District of Columbia Senior Debt Term Sheet

Description

How to fill out Senior Debt Term Sheet?

If you wish to comprehensive, acquire, or printing authorized papers themes, use US Legal Forms, the biggest collection of authorized varieties, that can be found on the Internet. Take advantage of the site`s simple and easy practical search to discover the documents you want. A variety of themes for organization and individual reasons are categorized by types and states, or keywords. Use US Legal Forms to discover the District of Columbia Senior Debt Term Sheet in a number of clicks.

Should you be already a US Legal Forms customer, log in in your profile and then click the Down load key to get the District of Columbia Senior Debt Term Sheet. Also you can gain access to varieties you earlier saved in the My Forms tab of the profile.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for the right town/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s articles. Do not forget about to learn the information.

- Step 3. Should you be not satisfied with the develop, take advantage of the Lookup industry towards the top of the monitor to discover other models in the authorized develop web template.

- Step 4. Upon having identified the form you want, click on the Purchase now key. Choose the costs prepare you like and include your qualifications to register to have an profile.

- Step 5. Procedure the transaction. You may use your credit card or PayPal profile to perform the transaction.

- Step 6. Choose the format in the authorized develop and acquire it on your own product.

- Step 7. Complete, edit and printing or indication the District of Columbia Senior Debt Term Sheet.

Each authorized papers web template you buy is your own permanently. You possess acces to each develop you saved in your acccount. Click the My Forms area and decide on a develop to printing or acquire once more.

Remain competitive and acquire, and printing the District of Columbia Senior Debt Term Sheet with US Legal Forms. There are thousands of skilled and condition-certain varieties you may use to your organization or individual requirements.

Form popularity

FAQ

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

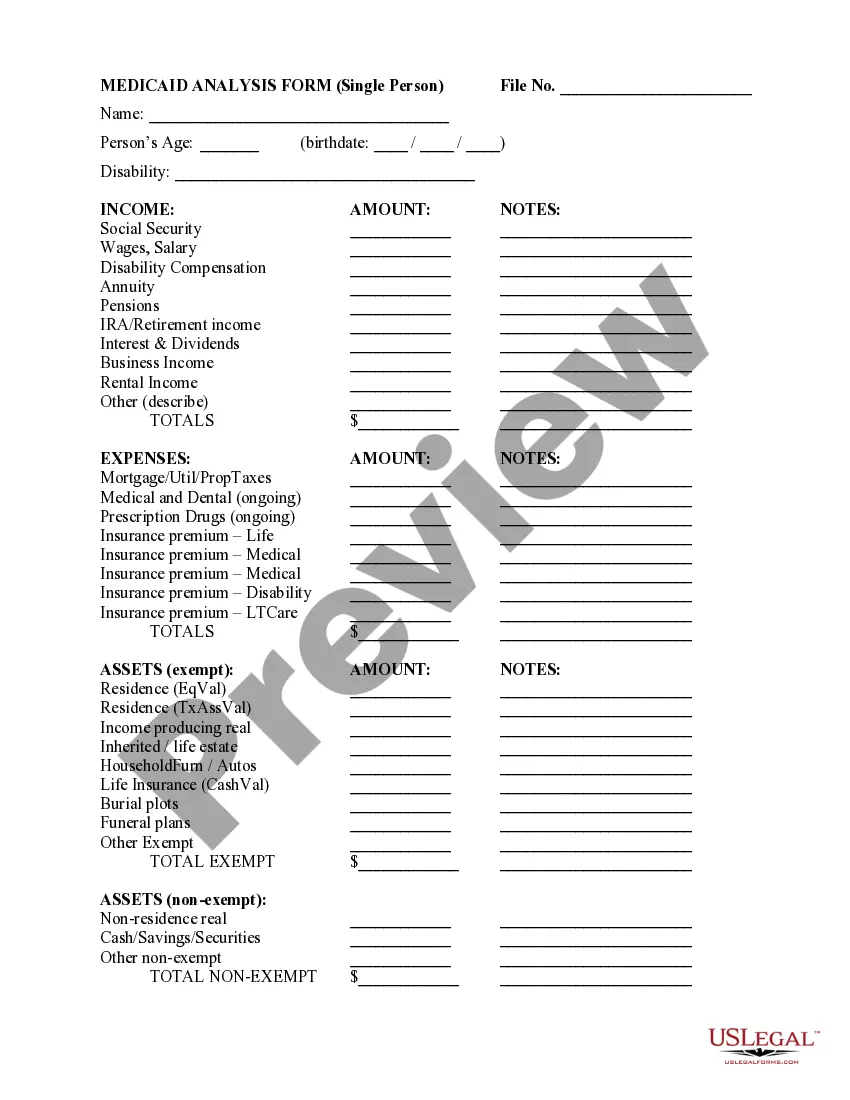

Senior debt is debt and obligations which are prioritized for repayment in the case of bankruptcy. Senior debt has the highest priority and therefore the lowest risk. Thus, this type of debt typically carries or offers lower interest rates.

Elements of a Term Sheet General Information. The top of a term sheet will outline general information such as the company name, investor name, date, and currency of the transaction. Amount. This section provides the amount of funding the investor and investee have tentatively agreed upon. ... Structure. ... Interest Rate.

The term loan can be of two types ? Term Loan A ?TLA? and Term Loan B ?TLB.? The primary difference between the two is the amortization schedule ? TLA is amortized evenly over 5-7 years, while TLB is amortized nominally in the initial years (5-8 years) and includes a large bullet payment in the last year.

On the other hand, senior debt financing is a high-priority loan backed by collateral and offered at a lower interest rate. How is senior debt calculated? Senior loan or debt is 2 to 3 times EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization).

Senior debts are loans secured by collateral (assets) that must be paid off before any other debts when a company goes into default. The lender in this case is paid out of the sale of the company's assets in priority sequence. Their priority position makes senior debts less risky for lenders.

Key Differences Senior debt has the highest priority and, therefore, the lowest risk. Thus, this type of debt typically carries or offers lower interest rates. Meanwhile, subordinated debt carries higher interest rates given its lower priority during payback. Banks typically fund senior debt.

Senior term debt is a loan with a priority repayment status in case of bankruptcy, and typically carries lower interest rates and lower risk. The term can be for several months or years, and the debt may carry a fixed or variable interest rate.