District of Columbia Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

You can dedicate several hours online trying to locate the official document template that meets the federal and state standards you need. US Legal Forms provides thousands of legal documents that are evaluated by experts.

You can actually download or print the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor from my service. If you already have a US Legal Forms account, you may Log In and then click the Obtain button. Next, you can complete, modify, print, or sign the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor. Every legal document template you receive is yours forever.

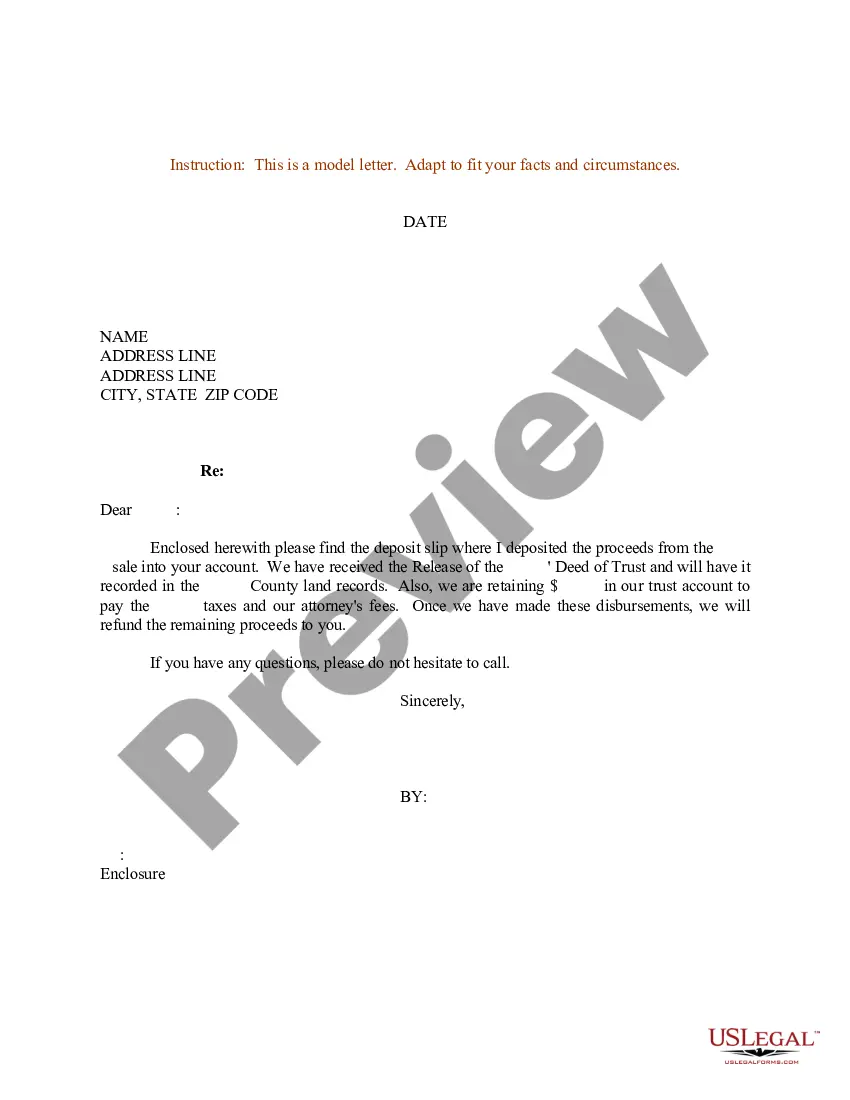

To get an additional copy of the acquired form, go to the My documents section and click the relevant option. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the state/city of your choice. Review the form outline to ensure you have chosen the appropriate form. If available, utilize the Review option to inspect the document template as well.

- If you wish to find another version of the form, utilize the Lookup area to locate the template that fits your needs and specifications.

- Once you have found the template you want, click Get now to proceed.

- Select the payment plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your device.

- Make modifications to your document if necessary. You can complete, alter, and sign and print the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Use professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

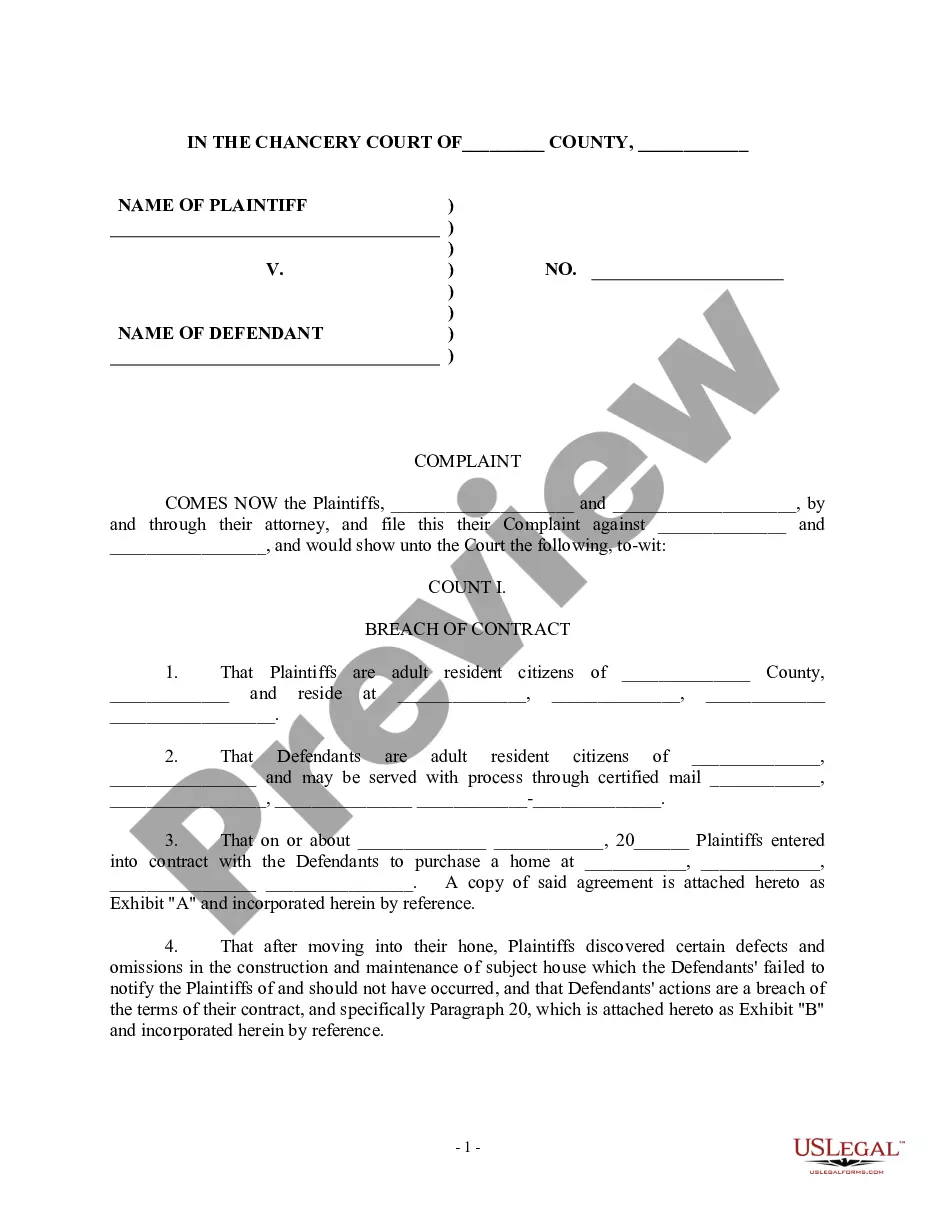

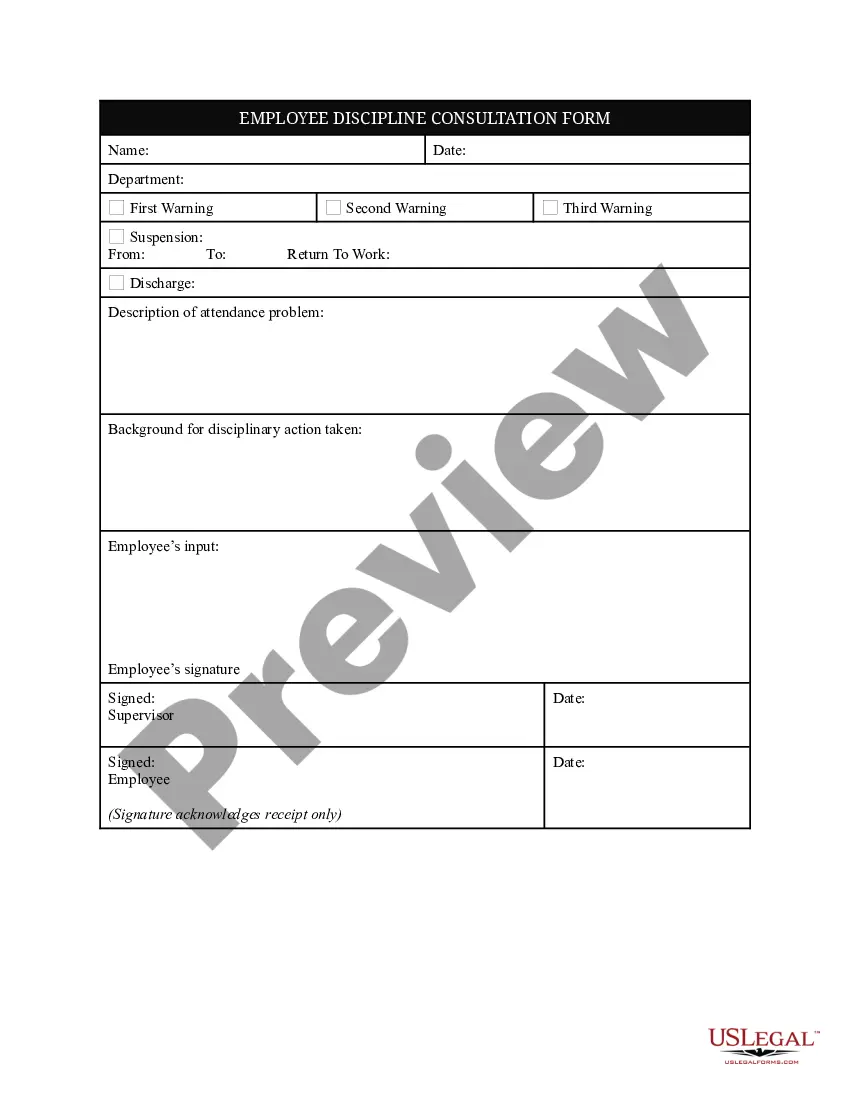

To fill out a declaration of independent contractor status form, start by providing your personal and business information. Include specific details regarding your work relationship, such as the level of control exercised over your tasks. This declaration is crucial for compliance, especially in the context of the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor, affirming your status and rights.

When filling out an independent contractor agreement, begin by identifying the parties involved. Clearly define the job duties, payment arrangement, and timeline for completion. Incorporate standard clauses related to confidentiality and termination, making sure it aligns with the guidelines of the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor to ensure legal protection.

To fill out an independent contractor form, enter your personal information, including your name and address, along with your business details. Clearly state the nature of the work or services you will provide, and specify payment terms. It’s essential to align this form with the provisions of the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor for clarity and compliance.

Filling out Schedule C as an independent contractor involves reporting your income and expenses from self-employment. Begin by detailing your business income, then categorize your expenses accurately to reflect your operational costs. Utilizing resources like US Legal Forms can simplify the process, particularly for those navigating the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor requirements.

To write an independent contractor agreement, start by outlining the key terms of the agreement. Include details such as the scope of work, payment terms, and the duration of the contract. Be sure to specify the responsibilities of both parties and any relevant legalities relating to the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor, ensuring you protect your rights.

Yes, the District of Columbia requires most businesses, including independent contractors, to obtain a general business license. This requirement is crucial for compliance and operating within legal parameters. By registering your business, you strengthen your legitimacy in the market and align with procedures like the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor.

You can verify a contractor's license in DC through the Department of Consumer and Regulatory Affairs' online database. This resource allows you to check the validity of the license, ensuring compliance with local laws. Ensuring that a contractor is properly licensed is crucial, especially when associating with individuals under the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor.

Yes, most contracting work in DC requires a specific contractor's license issued by the Department of Consumer and Regulatory Affairs. If you are classified under the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor, obtaining this license is essential for legal operation. Check with local authorities for details on the process and requirements.

To prove your status as an independent contractor, gather documents that show income received from clients, such as invoices or 1099 forms. Additionally, contracts and agreements, like the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor, can serve as strong evidence of your self-employment. This documentation supports your tax filings and proves your professional status.

Several states do not require a license for general contractors, although regulations can vary significantly. States like New Hampshire, Illinois, and New York have lenient licensing requirements compared to others. It’s crucial for you, as a contractor, to be aware of these regulations, particularly if you operate under the District of Columbia Underwriter Agreement - Self-Employed Independent Contractor.