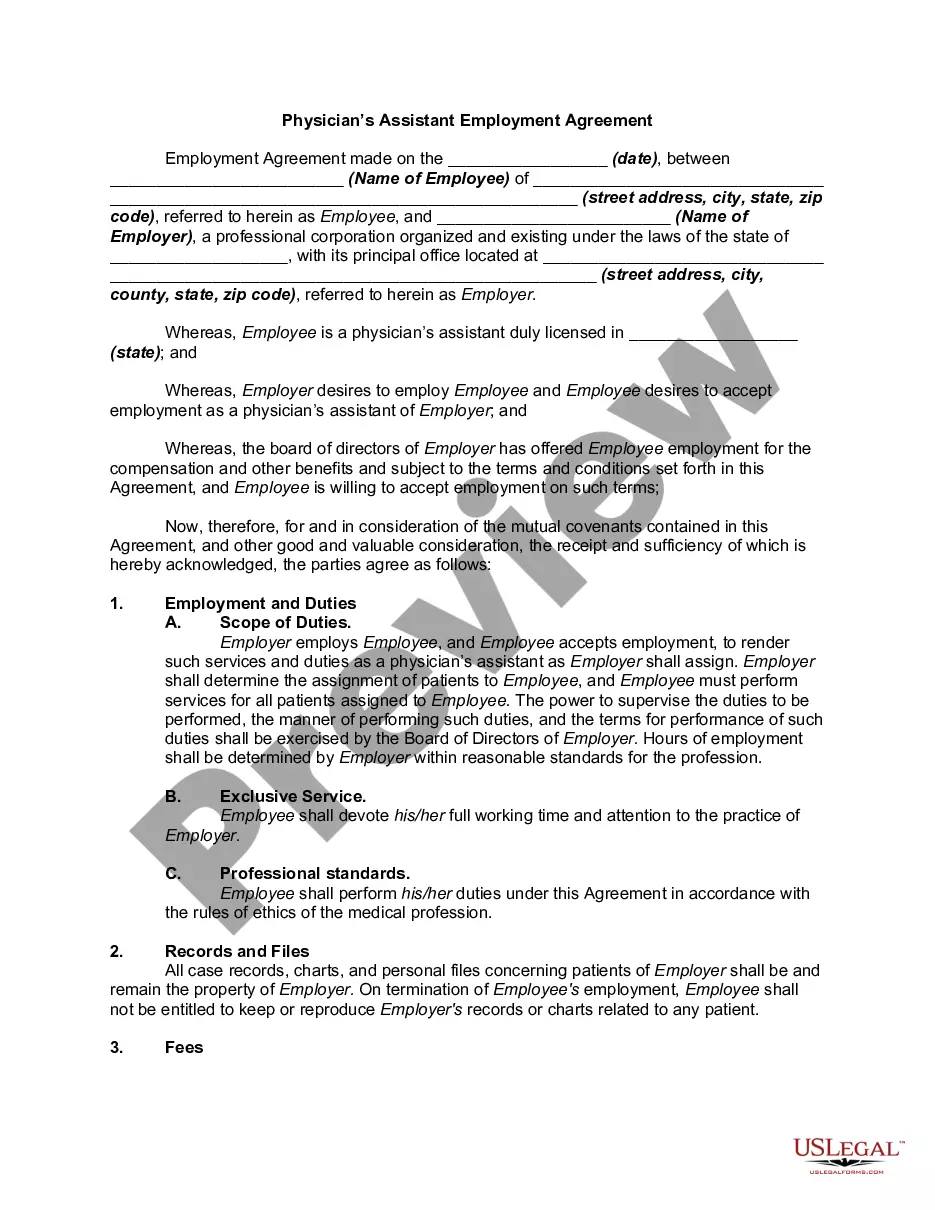

District of Columbia Physician's Assistant Agreement - Self-Employed Independent Contractor

Description

How to fill out Physician's Assistant Agreement - Self-Employed Independent Contractor?

If you require extensive, obtain, or print legal document templates, make use of US Legal Forms, the largest collection of legal forms, available online.

Leverage the site’s user-friendly and efficient search to locate the documents you need.

Various templates for business and personal applications are organized by categories and states, or keywords. Use US Legal Forms to acquire the District of Columbia Physician's Assistant Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and then click the Download button to access the District of Columbia Physician's Assistant Agreement - Self-Employed Independent Contractor.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates of the legal form.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you want and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the District of Columbia Physician's Assistant Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

- Finish and obtain, and print the District of Columbia Physician's Assistant Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal requirements.

Form popularity

FAQ

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.

Start Soliciting ClientsContact local businesses that could utilize your contracting services. Ask to schedule a meeting with the person in charge of hiring contract workers. Present an informational package that highlights your strengths and services. Follow up with each company if you do not hear back from them.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Because dentists and doctors are exempt from the ABC Test, they must meet the common law requirements to be classified as independent contractors in California. These requirements are similar in many other states across the country as well.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

In non legal-ease, if you are a doctor or a surgeon licensed in the State of California, you may work as an independent contractor for a health care entity.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Yes. What is an independent contractor? Doctors who are independent contractors are not employees of the hospital but have an agreement with the hospital to use the hospital's facilities and their pay structure is entirely different from employees.

The original exemptions to AB5 extended to doctors, dentists, insurance agents, lawyers, accounts, real estate agents, and hairstylists, among others. Now, eight months after AB5 went into effect, more industries and occupations have been exempted from AB5.