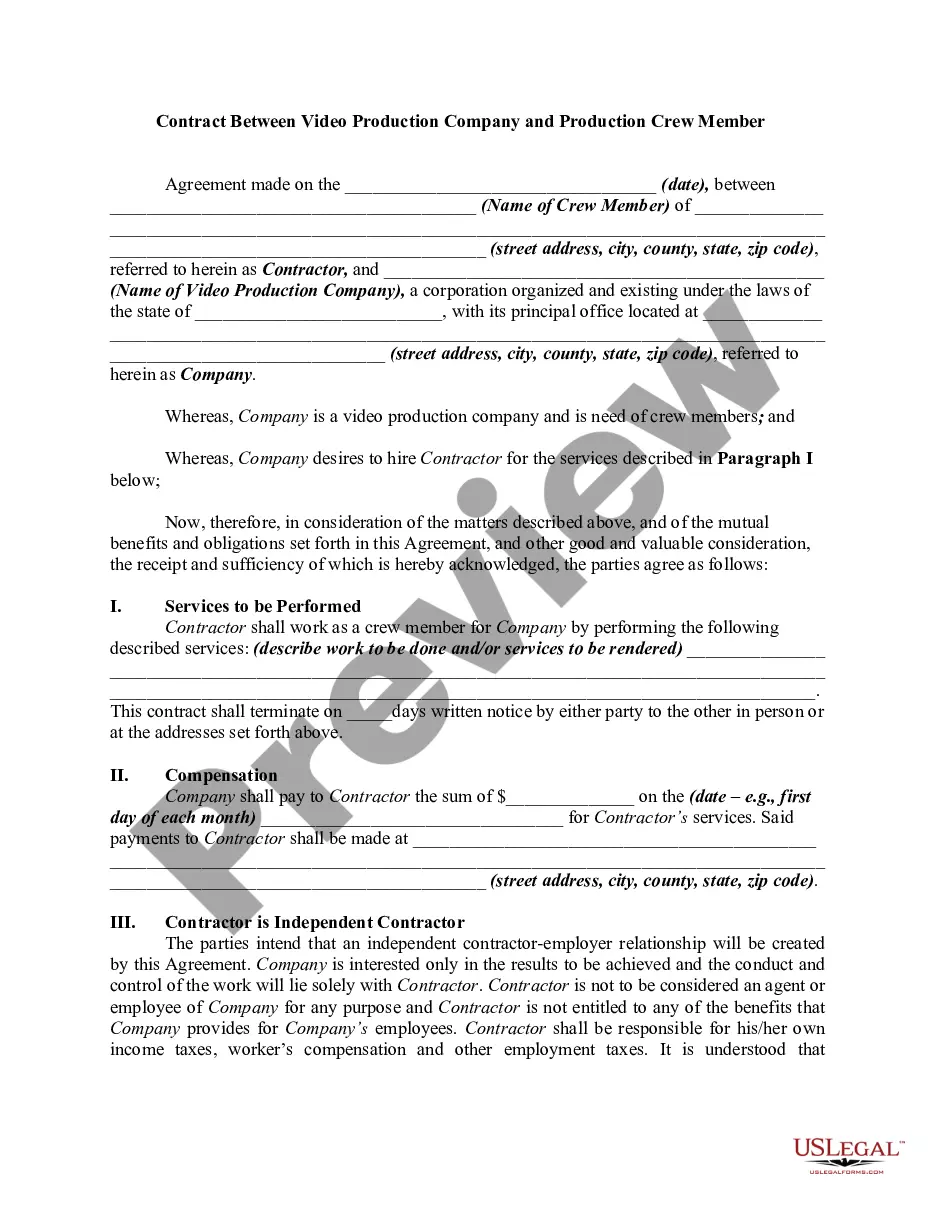

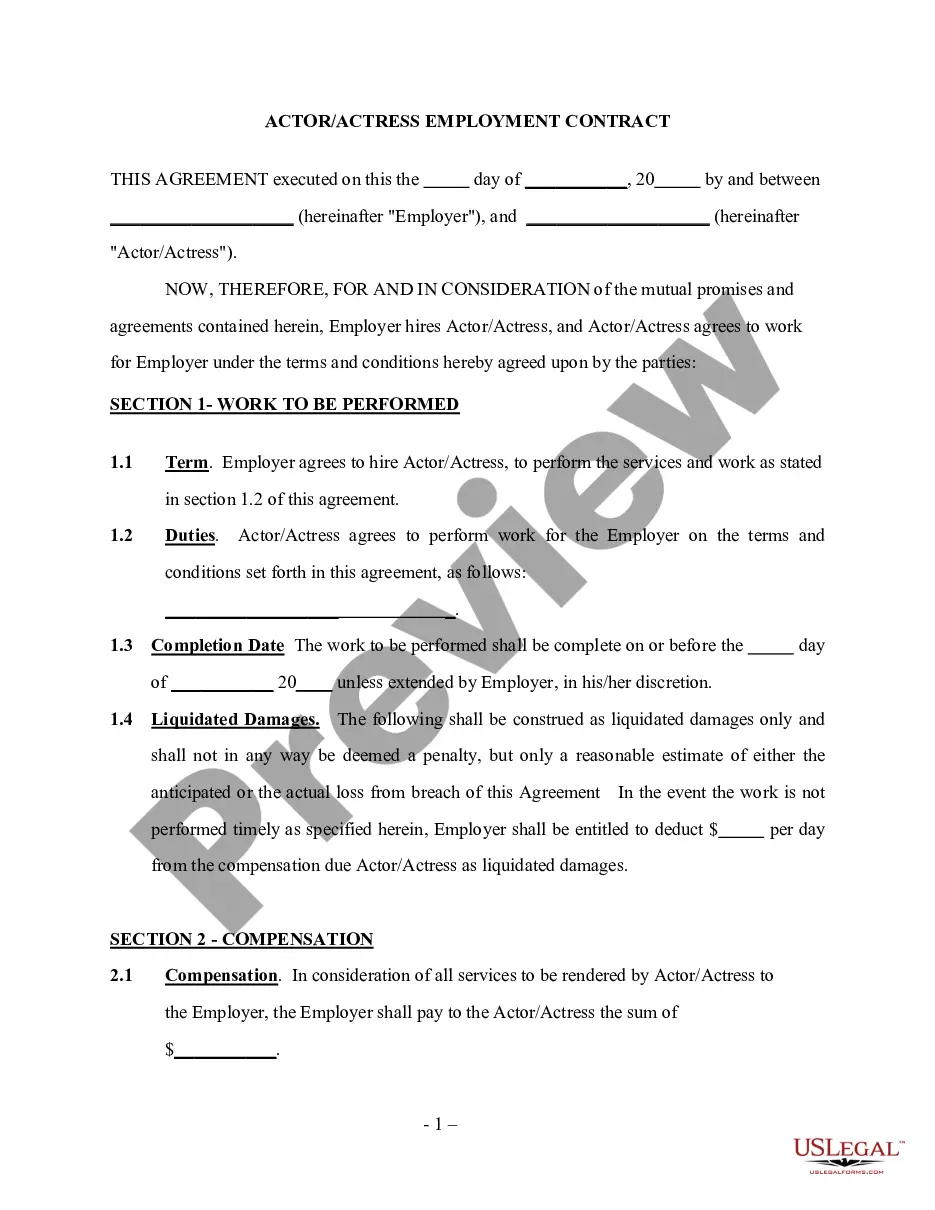

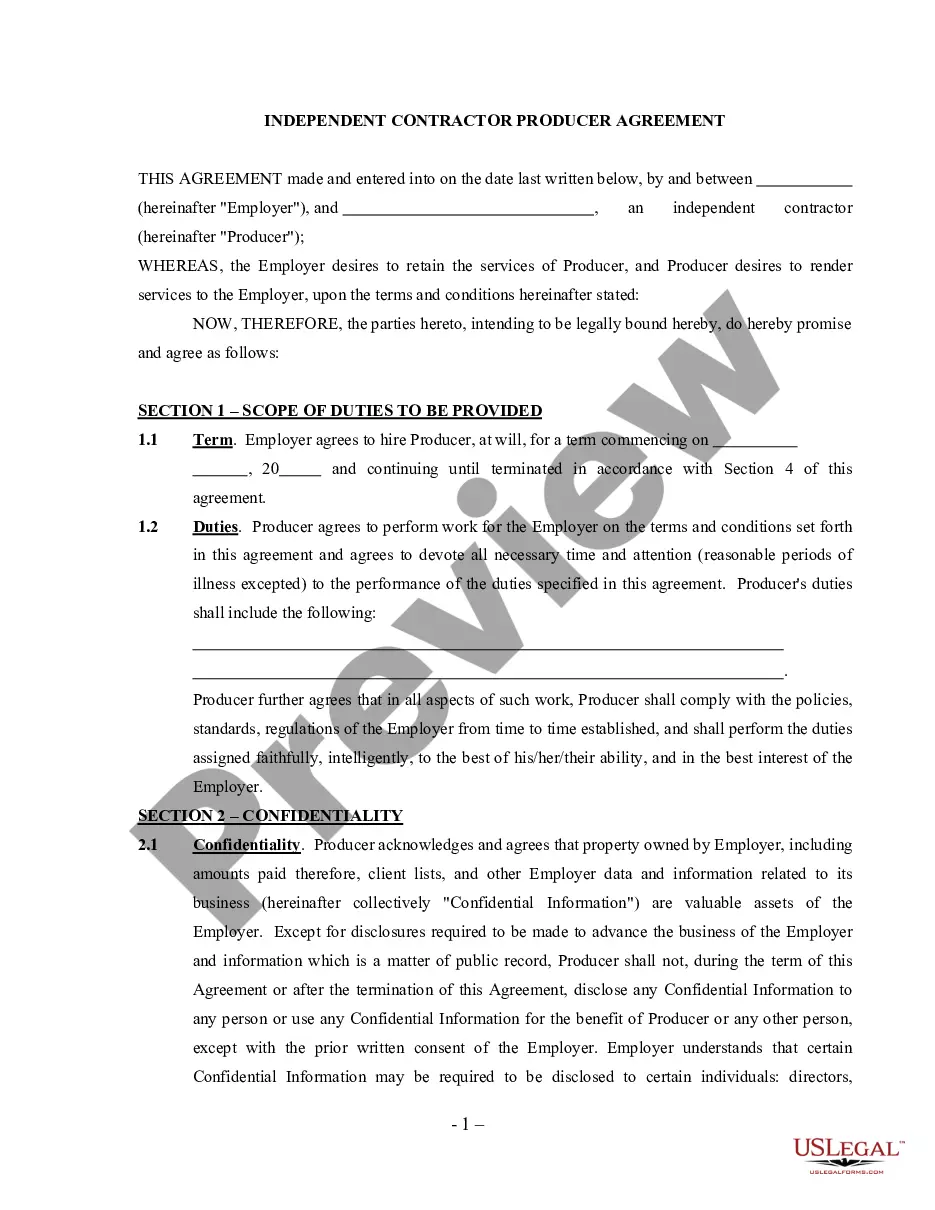

Filling out an independent contractor agreement is straightforward and crucial for clarity. Begin by including the names and addresses of both parties, along with a detailed description of the services to be performed. Next, outline payment terms, deadlines, and conditions under a District of Columbia Production Assistant Contract - Self-Employed Independent Contractor. Finally, ensure both parties sign the agreement to validate it.

A PCA can operate as an independent contractor, enjoying the benefits that come with such a status. When working under a District of Columbia Production Assistant Contract - Self-Employed Independent Contractor, they can dictate their own work conditions and clients. However, it's important to distinguish between being an independent contractor and an employee, as the legal implications differ.

To become an independent contractor as a CNA (Certified Nursing Assistant), start by understanding what it means under a District of Columbia Production Assistant Contract - Self-Employed Independent Contractor. You must obtain the necessary licenses and certifications required in your state. Then, market your services to potential clients or agencies and ensure you have a solid contract that outlines your duties and payment terms.

Certainly, a PCA (Personal Care Aide) can work as an independent contractor. Under a District of Columbia Production Assistant Contract - Self-Employed Independent Contractor, a PCA has the flexibility to work independently. This allows them to control their own schedule and client choices while also being responsible for their taxes and business expenses.

Yes, a caregiver can be self-employed, including under a District of Columbia Production Assistant Contract - Self-Employed Independent Contractor. This arrangement allows caregivers to set their own hours, choose their clients, and negotiate their rates. Moreover, self-employment often enables caregivers to manage their taxes more effectively, but it requires understanding tax obligations as independent contractors.

Yes, a production assistant can be classified as an independent contractor. They often work on a project basis, providing essential support to production teams while controlling their work hours and client engagements. By leveraging the District of Columbia Production Assistant Contract - Self-Employed Independent Contractor, they can outline their duties and payment terms effectively, protecting their interests and those of the clients.

Certainly, a virtual assistant can also work as a freelancer. This means they are not tied to a single employer, allowing for flexibility in work hours and client selection. Many utilize the District of Columbia Production Assistant Contract - Self-Employed Independent Contractor to clarify their roles and responsibilities, ensuring smooth operations in their freelance ventures.

Yes, a virtual assistant can operate as an independent contractor. This arrangement allows them to manage their workload and choose their clients. When they enter into agreements under the District of Columbia Production Assistant Contract - Self-Employed Independent Contractor, they establish clear terms for payment and deliverables, benefiting both parties involved.

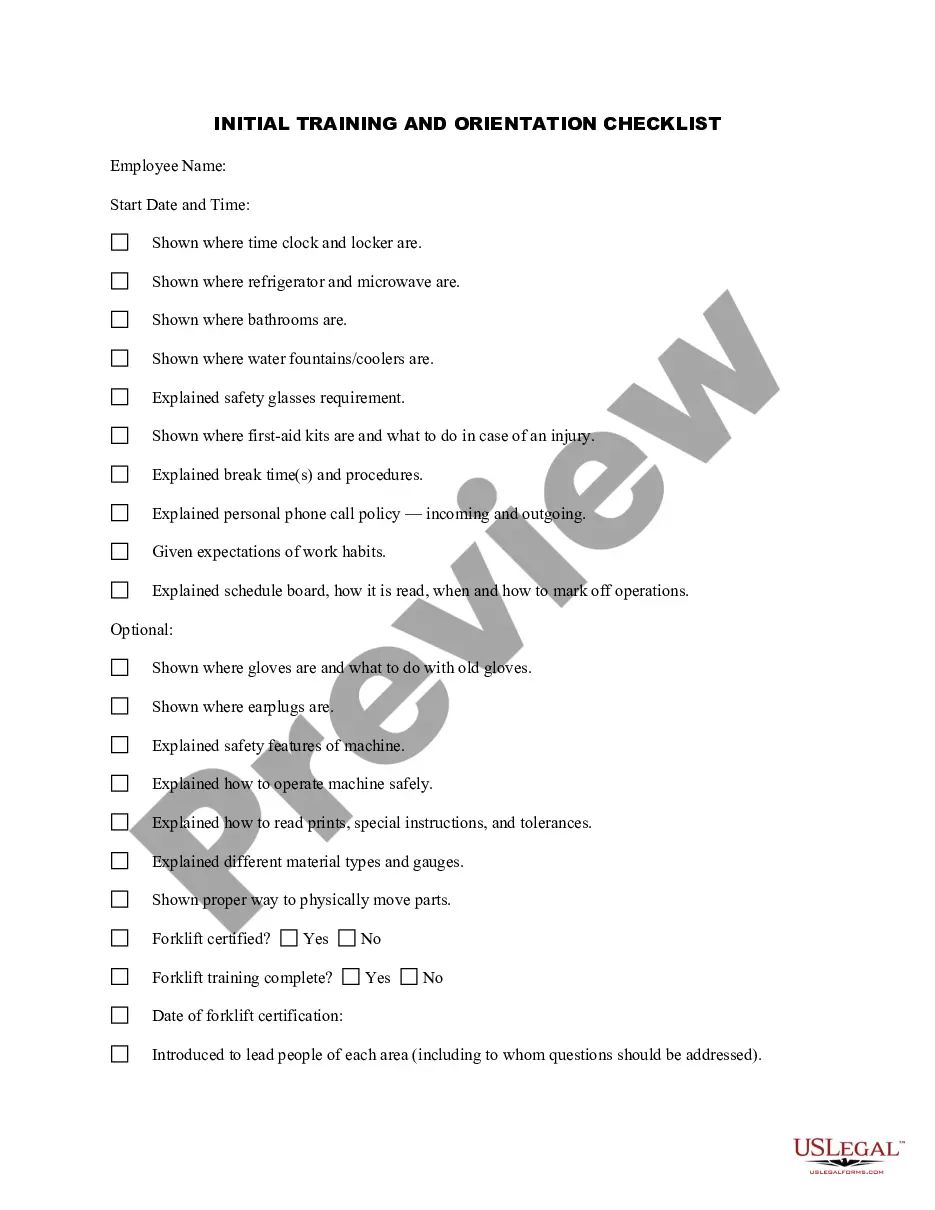

To demonstrate that you are self-employed, collect and maintain thorough records of your business activities. This evidence can include tax returns, bank statements, invoices, and contracts with clients. A District of Columbia Production Assistant Contract - Self-Employed Independent Contractor can significantly bolster your documentation, illustrating your independent status.